web3.0

web3.0

Covalent (CQT): Build a new on-chain protocol revenue system and commit to financial transparency

Covalent (CQT): Build a new on-chain protocol revenue system and commit to financial transparency

Covalent (CQT): Build a new on-chain protocol revenue system and commit to financial transparency

In the vibrant world of blockchain and decentralized technology, Covalent Network (CQT) is reshaping the on-chain economic system through its innovative protocol revenue model. Unlike traditional financial systems, this feature brings unparalleled accessibility, eliminating intermediaries and giving the community direct access to granular blockchain data.

Covalent’s value accumulation mechanism

At the core level, Covalent Network (CQT) plays a dual role. It is both a decentralized physical infrastructure and a middleware project. Promote the connection between the supply and demand sides of data on the chain. Analogous to well-known platforms such as Uber, Covalent connects query operators (supply side) with applications (demand side) and differentiates itself from traditional financial structures by extracting revenue at a certain rate as a way to accumulate protocol revenue. Come on.

For the foreseeable future, Covalent Network (CQT) will rely entirely on the Ethereum network and exclusively use $ETH tokens for network fees. Through its Ethereum Wayback Machine (EWM), an innovative solution designed to secure access to historical blockchain data, Covalent Network (CQT) ensures decentralization and avoids dependence on centralized entities. This strategic move not only solidifies the integration of the Covalent Network (CQT) system, but also actively strengthens Covalent Network (CQT)’s commitment to the Ethereum ecosystem by cultivating a symbiotic relationship, not only for the Covalent Network (CQT) system as a whole improvement, and is also expected to promote the broader development of the Ethereum network.

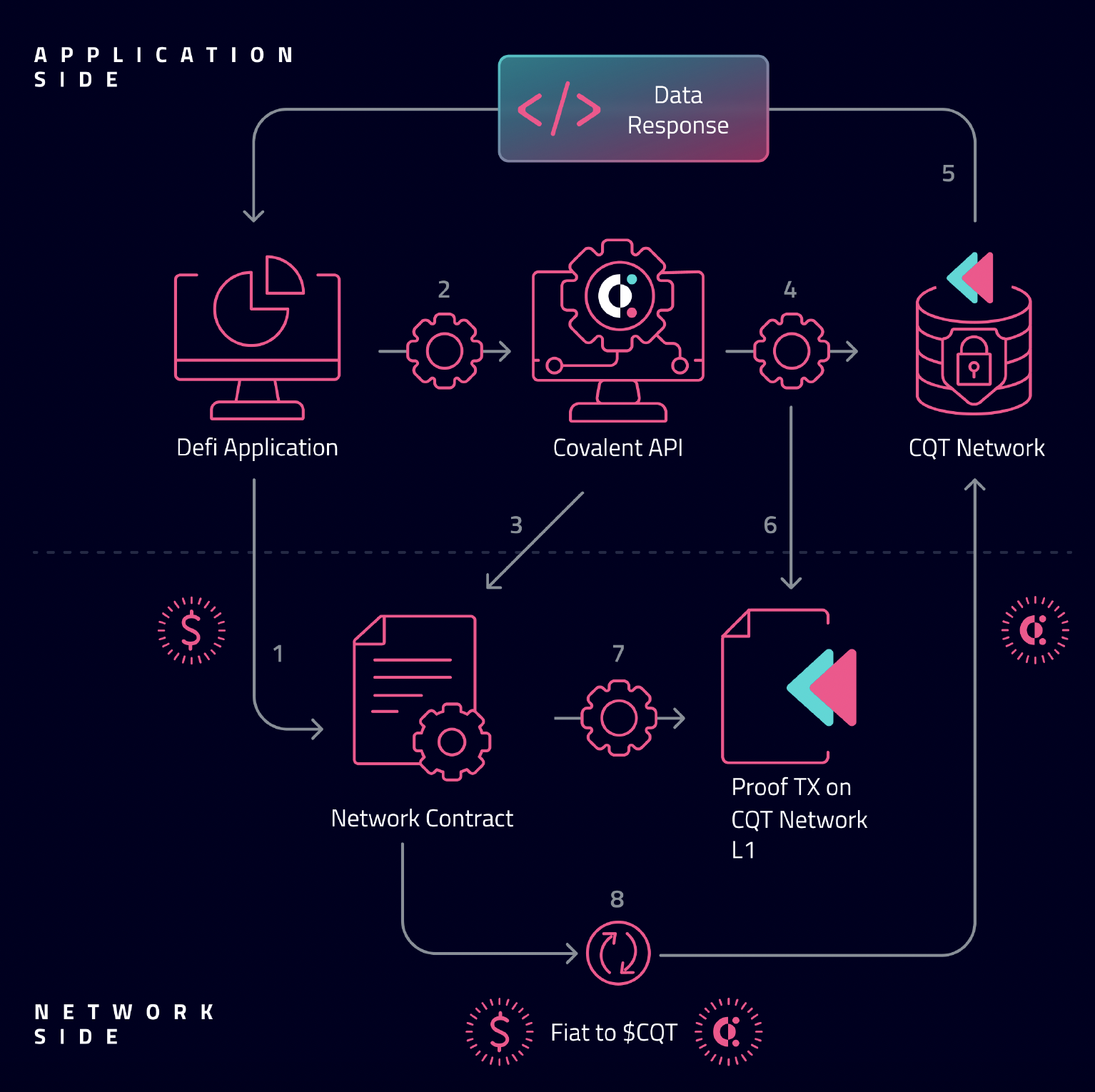

How does it work?

Covalent Network (CQT) uses $CQT as the governance and staking token. Operators participate in network operations by pledging tokens, and their work shares will be distributed according to their pledge ratio, while the income generated by demand parties entering the network through the protocol will be distributed to operators through a new profit sharing mechanism.

The main value accumulation mechanism process is as follows:

- The application directly queries the blockchain data API by interacting with the smart contract on the chain, and pays with stable currency.

- Pricing for APIs is determined by the carrier network.

- Stablecoins are converted to $CQT through the market buyback mechanism.

- $CQT is staked by the network operator as a security guarantee of its honest behavior.

- Earned $CQT are allocated to operators based on work completed.

- Operators sell a portion of the $CQT earned to pay for operating expenses, which again flows back into the ecosystem’s economy.

Convert demand into token value driver

It is worth noting that the demand side in Covalent Network (CQT) prices demand in US dollars or fiat currencies, ensuring Predictability of consumer bills under a variety of circumstances. Covalent Network (CQT) uses USD as the basis for collecting revenue, which is converted into $CQT (Covalent’s native token) through regular market purchases. $CQT is then distributed to validators as a network utility token, flowing back into the ecosystem and sustaining the operation of the network.

Covalent Network (CQT) provides fair compensation for those who actively participate in network operations, while the value accumulation of traditional models often favors passive stakeholders with limited or no direct participation in ecological construction. Obviously, Covalent Network (CQT) is fundamentally different from traditional economic models.

Q&A

Q: What is the difference between the decentralized model of Covalent Network (CQT) and the centralized model?

A: In the centralized model, passive token holders do not need to actively participate to benefit. The difference between Covalent and the centralized model is that its decentralized structure ensures that token holders are based on They are rewarded for their active contributions such as staking or running a validator node. This emphasizes active participation and establishes a fair and incentivized distribution model to ensure that the system operates efficiently in a decentralized manner.

Q: What is unique about Covalent Network (CQT) in terms of instant protocol revenue accumulation?

A: The more API calls made in the network, the more revenue is generated. By leveraging token incentives, costs will be reduced for users and long-term data availability will be transformed into a public benefit.

Q: Can you explain the current revenue accumulation method of Covalent Network (CQT) and the expected changes?

A: Currently, revenue accrual involves two steps: the demand side pays the protocol in USD as an API consumer, and converts it into $CQT tokens and distributes them to validators. As more validators join, our long-term goal is to build a more straightforward process that reduces reliance on centralized methods and builds larger decentralized systems over time.

About Covalent Network (CQT)

Covalent (CQT) focuses on blockchain data availability and supports millions of users to build a new economy. Since its establishment, Covalent has continued to help developers and analysts It provides comprehensive and real-time data on more than 200 chains.

The above is the detailed content of Covalent (CQT): Build a new on-chain protocol revenue system and commit to financial transparency. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1393

1393

52

52

37

37

110

110

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

The top ten cryptocurrency contract exchange platforms in 2025 are: 1. Binance Futures, 2. OKX Futures, 3. Gate.io, 4. Huobi Futures, 5. BitMEX, 6. Bybit, 7. Deribit, 8. Bitfinex, 9. CoinFLEX, 10. Phemex, these platforms are widely recognized for their high liquidity, diversified trading functions and strict security measures.

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

Suggestions for choosing a cryptocurrency exchange: 1. For liquidity requirements, priority is Binance, Gate.io or OKX, because of its order depth and strong volatility resistance. 2. Compliance and security, Coinbase, Kraken and Gemini have strict regulatory endorsement. 3. Innovative functions, KuCoin's soft staking and Bybit's derivative design are suitable for advanced users.

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

Quantum Chain (Qtum) is an open source decentralized smart contract platform and value transmission protocol. 1. Technical features: BIP-compatible POS smart contract platform, combining the advantages of Bitcoin and Ethereum, introduces off-chain factors and enhances the flexibility of consensus mechanisms. 2. Design principle: realize on-chain and off-chain data interaction through main control contracts, be compatible with different blockchain technologies, flexible consensus mechanisms, and consider industry compliance. 3. Team and Development: An international team led by Shuai Chu, 80% of the quantum coins are used in the community, and 20% rewards the team and investors. Quantum chains are traded on Binance, Gate.io, OKX, Bithumb and Matcha exchanges.

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum chains can be traded on the following exchanges: 1. Binance: One of the world's largest exchanges, with large trading volume, rich currency and high security. 2. Sesame Open Door (Gate.io): a large exchange, providing a variety of digital currency transactions, with good trading depth. 3. Ouyi (OKX): operated by OK Group, with strong comprehensive strength, large transaction volume, and complete safety measures. 4. Bitget: Fast development, provides quantum chain transactions, and improves security. 5. Bithumb: operated in Japan, supports transactions of multiple mainstream virtual currencies, and is safe and reliable. 6. Matcha Exchange: a well-known exchange with a friendly interface and supports quantum chain trading. 7. Huobi: a large exchange that provides quantum chain trading,

Popular science in the currency circle: What is the difference between decentralized exchanges and hybrid exchanges?

Apr 21, 2025 pm 11:30 PM

Popular science in the currency circle: What is the difference between decentralized exchanges and hybrid exchanges?

Apr 21, 2025 pm 11:30 PM

The difference between decentralized exchanges and hybrid exchanges is mainly reflected in: 1. Trading mechanism: Decentralized exchanges use smart contracts to match transactions, while hybrid exchanges combine centralized and decentralized mechanisms. 2. Asset control: Decentralized exchange users control assets, and mixed exchange ownership centralization and decentralization. 3. Privacy protection: Decentralized exchanges provide high anonymity, and hybrid exchanges require KYC in centralized mode. 4. Trading speed and liquidity: Decentralized exchanges are slower, liquidity depends on user pool, and hybrid exchanges are more fast and liquid in centralized mode. 5. Platform governance: Decentralized exchanges are governed by community governance, and hybrid exchanges are jointly governed by communities and centralized teams.