Mobile Tutorial

Mobile Tutorial

Mobile News

Mobile News

Huawei teamed up with Chengdu High-tech to control TD Tech with 100% equity, but the 2.12 billion sale of Nokia failed to reach

Huawei teamed up with Chengdu High-tech to control TD Tech with 100% equity, but the 2.12 billion sale of Nokia failed to reach

Huawei teamed up with Chengdu High-tech to control TD Tech with 100% equity, but the 2.12 billion sale of Nokia failed to reach

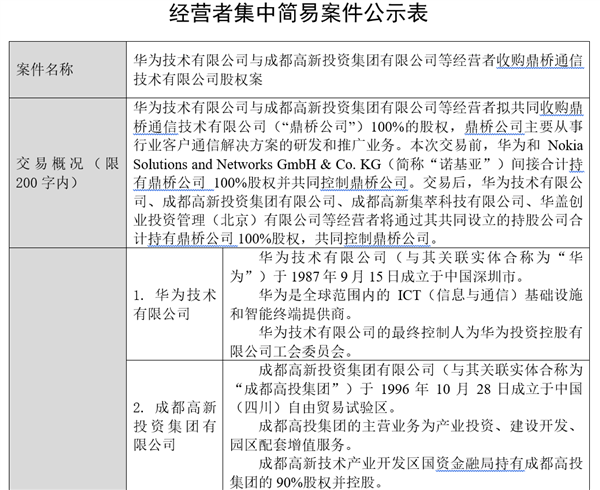

On January 19, the official website of the State Administration for Market Regulation announced the "case of acquiring the equity of TD Tech Co., Ltd. between Huawei Technologies Co., Ltd. and Chengdu High-tech Investment Group Co., Ltd.". This attention-grabbing dispute includes: significant new progress.

In this transaction, Huawei, Chengdu High-tech and other operators plan to jointly acquire 100% of the equity of TD Tech.

Before this transaction, Huawei and Nokia Solutions and Networks GmbH & Co. KG (Nokia) indirectly held 100% of the equity of TD Tech and jointly controlled TD Tech.

After the transaction, Huawei, Chengdu High-tech Investment Group Co., Ltd., Chengdu High-tech Jicui Technology Co., Ltd., Huagai Venture Capital Management (Beijing) Co., Ltd. and other operators will hold a total of TD Tech owns 100% equity and jointly controls TD Tech.

Chengdu Hi-tech Investment Group Co., Ltd. (collectively referred to as "Chengdu Hi-tech Investment Group" with its related entities) was established on October 28, 1996 in China (Sichuan) Free Trade The main business of the pilot zone is industrial investment, construction and development, and park supporting value-added services. The State-owned Assets Finance Bureau of Chengdu High-tech Industrial Development Zone holds 90% of the shares and controls it.

Chengdu Hi-tech Jicui Technology Co., Ltd. ("Chengdu Jicui") was established in the China (Sichuan) Pilot Free Trade Zone on May 27, 2020. Its main business is industrial investment. It is a state-owned enterprise in the High-tech Industrial Development Zone The Financial Services Bureau holds 100% of the shares.

Huagai Venture Capital Management (Beijing) Co., Ltd. (collectively referred to as "Huagai" with its related entities) was established in Beijing, China on June 11, 2015. Its main business is private equity fund management and investment. The controllers are Xu Xiaolin and Lu Binghui.

Tingqiao Company was established in Beijing, China on March 24, 2005. Its main business is the research and development and promotion of communication solutions for industry customers. The ultimate controllers before the transaction were Huawei and Nokia.

After Huawei was subject to continued sanctions from the United States, TD Tech obtained the design and technology authorization for Huawei mobile phones to manufacture and sell its own brand of smartphones. The models and specifications are exactly the same as Huawei mobile phones. For example, the N8 Pro is a nova A replica of the 8 Pro, the TD TECH M40 is a replica of the Mate 40. Even the names of the P50 and Mate 50 are exactly the same.

Let’s review the historical evolution of this incident——

In June 2006, the telecommunications equipment business of Nokia and Siemens merged, with each party investing 50 %, established Nokia Siemens Networks (Nokia Siemens Networks).

In April 2007, Siemens sold all its shares in TD TECH to Nokia Siemens Networks.

In 2011, TD Tech established a wholly-owned subsidiary, Chengdu TD Tech, to focus on the research, development and promotion of communication solutions for industry customers.

In July 2013, Nokia acquired 50% of Nokia Siemens' shares held by Siemens for 1.7 billion euros and renamed the company Nokia Solutions and Networks, thus holding 51% of TD TECH.

In April 2023, New Oriental New Materials announced that it planned to acquire 51% of the equity of TD TECH from Nokia through a fixed increase of 20 million yuan, with a transaction consideration of 2.1216 billion yuan.

Huawei immediately publicly raised strong objections, claiming that it had no intention or possibility to jointly operate TD TECH with New Oriental New Materials. Follow-up measures include but are not limited to exercising the right of first refusal, selling all shares to withdraw, and terminating its interest in TD TECH and its Relevant technology authorization from affiliated enterprises.

In September 2023, New Oriental New Materials issued an announcement and received a notice from Nokia to terminate the sale of 51% of TD TECH's equity, and the transaction fell through.

The above is the detailed content of Huawei teamed up with Chengdu High-tech to control TD Tech with 100% equity, but the 2.12 billion sale of Nokia failed to reach. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1377

1377

52

52

Samsung's 10,000-yuan foldable phone W25 revealed: 5-megapixel under-screen front camera and thinner body

Aug 23, 2024 pm 12:43 PM

Samsung's 10,000-yuan foldable phone W25 revealed: 5-megapixel under-screen front camera and thinner body

Aug 23, 2024 pm 12:43 PM

According to news on August 23, Samsung is about to launch a new folding mobile phone W25, which is expected to be unveiled at the end of September. It will make corresponding improvements in the under-screen front camera and body thickness. According to reports, Samsung W25, codenamed Q6A, will be equipped with a 5-megapixel under-screen camera, which is an improvement over the 4-megapixel camera of the Galaxy Z Fold series. In addition, the W25’s external-screen front camera and ultra-wide-angle camera are expected to be 10 million and 12 million pixels respectively. In terms of design, the W25 is about 10 mm thick in the folded state, which is about 2 mm thinner than the standard Galaxy Z Fold 6. In terms of screen, the W25 has an external screen of 6.5 inches and an internal screen of 8 inches, while the Galaxy Z Fold6 has an external screen of 6.3 inches and an internal screen of 8 inches.

The best time to buy Huawei Mate 60 series, new AI elimination + image upgrade, and enjoy autumn promotions

Aug 29, 2024 pm 03:33 PM

The best time to buy Huawei Mate 60 series, new AI elimination + image upgrade, and enjoy autumn promotions

Aug 29, 2024 pm 03:33 PM

Since the Huawei Mate60 series went on sale last year, I personally have been using the Mate60Pro as my main phone. In nearly a year, Huawei Mate60Pro has undergone multiple OTA upgrades, and the overall experience has been significantly improved, giving people a feeling of being constantly new. For example, recently, the Huawei Mate60 series has once again received a major upgrade in imaging capabilities. The first is the new AI elimination function, which can intelligently eliminate passers-by and debris and automatically fill in the blank areas; secondly, the color accuracy and telephoto clarity of the main camera have been significantly upgraded. Considering that it is the back-to-school season, Huawei Mate60 series has also launched an autumn promotion: you can enjoy a discount of up to 800 yuan when purchasing the phone, and the starting price is as low as 4,999 yuan. Commonly used and often new products with great value

Apple and Huawei both wanted to make a buttonless phone, but Xiaomi made it first?

Aug 29, 2024 pm 03:33 PM

Apple and Huawei both wanted to make a buttonless phone, but Xiaomi made it first?

Aug 29, 2024 pm 03:33 PM

According to a report from Smartprix, Xiaomi is developing a buttonless mobile phone codenamed "Suzaku". According to this news, this mobile phone codenamed Zhuque will be designed with an integrated concept, use an under-screen camera, and be equipped with Qualcomm Snapdragon 8gen4 processor. If the plan does not change, we are likely to see its arrival in 2025. When I saw this news, I thought I was back in 2019 - at that time, Xiaomi released the Mi MIX Alpha concept phone, and the surround-screen button-less design was quite amazing. This is the first time I have seen the charm of a buttonless mobile phone. If you want a piece of "magic glass", you must first kill the buttons. In "The Biography of Steve Jobs", Jobs once expressed that he hoped that the mobile phone could be like a piece of "magic glass".

Huawei will launch the Xuanji sensing system in the field of smart wearables, which can assess the user's emotional state based on heart rate

Aug 29, 2024 pm 03:30 PM

Huawei will launch the Xuanji sensing system in the field of smart wearables, which can assess the user's emotional state based on heart rate

Aug 29, 2024 pm 03:30 PM

Recently, Huawei announced that it will launch a new smart wearable product equipped with Xuanji sensing system in September, which is expected to be Huawei's latest smart watch. This new product will integrate advanced emotional health monitoring functions. The Xuanji Perception System provides users with a comprehensive health assessment with its six characteristics - accuracy, comprehensiveness, speed, flexibility, openness and scalability. The system uses a super-sensing module and optimizes the multi-channel optical path architecture technology, which greatly improves the monitoring accuracy of basic indicators such as heart rate, blood oxygen and respiration rate. In addition, the Xuanji Sensing System has also expanded the research on emotional states based on heart rate data. It is not limited to physiological indicators, but can also evaluate the user's emotional state and stress level. It supports the monitoring of more than 60 sports health indicators, covering cardiovascular, respiratory, neurological, endocrine,

A new generation of thousand-yuan magic machine! Redmi Note 14 series joins the Internet: supports up to 90W fast charging

Sep 02, 2024 pm 12:44 PM

A new generation of thousand-yuan magic machine! Redmi Note 14 series joins the Internet: supports up to 90W fast charging

Sep 02, 2024 pm 12:44 PM

According to news on September 2, three new models of the Redmi Note14 series have been launched on the Internet, supporting up to 90W fast charging. According to various sources, this series will be released this month, focusing on the thousand-yuan market. 1. There are three models in the series, including RedmiNote14, RedmiNote14Pro and RedmiNote14Pro+. They are respectively equipped with Qualcomm Snapdragon 7sGen3, Dimensity 7350, and second-generation Snapdragon 7s. The Redmi Note14Pro series uses a 1.5K curved screen. This is Redmi’s first curved screen model this year and is consistent with the screen form of the previous generation Note13Pro+. RedmiNote14Pro series appearance: large-area centered three-camera solution camera Deco

Honor Magic V3 big upgrade! Support Amap access to satellite communications

Sep 02, 2024 pm 01:54 PM

Honor Magic V3 big upgrade! Support Amap access to satellite communications

Sep 02, 2024 pm 01:54 PM

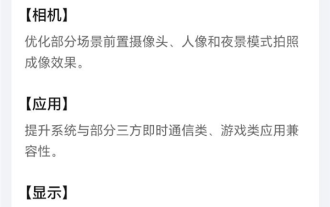

According to news on September 1, today, Honor MagicV3 received an important upgrade to MagicOS, which brought many new features and optimized experience. 1. In terms of satellite communications, Honor MagicV3 will support Amap’s access to satellite communications. Users can also initiate help through the “Satellite Help” function of Amap in a non-network environment. However, this function requires using a China Telecom card to activate the direct satellite connection service for mobile phones and upgrading the Amap App to version 15.0 or above. In terms of cameras, the imaging effects of the front camera, portrait and night scene modes in some scenes have been optimized to improve the photography experience. In terms of display, this upgrade improves the eye protection experience of the mobile phone screen and enhances the stability of the screen-off display scene. In addition, this update also improves the system

Dimensity 9400 is the most powerful flagship! Vivo X200 Pro detailed parameters exposed

Sep 04, 2024 am 06:47 AM

Dimensity 9400 is the most powerful flagship! Vivo X200 Pro detailed parameters exposed

Sep 04, 2024 am 06:47 AM

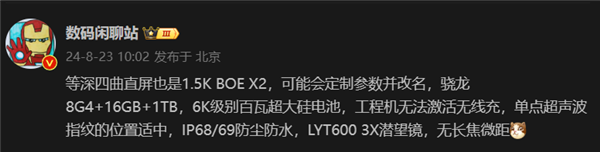

According to news on September 4, today, blogger Digital Chat Station exposed the detailed configuration of vivoX200Pro. Vivo Dust-proof and waterproof, supports single-point ultrasonic fingerprint. Compared with the previous generation vivoX100Pro, the screen, performance, and images of the X200Pro have been significantly upgraded, especially in terms of imaging. This is the first time that vivo has equipped the Pro version with a 200-megapixel periscope telephoto lens. The X100Ultra ultra-large cup released by vivo previously used a 200-megapixel periscope telephoto lens.

Realme GT7 Pro is full of products: ultrasonic fingerprint, super large battery, and 100W fast charging are all listed

Aug 23, 2024 pm 03:31 PM

Realme GT7 Pro is full of products: ultrasonic fingerprint, super large battery, and 100W fast charging are all listed

Aug 23, 2024 pm 03:31 PM

According to news on August 23, according to digital bloggers Digital Chat Station, the product capabilities of the Realme GT7 Pro will be comprehensively strengthened, and its configuration will cover ultrasonic fingerprints, periscope telephoto, ultra-large batteries, and 100-watt fast charging. 1. Realme GT7Pro has a built-in large 6000mAh battery and supports 100W fast charging. The engineering machine does not support wireless charging, and the mass production model is unknown. Equipped with single-point ultrasonic fingerprint recognition and supports IP68/69 dustproof and waterproof. Equipped with LYT6003X periscope, it does not support telephoto macro. Equipped with a 1.5K resolution equal depth four-curved screen, using BOE X2 substrate. It uses the Snapdragon 8Gen4 processor and supports up to 16GB of memory and 1TB of storage. The Realme GT7Pro is expected to be launched as soon as Q4 this year.