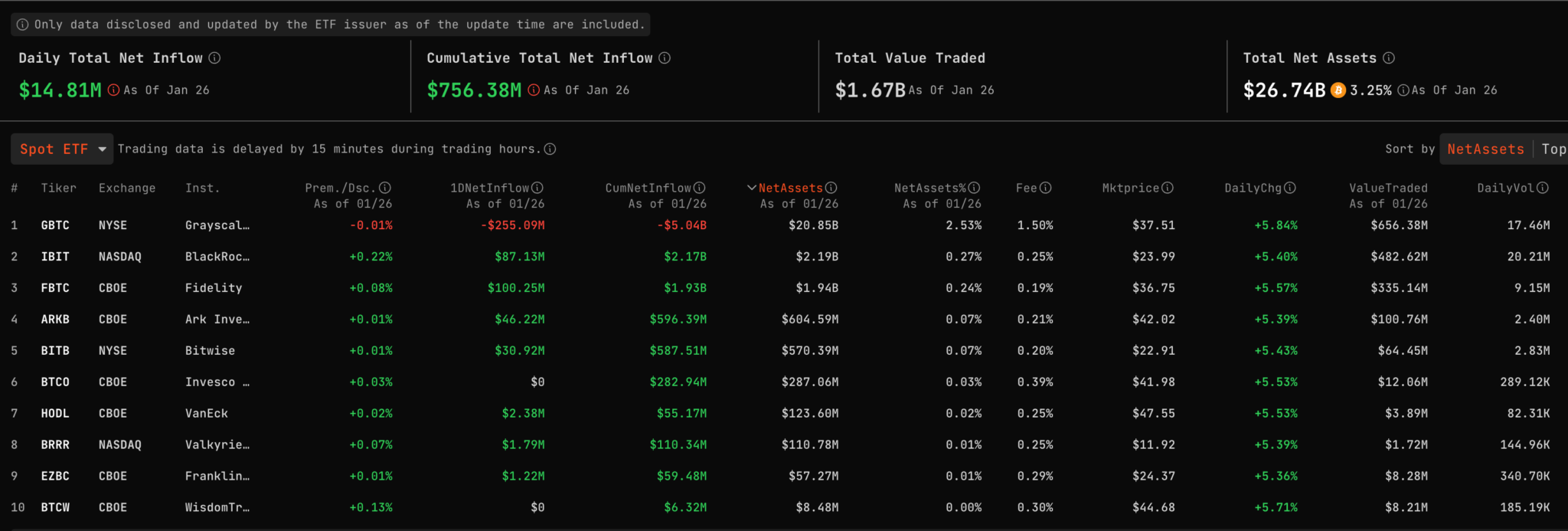

According to SoSoValue data, affected by the Grayscale GBTC sell-off, the Bitcoin spot ETF experienced a total net outflow of funds for four consecutive days from the 22nd to the 25th, with a total outflow of US$422 million. However, the Bitcoin spot ETF finally saw total net inflows on Friday, with an inflow of $14.81 million.

Daily inflow and outflow scale of Bitcoin spot ETF

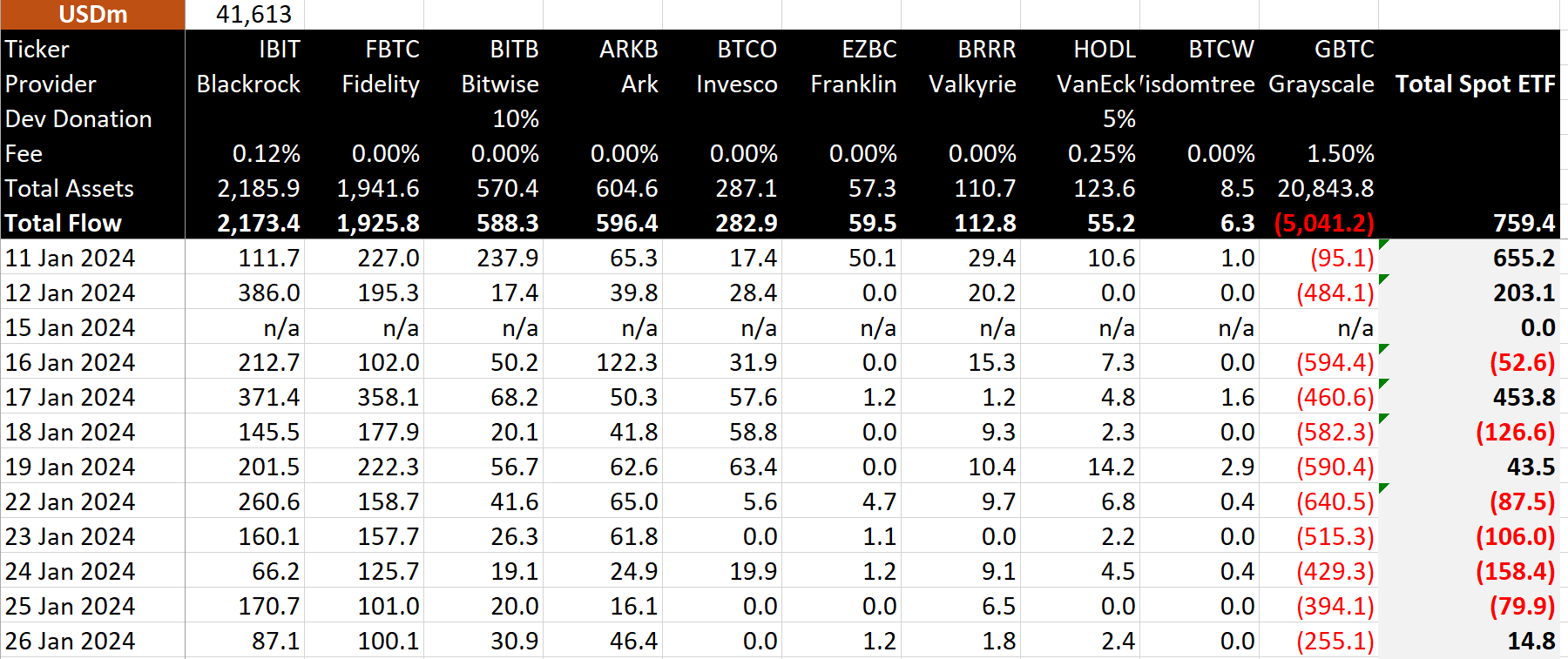

Among them, the single-day net outflow of Grayscale GBTC was US$255 million. In addition to Grayscale, other Bitcoin spot ETFs had a total net inflow of $269 million. Among them, Fidelity's FBTC had the largest single-day net inflow, with a net inflow of approximately US$100 million, accounting for 37.17% of the total net inflow. Followed by BlackRock's IBIT, with a net inflow of US$87.13 million, accounting for 32.3% of the total net inflow.

Bitcoin spot ETF inflows and outflows on Friday

According to data from BitMEX Research, since the net outflow of US$640 million peaked on the 22nd , GBTC’s net outflows have declined for four consecutive days, suggesting that the GBTC sell-off may have slowed down. In addition, within 12 trading days after GBTC was converted into a spot ETF and listed, the cumulative net outflow has reached US$5.04 billion.

Daily inflow and outflow scale of each Bitcoin spot ETF

Currently, the historical cumulative net inflow of Bitcoin spot ETF is US$756 million, Grayscale GBTC still holds net assets of $20.058 billion, and the total net asset value of Bitcoin spot ETFs is $26.74 billion.

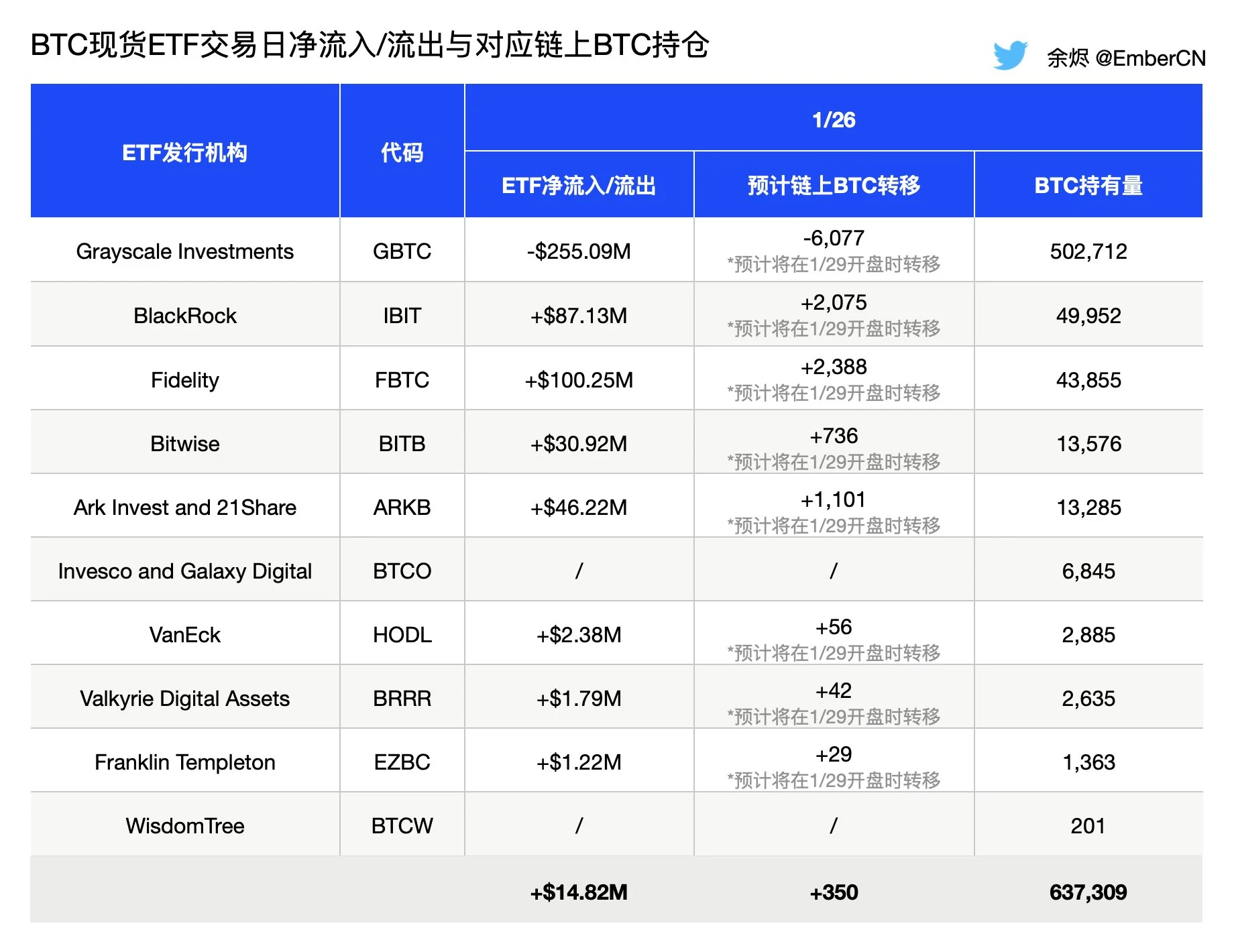

ETF custody address is expected to transfer US$525 million on Monday

On-chain analyst Yu Jin said that based on the inflow/outflow of funds on Friday, it is expected that when the U.S. stock market opens next Monday, the major Bitcoin spot ETFs A total of approximately 12,504 BTC ($525 million) will be transferred to escrow addresses.

Among them, the Grayscale GBTC custody address is expected to outflow approximately 6,077 BTC (capital outflow of 255 million US dollars on 1/26), and the remaining nine ETF custody addresses will inflow approximately 6,427 BTC (capital inflow of 2.70 on 1/26). billion US dollars), the overall net inflow was approximately 350 BTC (US$14.8 million).

The expected on-chain transfer volume of each ETF next Monday

Ember pointed out that after four consecutive days of net outflows, Bitcoin spot ETF funds once again experienced a net outflow. Inflows and outflows of Grayscale funds are also gradually declining, and the selling peak may have passed. The current ten BTC spot ETFs hold a total of approximately 637,309 BTC.

Bloomberg analyst James Seyffart has previously predicted that GBTC’s final outflow rate will reach between 20% and 35%, but at least 1/3 of these outflows will reinvest in Bitcoin , after including GBTC outflows, the net inflow of Bitcoin spot ETF funds this year will still reach 10 billion US dollars.

The above is the detailed content of Bitcoin spot ETF attracts huge funds, Grayscale GBTC abandonment ends. For more information, please follow other related articles on the PHP Chinese website!