Detailed explanation of how Bitcoin contract trading works on Eureka Exchange

Generally speaking, contract trading means that investors only need to judge the future currency price and can make profits without holding cryptocurrency. This is also very risky. For investors with weak self-control, it may become addictive. , and it will also cause asset losses. So you know how to play currency contract trading? It is very important. If you want to complete the contract transaction, you must use leverage appropriately, set stop loss orders, etc. Otherwise, it will easily lead to liquidation. This is why everyone says that currency contracts are terrible. As a novice, the most important thing is to understand the introductory tutorial of currency contract trading. The editor will explain it in detail below.

How to play currency circle contract trading?

Cryptocurrency contract trading involves leverage. Once the concept is understood, contract trading is not difficult. There are multiple exchanges that provide contract trading, such as Ethereum, Binance, and Huobi. The following is a detailed tutorial on trading BTC contracts on Eureka Exchange.

Please click on the official website of OKX Exchange (click here to register), select your mobile phone number to register, and enter your mobile phone number to receive the blind box. It is recommended to register using a mobile phone number, because registration using an email address requires mobile phone number verification.

2. Receive the digital verification code received on your mobile phone. The verification code is valid within 10 minutes. Please fill it in in time

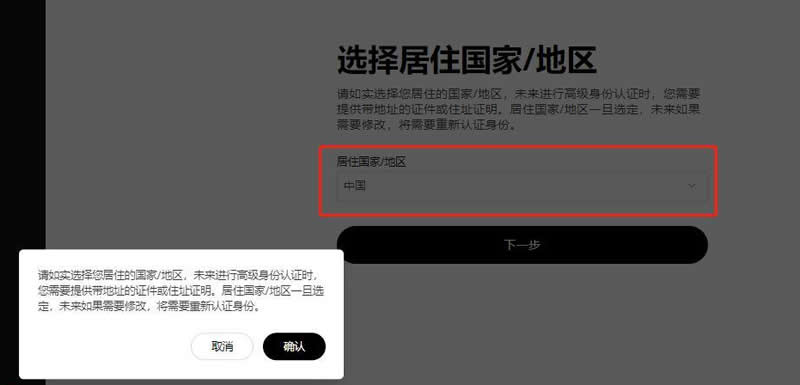

3. Select the corresponding country/region according to your location

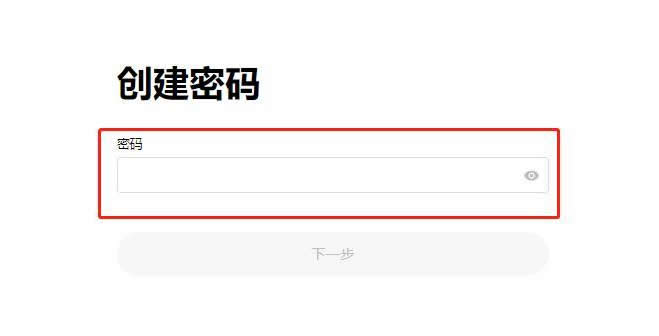

4. Users can set a password according to the prompts to ensure account security

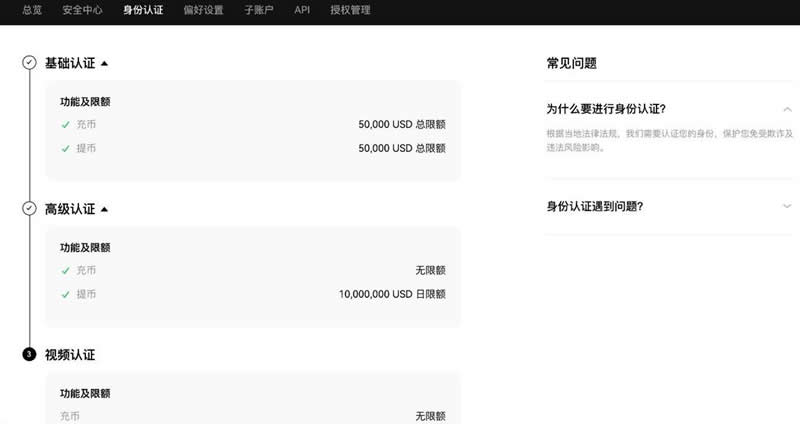

5. After logging in to your account, find the "User Center" icon on the homepage and enter the identity authentication page

6. Different levels can be selected according to different needs. Authentication (note: video authentication needs to be performed on the APP)

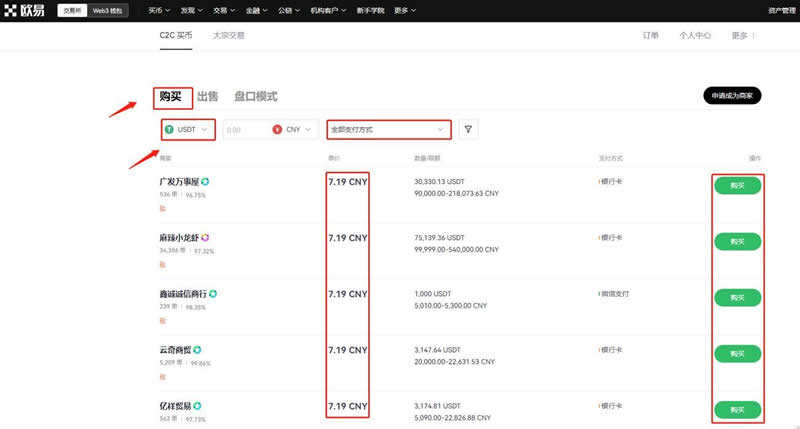

#7. After completing the identity authentication, you can conduct transactions and find "Buy Coins" on the homepage - "C2C Buy coins”

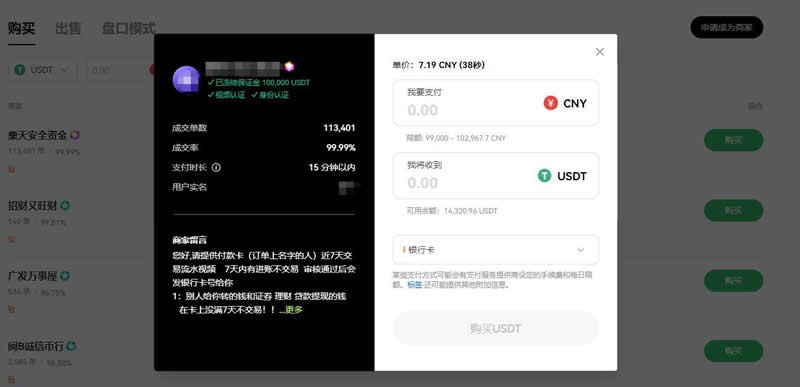

8. Select the “Buy” option, pay attention to select the currency to purchase, and click “All payment methods” to filter the payment method

9. After selecting the merchant, operate according to the merchant's message, then enter the purchase amount, click "Buy USDT" to pay and wait for the merchant to release the currency (if the currency is not received after payment, contact the merchant After the negotiation fails, you can click on the page Need help>Others>Get help>Initiate a complaint)

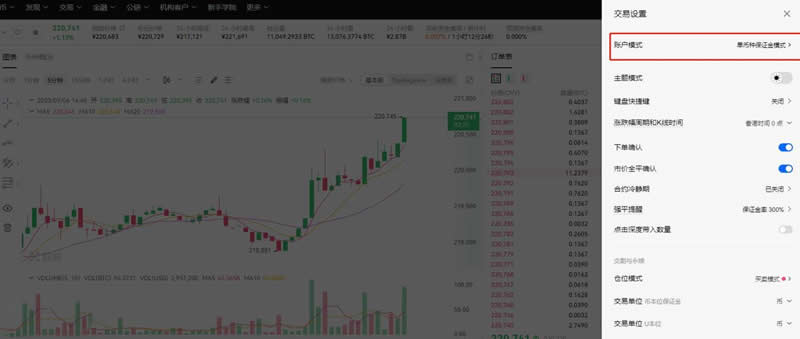

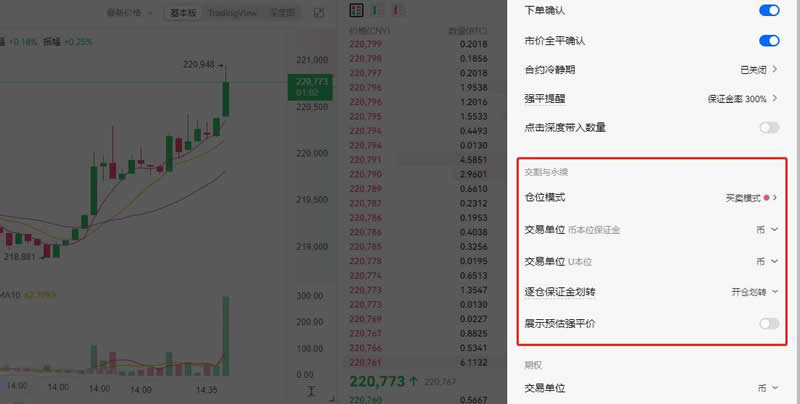

10. If you want to conduct contract transactions, you need to open the account mode And set to single-currency margin mode or cross-currency margin mode.

#11. You can continue to set up the contract, personalize the trading unit and order mode.

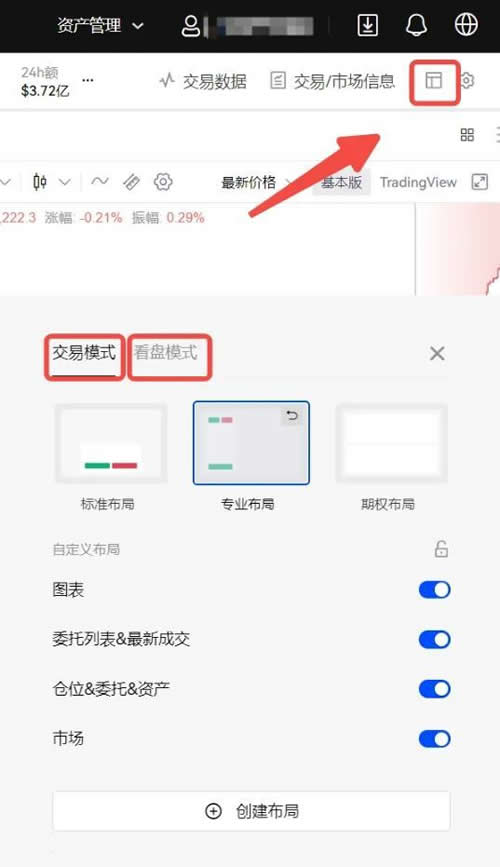

#12. You can customize the trading mode and Kanban mode. Select the professional layout here.

13. The delivery contract is divided into USDT margin delivery contract and currency-margin delivery contract. Here we take the currency-margin weekly delivery contract as an example. First, transfer our digital assets from the capital account to the trading account. If it has been completed, no additional transfer operations are required.

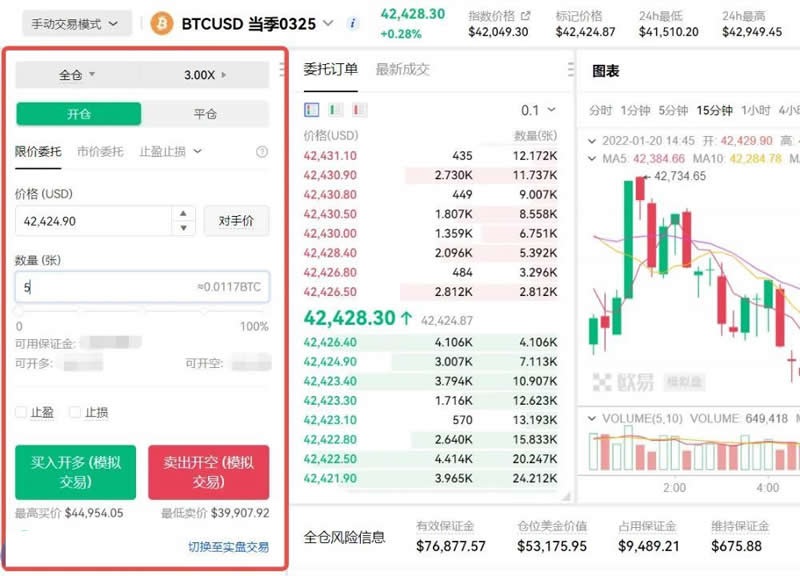

14. On the trading page, click the drop-down button on the right side of the currency pair, enter the currency in the search box, select delivery in the margin trading area, and select the contract period as the current week, Coin-margined/U-margined contracts for the next week, current quarter or second quarter. Here we take the current quarter currency-based contract as an example

15. Select the account mode and order type, enter the price and quantity, and click buy to open long (bullish) or sell Open short (short). For unfilled pending orders, you can click Cancel to cancel the order. Here we take opening a long position as an example.

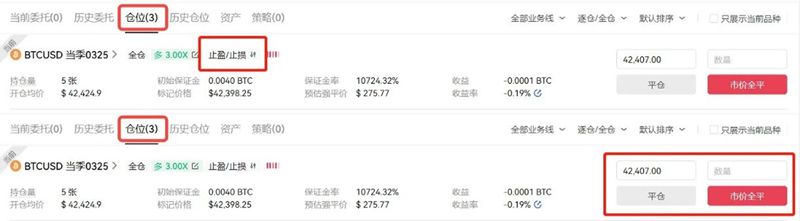

16. After the pending order is completed, you can view the relevant data of the order in the position interface, such as margin, income, rate of return, Estimated forced liquidation price, etc.

17. You can set stop-profit and stop-loss on the position interface. You can also choose to close the position. Enter the closing price and quantity to confirm the closing, or select the full market price. Complete the position closing operation.

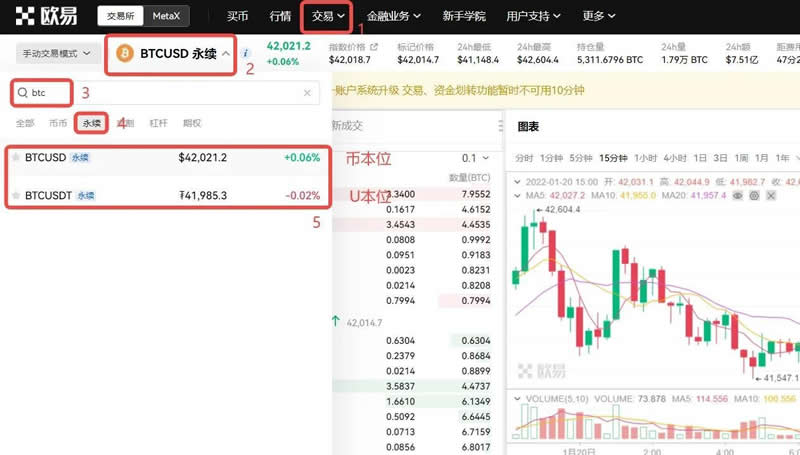

18. Perpetual contracts are divided into USDT margin perpetual contracts and currency-margined perpetual contracts. Here we take the USDT margin perpetual contract as an example. Similarly, transfer our digital assets from the capital account to the trading account. If it has been completed, no additional transfer operations are required.

19. On the trading page, click the drop-down button on the right side of the currency pair, enter the currency in the search box, select Perpetual in the margin transaction, and select the currency corresponding to the currency. Standard/U-based contracts. Here we take the U-based contract as an example

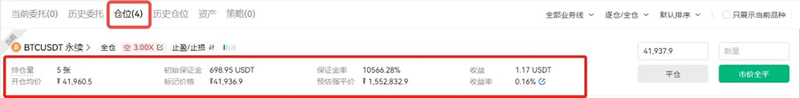

#20. Select the account mode, order type, enter the price and quantity, and click Buy to open long (bullish) or Sell to open short ( bearish). For unfilled pending orders, you can click Cancel to cancel the order. Here we take opening a short position as an example.

#21. After the pending order is completed, you can view the relevant data of the order in the position interface, such as margin, income, rate of return, Estimated forced liquidation price, etc.

22. You can set stop-profit and stop-loss on the position interface. You can also choose to close the position. Enter the closing price and quantity to confirm the closing, or select the full market price. Complete the position closing operation.

#What are the trading techniques for currency circle contracts?

Cryptocurrency contract trading is a high-risk, high-reward activity that requires caution and in-depth market understanding. Contract trading operation skills mainly include technical analysis, understanding risk management, identifying trend following, counter-trend trading, news event analysis, long and short two-way trading, etc. The following is a detailed introduction:

1. Technical analysis: Use technical analysis tools and charts to identify trends, support and resistance levels, and other technical indicators such as moving averages, relative strength indicator (RSI), etc. This helps in making trading decisions based on price charts.

2. Risk management: Set reasonable stop-loss and take-profit orders to limit potential losses and protect profits. Avoid over-leveraging and investing too much money in a single trade.

3. Trend following: Identify and track trends in the market, especially long-term trends. Trend following strategies allow traders to profit in the direction of a trend.

4. Counter-trend trading: Sometimes the market may rebound. Counter-trend trading is a transaction conducted when the trend reverses. This requires greater skill and attention and is not suitable for all traders.

5. News event analysis: Pay attention to news events in the cryptocurrency market and related industries, because these events may have a significant impact on prices. Timely news analysis can help you make smarter trading decisions.

6. Long and short two-way trading: Some platforms support long and short two-way trading, that is, investors can go long when the market rises and short when the market falls. This allows investors to profit in different market conditions.

7. Sentiment analysis: Understanding market sentiment is also important for trading. For example, excessive greed or fear can lead to excessive market volatility. Sentiment analysis can be used as a reference for decision-making.

8. Regularly evaluate and adjust strategies: Review and adjust your trading strategy regularly. Market conditions are constantly changing, and adapting to new market conditions is the key to successful trading.

The above is the detailed content of Detailed explanation of how Bitcoin contract trading works on Eureka Exchange. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Pi Node Teaching: What is a Pi Node? How to install and set up Pi Node?

Mar 05, 2025 pm 05:57 PM

Pi Node Teaching: What is a Pi Node? How to install and set up Pi Node?

Mar 05, 2025 pm 05:57 PM

Detailed explanation and installation guide for PiNetwork nodes This article will introduce the PiNetwork ecosystem in detail - Pi nodes, a key role in the PiNetwork ecosystem, and provide complete steps for installation and configuration. After the launch of the PiNetwork blockchain test network, Pi nodes have become an important part of many pioneers actively participating in the testing, preparing for the upcoming main network release. If you don’t know PiNetwork yet, please refer to what is Picoin? What is the price for listing? Pi usage, mining and security analysis. What is PiNetwork? The PiNetwork project started in 2019 and owns its exclusive cryptocurrency Pi Coin. The project aims to create a one that everyone can participate

Top 10 virtual digital currency app platforms in the world, the top ten virtual currency trading platforms in 2025

Mar 05, 2025 pm 08:00 PM

Top 10 virtual digital currency app platforms in the world, the top ten virtual currency trading platforms in 2025

Mar 05, 2025 pm 08:00 PM

With the booming development of the virtual currency industry, virtual digital currency trading platforms around the world are becoming increasingly stronger. This article focuses on the top ten virtual digital currency app platforms in the world in 2025, including Binance, OKX, Gate.io, Kraken, Gemini, FTX, Bybit, KuCoin, Huobi and Coinbase. These platforms are known for their advanced features, a wide range of transaction pairs, low fees and stable performance, providing users with a wide range of virtual currency trading options.

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Cryptocurrency has always been a realm where the cutting edge of technology meets bold ambition, and it's only getting more exciting in the future. As artificial intelligence continues to grow in influence, there are a handful of digital assets that

![Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February](https://img.php.cn/upload/article/001/246/273/174209101774967.jpg?x-oss-process=image/resize,m_fill,h_207,w_330) Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Mar 16, 2025 am 10:10 AM

Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Mar 16, 2025 am 10:10 AM

Technical indicators such as the OBV showed that selling pressure has been dominant, meaning more losses may be likely ahead.

Bitcoin historical price list 2015-2025 Bitcoin price trend charts in the past decade

Mar 12, 2025 pm 06:54 PM

Bitcoin historical price list 2015-2025 Bitcoin price trend charts in the past decade

Mar 12, 2025 pm 06:54 PM

This article reviews the ten-year price trend of Bitcoin from 2015 to 2025 in detail. Data shows that Bitcoin price fluctuates dramatically, experiencing huge changes from $200 to over $100,000. During this period, the price of Bitcoin was affected by a variety of factors, including halving of block rewards, market sentiment, regulatory policies, and global macroeconomic situation. The article analyzes the rise and fall of Bitcoin prices year by year, and focuses on interpreting the price changes in key years, providing a reference for investors to understand the history of Bitcoin prices and predict future trends. Keywords: Bitcoin price, Bitcoin trend, Bitcoin decade, digital currency, cryptocurrency

Top 10 Free Virtual Currency Exchanges Rankings The latest top ten virtual currency APP trading platforms

Mar 11, 2025 am 10:18 AM

Top 10 Free Virtual Currency Exchanges Rankings The latest top ten virtual currency APP trading platforms

Mar 11, 2025 am 10:18 AM

The top ten free virtual currency exchanges are ranked: 1. OKX; 2. Binance; 3. Gate.io; 4. Huobi Global; 5. Kraken; 6. Coinbase; 7. KuCoin; 8. Crypto.com; 9. MEXC Global; 10. Bitfinex. These platforms each have their own advantages.

Top 10 digital currency app platforms rankings Virtual currency exchange latest rankings in 2025

Mar 13, 2025 pm 06:45 PM

Top 10 digital currency app platforms rankings Virtual currency exchange latest rankings in 2025

Mar 13, 2025 pm 06:45 PM

Top 10 digital currency app platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Kraken, 5. Coinbase, 6. Huobi, 7. KuCoin, 8. Crypto.com, 9. Bitfinex, 10. Gemini; these platforms are ranked according to factors such as transaction volume, security and user experience. When choosing, the platform's security, liquidity, transaction fees, currency selection, user interface and customer support should be considered.

Cyber criminals were able to steal cryptocurrency worth 1.5 billion US dollars

Mar 16, 2025 am 11:12 AM

Cyber criminals were able to steal cryptocurrency worth 1.5 billion US dollars

Mar 16, 2025 am 11:12 AM

Since then, the provider has been investigating how this could have happened and how it will (hopefully) not happen again in the future.