This site (120bTC.coM) reported that the U.S. Securities and Exchange Commission (SEC) recently approved multiple Bitcoin spot ETFs, which is seen as the traditional financial community’s acceptance of cryptocurrencies. important milestone. This incident also triggered the market’s optimistic expectations for the future of Ethereum spot ETFs.

BTC continues to fall after ETF clearance

Although after the Bitcoin spot ETF is launched, the market generally expects traditional financial institutions to accelerate their entry and push the price of Bitcoin to climb to a high of $49,000, but in fact it's not true. Bitcoin failed to stabilize at this price, but quickly fell below $39,000, a drop of 11.6%, hitting its lowest point in nearly two weeks. This violent fluctuation shows that there are still uncertainties and risks in the Bitcoin market.

The market generally believes that the reason for the continued decline of Bitcoin is related to the negative premium of Grayscale Bitcoin Trust GBTC returning to zero, coupled with high management fees and other issues that caused investors to take profits. According to the latest Arkham Intelligence data, Grayscale has transferred nearly 113,000 Bitcoins from its wallet address since the 11th, with a total value of more than $4.5 billion. This data further exacerbated market concerns, suggesting that investor confidence in Bitcoin is declining.

Will ETH fall after the Ethereum spot ETF is passed?

According to Grayscale’s official data, as of now, they hold 2.96 million Ethereum, with a total value of approximately US$6.058 billion. If Grayscale launches an Ethereum spot ETF and it performs similarly to a Bitcoin ETF, Ethereum prices could be similarly affected once the Ethereum spot ETF is approved.

Grayscale Cryptocurrency Positions

Is Now the Right Time to Buy ETHE?

But on the other hand, if you value long-term investment, now may be a good time to buy Ethereum Trust ETHE.

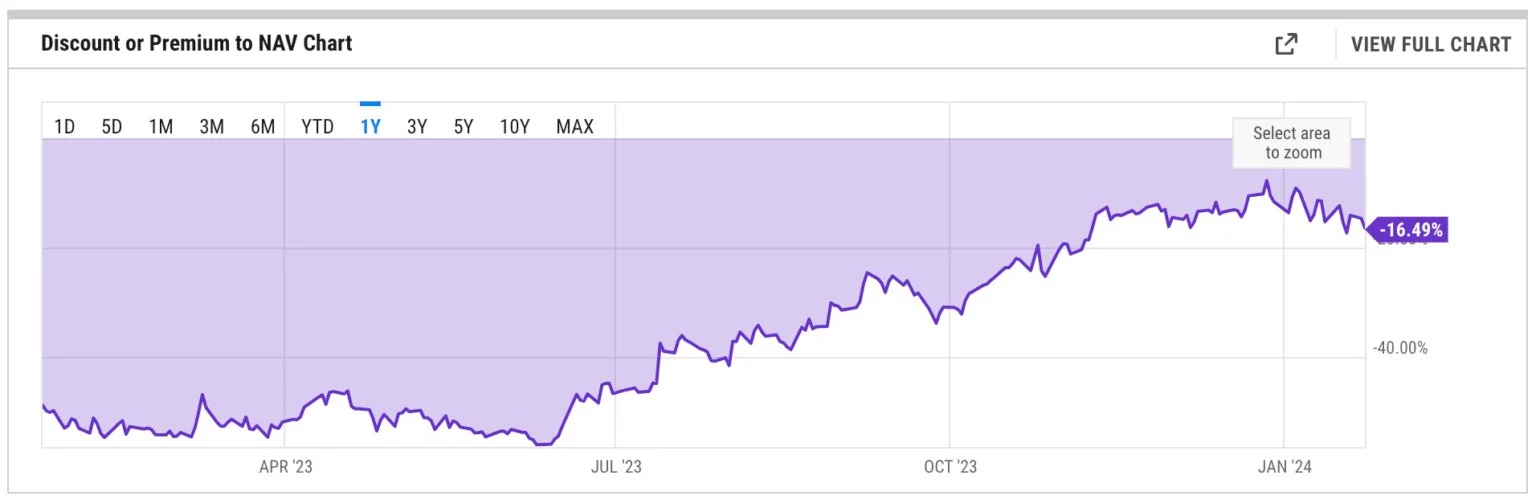

According to ycharts data, the current negative premium rate of ETHE is 16.49%. If the Ethereum spot ETF can really pass this year as market expectations, the discount in the middle will also be a good opportunity to buy. (Investors who bought GBTC at a discount have benefited a lot, but whether this will replicate the situation in Ethereum remains to be seen. After all, it is also necessary to consider whether the price of the Ethereum spot ETF can continue to rise)

Another potential benefit is the long-awaited Cancun (Dencun) upgrade. The EIP-4844 (protodanksharding) solution it plans to introduce will be used to "temporarily" store transaction data. , enhance the data storage capacity of Ethereum, which has the potential to further reduce the transaction fees of the second-layer network, which makes the market believe that the price of ETH will reach another level in the future.

The above is the detailed content of The passage of the Ethereum spot ETF may trigger a market correction, and Grayscale's 3 million ETH may face a sell-off similar to GBTC. For more information, please follow other related articles on the PHP Chinese website!

Ethereum Price Quotes

Ethereum Price Quotes

Douyin level price list 1-75

Douyin level price list 1-75

How to set path environment variable

How to set path environment variable

What is Baidu Index

What is Baidu Index

What are the main characteristics of computers?

What are the main characteristics of computers?

How to take screenshots on computer

How to take screenshots on computer

How to turn off the firewall

How to turn off the firewall

How to solve the problem of not being able to create a new folder in Win7

How to solve the problem of not being able to create a new folder in Win7

What is pr

What is pr