web3.0

web3.0

Fed Chairman Powell throws cold water on March interest rate cut! Bitcoin drops to $42,220, U.S. stocks dive

Fed Chairman Powell throws cold water on March interest rate cut! Bitcoin drops to $42,220, U.S. stocks dive

Fed Chairman Powell throws cold water on March interest rate cut! Bitcoin drops to $42,220, U.S. stocks dive

The U.S. Federal Reserve (Fed) made the expected decision at 3 a.m. this morning, choosing to keep the federal funds rate unchanged in the range of 5.25% to 5.5%. This is the fourth time.

Although the Federal Open Market Committee (FOMC) said in a subsequent policy statement that inflation remained a high priority, when discussing central bank policy, officials deleted the statement from last month that they considered "any additional policy tightening." ” language, which further rules out the possibility of future interest rate hikes.

Powell pours cold water on March rate cut

However, the latest policy statement did not explicitly imply a rate cut. Powell said only that the Fed may have completed all the rate hikes needed in this tightening cycle. If the economy develops as expected, it may be appropriate to initiate easing policy at some point this year, he said. However, he also expressed reservations about the market's optimistic expectations for a rate cut in March. He said that at today's meeting, he believed that it would be difficult for the committee to reach a sufficient level of confidence to decide on a rate cut at the March meeting, and this requires further observation.

Finally, Powell pointed out that the United States is not yet ready to declare that the economy has achieved a soft landing, believing that there is still some way to go.

Bitcoin fell to $42,220

Powell dispelled the market’s optimistic expectations for a rate cut in March, causing both U.S. stocks and Bitcoin to plummet. Before the Fed announced the news, the highest price of Bitcoin reached $43,745, but then fell rapidly. At the time of writing, the lowest price hit $42,220, a drop of 1.22% in the past 24 hours.

U.S. stocks fell sharply in late trading:

The Dow Jones index fell 317.01 points, or 0.82%, to close at 38,150.3 points

The Nasdaq fell 345.89 points, or 2.23%, to close at 15,164.01 points

The S&P 500 index fell 79.32 points, or 1.61%, to close at 4,845.65 points

The Philadelphia Semiconductor Index fell 59.07 points, or 1.37%, to close at 4,260.92 points

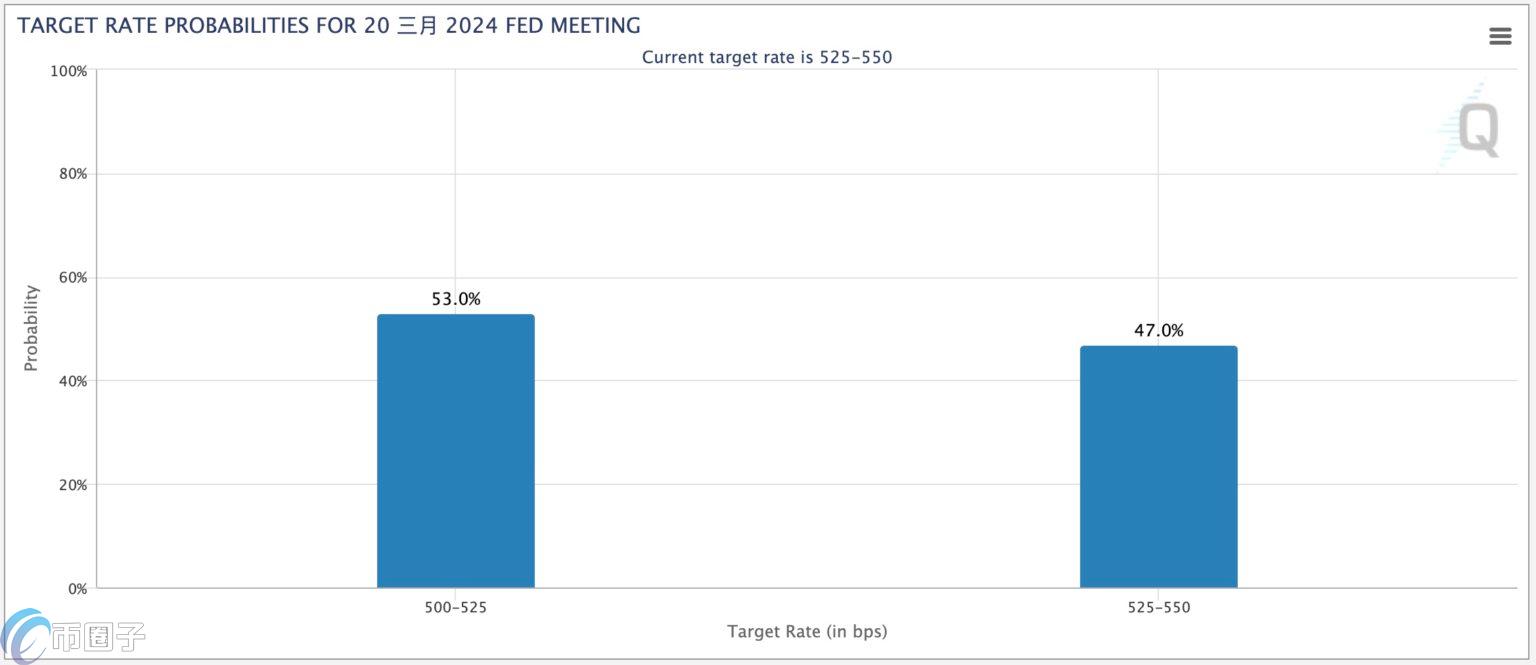

The market is betting on the chance of a rate cut in March

As Fed officials They seem to be still conservative about cutting interest rates. According to FedWatch data from the CME Group, the probability that the Federal Reserve will keep interest rates unchanged at the next March meeting is expected to reach 47%, and the probability of cutting interest rates by 1% has increased from 1% to 1%. It dropped from 73.4% a month ago to the current 53.0%.

The above is the detailed content of Fed Chairman Powell throws cold water on March interest rate cut! Bitcoin drops to $42,220, U.S. stocks dive. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

The possible price increase of Dogecoin ETF after approval is 2 to 5 times, and the current price of $0.18 may rise to $0.6 to $1.2. 1) In the optimistic scenario, the increase can reach 3 times to 10 times, due to the bull market and the boost of Musk; 2) In the neutral scenario, the increase is 1.5 times to 3 times, due to moderate capital inflows; 3) In the pessimistic scenario, the increase is 0.5 times to 1.5 times, due to bear market and low liquidity.

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

As of March 2025, the Dogecoin ETF has not yet had a clear approval schedule. 1. There is no formal application yet and the SEC has not received any relevant application. 2. Market demand and controversy are high, and regulators are conservative. 3. The potential timeline is a 1-2-year review period, which may be observed from 2025 to 2026, but there is high uncertainty.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

Want to play Ethereum? Choose the right trading platform first! There are centralized exchanges (CEXs) such as Binance, Ouyi, Coinbase, Kraken, and Gate.io. The advantages are fast speed and good liquidity, while the disadvantages are centralized risks. There are also decentralized exchanges (DEXs) such as Uniswap, SushiSwap, Balancer, and Curve. The advantages are security and transparency, while the disadvantages are slow speed and poor experience.

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

In 2025, choosing a "formal" Ethereum trading platform means security, compliance and transparency. Licensed operations, financial security, transparent operations, AML/KYC, data protection and fair trading are key. Compliant exchanges such as Coinbase, Kraken, and Gemini are worth paying attention to. Binance and Ouyi have the opportunity to become formal platforms by strengthening compliance. DeFi is an option, but there are risks. Be sure to pay attention to security, compliance, expenses, spread risks, back up private keys, and conduct your own research.

How to download kraken exchange

Mar 27, 2025 pm 04:21 PM

How to download kraken exchange

Mar 27, 2025 pm 04:21 PM

Want to experience a safe and reliable Kraken exchange? This tutorial details how to download the Kraken App (iOS & Android) and access the web version, and reminds everyone to pay attention to safety. Be sure to download it from the official channel, enable two-factor authentication, and protect account security.