web3.0

web3.0

US National Vulnerability Database Says Bitcoin Inscription Ordinals (ORDI) Fluctuates in the $50 Range

US National Vulnerability Database Says Bitcoin Inscription Ordinals (ORDI) Fluctuates in the $50 Range

US National Vulnerability Database Says Bitcoin Inscription Ordinals (ORDI) Fluctuates in the $50 Range

Recently, the BRC-20 token led by $ORDI has once again triggered the craze of Bitcoin inscriptions. However, Bitcoin Core developer Luke Dashjr publicly criticized Inscription, calling it a scam and a threat to the Bitcoin network. This accusation caused violent fluctuations in the price of ORDI and also triggered discussions about the future fate of BRC-20. Some are beginning to wonder whether the BRC-20 token will disappear.

US National Vulnerability Database Marks Ordinals

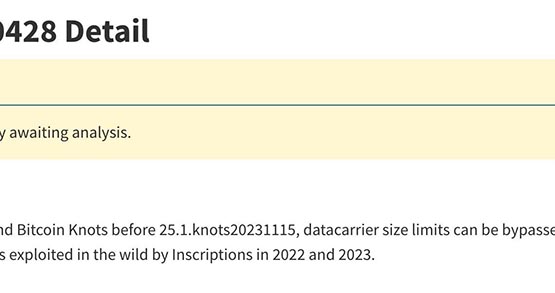

The US National Vulnerability Database (NVD) marked Bitcoin Inscription Ordinals as a "cybersecurity risk" on December 9 to remind people to pay attention to this security loopholes.

The official pointed out that the vulnerability is still under analysis, but mentioned in the description that before Bitcoin Core version 26.0 and Bitcoin Knots version 25.1.knots20231115, there was a way to bypass the data carrier size limit. That is, by obfuscating the data into code (e.g. using OP_FALSEOP_IF). This is similar to how 2022 and 2023 Inscriptions are being leveraged.

Being included on the NVD list means that a specific cybersecurity vulnerability has been identified and is considered an important issue of public concern. The list is managed by NIST, an agency affiliated with the U.S. Department of Commerce.

Slow Mist founder’s comment

Yu Xian, the founder of Slow Mist, said earlier that the news of Ordinals being included in the NVD list was received by Luke Reposted by Dashjr. Cosine noted that the Inscription issue was assigned a CVE number, indicating that it was confirmed as a vulnerability. However, he added that CVE numbers are nothing new and many security teams and individuals can apply. SlowMist may not pay much attention to this issue, but in the Bitcoin ecosystem, relevant actors may pay great attention to it, because the CVE number is one of the most well-known proofs of vulnerability in the security industry.

He also said that the CVE number was attached to the Bitcoin serial number inscription, which is indeed an insidious method. Although the current status on NVD is "The vulnerability has been received by NVD but has not yet been analyzed," this already labels it a "vulnerability."

But there is a high probability that this “loophole” label will not be removed.

$ORDI continues to fluctuate around 50 US dollars

As for the ORDI market price, since it reached a maximum of 69.8 US dollars last Wednesday (6th), ORDI has continued to fluctuate around 50 US dollars in the past few days. It fluctuated between ~$60 and was temporarily trading at $51.7 at the time of writing, down 0.32% in the past 24 hours.

The above is the detailed content of US National Vulnerability Database Says Bitcoin Inscription Ordinals (ORDI) Fluctuates in the $50 Range. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1389

1389

52

52

Top 10 cryptocurrency exchange platforms The world's largest digital currency exchange list

Apr 21, 2025 pm 07:15 PM

Top 10 cryptocurrency exchange platforms The world's largest digital currency exchange list

Apr 21, 2025 pm 07:15 PM

Exchanges play a vital role in today's cryptocurrency market. They are not only platforms for investors to trade, but also important sources of market liquidity and price discovery. The world's largest virtual currency exchanges rank among the top ten, and these exchanges are not only far ahead in trading volume, but also have their own advantages in user experience, security and innovative services. Exchanges that top the list usually have a large user base and extensive market influence, and their trading volume and asset types are often difficult to reach by other exchanges.

How long does it take to recharge digital currency to arrive? Recommended mainstream digital currency recharge platform

Apr 21, 2025 pm 08:00 PM

How long does it take to recharge digital currency to arrive? Recommended mainstream digital currency recharge platform

Apr 21, 2025 pm 08:00 PM

The time for recharge of digital currency varies depending on the method: 1. Bank transfer usually takes 1-3 working days; 2. Recharge of credit cards or third-party payment platforms within a few minutes to a few hours; 3. The time for recharge of digital currency transfer is usually 10 minutes to 1 hour based on the blockchain confirmation time, but it may be delayed due to factors such as network congestion.

'These types of structured investment opportunities are an important complement to the Guangzhou network ecosystem”

Apr 21, 2025 pm 05:06 PM

'These types of structured investment opportunities are an important complement to the Guangzhou network ecosystem”

Apr 21, 2025 pm 05:06 PM

CantonNetwork announces HydraX launch of SigmaValue tokens on its network, a token developed jointly by SigmaValue and HydraX, designed for institutions and recognized investors, is a non-neutral, high-yield notes. The token is designed to provide investors with stable returns and pay ETH interest regularly, and the principal can also be repaid in the form of ETH when it expires. Investors can trade in the secondary market of HydraXExchange. The collaboration between HydraX and SigmaValue simplifies the integration process. Ge, head of digital asset financial products at CantonNetwork

Litecoin (LTC) price drops sharply to $65

Apr 21, 2025 pm 06:15 PM

Litecoin (LTC) price drops sharply to $65

Apr 21, 2025 pm 06:15 PM

Litecoin (LTC) price plummeted to $65 in early April, down nearly 7.5% in a week, echoing the plunge in the wider cryptocurrency market. The market crash caused billions of dollars to evaporate market value, Bitcoin (BTC) fell below $75,000, and altcoins generally fell. Macro factors such as rising U.S. Treasury yields and expected interest rates appear to intensify risk aversion in global markets. In addition, the large outflow of funds from Bitcoin spot ETFs further hits the confidence of retail investors and institutional investors. Against this backdrop, Litecoin is once again facing its long-term resistance level - the 200-week exponential moving average (EMA). The EMA had suppressed LTC prices in July 2023, when the price was close to $88. Historically, LTC and the

Web3 social media platform TOX collaborates with Omni Labs to integrate AI infrastructure

Apr 21, 2025 pm 07:06 PM

Web3 social media platform TOX collaborates with Omni Labs to integrate AI infrastructure

Apr 21, 2025 pm 07:06 PM

Decentralized social media platform Tox has reached a strategic partnership with OmniLabs, a leader in artificial intelligence infrastructure solutions, to integrate artificial intelligence capabilities into the Web3 ecosystem. This partnership is published by Tox's official X account and aims to build a fairer and smarter online environment. OmniLabs is known for its intelligent autonomous systems, with its AI-as-a-service (AIaaS) capability supporting numerous DeFi and NFT protocols. Its infrastructure uses AI agents for real-time decision-making, automated processes and in-depth data analysis, aiming to seamlessly integrate into the decentralized ecosystem to empower the blockchain platform. The collaboration with Tox will make OmniLabs' AI tools more extensive, by integrating them into decentralized social networks,

Should Bitcoin become a medium of exchange, a medium of value storage, or both?

Apr 21, 2025 pm 08:06 PM

Should Bitcoin become a medium of exchange, a medium of value storage, or both?

Apr 21, 2025 pm 08:06 PM

The future of Bitcoin: a medium of exchange or a store of value? The debate continues to ferment in the core Bitcoin community, and the latest remarks by Twitter co-founder and BlockInc. CEO Jack Dorsey have sparked new discussions. Is Bitcoin a payment tool, a storage means of value, or both? This issue has always been the focus of fierce debate among industry insiders. Dorsey's recent remarks have ignited the debate again. Dispute about the use of Bitcoin Dorsey believes that if Bitcoin is stored as a store of value only, it will fail. He pointed out in a recent podcast that Bitcoin’s success lies in its payment capabilities. This view is in contrast to the current major narrative of Bitcoin. Many people, including Wink

bitget new user registration guide 2025

Apr 21, 2025 pm 10:09 PM

bitget new user registration guide 2025

Apr 21, 2025 pm 10:09 PM

The steps to register for Bitget in 2025 include: 1. Prepare a valid email or mobile phone number and a stable network; 2. Visit the Bitget official website; 3. Enter the registration page; 4. Select the registration method; 5. Fill in the registration information; 6. Agree to the user agreement; 7. Complete verification; 8. Obtain and fill in the verification code; 9. Complete registration. After registering, it is recommended to log in to the account, perform KYC identity verification, and set up security measures to ensure the security of the account.

AAVE's token repurchase program has been approved, Aave faces price struggle

Apr 21, 2025 pm 05:27 PM

AAVE's token repurchase program has been approved, Aave faces price struggle

Apr 21, 2025 pm 05:27 PM

The Aavenomics proposal has been officially passed, and the AAVE agreement has ushered in major reforms! The proposal aims to modify the token economics of the AAVE protocol and introduce a token repurchase mechanism, and has received more than 427,000 votes from AAVEDAO, far exceeding the quorum. Marc Zeller, founder of the AAVE Initiative Chain (ACI), announced that the proposal, which he proposed was overwhelmingly passed, with votes of up to 427,126 in favor and only 1,963 against. The core of the proposal is to spend $1 million a week on AAVE tokens for six months. This is seen as an experimental move to reduce the circulation supply of AAVE and thus increase its value. Zeller said this is just the beginning, DAO plan