System Tutorial

System Tutorial

LINUX

LINUX

Revealing the open source trading system shared by professional quantitative traders

Revealing the open source trading system shared by professional quantitative traders

Revealing the open source trading system shared by professional quantitative traders

Dear investors, hello! Open source quantitative trading system has become one of the hotly discussed topics today. Here, as a professional quantitative trader with many years of experience, I am willing to answer your relevant questions so that you can better understand and use this system.

1. What is open source quantitative trading system?

Open Source Quantitative Trading System Based on open source code technology, it aims to automatically control investment strategies and carry out in-depth analysis of financial data. This system displays a huge library of tools and computational models to assist investors in completing important tasks such as data analysis, model construction, and trading decisions.

2.Open source quantitative trading systemWhat are the advantages?

First of all, our open source system adheres to the principle of openness and transparency, allowing everyone to access and freely adjust and customize the code. Secondly, Open Source Quantitative Trading System, the system has excellent performance in scalability and flexibility, and can adapt to various investment strategies and market conditions without changing. Furthermore, the great help of community members allows the system to be continuously updated and improved.

3. How to start using the open source quantitative trading system?

Dear readers, first of all, please choose the open source quantitative trading system that suits you, and download and install it carefully. Later, by studying relevant documents and tutorials, you will become familiar with the basic concepts and operating steps of the system. After that, use the sample code to conduct backtesting and simulated trading sogou pinyin linux to understand the various functions and characteristics of the system.

4.Open source quantitative trading system Which investors are suitable?

Open Source Quantitative Trading System is especially suitable for you who already have certain investment knowledge and love data analysis and programming. It can effectively improve your trading efficiency and decision-making accuracy, while realizing the automatic execution of investment strategies.

5. How to optimize the performance of open source quantitative trading system?

If you want to further optimize the operating efficiency of Linux deletion files in open source quantitative trading system , please refer to the following suggestions: carefully debug various algorithms and models; optimize the data processing and storage system; make good use of Cutting-edge technologies such as parallel computing; and selecting the most suitable hardware facilities based on actual needs, etc. Hope this helps!

6.Open source quantitative trading systemWhat are the risks and challenges?

UsingOpen source quantitative trading system still faces some potential risks and challenges. The first thing to bear the brunt is the necessary relevant programming and data analysis skills. In addition, Open Source Quantitative Trading System should also carefully monitor market risks, technical risks, human errors and other factors, and should always be alert to potential loopholes or errors in the system and actively repair and upgrade them.

7. How to choose a suitable open source quantitative trading system?

When selecting an open source quantitative trading system, you need to focus on the following points: first, whether the system functions can meet your needs; secondly, pay attention to the activity of the community and the availability of relevant documents and tutorials Completeness; finally, we must also pay attention to the stability and reliability of the system. Based on these criteria, taking into account the characteristics and user reviews of each system, we can select the most suitable one.

8. How to deal with the future development of open source quantitative trading system?

The future direction of the open source quantitative trading system shared by all people will be mainly affected by various technological updates in the industry and market demand. It is recommended that investors always pay attention to industry trends, actively absorb new knowledge, and continuously improve investment strategies to respond to market changes. In addition, it is an indispensable responsibility of every participant to participate in community exchanges and collaborations and jointly promote system progress and upgrades!

After this understanding, I believe that you have a comprehensive understanding of the Open Source Quantitative Trading System. I hope you can use this technology properly, improve the quality of your investment, and hope that your wealth dreams can come true. If you have any questions, please feel free to contact me!

The above is the detailed content of Revealing the open source trading system shared by professional quantitative traders. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

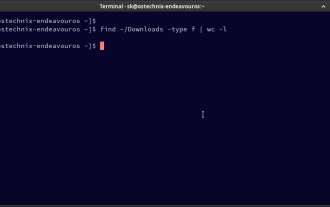

How To Count Files And Directories In Linux: A Beginner's Guide

Mar 19, 2025 am 10:48 AM

How To Count Files And Directories In Linux: A Beginner's Guide

Mar 19, 2025 am 10:48 AM

Efficiently Counting Files and Folders in Linux: A Comprehensive Guide Knowing how to quickly count files and directories in Linux is crucial for system administrators and anyone managing large datasets. This guide demonstrates using simple command-l

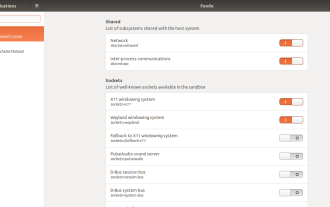

How To Easily Configure Flatpak Apps Permissions With Flatseal

Mar 22, 2025 am 09:21 AM

How To Easily Configure Flatpak Apps Permissions With Flatseal

Mar 22, 2025 am 09:21 AM

Flatpak application permission management tool: Flatseal User Guide Flatpak is a tool designed to simplify Linux software distribution and use. It safely encapsulates applications in a virtual sandbox, allowing users to run applications without root permissions without affecting system security. Because Flatpak applications are located in this sandbox environment, they must request permissions to access other parts of the operating system, hardware devices (such as Bluetooth, network, etc.) and sockets (such as pulseaudio, ssh-auth, cups, etc.). This guide will guide you on how to easily configure Flatpak with Flatseal on Linux

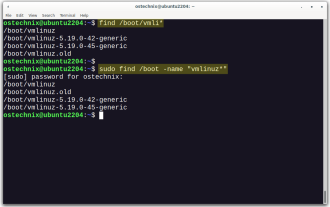

How To List Or Check All Installed Linux Kernels From Commandline

Mar 23, 2025 am 10:43 AM

How To List Or Check All Installed Linux Kernels From Commandline

Mar 23, 2025 am 10:43 AM

Linux Kernel is the core component of a GNU/Linux operating system. Developed by Linus Torvalds in 1991, it is a free, open-source, monolithic, modular, and multitasking Unix-like kernel. In Linux, it is possible to install multiple kernels on a sing

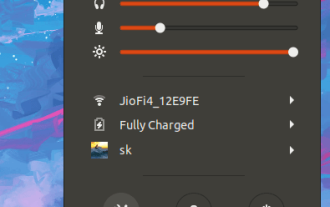

How To Type Indian Rupee Symbol In Ubuntu Linux

Mar 22, 2025 am 10:39 AM

How To Type Indian Rupee Symbol In Ubuntu Linux

Mar 22, 2025 am 10:39 AM

This brief guide explains how to type Indian Rupee symbol in Linux operating systems. The other day, I wanted to type "Indian Rupee Symbol (₹)" in a word document. My keyboard has a rupee symbol on it, but I don't know how to type it. After

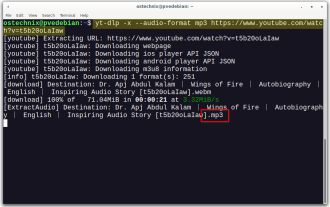

Yt-dlp Commands: The Complete Tutorial For Beginners (2025)

Mar 21, 2025 am 11:00 AM

Yt-dlp Commands: The Complete Tutorial For Beginners (2025)

Mar 21, 2025 am 11:00 AM

Have you ever wanted to save your favorite videos from the internet? Whether it's a funny cat video or a tutorial you want to watch later, Yt-dlp is here to help! In this comprehensive yt-dlp tutorial, we will explain what yt-dlp is, how to install i

What is the Linux best used for?

Apr 03, 2025 am 12:11 AM

What is the Linux best used for?

Apr 03, 2025 am 12:11 AM

Linux is best used as server management, embedded systems and desktop environments. 1) In server management, Linux is used to host websites, databases, and applications, providing stability and reliability. 2) In embedded systems, Linux is widely used in smart home and automotive electronic systems because of its flexibility and stability. 3) In the desktop environment, Linux provides rich applications and efficient performance.

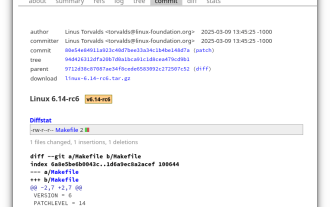

Linux Kernel 6.14 RC6 Released

Mar 24, 2025 am 10:21 AM

Linux Kernel 6.14 RC6 Released

Mar 24, 2025 am 10:21 AM

Linus Torvalds has released Linux Kernel 6.14 Release Candidate 6 (RC6), reporting no significant issues and keeping the release on track. The most notable change in this update addresses an AMD microcode signing issue, while the rest of the updates

LocalSend - The Open-Source Airdrop Alternative For Secure File Sharing

Mar 24, 2025 am 09:20 AM

LocalSend - The Open-Source Airdrop Alternative For Secure File Sharing

Mar 24, 2025 am 09:20 AM

If you're familiar with AirDrop, you know it's a popular feature developed by Apple Inc. that enables seamless file transfer between supported Macintosh computers and iOS devices using Wi-Fi and Bluetooth. However, if you're using Linux and missing o