As the U.S. Securities and Exchange Commission’s (SEC) approval deadline for a Bitcoin spot ETF approaches, the market is paying close attention to any developments. According to K33 Research analyst Vetle Lunde, he pointed out in a report yesterday that the SEC is expected to make a decision on the Bitcoin spot ETF between January 8 and January 10. However, news that may be announced in advance may have an impact on market conditions. Investors are nervously awaiting this decision, because if passed, the Bitcoin spot ETF is expected to bring more opportunities and liquidity, further promoting the development of the Bitcoin market.

Lunde emphasized that the approval of a Bitcoin spot ETF could trigger a "sell news" event, in which market participants quickly sell to profit after a major event occurs. Lunde estimates that there is a 75% chance of this happening, with a 20% chance of pushing prices up if approved and a 5% chance of rejection.

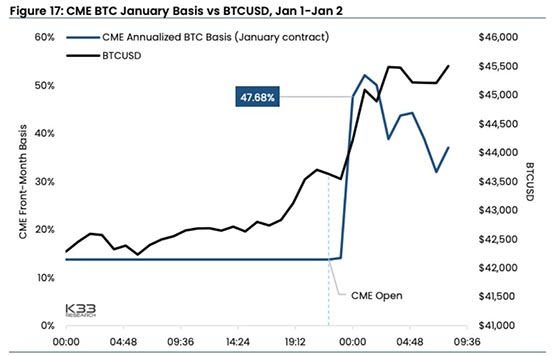

Lunde also pointed to signs of a bubble in the market, specifically the observed futures premium on the Chicago Mercantile Exchange (CME) as high as 50% annualized. Additionally, Bitcoin’s open interest has increased by more than 50,000 BTC over the past three months, indicating that institutional investors have increased their long positions in anticipation of the ETF’s approval. These are signs that the market's enthusiasm for Bitcoin may be too optimistic, and there are certain risks. Although the price of Bitcoin has been rising, investors should remain vigilant to avoid losses from a possible bubble burst.

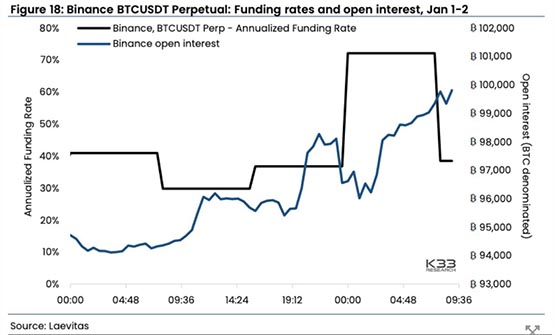

#The funding rate of Bitcoin perpetual contracts once reached an annualized high of 72%, which had a certain impact on retail investors. Lunde explained that since ETF approval is still a week away, shorts are reluctant to enter the market, which has led to an increase in the perpetual premium in the spot market, making the costs for long investors higher.

"After ETF approval, the aggressive leverage of bulls may lead to a long squeeze in the market."

In summary, Lunde believes that the Bitcoin spot ETF is highly anticipated, but whether it is overly anticipated will depend on the inflow of funds after its launch. He predicted that the day the ETF is approved, Bitcoin prices will reach a cycle high because short-term traders will take profits in large quantities and the premium will be unsustainable.

In the long term, however, he is optimistic that inflows through potential spot ETFs, coupled with reduced supply from the Bitcoin halving event in April, will further drive the market this year.

Regarding whether the Bitcoin spot ETF will be passed in January, Bloomberg ETF analyst Eric Balchunas also expressed reservations.

In an interview with Cointelegraph, Balchunas said that although rejection is less likely, the application for a Bitcoin spot ETF may be rejected this month if the SEC "needs more time" to consider it. Balchunas and colleague James Seyffart gave a 90% chance of approval, which means there is a 10% chance of rejection.

But Balchunas said that given the considerable time and effort invested by the SEC and Bitcoin ETF issuers, he believes that a direct rejection of the Bitcoin ETF at the last minute is unlikely.

In addition, if the SEC does issue an outright veto decision, Balchunas believes that fund issuers may follow the footsteps of crypto asset manager Grayscale and file a lawsuit against the regulator.

He said: People have invested too much money and effort and it is impossible to give up now. So, this won't be the end.

The above is the detailed content of Prediction: 70% of Bitcoin spot ETF approvals may face downside risks, and the probability of SEC rejection is 5%. For more information, please follow other related articles on the PHP Chinese website!