Bitcoin NFT transaction volume drops sharply, developers refute misleading data

Ordinals trading volume fell by more than 97%

According to the latest data, the Bitcoin non-fungible token (NFT) market has experienced a sharp decline in trading volume. According to data released by the Ordinals trading platform, trading volume fell by more than 97%. However, PHP editor Xigua believes that these data may have errors. Developers have dismissed this, saying the data is inaccurate. They pointed out that due to market instability and the emergence of new projects, fluctuations in trading volume are normal. Therefore, we need more data and evidence to fully assess the actual situation of the Bitcoin NFT market.

According to a report by DappRadar, the monthly transaction volume of the Bitcoin Ordinals protocol reached a peak of $452 million in May this year, and then began to decline month by month:

The transaction volume in June dropped by 76.5% month-on-month. %, to $106 million

July trading volume fell 66.9% month-on-month to $35 million

Since mid-August, trading volume has been only $3 million, compared with May It fell by more than 97%.

Ordinals trading volume and sales

Another data shows that active Bitcoin wallets have dropped significantly in the Ordinals market. There were 79,261 active wallets in May, and now there are only 6,708.

DappRadar concluded in the report that the trading volume of Ordinals has dropped sharply, and the overall NFT market has also shown a downward trend, which raises important questions about the future of Bitcoin NFTs.

"While it is not yet appropriate to completely dismiss Bitcoin Ordinals, market data reflects the warning signs of volatility and unpredictability in the NFT space. Many in the community believe that Bitcoin and Ethereum are different uses, perhaps should be more clearly demarcated. The next few months will be a critical period in determining whether Bitcoin can gain a foothold in the evolving NFT space or return to its primary role as a store of value."

Ordinals UAW dropped sharply

Ordinals developer: Most transactions are still related to Ordinals

However, regarding the recent rumors in the community that "Ordinals may be extinct" Ordinals developer Leonidas also jumped out to refute the remarks earlier. Bitcoin had 530,788 transactions in the past 24 hours, of which 450,785 were related to Ordinals. He said: When everyone claims that "Ordinals are dead," they actually account for 84.9% of Bitcoin network activity.

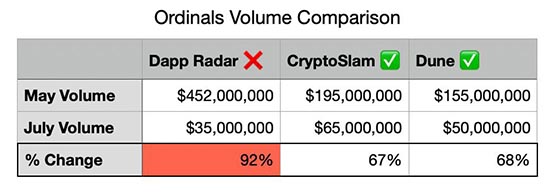

Another member of the Bitcoin community, trevor.btc, pointed out that in fact, the data reported by DappRadar is not accurate. The actual data is not 97% but about 67%.

To put it simply, although the trading volume of Ordinals is still declining, in the view of community developers and members, the sharp decline in Ordinals transactions is mainly caused by the general environment and the sharp decline of Bitcoin. The majority of transactions on the Bitcoin network are still related to Ordinals, which proves that Bitcoin NFT, as a new type of asset, does not see too many risks.

trevor.btc believes that DappRadar data is inaccurate

The above is the detailed content of Bitcoin NFT transaction volume drops sharply, developers refute misleading data. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

What are the advantages of Bijie.com's layout of crypto finance and AaaS services?

Apr 21, 2025 am 10:51 AM

What are the advantages of Bijie.com's layout of crypto finance and AaaS services?

Apr 21, 2025 am 10:51 AM

The advantages of Bijie.com in the fields of crypto finance and AaaS business include: 1. Crypto finance: ① Professional investment and research team, ② high-quality content ecology, ③ secure platform guarantee, and ④ rich product services. 2. AaaS business areas: ①Technical innovation capabilities, ②Data advantages, ③User base and demand insights.

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

Web3 trading platform ranking_Web3 global exchanges top ten summary

Apr 21, 2025 am 10:45 AM

Web3 trading platform ranking_Web3 global exchanges top ten summary

Apr 21, 2025 am 10:45 AM

Binance is the overlord of the global digital asset trading ecosystem, and its characteristics include: 1. The average daily trading volume exceeds $150 billion, supports 500 trading pairs, covering 98% of mainstream currencies; 2. The innovation matrix covers the derivatives market, Web3 layout and education system; 3. The technical advantages are millisecond matching engines, with peak processing volumes of 1.4 million transactions per second; 4. Compliance progress holds 15-country licenses and establishes compliant entities in Europe and the United States.

What aspects does Bijie.com's technological innovation in AaaS business specifically reflect?

Apr 21, 2025 am 10:48 AM

What aspects does Bijie.com's technological innovation in AaaS business specifically reflect?

Apr 21, 2025 am 10:48 AM

Bijie.com’s technological innovation in AaaS business is reflected in: 1. Combining smart contracts and blockchain to provide functions such as batch transactions and key recovery; 2. Integrating AI and blockchain to support decentralized AI training; 3. Multi-dimensional data integration and analysis to provide market insights; 4. Develop a one-stop AI service platform to help enterprises transform digitally.

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

Which platforms are better for novices to invest in Bitcoin?

Apr 21, 2025 am 11:54 AM

Which platforms are better for novices to invest in Bitcoin?

Apr 21, 2025 am 11:54 AM

Platforms suitable for novices to invest in Bitcoin are: 1. OKX: Strong ease of use, simple interface, complete security measures, rich educational resources, and support a variety of cryptocurrencies. 2. Binance: There are many trading varieties and strong liquidity, and provide a variety of trading tools. 3. Huobi: The interface design is simple, the transaction depth is good, and OTC transactions are safe.