Ethereum price could rise 75% via Bitcoin ETF

January 10 is the deadline for the U.S. Securities and Exchange Commission (SEC) to make a decision on a Bitcoin ETF. Markets are optimistic about the approval of a Bitcoin ETF, arguing that this key event could have broad implications for the crypto market, including Ethereum, the second-largest cryptocurrency by market capitalization.

If a Bitcoin ETF is approved, the price of Ethereum could rise by as much as 75% in the coming months.

Ethereum ETF

Approval of a Bitcoin ETF may set a regulatory precedent for other cryptocurrency-based ETFs, as it would establish a applicable regulatory framework for ETFs of other cryptocurrencies such as Ethereum. frame.

In December 2023, the SEC announced that it would make a postponement decision on several U.S. Ethereum ETF applications, with a new deadline set for May 2024. These ETFs include the Hashdex Nasdaq Ethereum ETF, Grayscale Ethereum Futures ETF, VanEck Ethereum Spot ETF, and the Ethereum Spot ETF proposed by ARK Invest and 21Shares.

The SEC process includes a delay in approval to allow for public input to decide whether the listing should occur. Additionally, the delay in approval comes as the committee investigates the classification of some PoS cryptocurrencies.

Interestingly, Ethereum was not considered a security in the recent SEC lawsuit against cryptocurrency exchanges. Additionally, the SEC did not challenge Ethereum’s classification, even during the Commodity Futures Trading Commission’s (CFTC) ETF registration process.

This increases the likelihood of a spot Ethereum ETF being approved in the United States in May 2024, which could boost ETH prices.

Ethereum-Bitcoin Correlation

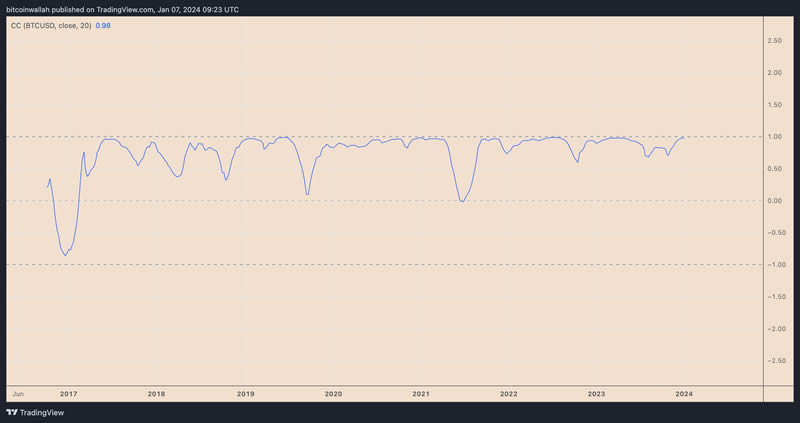

If the approval of the Bitcoin ETF becomes a "sell-the-news" event (i.e. a positive event), due to the correlation with the price of BTC in recent years Sex, the price of Ethereum may usher in a sharp rise.

Fundamentally speaking, the approval of a Bitcoin ETF could lead to increased investment in cryptocurrencies from traditional financial investors. This, in turn, could cause ETH prices to rise in anticipation of increased demand.

# Conversely, a delay or rejection of a Bitcoin ETF could lead to a short-term pullback. A recent Bitwise survey found that only 39% of U.S. financial advisors believe a Bitcoin ETF will be approved this year.

Technical Indicators

Judging from K-line technical indicators, recently, the price of ETH is approaching the resistance trend line of its rising wedge shape. Delay or rejection of the Bitcoin ETF could lead to a pullback to the wedge’s lower trendline near $1,865 in February.

The $1865 level coincides with ETH’s 0.236 Fibonacci line and its 50-week exponential moving average (the red wavy line on the chart above).

On the other hand, ETF approval could invalidate Ethereum’s rising wedge entirely in favor of an ascending triangle reversal pattern, as shown below.

If so, by March, Ethereum could rise to the triangle’s upside target near $3,870, a 75% upside from current price levels, and the 0.786 Fib The lines coincide.

The above is the detailed content of Ethereum price could rise 75% via Bitcoin ETF. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

PANews and Bullish joint roundtable: Crypto market development after Bitcoin ETF, how real-world assets enter Web3

Feb 29, 2024 pm 05:31 PM

PANews and Bullish joint roundtable: Crypto market development after Bitcoin ETF, how real-world assets enter Web3

Feb 29, 2024 pm 05:31 PM

2024 is destined to be a colorful year in the narrative of the encryption industry. At the beginning of the new year, the U.S. SEC approved the applications for 11 Bitcoin ETFs. With the legal entry of asset management giants such as BlackRock and Fidelity Capital, the price of Bitcoin has also been soaring, successfully exceeding US$57,000. On the afternoon of February 27, in Hong Kong, another crypto compliance hotspot, a roundtable forum co-organized by PANONY&PANews and Bullish was successfully held. Focusing on the topic of "The future of cryptocurrencies after the approval of Bitcoin ETF and how real-world assets can enter Web3", Priscilla Adams, Director of Bullish Compliance, and Nick van Eck, CEO and Co-Founder of Agora

Following U.S., Hong Kong approvals, Australia prepares for Bitcoin ETF wave

Apr 30, 2024 pm 04:07 PM

Following U.S., Hong Kong approvals, Australia prepares for Bitcoin ETF wave

Apr 30, 2024 pm 04:07 PM

The Australian Securities Exchange is expected to approve the first spot Bitcoin ETFs before the end of 2024. Spot Bitcoin ETFs are making an unprecedented splash in the cryptocurrency industry. Following the United States and Hong Kong, Australia is now gearing up for the launch of a series of Bitcoin exchange-traded funds (ETFs). The Australian Securities Exchange (ASX) has received applications from at least two organizations and has another in the pipeline. Australia Readies for Bitcoin ETFs According to a recent report from Bloomberg, ASX Limited, which manages about 80% of equity trading in the country, is expected to approve the listing of the first spot Bitcoin ETFs before the end of 2024. The filings follow the success of the U.S. Bitcoin ETF, which

How to Buy Bitcoin ETFs

Apr 12, 2024 pm 02:31 PM

How to Buy Bitcoin ETFs

Apr 12, 2024 pm 02:31 PM

A Bitcoin ETF is a financial instrument that tracks the value of Bitcoin and can be purchased through a brokerage account. The purchasing steps include: opening an account, recharging the account, searching for the stock code, placing an order, and completing the transaction. However, attention should be paid to its characteristics such as large price fluctuations, management fees, and lack of private key control.

Citron advises investors to short Coinbase (COIN) stock

Mar 02, 2024 pm 04:58 PM

Citron advises investors to short Coinbase (COIN) stock

Mar 02, 2024 pm 04:58 PM

However, the renowned researcher remains optimistic about Bitcoin. Coinbase has been on a strong run of late, with the platform beating analyst expectations and managing to rebound quickly from the trough of the crypto winter, according to newly released data for the fourth quarter of 2023. According to reports, the exchange recently suffered technical glitches, which were believed to be caused by high traffic. This issue caused some users' account balances to show zero. Quick recovery The platform has now recovered from the outage, and Coinbase CEO Brian Armstrong also explained what happened on X. Currently, all Coinbase functionality appears to be functioning normally except for PlayDapp (PLA) transfers. Although this failure did not actually

Korean financial expert analysis report: Potential economic risks brought by spot Bitcoin ETFs

Jun 25, 2024 pm 08:55 PM

Korean financial expert analysis report: Potential economic risks brought by spot Bitcoin ETFs

Jun 25, 2024 pm 08:55 PM

The launch of a spot Bitcoin (BTC) exchange-traded fund (ETF) in South Korea could cause severe economic disruption, according to a recent analysis by the Korea Institute of Finance (KIF). While the global trend is towards the approval of cryptocurrency-linked ETF products, the report highlights potential unique challenges that the Korean market may face. Potential Risks of Korean Bitcoin ETFs Globally, the approval and launch of Bitcoin spot ETFs has become a trend, and this phenomenon has caused widespread discussion and concern in the Korean financial community. In his report "Review of Overseas Virtual Asset Spot ETF Approval", Lee Bo-mi, a researcher at the Korean Financial Services Agency, deeply discussed the negative impact that Bitcoin ETFs may have on the Korean market. Li Pumei pointed out that although virtual assets

What does Bitcoin ETF mean?

Jan 31, 2024 pm 04:32 PM

What does Bitcoin ETF mean?

Jan 31, 2024 pm 04:32 PM

A Bitcoin ETF is a fund that can be traded on a stock exchange with assets primarily invested in Bitcoin. Bitcoin ETFs are similar to traditional ETFs, except they track Bitcoin rather than stocks or bonds. The purpose of Bitcoin ETFs is to provide investors with a convenient way to invest in Bitcoin without directly buying and holding Bitcoin. By purchasing Bitcoin ETFs, investors can indirectly invest in the Bitcoin market and enjoy the benefits of rising Bitcoin prices.

What are the Bitcoin etfs

Mar 19, 2025 pm 05:06 PM

What are the Bitcoin etfs

Mar 19, 2025 pm 05:06 PM

This article introduces common Bitcoin ETFs, including iShares Bitcoin Trust (IBIT), Grayscale Bitcoin Trust (GBTC), Fidelity Wise Origin Bitcoin Fund (FBTC), Ark 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF Trust (BITB), Grayscale Bitcoin Mini Trust (BTC), ProShares Bitcoin ETF (BITO), WisdomTree

Is a Bitcoin ETF approved? What impact will the adoption of Bitcoin ETF have?

Feb 04, 2024 am 10:05 AM

Is a Bitcoin ETF approved? What impact will the adoption of Bitcoin ETF have?

Feb 04, 2024 am 10:05 AM

Bitcoin ETF was the first to be launched in other markets, because the U.S. SEC has been slow to give an accurate answer on the approval of Bitcoin ETF. This has also made investors in the circle very concerned about whether the Bitcoin ETF has been approved? According to the latest news, the U.S. Securities and Exchange Commission announced on January 10, 2024, Beijing time, that it had officially approved the first Bitcoin spot exchange-traded fund. VanEck confirmed that all 11 applicants for the Bitcoin spot ETF were approved. It is expected that Trading can begin as early as January 11, 2024, U.S. time. Next, the editor will tell you in detail about the latest news on this Bitcoin ETF application. Is a Bitcoin ETF approved? According to the latest news, the Bitcoin ETF was announced on January 10, US time