Factors in Evaluating Ethereum's Value and Potential Investment Opportunities

On January 11, the U.S. SEC approved 11 Bitcoin ETFs. This event marked a new chapter for the encryption industry. The inflow of funds will further promote the development of the crypto market. With the development of the Bitcoin ecosystem, the market has also begun to turn its attention to the Ethereum ecosystem. Currently, Ethereum is up 7%. The Ethereum ecosystem will receive good news and market attention in the coming months.

Positive factors for ETH ecology in the next few months

Cancun upgrade

In order to achieve its positioning as a "world computer", Vitalik planned for Ethereum at the beginning of its birth An upgrade roadmap is prepared, including four stages: Frontier, Homestead, Metropolis, and Serenity. Currently, Ethereum is in the Metropolis stage, but faces limitations from performance issues and high gas fees. To solve these problems, the Ethereum team introduced some important improvements and features during the Metropolis phase, such as EIP (Ethereum Improvement Proposal) and ZK-SNARKs technology. These improvements are designed to increase Ethereum’s performance and scalability, as well as reduce transaction fees. Although there are still some challenges, the Ethereum team is continuously working hard to promote the development of the platform to realize its vision of becoming the world's leading smart contract platform.

The Cancun upgrade, also known as the Cancun-Deneb upgrade, is an important upgrade to the Ethereum main chain. This upgrade aims to improve the scalability, security and availability of the Ethereum network, while improving the transaction processing per second (TPS) of the main chain and reducing gas fees to achieve expansion of the Ethereum main chain. By introducing new protocols and technical improvements, the Cancun upgrade is expected to solve the scalability challenges faced by Ethereum, provide users with a better transaction experience, and lay a solid foundation for the development of the Ethereum ecosystem.

After the Cancun upgrade is completed, Ethereum’s network utility will be greatly improved and its infrastructure will become more complete, consolidating its status as the “King of Public Chains”. In addition, the Layer 2 sector will also usher in unprecedented development and prosperity.

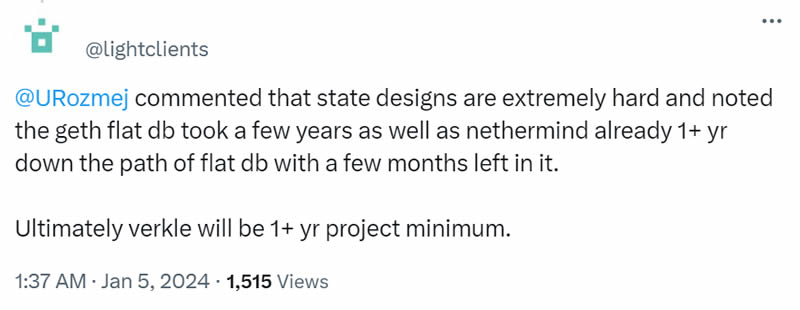

According to a post by Geth team developer lightclients, the 178th Ethereum Core Developer Executive Meeting (ACDE) has ended. During this meeting, it was confirmed that the Cancun upgrade date for the Goerli testnet will be January 17. In addition, the dates for the Sepolia testnet upgrade and the Holesky testnet upgrade were determined to be January 30 and February 7 respectively. If all goes well, the developers plan to release the Goerli client next week and the Sepolia/Holesky client the week of January 22nd.

Ethereum ETF

The Bitcoin ETF has been passed and has been postponed several times by the SEC. The application for the Ethereum ETF has become the next focus of the community.

On December 19, the U.S. Securities and Exchange Commission (SEC) announced that it would postpone its decision on ARK/21Shares and VanEck’s Ethereum spot exchange-traded fund (ETF) applications. According to the latest arrangement, the resolution will be postponed to late May 2024. At the same time, The Block reported that the SEC has also postponed decisions on the Hashdex Nasdaq Ethereum ETF and Grayscale Ethereum Trust conversion applications. These moves to delay the resolution mean that the SEC’s approval of the Ethereum ETF still needs more time to review and evaluate.

Bloomberg analyst James Seyffart hinted on the Unchained podcast that the U.S. SEC’s stance on Ethereum may undergo a subtle shift. He pointed out that the SEC recently approved an Ethereum futures ETF, which may mean that the SEC is gradually recognizing that Ethereum is a commodity rather than a security.

On January 11, Cointelegraph reported that Bloomberg ETF analyst Eric Balchunas said that the probability of spot Ethereum ETF being approved in May was 70%, and also hinted that “there are rumors about spot Ethereum ETF in behind-the-scenes channels” It will be good".

However, digital asset lawyer Joe Carlasare believes that the approval of the spot Ethereum ETF may take longer than expected. At the same time, the U.S. Securities and Exchange Commission is also working hard to carefully create a precedent that allows them to decide which digital assets are allowed. Asset ETFs retain some discretion when entering the market.

Layer2 expansion narrative

On the one hand, the implementation of the Ethereum Cancun upgrade EIP4844 Proto-Danksharding proposal will bring more possibilities to the Layer2 Rollup project. On the other hand, Layer 2s have developed a thriving market in exploring the scalability direction of Ethereum. In addition to the Cancun upgrade, in the “capacity expansion battle” that will start in the summer of 2023, Layer 2 has also launched expansion plans.

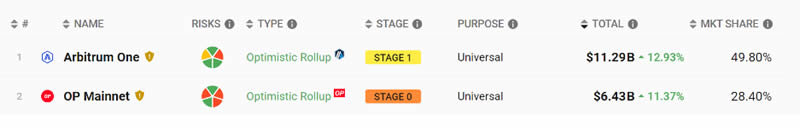

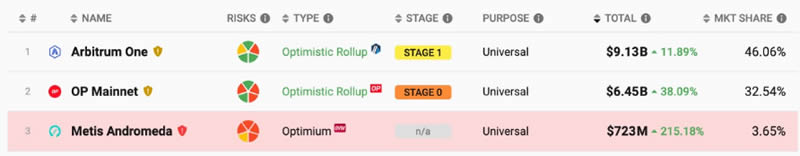

Since its development, the community has witnessed various possibilities of the Layer2 ecosystem, taking the leading Layer2 Optimistic and Arbitrum, as well as the newly popular Layer2 Metis as examples. It is foreseeable that in 2024, Layer 2 will continue to bring more imagination to the Ethereum ecosystem.

Optimistic: OP stack opens the "Super Chain Universe"

Currently, Optimistic and Arbitrum occupy the majority of the capital share of the Layer2 market.

In October 2022, Optimism introduced the OP Stack, which is "a highly scalable, highly interoperable modular open source blueprint of various types." Optimistic proposed the Superchain strategy in February 2023 and adopted the L2 of the OP stack. Due to the consistency of the technical architecture, they can achieve safe, efficient, atomic-level communication and interaction of information and assets, similar to Cosmos. "Interchain" is called Superchain.

After OP stack was launched, it has gained a lot of adoption. Many public chains such as Coinbase, opBNB, Zora, and Worldcoin have given OP Stack good brand endorsement. In June 2023, Optimism Blockchain announced that it would be renamed OP Mainnet to distinguish OP Mainnet from the Optimism ecological chain built on OP Stack. It is foreseeable that the multi-chain universe of OP stack will be more prosperous in 2024.

Arbitrum: Orbit drives ecological Layer3 blowout

On January 3, Binance’s new Launchpool project Xai (XAI) attracted the attention of the community. After several days of decline after its release, XAI had over 25% of its battle servers on January 11th. As the Oribit network customized and developed by Arbitrum to meet the needs of large-scale Web3 games, Xai (XAI) and the Oribit network ecosystem it represents are of great strategic significance to Arbitrum.

Arbitrum Orbit Ecology

In June 2023, the Arbitrum development team Offchain Labs released the Arbitrum Orbit development tools, aiming to help developers develop L3 blockchain Develop more easily on Arbitrum Orbit and manage your own Arbitrum Rollup and AnyTrust chains.

Arbitrum Orbit has the same compatibility as the EVM introduced by Stylus. This means developers can deploy EVM-compatible smart contracts directly using Solidity, C, C++, and Rust without abandoning the language and toolchain they are using. Additionally, the Arbitrum Orbit platform has added support for custom Gas tokens. These tokens are used to pay transaction fees. This development allows the Orbit blockchain to use specific ERC-20 tokens that meet technical standards to handle gas or transaction fees on its network. Previously, the Orbit chain could only use Ethereum as its Gas token.

The community believes that Orbit will be able to promote the Arbitrum ecosystem to achieve more breakthroughs. In December 2023, TreasureDAO on the Arbitrum ecosystem announced that it would build a game chain and planned to use MAGIC as the Gas token. In the future, the measures taken by Layer 2 to attract developer resources will also bring more liquidity to the Ethereum ecosystem.

Metis: Decentralized Sorter

In addition to "veteran projects" such as Optimistic and Arbitrum, the imagination of Layer 2 can also be seen in Metis, which has increased by more than 350% in two weeks. In December 2023, MetisO’s TVL exceeded US$700 million, surpassing Base and zkSync to rank third.

Metis is a Layer 2 expansion solution for Ethereum developed based on Optimistic Rollup. It was co-founded by Elena Sinelnikova, Kevin Liu and Yuan Su in 2018. General infrastructure projects.

Layer2 is generally criticized for the centralization of sorting. Most project parties tended to centralized operation and maintenance in the early days to ensure security and stability. After the Metis Foundation announced the establishment of an ecological development fund composed of 4.6 million METIS tokens, Metis is expected to become the first decentralized sorter’s Optimistic Rollup early next year. The growth of Metis has also updated the technical narrative of the sorter. Added to the positives. The decentralized sorter is just the beginning of Rollup Layer2’s potential. The community’s longed-for Layer2 native DeFi, ecological explosion and other visions must be based on this.

Each ZK Rollup: Starknet airdrop is imminent, and the ecosystem is ready to go

On December 1, 2023, the Starknet Foundation stated that it has conducted an airdrop snapshot and will release STRK in the first quarter of 2024 Tokens are distributed to certain past active users and contributors, while unlocking tokens issued in the past.

RabbitX is a derivatives platform built on Starknet. Its token, RBX, rose more than 400% between October and November 2023 and has now retreated. In addition to DEX, Loot Realm, the chain game ecosystem on Starknet, has also gained market attention with the concept of "full-chain games". Loot Realm is driven by the Loot NFT community DAO and contains multiple sub-games. Its token LORDS has increased by nearly 10% in the past month. 90%.

In addition to Starknet, zkSync’s airdrop expectations are also becoming stronger. Currently, DEXs worthy of attention on zkSync include SyncSwap, Mute.io, etc. Syncswap’s daily trading volume exceeds US$9 million, and its total token SYNC is 100 million, of which airdrops will account for 15%. Mute.io is the first batch of native DEX on zkSync Era. In addition to trading, it also provides various income amplifiers. Users can purchase bonds with a 7-day lock-up period at a discount through bonds similar to the (3,3) model. MUTE token. As of writing, MUTE has increased by more than 15% in the past 24 hours.

In addition, Linea, a Layer2 network owned by ConsenSys, cannot but be paid attention to. According to Dune Analytics data, as of December 24, 2023, the Linea mainnet has exceeded 290,000 ETH, and the number of interactive addresses has exceeded 390,000. Currently, there are more than 40 protocols on Linea, among which Mendi Finance is the native lending project on Linea, ranking second in the TVL ecosystem, and its token MENTI has increased by more than 48% in the past 24 hours.

Mantle Network is a unified ecosystem and EVM-compatible Layer2 network created by the merger of Mantle and BitDAO. It adopts a modular architecture and uses EigenLayer as the DA solution to provide new scalability possibilities for Ethereum. Recently, Trader Joe launched the DEX Merchant Moe dedicated to the Mantle ecosystem. JOE holders will receive an airdrop of 2.5% of the total project tokens when the new token MOE TGE is used, and an additional 5% will be distributed in the next 12 months.

The TVL of FusionX, the native DEX on the Mantle network, has tripled in the past two months and is $25 million at the time of writing. FusionX is the first community-driven AMM on the Mantle network. There is a special The function allows users to obtain preferential purchase qualifications for new tokens by staking specific tokens.

On January 10, EigenLayer announced the launch of three new liquidity staking tokens and provided Restaking services for them, including Mantle LSP’s receiving token mETH, with an annual interest rate of 7.2%.

Taiko, the Type 1 zkEVM network favored by celebrity VCs and approved by Vitalik, deserves attention. In June 2023, Taiko announced it had raised $22 million in two seed rounds, the first $10 million led by Sequoia China and the second $12 million led by Generative Ventures. Taiko is considered by the community to be one of the most promising projects in the current zkEVM field. It aims to become a fully decentralized, zero-knowledge extended zkEVM equivalent to Ethereum, which can enable developers and users to safely experience Ethereum and trade. The fees are lower and no changes are made to Ethereum.

Currently, Taiko is still in the test network stage. In December 2023, Taiko launched a developer incentive program with a bonus of US$30 million and launched community education activities. Users who complete tasks will receive loyalty integral.

Low market value L2 targets

Compared to Arbtrum and Optimism, which have a circulating market value of US$3 billion, some Layer 2s that have recently developed and have lower market value often have more novel narratives and their value discovery It is still in its early stages and is expected to show greater investment space in a new round of bull market.

On December 7, 2023, the ZK L2 community network ZKFair officially announced that the test network was online and open to all community users. ZKFair is the first L2 network based on Polygon CDK, Celestia DA & Lumoz ZK-RaaS. Once launched, it attracted great attention from the community with its innovative model of 100% community Fair Launch. On the day the testnet was launched, more than 30,000 users flocked to it. Enter the network to interact. Three days after going online, ZKFair’s TVL exceeded US$12 million.

On January 10, ZKFair announced the launch of the ZKF staking mechanism. Users who pledge ZKF can receive 75% of the gas fee of the ZKFair chain as dividends. The calculation and distribution of income will begin on January 15. At the same time, between January 14 and January 20, users who stake ZKF will also receive airdrop benefits from Sideswap (SIDE), the first Fair launch ecological project on ZKFair.

In the field of encryption, there is still room for imagination in chain games. Hypr Network is a layer 2 blockchain built on Ethereum, aiming to enhance its functionality and solve its limitations. Hypr specializes in providing a fast and cost-effective platform for zero-knowledge on-chain gaming. By leveraging zero-knowledge proofs, Hypr ensures enhanced data privacy and security for gaming applications, allowing players to transact and interact without leaking sensitive data. According to Coingecko data, its token HYPR has increased by 25% in the past week.

EigenLayer activates the Restaking economy

The re-pledge concept (Restaking) introduced to Ethereum by EigenLayer in June 2023 has become a hot topic of discussion. Restaking allows users to re-stake their already pledged Ethereum or Liquidity Staked Tokens (LST) to provide additional security for various decentralized services on Ethereum and earn additional rewards for themselves.

However, the Restaking model limits the liquidity of capital to a certain extent, so LST tokens came into being. BlockBeats has compiled LST sector projects worth paying attention to.

Restake Finance is the first protocol to launch modular liquidity re-staking for EigenLayer. After users deposit the LST generated by liquidity staking into Restake Finance, they can deposit it into EigenLayer through the project and allow users to generate reaped ETH (rstETH) serves as a re-pledge certificate. Users can participate in various DeFi protocols and earn income through rstETH, and will also receive points rewarded by EigenLayer.

Restake Finance has ushered in a highlight moment recently, and its token RSTK has increased by more than 200% in the past two weeks. In addition, as one of the entrances to the EigenLayer ecosystem, EigenLayer's LRT and strategy management platform Renzo Protocol officially launched the Ethereum mainnet on December 19, and announced the launch of the points program Renzo ezPoints on January 4, aiming to reward contributions to the protocol. Users who contribute can earn points by casting ezETH.

In the re-pledge track, there are many projects that have transitioned from the LSD business. KelpDAO is an organization focused on the field of liquidity re-hypothecation supported by the LSD protocol Stader Labs. Its business model is also similar to Restake Finance. It is worth noting that Kelp DAO currently has no token, while Stader Labs’ token SD has achieved an increase of more than 100% in the past month.

On October 18, DeFi protocol ether.fi announced the launch of Liquid Staking Token (LST) eETH, allowing users to generate rewards by staking Ethereum (ETH). As of writing, ether.fi TVL has exceeded $150 million, and according to the roadmap announced by the team, ether.fi will issue tokens in April.

The Ethereum staking infrastructure SSV Network announced on January 4 that it has started a re-staking business, allowing the responsibilities of EigenLayer’s verifiers to be distributed to SSV, leveraging the distributed and non-custodial features of SSV to enhance its verification performance and safety. It is worth mentioning that SSV’s re-pledge nodes are very distributed and can currently be combined with four nodes, ANKR/Forbole/Dragon Stake/Shard Labs, to provide re-pledge services. In the past week, SSV has increased by more than 30%.

Swell, which was originally positioned as an Ethereum staking protocol, is now gradually moving closer to Restaking. By combining token distribution with Restaking, its derivative LST token swETH is the third largest TVL token on EigenLayer after stETH (Lido) and ETH, with a pledged amount of over 110,000. The Restake version of swETH is called rswETH and focuses on the Restaking track. The Liquid Restaking Committee established by it has already been joined by projects such as AltLayer and InfStones.

On January 11, Pendle, a revenue strategy protocol positioned as LSD RWA, stated on social platforms that it would launch ether.fi’s liquid pledge token (LST) eETH and officially enter the Restaking/LRTfi field. Users can Earn more with its Liquid Restaking Tokens (LRT). On the same day, PENDLE rose by more than 30%.

Since EigenLayer detonated the Ethereum re-staking track, other EVM and non-EVM ecosystems have also begun to have their own re-staking concept projects. Picasso is a network that supports cross-ecosystem IBC, and its native token PICA is designed and deployed as a unified network token that supports multiple L1 blockchains such as Polkadot, Kusama, and Cosmos. Recently, Picasso has brought the re-staking concept into the Solana network, and users can stake SOL, mSOL, jitoSOL and other LP tokens to support the validators of Solana’s cross-chain IBC.

Layerless, the Omnichain Liquid Restake protocol powered by EigenLayer and LayerZero, is also creating Omnichain Re-Staking Tokens (ORT). When a user deposits LST (such as stETH, cbETH or rETH) into EigenLayer, he or she will receive an ORT (Omnichain Restaked Token), which represents the user's EigenLayer share, making it liquid, composable, and usable in DeFi protocols use. Currently, Layerless plans to launch a testnet in the first quarter.

LSDFi, RWA, DEX and other concepts

The Shanghai upgrade in 2023 has brought unprecedented prosperity to the LSD track and also brought a lot of liquidity to the Ethereum ecosystem. According to data from DefiLlama, a total of US$32 billion in funds is pledged, of which Lido has a total value of more than US$24 billion in ETH pledged, accounting for 75% of the market share, which is much higher than other competitors. As more funds flow into Ethereum, it can be expected that the LSD market will continue to heat up. On January 10, LDO briefly exceeded $3.8, rising by more than 18% in 24 hours.

In addition to releasing liquidity around EigenLayer, Prisma, which has a small market capitalization and luxurious endorsements, is also worthy of attention. Prisma is jointly endorsed by the founders of multiple projects such as Curve Finance, Convex Finance, Swell Network and CoingeckoFinance, as well as Frax Finance, Conic Finance, Tetranode, OK Venture, Llama Airforce, GBV, Agnostic Fund, Ankr Founders, MCEG, Eric Chen Waiting for first-line well-known projects to participate in investment.

Currently driven by RWA, the potential market capitalization of RWA could reach tens of trillions of dollars within the next five years. MakerDAO, which provides stablecoins for Ethereum, already has a layout in the direction of RWA.

MakerDAO’s first formal RWA project, New Silver, was established in 2021, with a debt ceiling of US$20 million. The underlying assets are mortgage assets (Mortgage Loan) sponsored by New Sliver. Through New Sliver, The issuer SPV raised capital on the Centrifuge tokenization platform. In addition, the U.S. debt RWA project BlockTower Andremeda launched by BlockTower Capital is currently one of MakerDAO's largest RWA projects, with a debt ceiling of US$1.28 billion and current asset size of more than US$1 billion.

In addition, Uniswap v4, Uniswap X and other intent-based DEX are also becoming themes in 2024.

In June 2023, Uniswap released the Uniswap v4 code draft, with the vision of allowing anyone to make trade-off decisions by introducing "hooks". According to Uniswap Labs officials, Uniswap V4 will be launched after the Dencun upgrade. A month later, Uniswap announced the launch of UniswapX, a non-custodial, Dutch auction-based protocol. According to the team, Uniswap v4 optimizes pool customizability to maximize expressiveness, while Uniswap X optimizes routing to maximize output tokens. Combined, the two protocols provide traders with the best possible trading experience while maintaining their commitment to a decentralized, censorship-free and permissionless marketplace.

The project that also follows the intention narrative is CowSwap, a DEX aggregator that integrates batch transactions, intention and MEV protection and other functions. It uses batch auction as its core price discovery mechanism. CowSwap Establishing a unified settlement price for all trades in a batch eliminates issues such as front-running common in instant execution models. Batch auctions can also settle many transactions simultaneously, optimizing gas fees.

The above is the detailed content of Factors in Evaluating Ethereum's Value and Potential Investment Opportunities. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1655

1655

14

14

1413

1413

52

52

1306

1306

25

25

1252

1252

29

29

1226

1226

24

24

'Notorious” Conor McGregor Launches Cryptocurrency Venture, Promises to 'Change the CRYPTO Game” With His $REAL Coin

Apr 06, 2025 am 10:14 AM

'Notorious” Conor McGregor Launches Cryptocurrency Venture, Promises to 'Change the CRYPTO Game” With His $REAL Coin

Apr 06, 2025 am 10:14 AM

“Notorious nearly never happened. You want the real story? The McGregor story could've been about the lad who never left Dublin. I manifested greatness…”

BlockDAG (BDAG) Breaks Records With 2,380% Presale Price Jump, Outpacing Dogecoin (DOGE) and Kaspa (KAS)

Apr 04, 2025 am 10:16 AM

BlockDAG (BDAG) Breaks Records With 2,380% Presale Price Jump, Outpacing Dogecoin (DOGE) and Kaspa (KAS)

Apr 04, 2025 am 10:16 AM

With crypto gaining traction again, three names are catching serious attention—Kaspa (KAS), Dogecoin (DOGE), and BlockDAG (BDAG)

Troller Cat ($TCAT) Is the Next Big Meme Coin Project You Need to Watch

Apr 04, 2025 am 11:22 AM

Troller Cat ($TCAT) Is the Next Big Meme Coin Project You Need to Watch

Apr 04, 2025 am 11:22 AM

Ever wondered what makes meme coins soar to the moon and capture the imagination of millions? From massive returns to viral online communities

Partnership will introduce a smart launchpad, decentralized exchange, influencer marketplace, and decentralized AI infrastructure with tools for improving token launches and measuring market performan

Apr 04, 2025 am 11:18 AM

Partnership will introduce a smart launchpad, decentralized exchange, influencer marketplace, and decentralized AI infrastructure with tools for improving token launches and measuring market performan

Apr 04, 2025 am 11:18 AM

This collaboration combines Generative Mind's advanced AI capabilities with Waterfall's decentralized infrastructure to develop innovative, transparent, and efficient Web3 solutions.

EOS Price Defies the Market Crash: 46% in a Week!

Apr 04, 2025 am 10:20 AM

EOS Price Defies the Market Crash: 46% in a Week!

Apr 04, 2025 am 10:20 AM

While Bitcoin and the broader crypto market are under pressure, EOS is showing unexpected strength

Silver Will Surpass Both Gold and Bitcoin in Value

Apr 04, 2025 am 11:16 AM

Silver Will Surpass Both Gold and Bitcoin in Value

Apr 04, 2025 am 11:16 AM

Silver has expanded its market reach within industrial sectors, leading to unprecedented increases in global demand. In Robert Kiyosaki‘s eyes, the market transition will cause silver to surpass both gold and Bitcoin in value.

Dogecoin (DOGE) Price Plummets 17%

Apr 08, 2025 am 11:20 AM

Dogecoin (DOGE) Price Plummets 17%

Apr 08, 2025 am 11:20 AM

The Dogecoin price plummeted 17% in the last 24 hours to trade at $0.1365 as of 4.30 a.m. EST on trading volume that skyrocketed 271% to $2.24 billion.

Nasdaq Files to List VanEck Avalanche (AVAX) Trust ETF

Apr 11, 2025 am 11:04 AM

Nasdaq Files to List VanEck Avalanche (AVAX) Trust ETF

Apr 11, 2025 am 11:04 AM

This new financial instrument would track the token's market price, with a third-party custodian holding the underlying AVAX