web3.0

web3.0

Bitcoin spot ETF suffered major decline after approval! Kaiko: Binance, OKX, Upbit face selling pressure

Bitcoin spot ETF suffered major decline after approval! Kaiko: Binance, OKX, Upbit face selling pressure

Bitcoin spot ETF suffered major decline after approval! Kaiko: Binance, OKX, Upbit face selling pressure

Bitcoin spot ETF plunged after approval

Bitcoin ushered in the first listing of the spot ETF on January 11. Bitcoin soared to $48,988 after the U.S. stock market opened that day, but finally closed at $45,569. On the following 12th, the price of Bitcoin fell further to $41,360.

Binance, OKX, Upbit welcome selling pressure

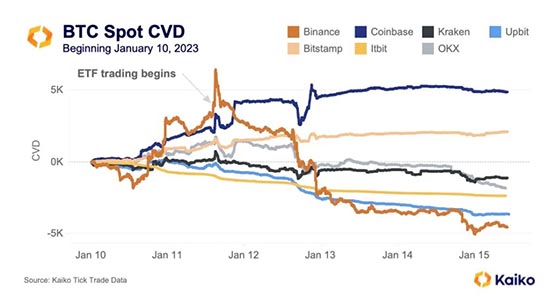

According to Kaiko’s report, after the ETF started trading, the cumulative trading volume difference (CVD) of all major exchanges showed significant changes. The CVD of Binance and OKX quickly dropped to negative values.

Upbit, despite lower trading volume, also showed sustained selling with little retracement.

However, the CVDs of Coinbase and Bitstamp remain positive.

CVD tracks the net difference in buying and selling volume over time, reflecting overall bullish/bearish pressure in the market. Positive values indicate greater buying pressure, and negative values indicate greater selling pressure.

Exchange CVD changes

Judging from the performance of the Bitcoin spot ETF in the past week since its launch, this seems to be closer to a "sell the news" event.

The above is the detailed content of Bitcoin spot ETF suffered major decline after approval! Kaiko: Binance, OKX, Upbit face selling pressure. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1393

1393

52

52

1207

1207

24

24

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

Institutional investors should choose compliant platforms such as Coinbase Pro and Genesis Trading, focusing on cold storage ratios and audit transparency; retail investors should choose large platforms such as Binance and Huobi, focusing on user experience and security; users in compliance-sensitive areas can conduct fiat currency trading through Circle Trade and Huobi Global, and mainland Chinese users need to go through compliant over-the-counter channels.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

Ranking of exchanges in low-cost fees in 2025

Apr 22, 2025 am 06:21 AM

Ranking of exchanges in low-cost fees in 2025

Apr 22, 2025 am 06:21 AM

The exchange with the lowest handling fee in the currency circle is Binance, with a spot trading rate of 0.1%. 1. Binance: The spot transaction fee rate is 0.1%, and BNB deduction fee is supported. 2. OKX: The spot transaction fee rate is 0.02%-0.15%, suitable for high-frequency trading. 3. Gate.io: The spot transaction fee rate is 0.2%, and the coin is listed quickly.

The latest list of recommended cryptocurrency trading platforms (updated in 2025)

Apr 22, 2025 am 07:12 AM

The latest list of recommended cryptocurrency trading platforms (updated in 2025)

Apr 22, 2025 am 07:12 AM

The recommended cryptocurrency trading platforms in 2025 include: 1. OKX, which ranks first with its technical strength and global operations; 2. Binance, which leads in the number of users and transaction volume; 3. Gate.io, which has a rich currency and low transaction fees; 4. Huobi Global, which has a stable user base; 5. Kraken, which is known for its security and compliance; 6. Coinbase, which focuses on compliance; 7. KuCoin, which has strong innovation and community interaction; 8. Crypto.com, which has a strong brand influence; 9. Bitfinex, which is the first choice for professional traders; 10. MEXC Global, which has fast transaction speed and low fees.

Tips and recommendations for the top ten market websites in the currency circle 2025

Apr 22, 2025 am 08:03 AM

Tips and recommendations for the top ten market websites in the currency circle 2025

Apr 22, 2025 am 08:03 AM

Domestic user adaptation solutions include compliance channels and localization tools. 1. Compliance channels: Franchise currency exchange through OTC platforms such as Circle Trade, domestically, they need to go through Hong Kong or overseas platforms. 2. Localization tools: Use the currency circle network to obtain Chinese information, and Huobi Global Station provides a meta-universe trading terminal.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.