web3.0

web3.0

Pantera releases outlook for 2024: Bitcoin renaissance, rise of DeFi 2.0, social tokenization and other trends

Pantera releases outlook for 2024: Bitcoin renaissance, rise of DeFi 2.0, social tokenization and other trends

Pantera releases outlook for 2024: Bitcoin renaissance, rise of DeFi 2.0, social tokenization and other trends

1. The resurgence of Bitcoin ushered in DeFi 2.0

BTC’s market share increased from 38% at the beginning of the year to 50% at the end of the year, coupled with the unforgettable popularity , all of which have brought BTC back into investors’ sight again.

Pantera believes BTC has at least three major catalysts for a resurgence next year:

The fourth halving in April 2024

Institutional investors are expected to approve multiple Bitcoins Spot ETF

Enhancement of programmable functions, including Ordinals protocol and L2 and expansion solutions (such as Stacks and Rootstock)

Regarding the third point, Pantera predicts that there will be more Ethereum DeFi protocol transplants Come to Bitcoin and usher in DeFi 2.0.

2. New applications on the chain: Tokenized social services

Friend.tech and other social applications have successfully derived a new token economic model for the SocialFi field by integrating with Twitter accounts .

Pantera expects more experiments in the social space in the future, in which tokenization will play a key role. Fungible Tokens are expected to become a new form of loyalty points, while Non-Fungible Tokens (NFTs) may become an important form of personal social data and resources.

3. Traditional finance and DeFi interact more frequently

In addition to predicting that the adoption of Bitcoin spot ETF will significantly increase the adoption rate of institutions, Pantera believes that institutions will further seek tokenized RWA and Traditional financial (TradFi) products.

Just as BTC was previously mapped with WBTC and cross-chained to Ethereum, TradFi assets will also interact with DeFi more frequently, thus deriving the "TradFi-DeFi cross-chain bridge" project.

4. Cross-pollination of modular blockchain and zero-knowledge proof

Both modular blockchain and zero-knowledge proof have made significant progress in the past year, such as the recent Celestia mainnet, Espresso’s Arbitrum collaboration, etc.

Pantera believes that the combination of these two technologies will be an interesting trend in the future, and in consumer-related applications, zero-knowledge proofs may be more used in identity protection and privacy projects, such as those based on ZK decentralized digital identity.

5. More computing-intensive applications are on the chain, such as AI and DePIN

Pantera pointed out that expansion problems such as excessive on-chain fees have been solved, and the gas fee of Ethereum L2 is less than 0.02 US dollars. , Solana is several digits lower, so it can be expected that within the next year, computing-intensive applications that require a large amount of computing resources will become more economically feasible to run on the chain.

Pantera named several projects:

Hivemapper: Decentralized Google Maps

Bittensor: Decentralized Machine Learning Platform

Modulus Labs: AI generated NFT artwork

The Graph: On-chain knowledge graph plan

Realmsverse: Chain games on Starknet

6. Small public chains need to focus on specific applications

Pantera finally mentioned the competition situation of public chains. In fact, there is not much difference between L1 and L2 in terms of user experience. Solana and Avalanche can even directly compete with L2.

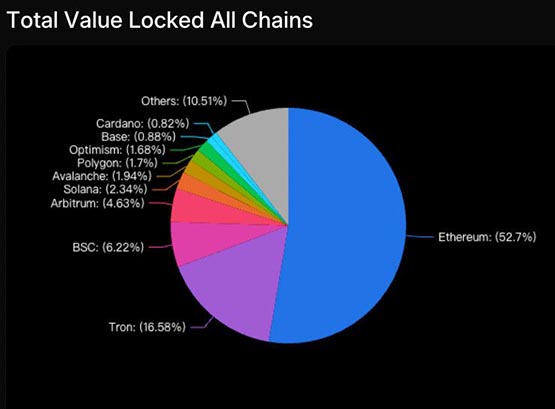

Also due to the same nature, the five major public chains such as Ethereum and BNBChain have locked 80% of the total TVL.

Pantera believes that public chains with smaller ecosystems must focus on specific vertical areas (such as social networking, games, DeFi) to maintain their advantages, thereby effectively becoming "application chains".

In fact, among the top 10 L2s ranked by TVL, dydx, Loopring, and Ronin are already application chains focusing on a single vertical field.

The above is the detailed content of Pantera releases outlook for 2024: Bitcoin renaissance, rise of DeFi 2.0, social tokenization and other trends. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

okx virtual currency trading app apple download tutorial

Mar 31, 2025 pm 09:00 PM

okx virtual currency trading app apple download tutorial

Mar 31, 2025 pm 09:00 PM

This article provides tutorials on downloading and installing the OKX virtual currency trading APP Apple version. Due to Apple's system restrictions, it is recommended to directly access OKX official website to register. Android users need to allow the installation of applications from unknown sources in their mobile phone settings. After downloading the installation package, click Install, complete the installation process and start the APP, and finally register or log in to the account to start using OKX Exchange for virtual currency trading. The tutorial contains detailed steps to help you quickly get started with the OKX trading app.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.