UMA Lianchuang Analysis OEV Tool Oval: Achieved more than 2.5 times growth in 5 days

Recently, UMA announced on January 17 that it would launch Oval, a tool for extracting value from oracles, and the price increased more than 2.5 times in just 5 days. On January 23, UMA officially launched Oval on the Ethereum mainnet, and UMA’s co-founder Hart Lambur also published an article explaining Oval in detail.

Key Takeaways:

Oracle Extractable Value (OEV), a type of MEV, is generated when a price update to a lending agreement triggers liquidation.

Lending protocols lost hundreds of millions of dollars on OEV.

Oval runs on the Ethereum mainnet, enabling protocols to use this OEV as a form of revenue and contribute to the sustainable development of DeFi.

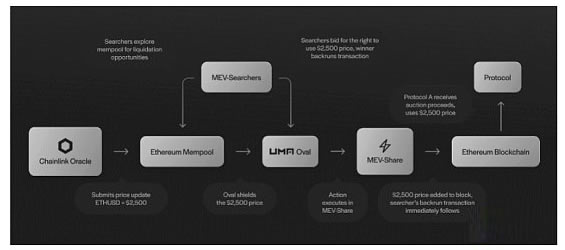

#Oval does this by wrapping Chainlink price updates and auctioning OEV using Flashbots’ MEV-Share.

Oval leverages proven Chainlink and Flashbots infrastructure to minimize integration costs and trust assumptions.

Oval requires no code for integration and can capture 90% of oracle MEV.

On January 23, 2024, UMA released Oval, the Oracle value aggregation layer, on the Ethereum mainnet. Oval uses a type of MEV called OEV (Oracle Extractable Value: Oracle Extractable Value) to obtain the income of the lending agreement. This innovative feature enables Oval to more effectively extract and utilize the value of Oracle, thereby bringing more revenue opportunities to users. The release of UMA has attracted widespread attention and interest and is of great significance to the development of the Ethereum ecosystem. The launch of Oval provides users with more flexible and efficient options, while also bringing more possibilities and prospects to the development of lending protocols.

Ethereum, the leading DeFi protocol, generates hundreds of millions of dollars in OEV every year. Aave and Compound have each generated well over $100 million in OEV since launch. This value is lost to the MEV supply chain, adding no benefit to the protocol.

Oval is not an oracle. Oval is a mechanism that integrates with lending protocols and recaptures the value generated when Chainlink prices are updated.

Oval wraps existing Chainlink Data Feeds. In order to extract OEV, searchers must conduct an order flow auction in Flashbots’ MEV-Share, with auction proceeds flowing into the protocol.

Oval redirects up to 90% of OEV back into its creation protocol. The revenue captured again by Oval can make DeFi protocols and oracle infrastructure more sustainable.

1. What is Oracle Extractable Value (OEV)?

An Oracle Extractable Value (OEV) is a MEV that is created when the protocol receives updates from a price oracle.

Take a lending protocol like Aave as an example: the Aave market can create OEV from price updates from the Chainlink Data Feed, thus exposing over-leveraged positions to liquidation. In order to ensure the smooth operation of Aave, liquidators can obtain risk-free profits by quickly closing positions.

The lending protocol provides large liquidation bonuses to ensure that collateral can be sold quickly, allowing anyone (called a "searcher" in MEV) to repay the debt and claim the collateral at a discount. For example, liquidations on Aave offer a 5-10% liquidation discount. These discounts must be large to ensure that assets can be sold quickly even in times of extremely high volatility.

This liquidation discount is the theoretical maximum OEV, and Oval is able to capture 90% of it.

Superstate CEO Robert Leshner said: “MEV protection, and specifically MEV capture, is at the forefront of Ethereum research. Personally, I’m excited to see UMA partnering with Chainlink and Flashbots to pursue capture With hundreds of millions of dollars in MEV flowing out of lending protocols, I'm also excited that Oval is expected to bring a broader range of new revenue streams to DeFi protocols."

To obtain clearing fees, MEV hunters compete with each other and block builders Provide large "tips" in order to include their transactions in the block. The block builder then pays the block proposer a significant portion of the value in order to add the transaction to the blockchain. Each party makes significant profits from OEV, but actually contributes nothing to the value-creating agreement.

2. Oval operating mechanism

Oval achieves OEV capture by packaging Chainlink price updates and gathering searchers to participate in the auction. The auction uses MEV-share, an order flow auction protocol operated by Flashbots.

#Oval appends repayment instructions to the seeker's packet, requiring that any excess value be repaid to the protocol. Without Oval, this excess value is lost. We estimate Oval could recoup hundreds of millions of dollars in value.

As a precaution, if there are any delays related to Oval or MEV-share, Chainlink prices will be released automatically. This ensures that quick liquidations are always possible.

3. MEV Research Frontier

Oval was built by its team in close collaboration with the Flashbots team, using MEV-share’s existing order flow auction infrastructure.

Flashbots estimates that over 415,000 ETH in value has been withdrawn since Ethereum’s big merger in September 2022. In the MEV supply chain, this value is extracted from the protocol and unsuspecting users, with much of that value flowing into the pockets of Ethereum block builders and validators. This is what we strive to change.

Oval acts as a MEV capture tool that disrupts the MEV supply chain and transfers up to 90% of OEV extracted from lending protocols back to the protocol as revenue.

By doing this, Oval allows protocols to create new revenue streams and potentially bring new mechanism designs and business models to DeFi.

“At Flashbots, we have always believed that dapps can significantly limit the amount of MEV they are exposed to,” said Hasu, head of strategy at Flashbots. “The key insight is that protocols should not blindly broadcast transactions to a public mempool, but rather auction the right to execute transactions to a competitive searcher market. It is based on this insight that Oval ultimately returns OEV to the Defi protocol and its users. We look forward to helping them in this process."

4. Security first

Oval's design will not bring any additional to the underlying infrastructure of Chainlink Data Feeds risk. To ensure this, Oval has been audited by Open Zeppelin.

Because Oval uses Chainlink Data Feeds, blue chip protocols integrating the solution can continue to obtain prices from the most used oracle providers in DeFi.

Oval also has the same bounty program, which covers all of UMA’s audited contracts, such as those behind UMA Optimistic Oracle, oSnap, and Across Bridge.

Tarun Chitra, CEO of Gauntlet, said: “Oval has a very compelling value proposition for major protocols like Aave – updating contract addresses starts to earn a lot of MEV revenue that would not be earned otherwise. Gauntlet is excited to work with Working with leading DeFi protocols such as Aave and Compound, we look forward to seeing how Oval can create additional revenue streams for their products."

5. How to integrate?

At the contract level, Oval operates in the same manner as the Chainlink Data Feed, providing Chainlink prices to the protocol without any impact on the end user experience.

Existing protocols can easily integrate Oval through a simple governance vote. No code changes are required.

The above is the detailed content of UMA Lianchuang Analysis OEV Tool Oval: Achieved more than 2.5 times growth in 5 days. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1385

1385

52

52

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Cryptocurrency has always been a realm where the cutting edge of technology meets bold ambition, and it's only getting more exciting in the future. As artificial intelligence continues to grow in influence, there are a handful of digital assets that

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network recently held PiFest 2025, an event aimed at increasing the token's adoption. Over 125,000 sellers and 58,000 merchants participated

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Ouyi usually refers to Ouyi OKX. The global way to download Ouyi OKX APP is as follows: 1. Android device: Download the APK file through the official website and install it. 2. iOS device: access the official website through the browser and directly download the APP.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

Ethereum (ETH) price edges toward resistance, Tether news reveals a €10M media deal, and BlockDAG reaches new milestones with Beta Testnet and growing adoption.

In Celebration of Pi Day, a Community of Pi Network Enthusiasts Held a Bartering Event in Muntinlupa City

Mar 22, 2025 am 10:02 AM

In Celebration of Pi Day, a Community of Pi Network Enthusiasts Held a Bartering Event in Muntinlupa City

Mar 22, 2025 am 10:02 AM

Pi Network Celebrates Pi Day with a Bartering and Merchant Orientation Event in the Philippines

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

The crypto market continues to face turbulence, with Cardano (ADA) dropping 12% to $0.64, prompting concern across the altcoin sector.