web3.0

web3.0

Binance announced a large-scale multi-chain token destruction, and BUSD is about to disappear!

Binance announced a large-scale multi-chain token destruction, and BUSD is about to disappear!

Binance announced a large-scale multi-chain token destruction, and BUSD is about to disappear!

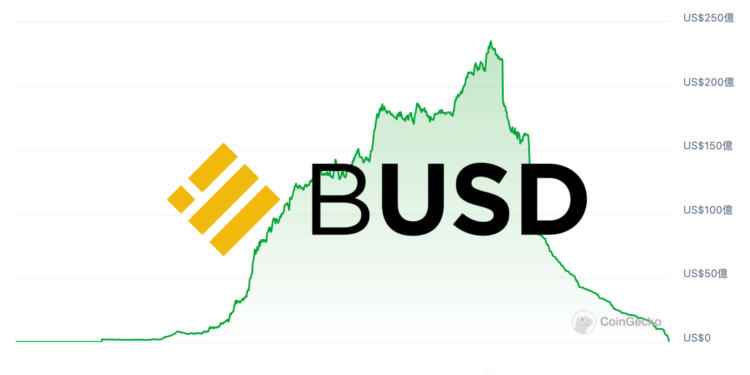

Binance announced on the 5th of this month that it would convert its Binance-Peg BUSD mortgage assets to FDUSD at a 1:1 ratio, which is a measure taken to liquidate BUSD. At that time, BUSD’s market value had just fallen below $1 billion, and in just the next two weeks, its market value dropped further to less than $100 million.

According to data from CoinGecko, BUSD’s current market capitalization is approximately US$99.64 million, which has shrunk by more than 99.5% compared to its market capitalization high of nearly US$23.5 billion in November 2022. In addition, BUSD used to be the third largest stablecoin by market capitalization, but currently ranks only 19th.

The Decline and Fall of BUSD

Compared with the chart above, the market value of BUSD experienced a sharp decline in November 2022. This decline was not only affected by the bankruptcy of FTX and the entire cryptocurrency market entering a bear market, but also by stablecoin issuer Circle reporting to the New York Department of Financial Services (NYDFS). Circle pointed out that Binance failed to provide sufficient reserve funds for BUSD issued through Paxos. These factors combined led to the decline in BUSD’s market value.

Binance admitted in January that there was a $1 billion gap in the BUSD version of the reserve, but said this was an "operational delay" and the problem was quickly resolved.

In February last year, the market value of BUSD fell sharply again due to regulatory restrictions. At that time, Paxos was sued by the SEC for allegedly "issuing unregistered securities" and was ordered by NYDFS to stop issuing new BUSD.

Soon after, Paxos and Binance terminated their BUSD cooperation. Paxos stated that they will continue to support existing BUSD until at least February of this year.

On December 15 last year, Binance announced that it would stop supporting BUSD products, and on December 31, it would exchange BUSD in some user accounts for FDUSD at a 1:1 ratio. In addition, on the 5th of this month, it was announced that Binance-Peg BUSD mortgage assets will be converted into FDUSD. The continuous occurrence of these events resulted in a significant decline in the market value of BUSD.

Binance will destroy Binance-pegged tokens on multiple chains today

In addition, Binance announced an important initiative today: it plans to destroy a large number of Binance-pegged Tokens on various chains ( The token linked to Binance, referred to as B-Token) is destroyed and the equivalent amount of Token used as collateral on the native network is released.

Currently, Binance has issued a total of 66 different B-Tokens.

The reason behind it?

This action caused a positive response in the community. One netizen commented: “This initiative demonstrates Binance’s commitment to improving token economics, increasing ecosystem value, and increasing transparency. It is really exciting to see them taking action to optimize the network and release collateral on the native chain. Be excited. I look forward to them continuing their great work!"

As mentioned above, Binance has been criticized by Circle for failing to provide sufficient reserves to support its issued Binance-Peg BUSD. Now, by burning a large number of its issued tokens, Binance may be working towards greater compliance and transparency. This token burning helps demonstrate a company’s compliance with relevant regulations and demonstrates its commitment to transparency. At the same time, this also helps eliminate concerns that Binance may use customer assets as B-Token collateral.

However, the specific reasons behind Binance’s token destruction may be quite diverse, and we need to continue to pay attention to further official statements and explanations.

The above is the detailed content of Binance announced a large-scale multi-chain token destruction, and BUSD is about to disappear!. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

What are the advantages of Bijie.com's layout of crypto finance and AaaS services?

Apr 21, 2025 am 10:51 AM

What are the advantages of Bijie.com's layout of crypto finance and AaaS services?

Apr 21, 2025 am 10:51 AM

The advantages of Bijie.com in the fields of crypto finance and AaaS business include: 1. Crypto finance: ① Professional investment and research team, ② high-quality content ecology, ③ secure platform guarantee, and ④ rich product services. 2. AaaS business areas: ①Technical innovation capabilities, ②Data advantages, ③User base and demand insights.

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

Binance's big move: The margin collateral ratio of multi-currency combinations will be adjusted in April

Apr 21, 2025 am 11:36 AM

Binance's big move: The margin collateral ratio of multi-currency combinations will be adjusted in April

Apr 21, 2025 am 11:36 AM

Binance made several adjustments to the margin collateral ratio of multi-currency combinations in April 2025. 1. Adjustment on April 4: In the multi-asset margin mode, FLOW and COMP have dropped from 80% to 70%, 1INCH has dropped from 70% to 65%, HOT and RVN have dropped from 70% to 60%, IOTX has dropped from 70% to 55%; in the unified account mode, CRV and UNI have dropped from 85% to 80%, ALGO has dropped from 85% to 75%, KSM has dropped from 80% to 70%, XTZ has dropped from 75% to 60%, and XEC has dropped from 70% to 55%. 2. Adjustment on April 11: In the combination margin mode, ICP dropped from 80% to 70%, SNX dropped from 80% to 65%, and MANA dropped from 75% to 6

Top 10 virtual currency trading app rankings Top 10 virtual currency exchange rankings

Apr 21, 2025 am 09:21 AM

Top 10 virtual currency trading app rankings Top 10 virtual currency exchange rankings

Apr 21, 2025 am 09:21 AM

This article publishes the latest top ten virtual currency trading app rankings and top ten virtual currency exchange rankings in 2024, including platforms such as Binance, Ouyi and Sesame Open. The article emphasizes that when choosing a platform and APP, factors such as security, transaction experience, and compliance should be considered, and investors should be reminded to pay attention to the risks of virtual currency transactions.

The top ten virtual currency trading app addresses

Apr 21, 2025 am 09:24 AM

The top ten virtual currency trading app addresses

Apr 21, 2025 am 09:24 AM

This article summarizes the information of the top ten virtual currency trading apps including Binance, Ouyi and Sesame Open Door, but for security reasons, the URL is not provided directly. Instead, it emphasizes the importance of safe access to the official platform through trusted channels and provides verification methods. At the same time, the article reminds investors to consider factors such as security, transaction fees, currency selection when choosing an APP, and pay attention to the risks of virtual currency trading.

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

Web3 trading platform ranking_Web3 global exchanges top ten summary

Apr 21, 2025 am 10:45 AM

Web3 trading platform ranking_Web3 global exchanges top ten summary

Apr 21, 2025 am 10:45 AM

Binance is the overlord of the global digital asset trading ecosystem, and its characteristics include: 1. The average daily trading volume exceeds $150 billion, supports 500 trading pairs, covering 98% of mainstream currencies; 2. The innovation matrix covers the derivatives market, Web3 layout and education system; 3. The technical advantages are millisecond matching engines, with peak processing volumes of 1.4 million transactions per second; 4. Compliance progress holds 15-country licenses and establishes compliant entities in Europe and the United States.