web3.0

web3.0

Six major themes and related projects for crypto infrastructure looking forward to 2024 - Delphi Digital's perspective

Six major themes and related projects for crypto infrastructure looking forward to 2024 - Delphi Digital's perspective

Six major themes and related projects for crypto infrastructure looking forward to 2024 - Delphi Digital's perspective

"Unlike the current situation, in the future tokens may be used more to support specific solvers to gain income, and these solvers may participate in one or more independent applications. Due to intent-based cross-chain value transfer applications , such as Across, deBridge's DLN, @hashflow, Connext, CHAINFLIP LABS, Uniswap Labs, etc., require solvers to have similar functions, so it is reasonable to expect that the same solver will participate in multiple applications." - Excerpted from "2024 Basics Facilities Outlook”.

Our "Infrastructure Outlook 2024" provides a comprehensive and in-depth exploration of the following 6 major themes:

Theme 1: The Battle of L2

Research and analyze Blast L2, the biggest catalyst that may lead to the next round of market collapse, and the increasingly fierce competition among rollups.

The L2 ecosystem is becoming increasingly siled -- dissecting Arbitrum, Optimism, Base, zkSync, Mantle, Starknet, Polygon and more.

Ethereum Alignment: Fungible DA (data availability) is needed for scalability and a top protocol with competing products.

In-depth research on value accumulation: from ETH, L2 tokens to fungible DA – reflecting different fee generation designs and future rollup structures.

Entering the L1 competition landscape, the main competitors are Monad, Sei, Berachain, Sui and Aptos.

Topic 2: Solana

A comprehensive overview of the state of Solana -- evaluating the pros and cons of Solana's architecture, changing fees, and NFTs Changing relationship with SOL prices.

Firedancer & Franendancer: A concise summary of Firedancer, the latest optimization and performance updates, and Franendancer architecture.

Payments: Solana’s areas of expertise – assessment of payment activity and infrastructure, analysis of payment applications and integrations like Sphere, Code, Sling, Shopify, and more.

OPOS: Only possible on Solana – Overview of Solana’s unique applications, including the Crankless Limit Orderbook DEX “Phoenix”, consumer-facing apps, and creator-facing cNFT platform DRiP, sanctum, a liquidation DAO focused on Solana LST, and more.

Theme 3: Intent-based cross-chain future, value will flow to solvers

Profitable token bridges will decline, which will affect the entire USDC chain A thorough review of the standard CCTP will change the bridging landscape.

The main player in the future of intent-based bridging is Across, which is the most mature intent-based bridge.

Where does the value come from?

Future Outlook: The ubiquity of intent and how the lines between applications are becoming increasingly blurred in an intent-centric world.

Topic 4: Solver Centralization

The evolution of DEX (decentralized exchange) to an intent-based architecture, focusing on in-depth study of UniswapX .

Solver Fifty Shades of Decentralization: Competition, Decentralization, and Requirements in Solver.

Solver will dominate intent-based DEX trading volume.

Topic 5: THORChain & Chainflip – Scaling is Bitcoin’s decentralized highway

On THORChain and its development, Synths and protocols A comprehensive overview of own liquidity.

What are the benefits of Synths?

Future Outlook: What’s next for Thorchain in 2024?

In-depth study of Chainflip: used to evaluate the differentiating factors of THORChain such as JIT AMM and MEV in Chainflip.

Topic 6: Ethereum Roadmap

Future Hard Forks – A look at two major upcoming hard forks: Deneb-Cancun Hard fork and Prague-Electra hard fork.

EIP-4844 and its impact on data release -- a case study in one of the most anticipated Ethereum upgrades since EIP-1559 and the Ethereum merger.

One key takeaway: "The future of cross-chain is based on intent, and value will flow to solvers."

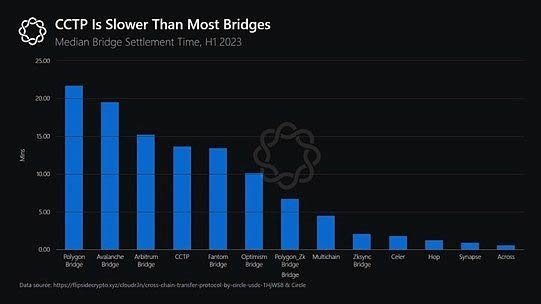

CCTP and Canonical Bridge have clear advantages and disadvantages. First, they solve most liquidity/user experience fragmentation issues by increasing the share of canonically denominated assets. On the other hand, due to their conservative nature, they are slow. Authentication for Rollup bridges can take hours or weeks, while CCTP can take anywhere from tens of minutes to hours.

However, users want faster speeds. Therefore, adoption of backend services may come from user-facing applications that compete with each other in terms of speed, capital efficiency, and gas cost. As a result, we believe intent-based design will have a competitive advantage.

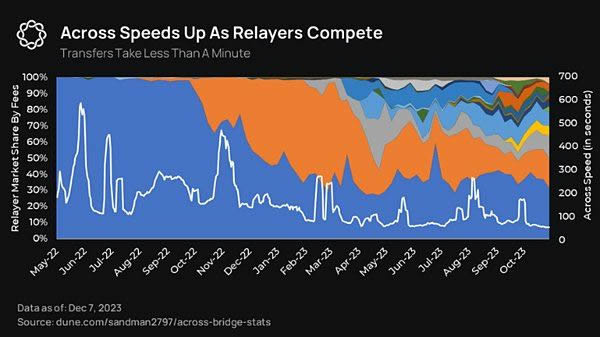

Across stands out as the most mature intent-based bridge. Particularly active in the area of connectivity between Ethereum and Ethereum rollups, coupled with the increasing adoption of rollups, Across has gained considerable market share.

Our main point is that the future of cross-chain will be based on intent, which can be explained by taking Across as an example.

The intent-based liquidity network is unique in its ability to leverage off-chain liquidity through an open, permissionless off-chain main market of solvers.

The idea is: users outsource bridging risks to solvers. Solvers compete to realize cross-chain transfer intentions and capture value through fees.

The cross-chain transfer process through Across can be simplified into the following 3 steps:

Step 1, generate intention: the user deposits the assets into the escrow account to express his cross-chain transfer intention, The relayer will receive the fee after the intent is completed.

Step 2, Intent Completion: Relayers compete to identify and complete user intent on the target chain to earn fees, using off-chain liquidity to pay out of their own pockets.

Step 3, Settlement: Completed transactions on the target chain are sent back to the source chain for verification. The winning relayer will unlock the assets in custody and verify them through Across’ UMA’s optimistic oracle to reduce on-chain gas costs.

Key aspects: Users’ cross-chain transfer intentions are provided with immediate service by relayers, who will be compensated later. This guarantees users the fastest processing speeds while enabling relayers to minimize operating costs.

Transaction-based bridge transfer time is limited by the finality of the source and target chains. Intent-based bridging overcomes this problem by using relayers. Relayer can implement user intent on the target chain even before the transaction on the source chain is completed. This makes transactions faster as competition among relayers increases.

Across's settlement is optimized for gas fee minimization, with periodic (every 2-4 hours) batch payments to reduce gas amortization costs. Across uses UMA's optimistic oracle for verification, further reducing gas costs.

Reliability is crucial for a liquidity network like Across. To ensure the continued availability of liquidity on the target chain, the protocol also helps relayers rebalance their liquidity. This is achieved through Across using on-chain liquidity pooled by passive LPs (liquidity providers), using a hub-and-spoke (spoke) model, that is, there is a central pool on the Ethereum mainnet, and on the target chain There are some smaller radiant pools.

The protocol proactively manages rebalancing by periodically adjusting liquidity between the radiating pool and the central pool. Such flexibility allows relayers to receive payments on the chain of their choice, regardless of the user’s deposit location. These pools also serve as backup for off-chain liquidity in case relayers fail to serve user intent.

Future Outlook:

Across currently uses Canonical Bridge and is planning to move to Universal Bridge Adapter UBA to achieve rebalancing of liquidity. UBA will involve off-chain relayers, incentivize the balancing pool, and impose penalties on relayers who withdraw from the underbalanced radiation pool.

After UBS, Across will not bind a specific bridge method and will allow relayers to choose any bridge and compatible chain without using a canonical bridge.

The above is the detailed content of Six major themes and related projects for crypto infrastructure looking forward to 2024 - Delphi Digital's perspective. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Cryptocurrency has always been a realm where the cutting edge of technology meets bold ambition, and it's only getting more exciting in the future. As artificial intelligence continues to grow in influence, there are a handful of digital assets that

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network recently held PiFest 2025, an event aimed at increasing the token's adoption. Over 125,000 sellers and 58,000 merchants participated

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Ouyi usually refers to Ouyi OKX. The global way to download Ouyi OKX APP is as follows: 1. Android device: Download the APK file through the official website and install it. 2. iOS device: access the official website through the browser and directly download the APP.

In Celebration of Pi Day, a Community of Pi Network Enthusiasts Held a Bartering Event in Muntinlupa City

Mar 22, 2025 am 10:02 AM

In Celebration of Pi Day, a Community of Pi Network Enthusiasts Held a Bartering Event in Muntinlupa City

Mar 22, 2025 am 10:02 AM

Pi Network Celebrates Pi Day with a Bartering and Merchant Orientation Event in the Philippines

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

The crypto market continues to face turbulence, with Cardano (ADA) dropping 12% to $0.64, prompting concern across the altcoin sector.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

Ethereum (ETH) price edges toward resistance, Tether news reveals a €10M media deal, and BlockDAG reaches new milestones with Beta Testnet and growing adoption.