web3.0

web3.0

Expert survey shows: 39% of experts believe that Bitcoin spot ETF is expected to be approved this year, and BTC is expected to face significant fluctuations

Expert survey shows: 39% of experts believe that Bitcoin spot ETF is expected to be approved this year, and BTC is expected to face significant fluctuations

Expert survey shows: 39% of experts believe that Bitcoin spot ETF is expected to be approved this year, and BTC is expected to face significant fluctuations

Bitwise Asset Management and VettaFi, two cryptocurrency index fund managers, today released their sixth annual “Bitwise/VettaFi 2024 Financial Advisor Attitudes Benchmark Survey on Crypto-Assets” report . The report was conducted from October 20 to December 18 this year and collected responses from 437 financial advisors.

Only 39% think it will be approved

According to the report, only 39% of advisors expect a Bitcoin spot ETF to be approved in 2024. In contrast, Bloomberg ETF analysts believe that the likelihood of the Bitcoin spot ETF being approved in January this year is as high as 90%.

The vast majority of respondents believe that the passage of the Bitcoin spot ETF is an important catalyst. According to the survey results, 88% of advisors expressed interest in buying Bitcoin, but they are currently waiting for approval of a Bitcoin spot ETF. Additionally, only 19% of advisors said they were able to purchase cryptocurrencies in their client accounts, meaning access to cryptocurrencies remains somewhat restricted.

Key findings from the remainder of the survey include:

98% of advisors currently allocating cryptocurrency to client accounts intend to maintain or increase such investments in 2024

59 % of advisors say “some” or “all” of their clients invest in cryptocurrencies on their own outside of advisory relationships The main barrier to widespread adoption, while 47% of advisors believe volatility is a minor but urgent issue that needs to be addressed.

Compared to Ethereum, 71% of advisors preferred Bitcoin to Ethereum, a significant increase from 53% the previous year.

Bitcoin may face greater volatility

Whether the U.S. Securities and Exchange Commission (SEC) will approve the application for a Bitcoin spot ETF before January 10 as expected by the market is affecting the Bitcoin market. towards.

After Matrixport issued a research report on the 3rd, warning that since the SEC’s requirements for Bitcoin spot ETFs have not been fully met, the SEC will not clear any Bitcoin spot ETFs in January, Bitcoin fell sharply on the evening of the 3rd. It plummeted by more than $4,000 in one hour, plummeting from around $45,000 to $40,750, and tens of thousands of people liquidated their positions instantly.

But soon, Fox Business quoted people familiar with the matter as reporting that the SEC may approve the ETF as soon as this Friday, and after the official start of trading next week, the price of Bitcoin rebounded rapidly due to this, and today It once rose back to US$45,000 in the morning, but fell back again before the deadline, reporting at US$43,484, an increase of 1.3% in the past 24 hours.

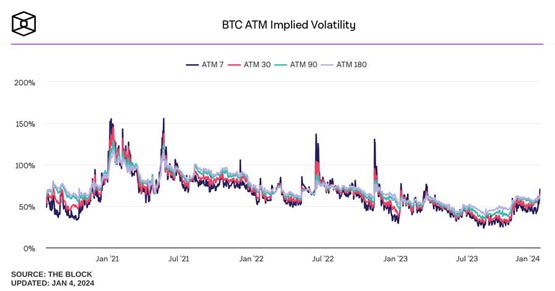

Bitfinex analysts pointed out that derivatives traders currently expect “unprecedented” volatility in the Bitcoin market. Options market signals indicate that derivatives traders’ current volatility expectations are higher than those expected throughout 2023. annual volatility levels.

Currently, Bitcoin’s implied volatility has surged to a new multi-month high of 70.1%, which is higher than the historical average volatility of 41.1%. Bitfinex analysts remind that because of the upcoming SEC decision, people should pay attention to short-term options. Implied volatility spiked, suggesting investors must be aware of greater moves.

THE BLOCK DATA DASHBOARD

THE BLOCK DATA DASHBOARD

The above is the detailed content of Expert survey shows: 39% of experts believe that Bitcoin spot ETF is expected to be approved this year, and BTC is expected to face significant fluctuations. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.