Bitcoin Spot ETF Passed Silently, SEC Chairman Claims Multiple Violations in Crypto

Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission (SEC), recently took to his personal X account to address the numerous violations occurring in the cryptocurrency industry. He expressed concerns about the detrimental impact these violations have on public trust, as many victims find themselves queuing up in bankruptcy courts. This environment also creates an unfavorable situation for honest and law-abiding participants, making it difficult for them to compete.

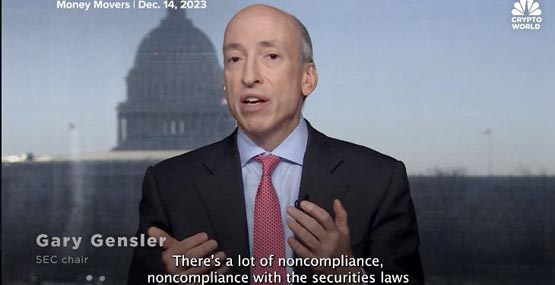

Gary Gensler also attached to this article a clip from his interview with CNBC on December 14. In this clip, he mentioned that there are a lot of irregularities in the crypto space, and many intermediaries who call themselves trading platforms are engaged in business that is not accepted by traditional finance. The SEC has successfully resolved numerous cases around the world, and securities laws help protect investors from fraud and manipulation.

The SEC is actually quietly arranging for the ETF to pass

According to an article by Fox Business senior reporter Charles Gasparino on the X platform, the SEC is conducting a rare conference call with applicants for Bitcoin spot ETFs. He revealed that the meeting may result in approval before January 10.

According to another Fox Business reporter Eleanor Terrett, sources who participated in the call told her that the purpose of this call was to ensure that every applicant adopts the "cash creation" model. At the same time, the Securities and Exchange Commission (SEC) requires issuers to remove any hint of physical redemption from filing documents. This measure is intended to ensure that applicants do not exchange physical funds when conducting transactions, but rather conduct transactions in cash. This requirement also reflects the SEC’s increased supervision of the market to ensure fairness and transparency in transactions.

SEC Attitude Confuses the Public

Despite Gary Gensler pointing out irregularities in the crypto space, the adoption of a Bitcoin spot ETF is accelerating, which is in stark contrast to the SEC’s attitude.

According to a Reuters report on December 15, the SEC rejected a petition filed by Coinbase Global (COIN.O) to establish new rules in the field of digital assets. SEC Chairman Gary Gensler said that existing laws and regulations apply to the current cryptocurrency market.

Paul Grewal, chief legal officer of Coinbase, pointed out that we should view our industry with a fair attitude, because no one believes that the law is clear and there is still a lot of work to be done. He calls on us to work together to create laws and rules that benefit consumers and American innovation.

After the SEC’s rejection, Grewal shared a court document on social media platform right.

The above is the detailed content of Bitcoin Spot ETF Passed Silently, SEC Chairman Claims Multiple Violations in Crypto. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

Top 10 virtual currency trading platforms with the lowest handling fee

Apr 22, 2025 am 08:30 AM

Top 10 virtual currency trading platforms with the lowest handling fee

Apr 22, 2025 am 08:30 AM

Binance spot trading fee is 0.1%, and holding BNB can be reduced to 0.025%; OKX rate is 0.1%-0.2%, with a minimum of 0.02%; Gate.io rate is 0.2%, with a minimum of 0.10%; FTX rate is 0.02%-0.05%, but has filed for bankruptcy; Coinbase Pro rate is as low as 0.05%, ordinary users; Kraken rate is 0.16%-0.26%, with a minimum of 0.10%; Bitfinex rate is 0.1%-0.2%, with a minimum of 0.02%; Huobi rate is 0.2%, with a minimum of 0.02%; KuCoin rate is 0.1%, with a minimum of 0.02%; Bithumb rate is 0.15%, with a minimum of 0.02%; Huobi rate is 0.2%, with a minimum of 0.02%; KuCoin rate is 0.1%, with a minimum of 0.02%;

Can two exchanges convert coins to each other? Can two exchanges convert coins to each other?

Apr 22, 2025 am 08:57 AM

Can two exchanges convert coins to each other? Can two exchanges convert coins to each other?

Apr 22, 2025 am 08:57 AM

Can. The two exchanges can transfer coins to each other as long as they support the same currency and network. The steps include: 1. Obtain the collection address, 2. Initiate a withdrawal request, 3. Wait for confirmation. Notes: 1. Select the correct transfer network, 2. Check the address carefully, 3. Understand the handling fee, 4. Pay attention to the account time, 5. Confirm that the exchange supports this currency, 6. Pay attention to the minimum withdrawal amount.

A list of top ten virtual currency trading platforms that support multiple currencies

Apr 22, 2025 am 08:15 AM

A list of top ten virtual currency trading platforms that support multiple currencies

Apr 22, 2025 am 08:15 AM

Priority is given to compliant platforms such as OKX and Coinbase, enabling multi-factor verification, and asset self-custody can reduce dependencies: 1. Select an exchange with a regulated license; 2. Turn on the whitelist of 2FA and withdrawals; 3. Use a hardware wallet or a platform that supports self-custody.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.