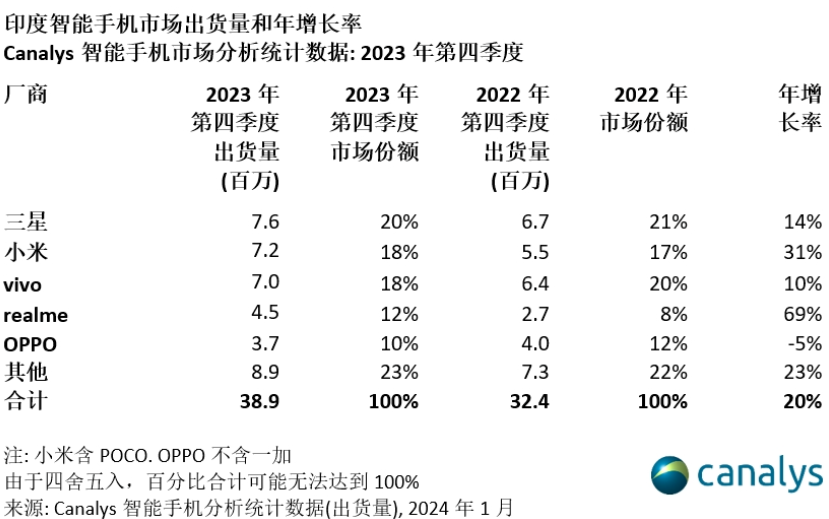

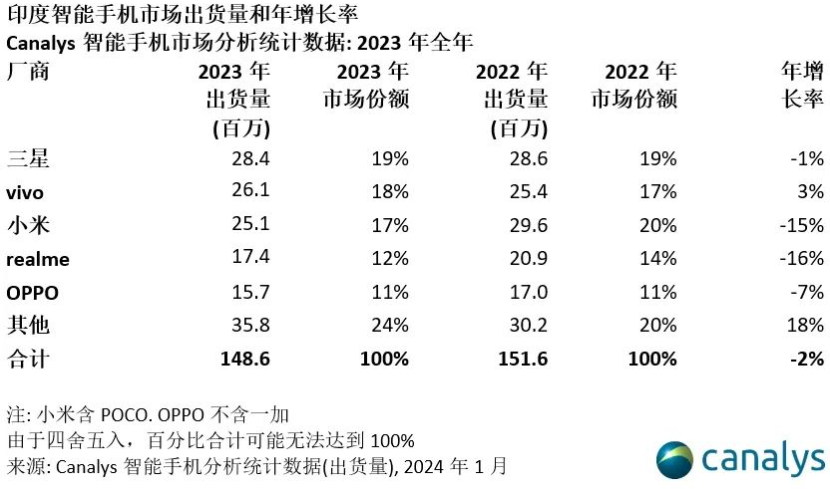

According to news on January 20, according to the latest data released by Canalys, the Indian smartphone market grew by 20% year-on-year in the fourth quarter of 2023, with shipments reaching 38.9 million units. Total shipments for the full year 2023 were 148.6 million units, down slightly by 2%.

Indian market shipments in the fourth quarter of 2023: Samsung shipped 7.6 million units, occupying 20% of the market share, a year-on-year increase of 14%; Xiaomi shipped 7.2 million units, occupying 18% Market share, a year-on-year increase of 31%; vivo shipped 7 million units, occupying 18% of the market share, a year-on-year increase of 10%; realme shipped 4.5 million units, occupying 12% of the market share, a year-on-year increase of 69 %;OPPO shipped 3.7 million units, occupying 10% of the market share, down 5% year-on-year;

Canalys senior analyst Sanyam Chaurasia said, “In 2023, continuous investment in mainstream retail space will not only be beneficial to manufacturers, but also Stabilizing the overall market. In the fourth quarter, the offline shipment share of brands such as Xiaomi and realme hit a new high. Xiaomi adjusted its shipment matrix to balance offline and online channel shipments, but offline channel shipments reached a record high The highest quarter. Its Redmi 12 5G and the recently launched Redmi 13C series both contributed to shipments of more than one million units through offline channels. Similarly, realme also balanced its shipment channels, with the Narzo series driven by e-commerce and the rest of its products The portfolio continues to be dominated by offline channels. For manufacturers, if they want to further consolidate their position in the high-end market and gain more high-end market shares, manufacturers should continue to enhance the confidence of their channel partners." Learned from the report, Canalys expects the Indian smartphone market to post mid-single-digit growth in 2024, driven by affordable 5G phones and replacement cycles. But the biggest challenge manufacturers will face will be how to deal with rising material costs. ReferenceIn the fourth quarter of 2023, the Indian smartphone market rebounded by 20% and fell slightly by 2% for the whole year

Canalys senior analyst Sanyam Chaurasia said, “In 2023, continuous investment in mainstream retail space will not only be beneficial to manufacturers, but also Stabilizing the overall market. In the fourth quarter, the offline shipment share of brands such as Xiaomi and realme hit a new high. Xiaomi adjusted its shipment matrix to balance offline and online channel shipments, but offline channel shipments reached a record high The highest quarter. Its Redmi 12 5G and the recently launched Redmi 13C series both contributed to shipments of more than one million units through offline channels. Similarly, realme also balanced its shipment channels, with the Narzo series driven by e-commerce and the rest of its products The portfolio continues to be dominated by offline channels. For manufacturers, if they want to further consolidate their position in the high-end market and gain more high-end market shares, manufacturers should continue to enhance the confidence of their channel partners." Learned from the report, Canalys expects the Indian smartphone market to post mid-single-digit growth in 2024, driven by affordable 5G phones and replacement cycles. But the biggest challenge manufacturers will face will be how to deal with rising material costs. ReferenceIn the fourth quarter of 2023, the Indian smartphone market rebounded by 20% and fell slightly by 2% for the whole yearThe above is the detailed content of Four Chinese brands, vivo and Xiaomi, will enter the top 5 in the Indian smartphone market in 2023, reaching 148.6 million units.. For more information, please follow other related articles on the PHP Chinese website!

How to flash Xiaomi phone

How to flash Xiaomi phone

VIVO is a brand from which country?

VIVO is a brand from which country?

Win7 prompts that application data cannot be accessed. Solution

Win7 prompts that application data cannot be accessed. Solution

Why is there no response when headphones are plugged into the computer?

Why is there no response when headphones are plugged into the computer?

bios cannot detect solid state drive

bios cannot detect solid state drive

string to int

string to int

What are the programming languages?

What are the programming languages?

Android desktop software recommendations

Android desktop software recommendations