What are the Cosmos ecological potential protocols that have not yet issued coins?

This article learns about 4 potential protocols that have not yet issued coins in the Cosmos ecosystem.

Let’s dive in together⬇️

1. ZetaChain

ZetaChain is a Layer1 blockchain with cross-chain interoperability and supports non-intelligent intelligence such as BTC and Doge. Contract chain communication. In addition, it is also compatible with EVM, enabling users and developers to implement universal smart contracts and messaging on different chains.

Developers can use the toolset to build a full-chain DApp based on ZetaChain from a single point.

Currently, more than 150 DApps have joined the ZetaChain ecosystem, and the number of testnet users has exceeded 3 million. Click this link for details.

The reasons to pay attention to ZetaChain are:

1. LayerZero is about to release Token, and the full-chain narrative is about to rise (and Wormhole is also about to issue coins);

ZetaChain is a support The platform of BTC chain, which is consistent with the basic principles of BTC. In the future, DApps on ZetaChain may have the ability to support native BTC assets. For example, Sushi recently announced a partnership with ZetaChain to provide native BTC support for its users, allowing them to exchange native BTC between 30 networks. This collaboration provides users with more trading options and flexibility.

3. ZetaChain has officially announced many cooperations during this period, including the SushiSwap mentioned above, as well as Curve, Bounce, etc.

4. ZetaChain’s important partner WaaS (Wallet as a Service) provider Magic completed a $52 million financing last year, led by Paypal.

ZetaChain has currently released the vision and roadmap for the launch of Mainnet 1.0.

In addition, the Ultiverse sub-game Meta Merge, led by Binance Labs, has joined the ZetaChain test network for construction. In the future, Ultiverse will also expand its multi-chain interoperability as a metaverse platform through ZetaChain. The progress of cooperation between these two projects is also worthy of attention.

Now, we can also participate in the interaction of the ZetaChain test network through OKX Web3 Wallet: Link

2. Dymension

Dymension is also a member of the modular blockchain. It is a modular settlement layer.

Celestia peels off the DA layer and builds it as a modular component to provide DA services for Layer 2. Layer 2 only needs to do the execution work and perform data settlement on Layer 1. The reason why Layer 2 chooses Celestia as the DA layer can essentially be attributed to "higher cost performance" (which means higher profits).

The launch of Dymension is to solve the sense of separation between Layer 2 people. Previously, Layer 2 was deployed with customization, using different multi-signature bridging methods and different security assumptions. Dymension will unify Layer 2 through IBC, formulate standardized processes, and ultimately realize the vision of building a Web3 Internet by RollApps.

To put it simply, what Dymension does is to use the IBC protocol to unify Layer 2 standards and integrate liquidity, use Dymension Hub to protect the liquidity in the network, and connect the DA layer (such as Celestia, Near, etc.) RollApps independently chooses) to publish its transaction data.

The interesting thing about Dymension is that it is built around RollApps (a new encryption primitive). Developers building on it only need to polish the product and provide better user services.

In addition, let me mention two more projects on the same track:

- Eclipse is a competing product of Dymension;

- Fuel is a modular execution layer.

3. Saga

If you want to understand Saga simply, you can also understand it as part of the modular ecosystem. Saga's main service form is to help other developers build dedicated chains. These developers can make product design choices based on their own needs.

The Saga team believes that the current competition for Web3 applications is essentially a competition for block space. Therefore, Saga's vision is to enable developers to build their dedicated Web3 application chains in the easiest way possible.

That is, send a link with one click.

Saga once again lowers the threshold based on Cosmos. Through Saga, developers can start an EVM chain of their own within 10 minutes. Saga calls it The Unblock movement.

Saga’s tendency is to create an interoperable game (metaverse) ecosystem.

From my personal point of view, this tendency is very consistent with the services provided by Saga. Based on Saga, game developers can focus on game design and have higher flexibility and interoperability.

4. Berachain

BeraChain is a Cosmos Layer1 based on EVM and adopts PoL (Proof of Liquidity) consensus mechanism. Now that BeraChain has been launched on the public test network "Artio", developers and users can participate in Galxe's interactive tasks by receiving water from the faucet.

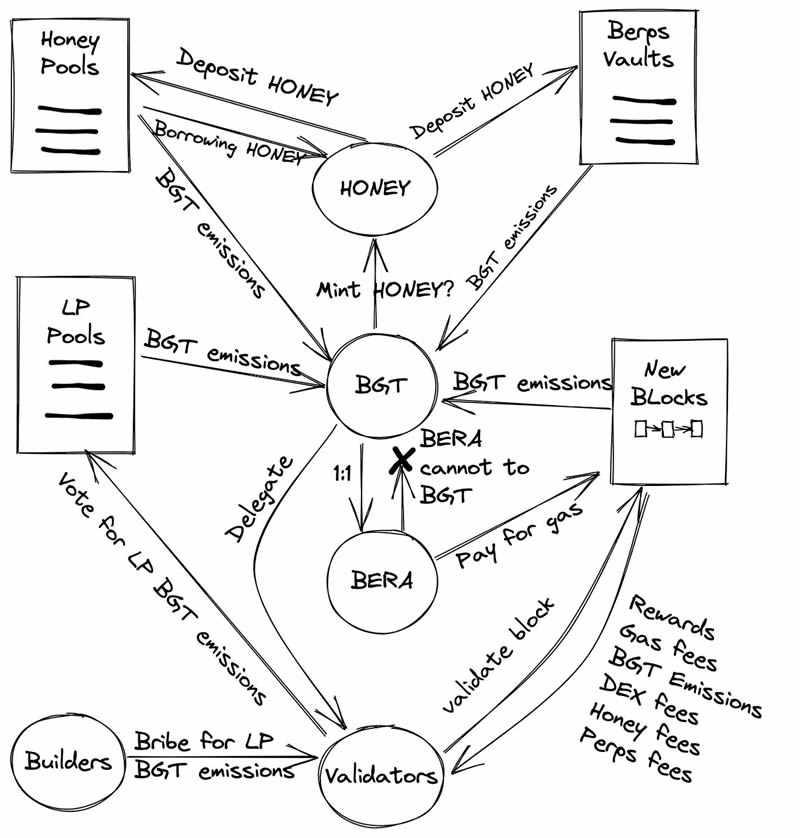

It adopts a three-token model in design:

$BERA: Gas Token, 10% inflation;

$BGT: Governance Token, but not transferable, It can only be obtained by pledging assets;

$HONEY: over-collateralized stable currency, protocol income distribution medium.

After the BeraChain mainnet is launched, users are allowed to pledge wBTC, wETH, wstETH, USDC, USDT, DAI and other assets, and obtain the income distribution and BERA of DeFi activities. The pledge income distribution weight of various assets will be determined by BGT governance is completed. In the future, there is a high probability that the BeraChain ecosystem will also see liquidity staking and aggregated governance products similar to Stride and Convex.

As for the airdrop details, the official has not announced them yet. My personal guess is that in addition to NFT Holder, BeraChain may also airdrop to TIA Staker.

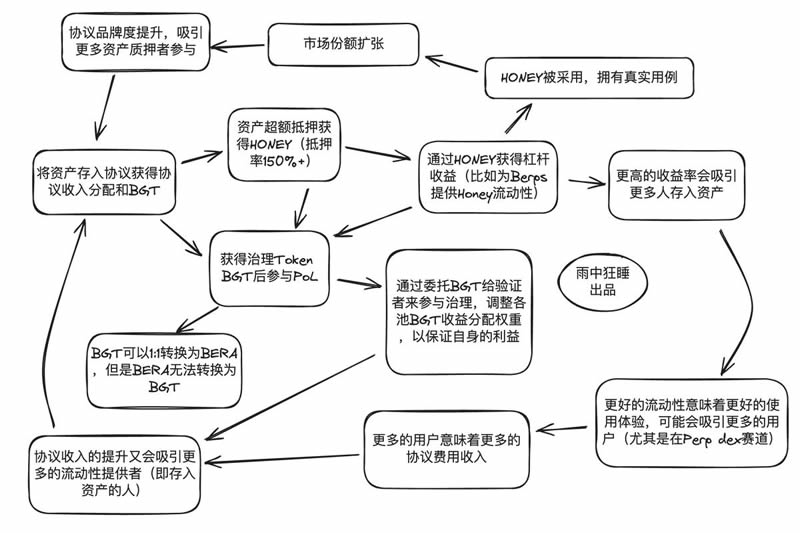

From my perspective, Berachain builds a flywheel as shown in the picture below.

When it was first launched, Berachain’s model was very similar to Canto’s, which promoted the rise of TVL through inflation of tokens. However, as the number of users increases and fee income increases, Berachain will take a different path from Canto. Moreover, Berachain's built-in governance game and stable currency will further promote the market demand for its Gas Token BERA.

Finally, let’s summarize what each chain in the Cosmos ecological protocol is doing during this period:

Neutron is recruiting some remnants of the Luna era and doing something big. AEZ (ATOM Economic Zone) ecology. LaunchpadEclipse Fi on it is also worthy of attention.

The main lines of Osmosis² are LSD, suppressing inflation and merging with Umee (now UX).

Although Injective’s ecology is weak, its main force is strong and its currency price performance is very good.

Kujira performed equally well. Kujira’s staking income is not inflation, but real income.

THORChain follows the cross-chain narrative of native BTC, and two other projects with the same concept are Maya Protocol and CHAINFLIP.

Stride is LSD on Cosmos, with a market share of over 90%. There are also new competing products on the market that compete with Stride.

Sei has now embarked on the parallel EVM narrative, and has been sought after by many markets some time ago.

Kava stops inflation in the new coin generation.

The reason why Axelar Network initially surged was the Upbit List. Today it is reducing token inflation through governance proposals and is expected to be affected by token releases by Wormhole and LayerZero in the future.

Canto Public chose to leave Cosmos and embrace the Polygon ecosystem. Its main narrative is RWA and full-chain stablecoins. Therefore, it will also be affected by the release of LayerZero tokens.

In addition, the market has been speculating on some LRT concepts recently, so the LRT $PICA on Cosmos (recently expanding to Solana) has also received widespread attention, and the price performance is good.

Original link

The above is the detailed content of What are the Cosmos ecological potential protocols that have not yet issued coins?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network recently held PiFest 2025, an event aimed at increasing the token's adoption. Over 125,000 sellers and 58,000 merchants participated

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Cryptocurrency has always been a realm where the cutting edge of technology meets bold ambition, and it's only getting more exciting in the future. As artificial intelligence continues to grow in influence, there are a handful of digital assets that

![Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February](https://img.php.cn/upload/article/001/246/273/174209101774967.jpg?x-oss-process=image/resize,m_fill,h_207,w_330) Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Mar 16, 2025 am 10:10 AM

Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Mar 16, 2025 am 10:10 AM

Technical indicators such as the OBV showed that selling pressure has been dominant, meaning more losses may be likely ahead.

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

Ethereum (ETH) price edges toward resistance, Tether news reveals a €10M media deal, and BlockDAG reaches new milestones with Beta Testnet and growing adoption.

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Ouyi usually refers to Ouyi OKX. The global way to download Ouyi OKX APP is as follows: 1. Android device: Download the APK file through the official website and install it. 2. iOS device: access the official website through the browser and directly download the APP.

In Celebration of Pi Day, a Community of Pi Network Enthusiasts Held a Bartering Event in Muntinlupa City

Mar 22, 2025 am 10:02 AM

In Celebration of Pi Day, a Community of Pi Network Enthusiasts Held a Bartering Event in Muntinlupa City

Mar 22, 2025 am 10:02 AM

Pi Network Celebrates Pi Day with a Bartering and Merchant Orientation Event in the Philippines

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

Cyber criminals were able to steal cryptocurrency worth 1.5 billion US dollars

Mar 16, 2025 am 11:12 AM

Cyber criminals were able to steal cryptocurrency worth 1.5 billion US dollars

Mar 16, 2025 am 11:12 AM

Since then, the provider has been investigating how this could have happened and how it will (hopefully) not happen again in the future.