The U.S. Securities and Exchange Commission (SEC) has entered an important stage in approving the Bitcoin spot ETF. Last night, Grayscale once again submitted a prospectus to the SEC for converting Bitcoin Trust (GBTC) into a spot ETF.

The prospectus provides potential investors with detailed information, including investment objectives, fees, risks and management team. ETFs can only be publicly offered and traded after regulatory approval.

Although Grayscale has been updated three times, Bloomberg ETF analyst James Seyffart pointed out that the latest filing lacks detailed information, There are clear instructions only on cash creation, but no Authorized Participants (APs) are specifically named. It’s unclear why. The SEC clearly wanted to see AP’s explanation, but Grayscale didn’t provide it. Additionally, there is no description of the fees in the document, which is also an important issue.

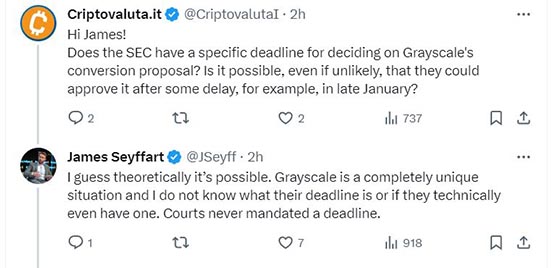

In response to questions from community members, James Seyffart pointed out that the court did not set a deadline for Grayscale’s Bitcoin spot ETF conversion application. So it's theoretically possible that Grayscale's application wouldn't be approved by the mid-January deadline. He believes Grayscale is an entirely unique situation and he doesn't know their deadline because the courts have never set out on it.

The above is the detailed content of Bloomberg analyst: SEC updates GBTC prospectus still lacks important information. For more information, please follow other related articles on the PHP Chinese website!