web3.0

web3.0

Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them

Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them

Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them

php editor Zimo brings you a detailed tutorial on Bitcoin contracts. Bitcoin contracts are a type of financial derivative that can be bought and sold through trading platforms. Unlike actual Bitcoin, trading in Bitcoin contracts does not require actual holding of Bitcoins, but rather earns the price difference through the price fluctuations of the contract. There is no time limit for the purchase and sale of Bitcoin contracts, and transactions can be conducted at any time. In this article, we will introduce you to the gameplay and transaction process of Bitcoin contracts to help you better understand and utilize Bitcoin contracts. Let’s explore together!

Can Bitcoin contracts be bought and sold at any time?

Bitcoin contract is a financial derivative in the Bitcoin market, which can be bought and sold at any time. Taking Eureka Exchange as an example, it provides a detailed tutorial on how to play Bitcoin contracts.

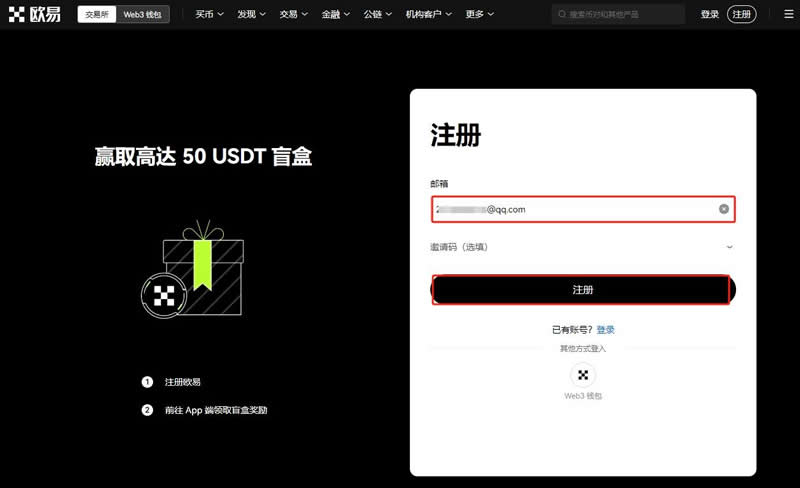

1. Open the official website of OKX Exchange (click here to register), enter your email address on the home page, and click "Register"

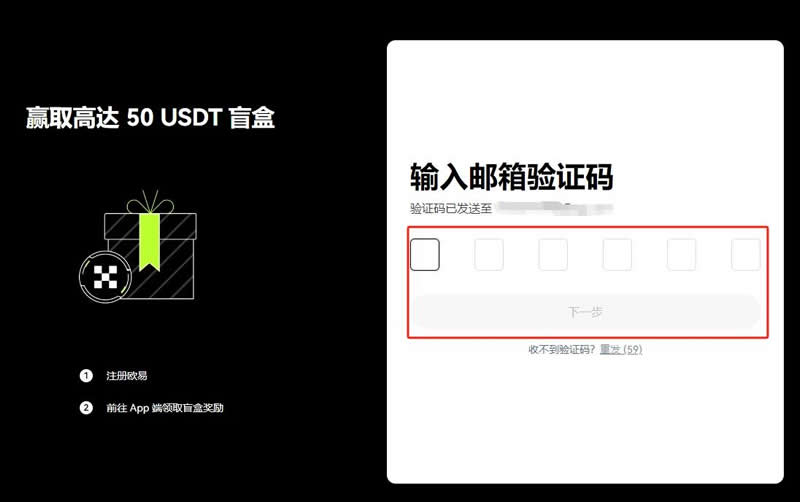

2. Swipe right Slide the slider to complete the puzzle for verification, then enter the verification code received by email. The verification code is valid for 10 minutes

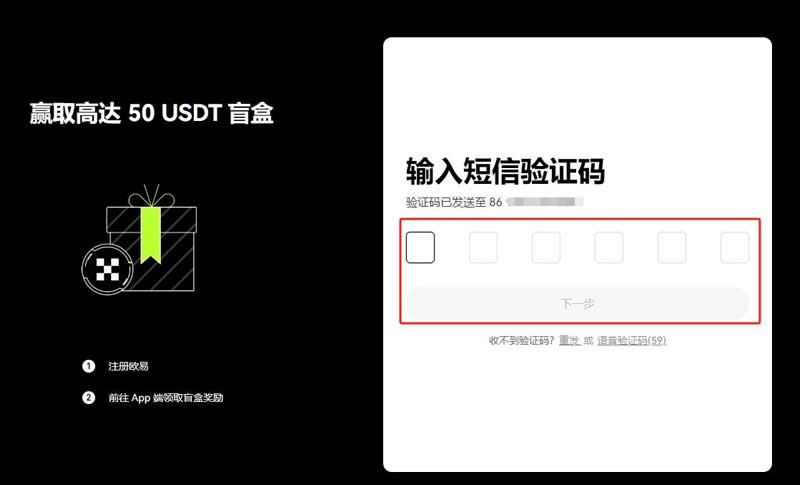

3. Then enter your mobile phone number and click "Verify Now" ”

#4. Enter the six-digit verification code received on your mobile phone, which is also valid for 10 minutes

5. Select your country/region of residence, check the Terms of Service, "Risk and Compliance Disclosure" and Privacy Policy and Statement

#6. When creating a password, the length must be 8- 32 characters, 1 lowercase letter, 1 uppercase letter, 1 number, 1 symbol, such as: !@ # $ % and other conditions

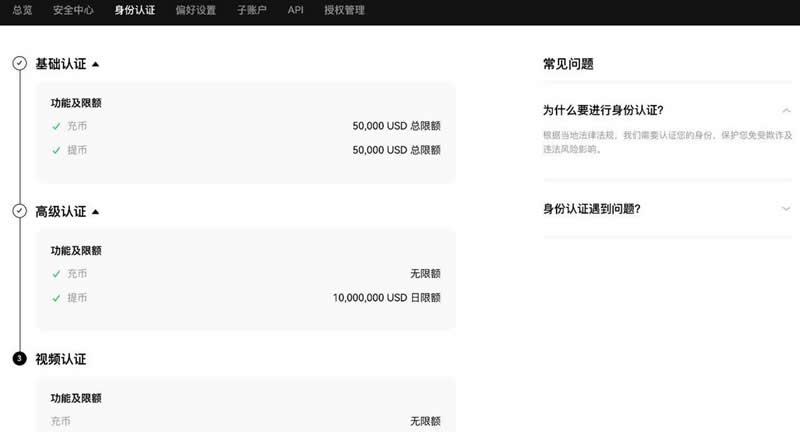

7. Log in account Afterwards, find the "User Center" icon on the homepage and enter the identity authentication page

8. Different levels of authentication can be carried out according to different needs (note: video authentication needs to be done on the APP Operation)

#9. After completing the identity authentication, you can proceed with the transaction and find "Buy Coin" on the homepage - "C2C Buy Coin"

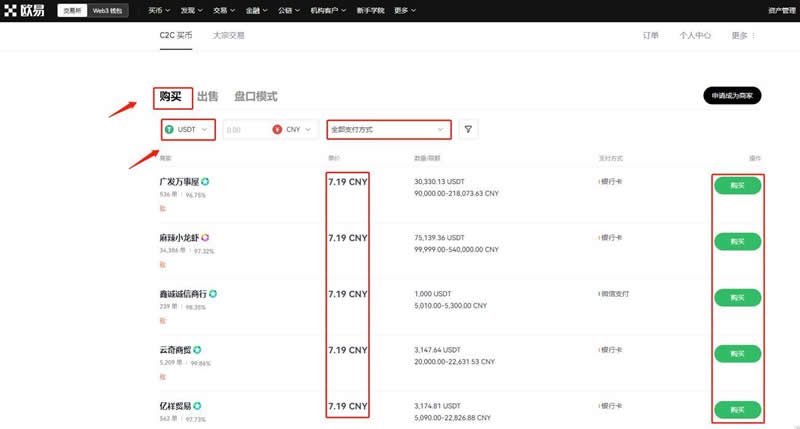

10. Select the "Purchase" option, pay attention to select the purchase currency, and click "All Payment Methods" to filter the payment method

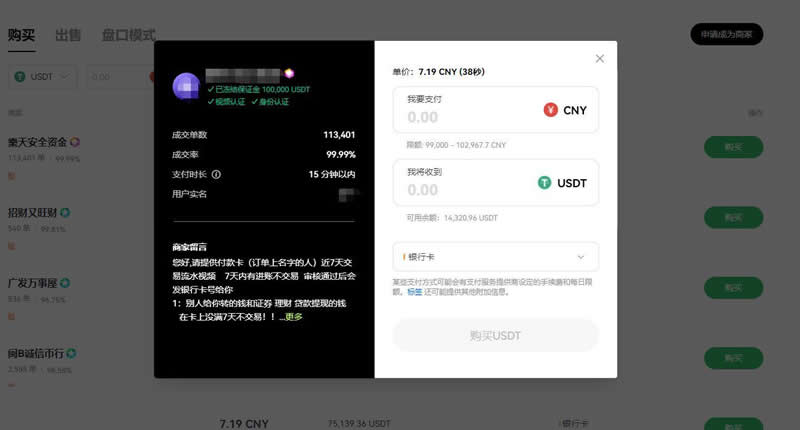

11. Select After entering the merchant, operate according to the merchant's message, then enter the purchase amount, click "Buy USDT" to pay and wait for the merchant to release the currency (if you do not receive the currency after payment, you can click on the page for help after negotiating with the merchant to no avail> Others>Get help>Initiate a complaint)

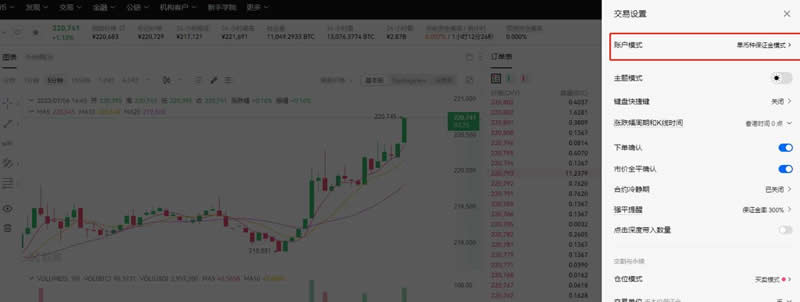

12. If you want to conduct contract transactions, you need to open the account mode and set it to single-currency margin mode or cross-currency A margin model.

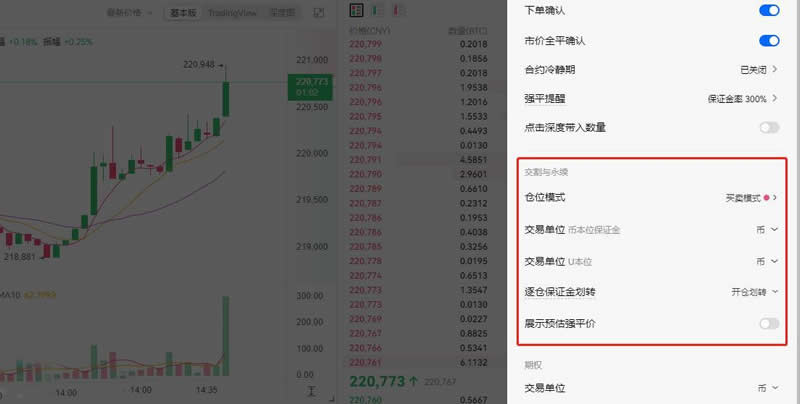

13. You can continue to set up the contract, personalize the trading unit and order mode.

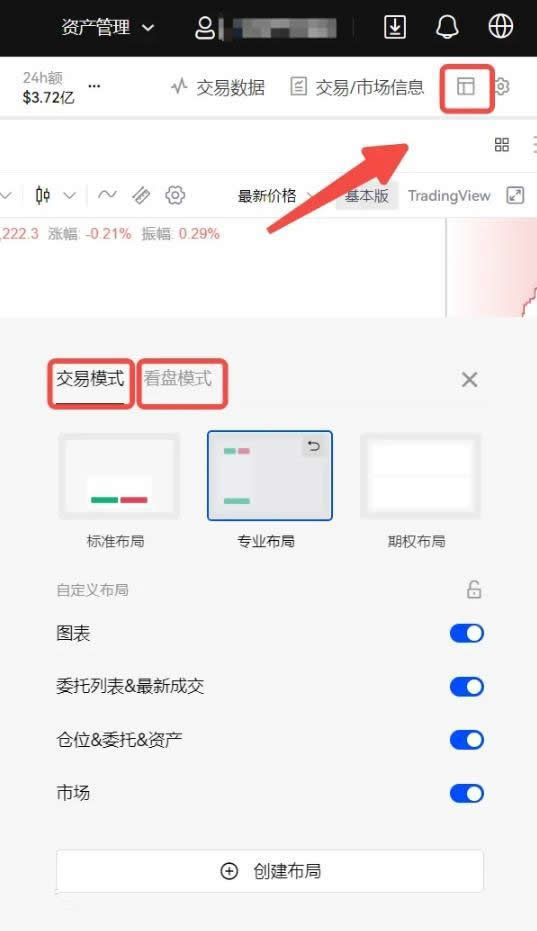

#14. You can customize the trading mode and Kanban mode. Select the professional layout here.

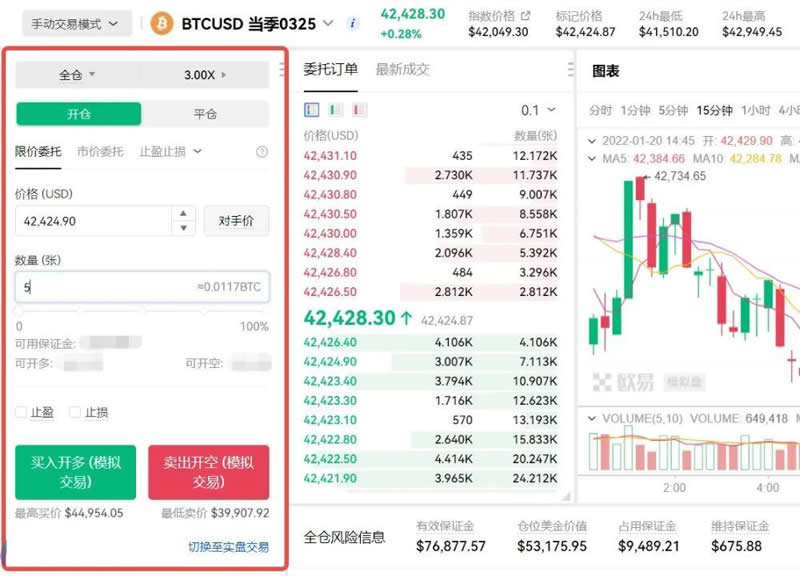

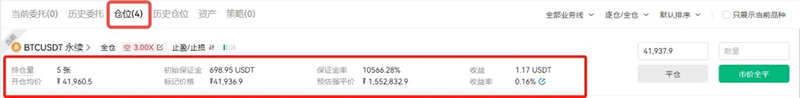

15. The delivery contract is divided into USDT margin delivery contract and currency-margin delivery contract. Here we take the coin-margin weekly delivery contract as an example.

First transfer our digital assets from the capital account to the trading account. If it has been completed, no additional transfer operation is required.

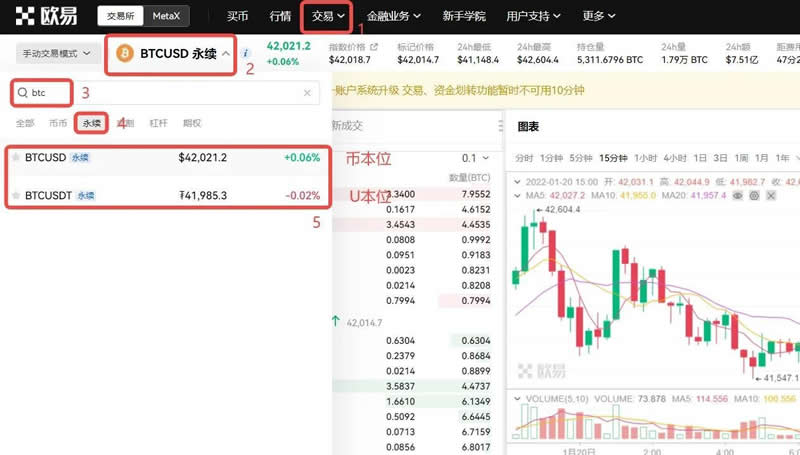

16. On the trading page, click the drop-down button on the right side of the currency pair, enter the currency in the search box, select delivery in the margin trading area, and select the contract period as the current week, Coin-margined/U-margined contracts for the next week, current quarter or second quarter. Here we take the current quarter currency-based contract as an example

Is there a time limit for buying and selling Bitcoin contracts?

There are time limits for Bitcoin contract sales, but the time limits are different for different contract types. Currently, there are three main types: futures, options and CFDs. The following is a detailed introduction:

1. Futures Contract: Bitcoin futures contracts typically have a specified expiration date. The expiration date is the date when the contract ends and the trader holding the contract is required to deliver or receive the corresponding Bitcoins. The expiration date is usually a specific date in the future, such as the third Friday of each quarter.

2. Options contracts: Bitcoin options contracts usually have a specified expiration date. The expiration date is the date until which the contract is valid and the trader holding the contract must decide whether to exercise the option. The expiration date can be either a European-style option (which can only be exercised on the expiration date) or an American-style option (which can be exercised any time before the expiration date).

3. Contract for Difference (CFD): Bitcoin CFD usually does not have a clear expiration date. This means you can hold the contract for as long as you want. The opening and closing of CFD positions can be carried out according to the trader's decision, so the holding time can be controlled by the trader himself.

The above is the detailed content of Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1389

1389

52

52

How to use Bitcoin contract hedging

May 09, 2024 pm 07:57 PM

How to use Bitcoin contract hedging

May 09, 2024 pm 07:57 PM

Bitcoin contract hedging is a strategy that offsets the risk of price fluctuations by buying and selling different contracts. The operational steps include: determining the hedging target, selecting the appropriate contract, determining the position size, opening a position, tracking the market and closing the position. In the example, investors hedge the risk of falling prices of Bitcoin holdings by buying and selling perpetual contracts. It is important to note that hedging has transaction fees and requires ongoing monitoring and adjustment.

Can the Bitcoin contract cooling-off period be withdrawn? Tutorial on how to deactivate the Bitcoin contract cooling-off period

Jun 03, 2024 pm 01:35 PM

Can the Bitcoin contract cooling-off period be withdrawn? Tutorial on how to deactivate the Bitcoin contract cooling-off period

Jun 03, 2024 pm 01:35 PM

Bitcoin contracts have gradually become a popular investment tool and are loved by everyone. However, because of the volatility of the Bitcoin market, investors tend to trade emotionally. In order to encourage investors to be responsible in trading, exchanges have successively introduced cooling-off periods. It is intended to be a self-help tool. Allow investors to temporarily disable contract trading to prevent trading addiction, and allow investors to take a break and reflect on their trading strategies by temporarily disabling the contract trading function. After briefly understanding the concept of the cooling-off period, there are still investors who do not understand its meaning and want to know specifically whether the cooling-off period of the Bitcoin contract can be withdrawn? Judging from the data analysis, it cannot be withdrawn and can only wait for the cooling-off period to end. The editor below will tell you in detail. Can the Bitcoin contract cooling-off period be withdrawn? Bitcoin contract cooling off period is not

How are Bitcoin platform handling fees calculated?

Feb 04, 2024 am 10:09 AM

How are Bitcoin platform handling fees calculated?

Feb 04, 2024 am 10:09 AM

In the Bitcoin market, Bitcoin transactions require the same handling fees as stocks, but different trading methods have different charging standards. For example, the leading exchange Ouyi shows that currently the lowest level users charge 0.15% for each Bitcoin transaction. Handling fees, but it should be noted that Bitcoin handling fees are divided into spot handling fees and contract handling fees. How are the Bitcoin platform handling fees calculated? The simple formula algorithm is handling fee = position value * handling rate. This formula is applicable to both trading methods. Next, the editor will tell you in detail. How are Bitcoin platform handling fees calculated? How Bitcoin platform fees are calculated may vary from platform to platform. Generally speaking, the platform will distinguish between spot handling fees and contract handling fees. Take Eureka Exchange as an example (new users can click here

How much is the minimum price for Binance Futures?

Jul 02, 2024 pm 12:32 PM

How much is the minimum price for Binance Futures?

Jul 02, 2024 pm 12:32 PM

The minimum threshold for Binance Futures trading depends on the different trading pairs, with a minimum of $1 and a maximum of $10. Specifically, the minimum trading amount is $10 for the BTCUSDT trading pair, $1 for the ETHUSDT trading pair, and $1 for the USDT-M perpetual contract.

What is the relationship between Bitcoin contract price and spot price? What's the difference?

Feb 29, 2024 pm 09:55 PM

What is the relationship between Bitcoin contract price and spot price? What's the difference?

Feb 29, 2024 pm 09:55 PM

Bitcoin is one of the most frequently traded cryptocurrencies among investors, and Bitcoin contracts are also the most popular trading method. Unlike spot trading, contract trading allows investors to make more profits with less principal, and at the same time There are also greater risks. Not only that, some investors also find that there seems to be some relationship between the contract price and the spot price, but they cannot clearly understand what is the relationship between the Bitcoin contract price and the spot price? The relationship between the two is somewhat complicated. The spot price is the price at which Bitcoin is bought or sold at the current market price, and the contract price is the price of Bitcoin contracts traded in the derivatives market. The editor below will tell you in detail. What is the relationship between Bitcoin contract price and spot price? The relationship between Bitcoin contract prices and spot prices

Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them

Jan 27, 2024 am 09:42 AM

Excerpt: Detailed explanation of how to buy and sell Bitcoin contracts and how to play them

Jan 27, 2024 am 09:42 AM

In the Bitcoin contract market, when you purchase a futures contract, you do not own the underlying crypto asset. Instead, what you have is a contract that agrees to buy or sell Bitcoin on a certain date in the future. The Bitcoin contract is designed to protect its underlying asset from price fluctuations and adverse price changes. There are currently not a few investors playing Bitcoin contracts, but There are only a few people who have comprehensive knowledge about contracts, especially regarding contract trading times. Can it be said that Bitcoin contracts can be bought and sold at any time, just like spot prices? Still different, is there a time limit for Bitcoin contract buying and selling? Generally speaking, it can be bought and sold at any time, but there will be a time limit. The editor will explain it in detail below. Can Bitcoin contracts be bought and sold at any time? Bitcoin contract is a financial derivative in the Bitcoin market, with

Is the Bitcoin contract price determined by the spot price? Why?

Mar 07, 2024 am 11:30 AM

Is the Bitcoin contract price determined by the spot price? Why?

Mar 07, 2024 am 11:30 AM

Contract trading and spot trading are the two most common trading methods for investors to enter the Bitcoin market. Contract trading is a type of financial derivatives trading that speculates or hedges based on Bitcoin price changes. Spot trading refers to the direct purchase or sale of actual Bitcoin assets, rather than speculation through derivatives contracts. Some investors will also find that the price will change with the spot price when conducting contract transactions. As a result, is the Bitcoin contract price determined by the spot price? According to the current data, this question will affect the contract price, but it does not determine the relationship. The editor will explain it in detail below. Is the Bitcoin contract price determined by the spot price? Bitcoin contract prices are affected by spot prices, but do not entirely depend on the spot market. Bitcoin Contract

How to calculate the profit of Bitcoin contract with 100 times leverage? How to use Bitcoin leverage trading?

Jul 24, 2024 am 11:17 AM

How to calculate the profit of Bitcoin contract with 100 times leverage? How to use Bitcoin leverage trading?

Jul 24, 2024 am 11:17 AM

Bitcoin’s 100x leverage means that the equivalent of 100 units of Bitcoin (100x holdings) can be traded, with gains or losses magnified 100x. The calculation formula is: Profit = Number of contracts x Leverage multiple x (opening price - closing price). Leveraged trading is a high-risk, high-yield method. You need to choose a reputable platform, set leverage multiples, set stop losses, pay attention to position management, and fully understand market dynamics for research and analysis.