According to Bloomberg on October 24, the iShares spot Bitcoin exchange-traded fund (ETF) proposed by the investment company BlackRock (BLK.US) has been approved by the U.S. Securities Depository Trust and Clearing Corporation (DTCC) ) is listed , which indicates that the fund may receive approval from the U.S. Securities and Exchange Commission (SEC). After the news was announced, Bitcoin violently rose by US$2,000 in the short term, exceeding the US$35,000 mark. As of press time, Bitcoin has risen nearly 11% to US$33,890 per coin.

The first ETF listed on DTCC

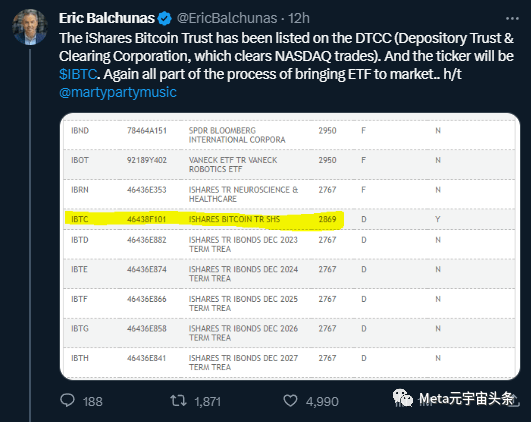

Bloomberg ETF analyst Eric Balchunas noted in an October 23 Twitter post that the DTCC listing is part of a push for cryptocurrency ETFs to enter the market. The iShares Spot Bitcoin ETF, which has the ticker symbol IBTC, may be listed on the Nasdaq stock exchange. The investment vehicle had applied for listing and trading approval in June.

Balchunas noted: “This is the first ETF to be listed on DTCC, and there are currently no other ETFs.” However, it is worth noting that BlackRock is leading the way in these logistics, including seeding, quoting and DTCC, These logistics often occur before the launch. So it's hard not to think this is a sign that they're either positive or about to get approval.

According to Balchunas’ speculation, BlackRock may have obtained permission from the U.S. Securities and Exchange Commission to list ETFs, or is actively preparing for related matters. Based on BlackRock’s filing date, the SEC will make a final decision to approve or deny the listing of the ETF by January 10, 2024.

Important nodes in the legalization process

Meta Yuanshi Toutiao (WeChat id: TopMetaNews) believes that this news is of great significance to the cryptocurrency market because it may mean an important step in the legalization process of U.S. cryptocurrency ETFs.

First of all, this event had a positive impact on the price of Bitcoin. After the news was announced, the price of Bitcoin surged in the short term, reflecting the market's eager expectations for cryptocurrency ETFs and investors' optimistic expectations for the future development of Bitcoin.

Secondly, this move by BlackRock may have an impact on the approval of other cryptocurrency ETFs. If BlackRock’s application is approved, it could open the floodgates for a number of spot crypto ETF applications currently under review by the SEC.This will further promote the development of the cryptocurrency market and provide investors with more investment options. Of course, we should also see that although the cryptocurrency market has developed rapidly in recent years, its risks cannot be ignored. This is not only because cryptocurrency prices are highly volatile and investors need to bear higher risks. After all, it has only been a week since the Cointelelgraph fake news incident.

otherIf BlackRock’s application is approved, it could open the floodgates to a number of spot crypto ETF applications currently under review by the SEC, including ARK Investment, Fidelity and Valkyrie. Meta Meta Universe Headlines (WeChat id: TopMetaNews) To date, the U.S. Securities and Exchange Commission has not approved applications for spot Bitcoin or Ethereum to be listed on U.S. exchanges, but will begin to allow investment tools linked to Bitcoin futures in October 2021.

Ahead of BTCC’s listing, the U.S. Court of Appeals issued a mandate to enforce an August 29 decision requiring the U.S. Securities and Exchange Commission to review Grayscale Investments’ application for a spot BTC ETF. Grayscale filed a registration statement with the U.S. Securities and Exchange Commission to list its Bitcoin Trust shares on the New York Stock Exchange Arca on October 19 under the ticker GBTC.

The above is the detailed content of BlackRock ETF launch may cause Bitcoin price to exceed $35,000. For more information, please follow other related articles on the PHP Chinese website!