Since the U.S. Securities and Exchange Commission (SEC) approved a Bitcoin spot ETF, the price of Bitcoin has fallen significantly. Bitcoin, which peaked at $48,969, is now oscillating around $41,500. The market believes that this may be related to investors selling out to make profits after Grayscale GBTC transformed into a Bitcoin spot ETF. This selling pressure caused negative premiums to approach zero, triggering continued heavy selling activity.

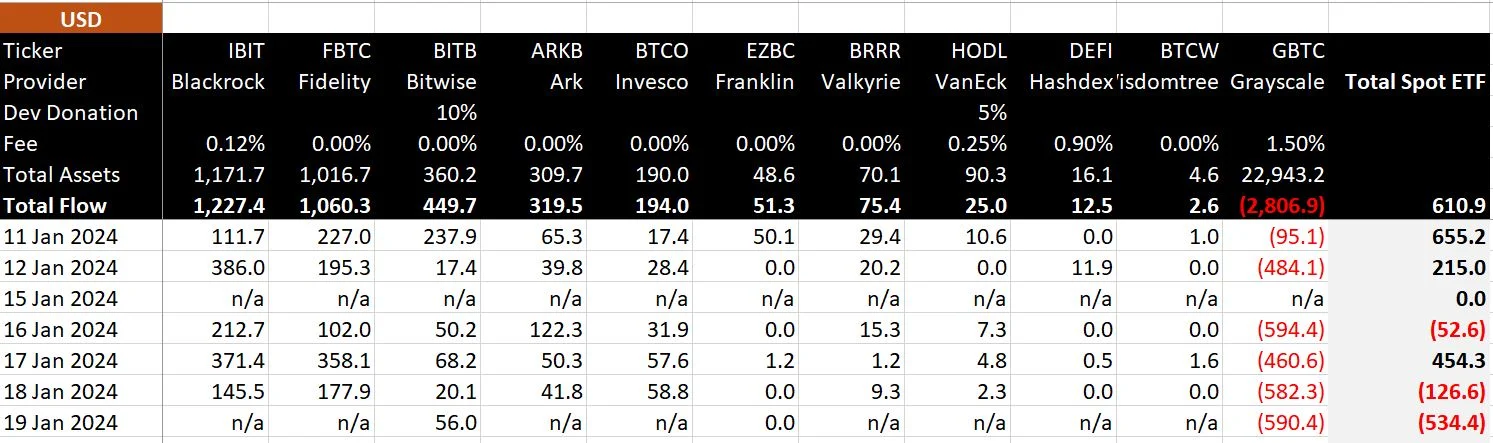

According to data from BitMEX Research, in the first six trading days since GBTC transformed into a Bitcoin spot ETF, GBTC had a total outflow of US$2.8 billion. Specifically, there was an outflow of $95.1 million on day 1, $484.1 million on day 2, $594.4 million on day 3, $460.6 million on day 4, $582.3 million on day 5, and $582.3 million on day 4. There was an outflow of $590.4 million in 6 days. These data indicate that investors are not optimistic about GBTC outflows.

Daily changes in capital inflows and outflows of various Bitcoin spot ETFs

Will Bitcoin continue to fall?

Although some people in the market believe that one of the reasons for the sell-off of GBTC may be related to its high management fee of 1.5%, Bloomberg analyst Eric Balchunas believes that only 10% of GBTC funds have flowed out and flowed into the other 9 tranches. ETF, well below expectations. This suggests that the impact of capital flows is not that significant and that other factors may be at play.

Given that GBTC is the world’s largest Bitcoin ETF, holding more than $25 billion in Bitcoin, Onchain Capital’s Ran Neuner warned that Bitcoin may face a period of selling pressure. Holding $25 billion in assets is a considerable amount, and even if only 20% were redeemed, there would be $5 billion of selling pressure in the market.

Therefore, Chris J Terry, chief architect of BTCdata, tweeted on the 21st that before the GBTC liquidation is completed, the price of Bitcoin may continue to fall or remain flat. He predicted that a sell-off of as much as $25 billion could occur in the coming weeks. In addition, Grayscale’s decision to keep the ETF management fee at 1.5% is considered the biggest strategic mistake in the history of cryptocurrency.

Mike Novogratz is optimistic that Bitcoin will rise within 6 months

However, Galaxy Digital founder Mike Novogratz did not agree with Chris J Terry’s argument. He tweeted on the 21st that although people would Sell GBTC, but most people will switch to investing in other ETFs, and his own Invesco Galaxy Bitcoin ETF is his favorite: Let’s not miss the forest because there are trees ahead. Now, it is easier for baby boomers to buy the underlying, You can get 4 to 5x leverage with Bitcoin exposure, the indigestion will be over and Bitcoin will be higher in 6 months.

Mike Novogratz predicted in November last year that as the Bitcoin spot ETF was approved for listing, up to 10 billion new funds would flow into the Bitcoin ETF in the first year, and the price of Bitcoin would surge to All-time high for the 2021 bull run at $69,000.

The above is the detailed content of Will Bitcoin continue to fall before Grayscale GBTC is liquidated? Mike Novogratz bullish on gains in 6 months. For more information, please follow other related articles on the PHP Chinese website!