web3.0

web3.0

Solana's daily active addresses exceed one million, data reveals the key driving role of WEN airdrop and Jupiter

Solana's daily active addresses exceed one million, data reveals the key driving role of WEN airdrop and Jupiter

Solana's daily active addresses exceed one million, data reveals the key driving role of WEN airdrop and Jupiter

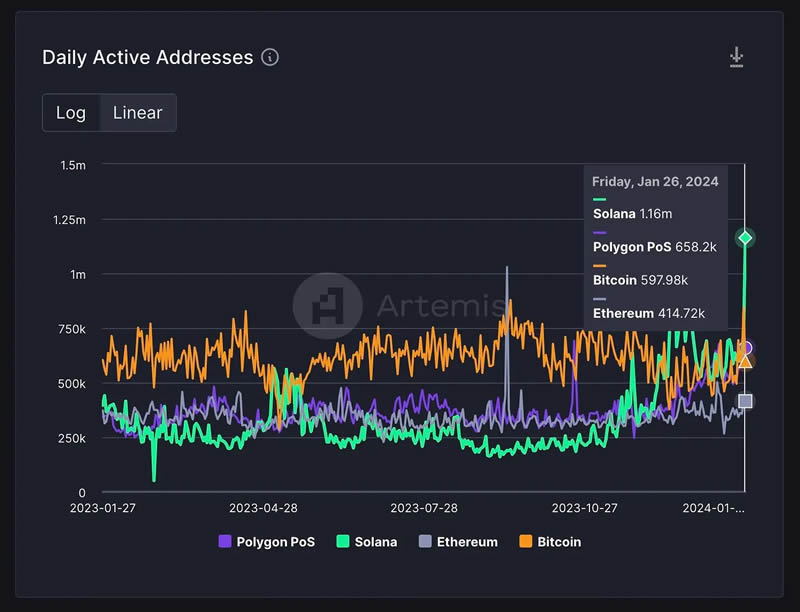

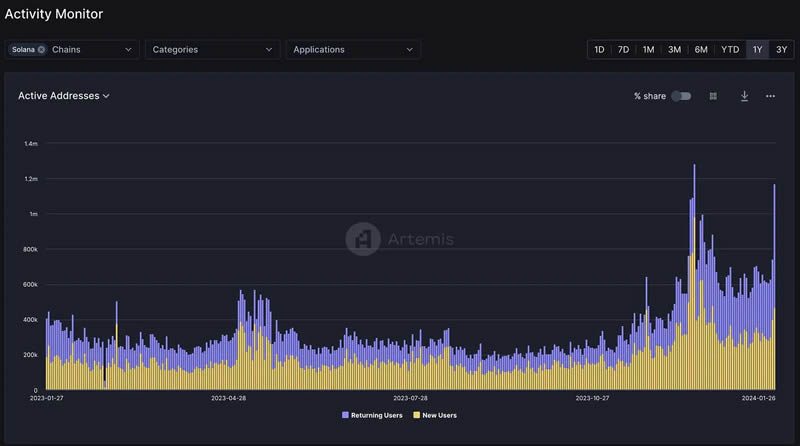

On January 26, 2024, Solana’s daily active addresses exceeded 1 million. This number last appeared in mid-December 2023. The breakthrough sparked discussion about the drivers of growth in Solana's user activity. This article will analyze the activity that occurred on Solana on January 26, 2024, and explore the applications and users driving this growth.

Text

On January 26, 2024, Solana’s daily active addresses exceeded 1 million.

According to data from Coingecko, Solana recorded over 1 million daily active addresses between December 15 and 17, 2023, coinciding with the peaks and declines in $BONK price. consistent.

This begs the question, what is driving user activity on Solana on January 26, 2024? Which applications or users are driving the growth in active addresses?

In this article, we try to answer the above questions. We built Activity Monitor to help analysts understand what drives on-chain activity. And if we see an increase in network activity (such as fees, daily transactions, or daily active addresses) on Ethereum, Polygon, Solana, etc., can we use this tool to better understand what applications or users are driving usage of the chain?

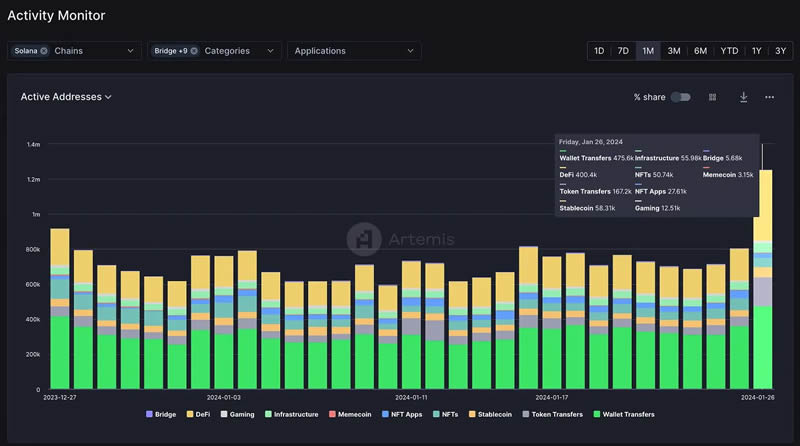

In today’s article, we use Activity Monitor to better understand what happened on Solana on January 26, 2024. Overall, there has been a significant increase in active addresses driven by the $WEN airdrop. $WEN is a community token on Solana that is distributed to wallet holders who exchange more than $5 on Jupiter, Ovols NFT holders, Blue Chip NFT holders, or Genesis Saga holders. The purpose of this airdrop campaign is to incentivize and reward participants in the Solana ecosystem. By distributing $WEN tokens, the project team hopes to attract more users to participate and increase the activity of the Solana network. This initiative has a positive impact on the development and promotion of the Solana ecosystem, while also bringing real economic returns to participants.

Which applications and users are driving Solana user growth?

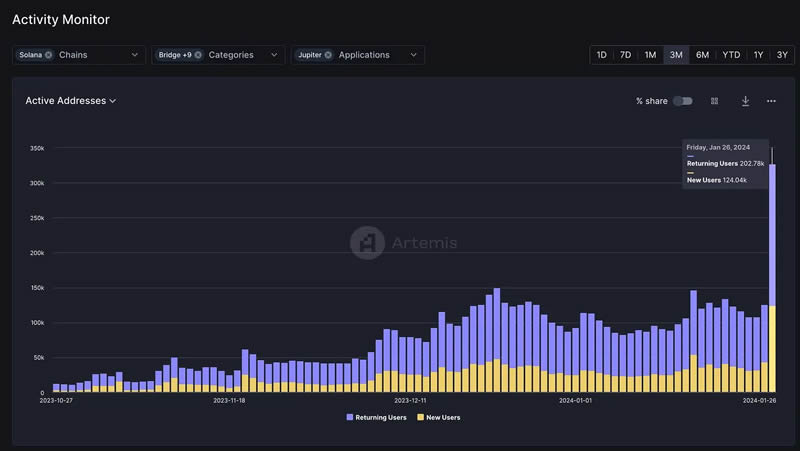

Using Activity Monitor, we see that DeFi and token transfers have driven the growth of a large number of active addresses in the past 24 hours: DeFi users increased from 178,000 on Thursday, January 25th to January 26th 400,000 on Friday. Likewise, the number of active addresses transferring tokens grew from approximately 55,000 on Thursday to 167,000 on Friday.

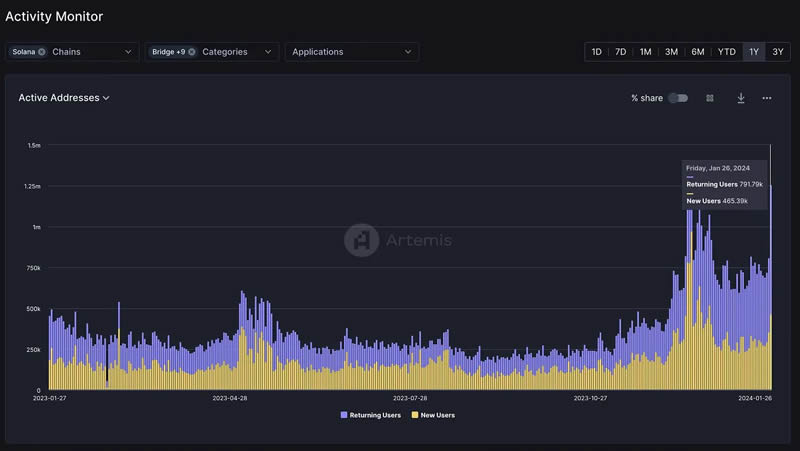

It is worth noting that on January 26, 2024, 37% of the daily active addresses on Solana were new. They may be new wallets and new ones joining Solana. New wallets and addresses opened by users, or possibly bots, to take advantage of the Jupiter or $WEN airdrops.

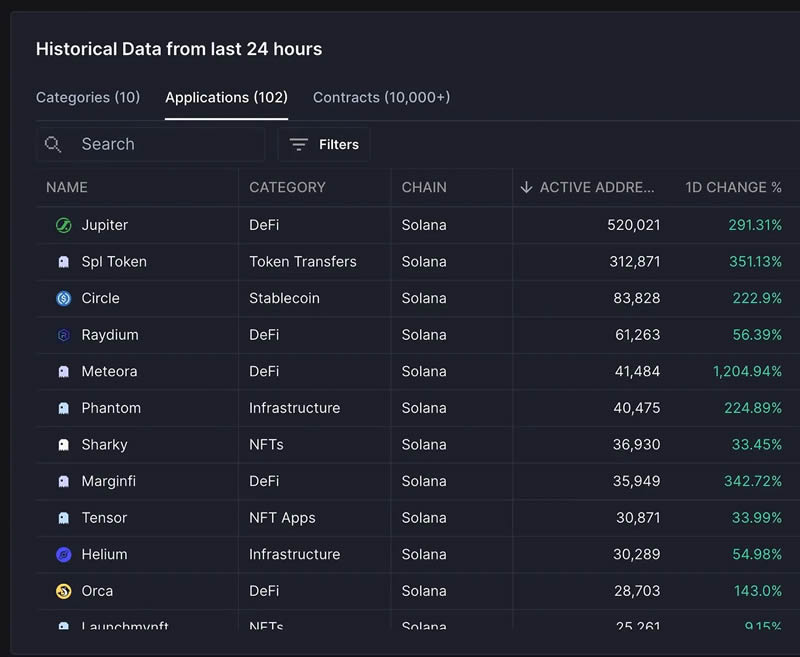

What application drives the most new active addresses? Looking at the application table below, we find that Jupiter, the DEX aggregator on Solana, will be conducting one of the most anticipated airdrops on January 31, 2024.

We see that more than 520,000 active addresses interact with Jupiter’s smart contracts, with the majority being old users (62%) and new users (38%).

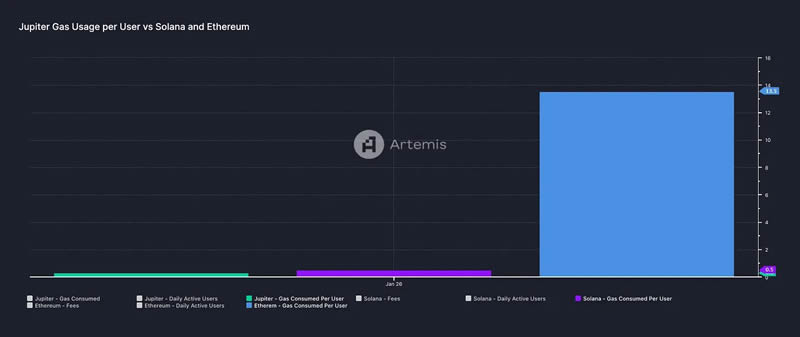

It is worth noting that the average gas consumption per user on Jupiter (total gas fees paid on Jupiter / total number of Jupiter daily active addresses) is approximately $0.3 , while on Solana overall it is $0.49. Using Ethereum as a benchmark, the average gas consumption per user is $13.55. Solana’s lower gas fees make it easier to conduct more transactions on the chain.

Why is there more activity on Jupiter?

In short, this is what to expect from the $WEN airdrop and $JUP airdrop.

Background

According to data from Stepn Finance, during the airdrop period, more than 117,000 addresses were active at the same time yesterday

Due to the large amount of activity surrounding the WEN airdrop, Phantom has experienced some performance issues

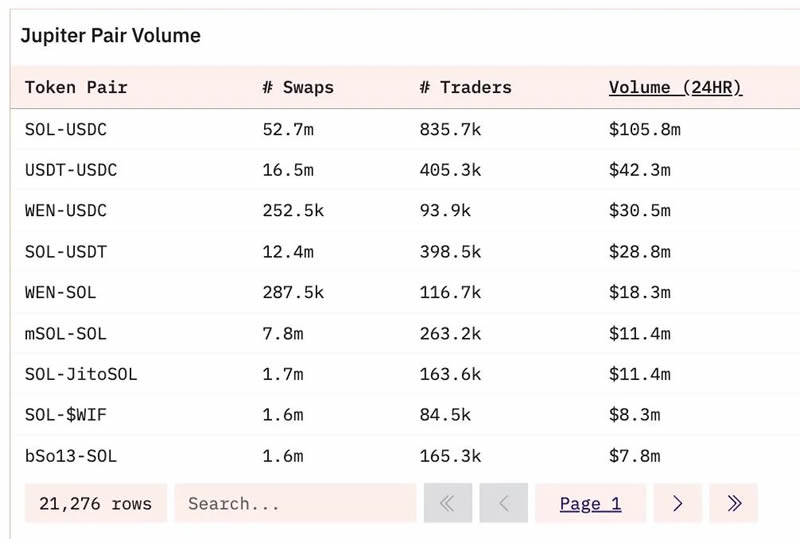

On Jupiter, a large number of exchanges took place yesterday between SOL-USDC (52.7 million transaction volume), in addition, WEN had approximately $48 million in transaction volume between SOL and USDC.

We compare the driving token transfer volume (transfers not related to SOL, so considered $WEN transfers between wallets/smart contracts) and Speculations for the exchange on Jupiter are:

Investors looking to buy (or sell) $WEN on Jupiter: Given the rising prices of $WIF and $BONK, investors may Hopefully get ready for another Meme price increase.

-

Those aiming to obtain the $WEN airdrop and Jupiter airdrop: However, it is worth noting that actions taken on January 26, 2024 do not affect eligibility for the two token airdrops :

$WEN's shortlist eligibility requires at least $5 to be exchanged within the past 6 months until January 19, 2024, so any action taken after January 19th will There will be no impact on airdrop eligibility or amount, as airdrops are distributed equally to each eligible wallet. (Source: https://lfg.jup.ag/wen)

$JUP air investment eligibility requires action to be taken before November 2, 2023, so actions taken after this point in time None of the actions will affect the eligibility of the air investment

Conclusion

There is a question for both investors and protocols, which set of applications will Ultimately driving the next wave of crypto user growth.

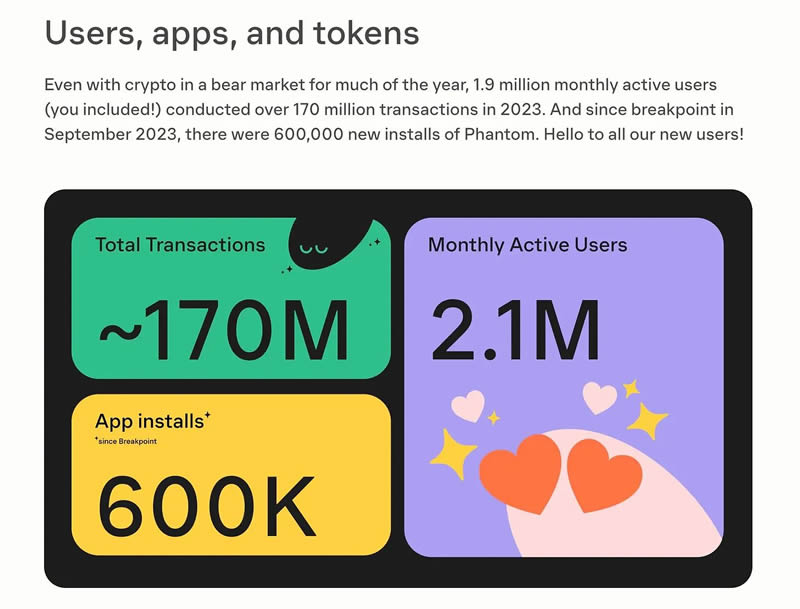

Phantom shared in its 2023 Year in Review that in the 3 months since Breakpoint, between September and December 2023, there were more than 600,000 installations, which also coincided with the Solana price increase , the end of the FTX trial coincides with the JTO airdrop.

As we saw in the growth in the number of new active addresses in mid-December 2023 and January 26, 2024, it seems like $WIF, $BONK, Memes like $WEN and the anticipation of airdrops obviously play a big role in attracting new users.

The above is the detailed content of Solana's daily active addresses exceed one million, data reveals the key driving role of WEN airdrop and Jupiter. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

As of March 2025, the Dogecoin ETF has not yet had a clear approval schedule. 1. There is no formal application yet and the SEC has not received any relevant application. 2. Market demand and controversy are high, and regulators are conservative. 3. The potential timeline is a 1-2-year review period, which may be observed from 2025 to 2026, but there is high uncertainty.

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

Want to play Ethereum? Choose the right trading platform first! There are centralized exchanges (CEXs) such as Binance, Ouyi, Coinbase, Kraken, and Gate.io. The advantages are fast speed and good liquidity, while the disadvantages are centralized risks. There are also decentralized exchanges (DEXs) such as Uniswap, SushiSwap, Balancer, and Curve. The advantages are security and transparency, while the disadvantages are slow speed and poor experience.

Detailed explanation of the issuance price and issuance time of LOOM coins

Mar 20, 2025 pm 06:21 PM

Detailed explanation of the issuance price and issuance time of LOOM coins

Mar 20, 2025 pm 06:21 PM

LOOM Coin, a once-highly-known blockchain game and social application development platform token, its ICO was held on April 25, 2018, with an issue price of approximately US$0.076 per coin. This article will conduct in-depth discussion on the issuance time, price and important precautions of LOOM coins, including market volatility risks and project development prospects. Investors should be cautious and do not follow the trend blindly. It is recommended to refer to the official website of Loom Network, blockchain browser and cryptocurrency information platform to obtain the latest information and conduct sufficient risk assessment. The information in this article is for reference only and does not constitute investment advice. Learn about LOOM coins, start here!

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

In 2025, choosing a "formal" Ethereum trading platform means security, compliance and transparency. Licensed operations, financial security, transparent operations, AML/KYC, data protection and fair trading are key. Compliant exchanges such as Coinbase, Kraken, and Gemini are worth paying attention to. Binance and Ouyi have the opportunity to become formal platforms by strengthening compliance. DeFi is an option, but there are risks. Be sure to pay attention to security, compliance, expenses, spread risks, back up private keys, and conduct your own research.

The difference between Ether and Bitcoin What is the difference between Ether and Bitcoin

Mar 19, 2025 pm 04:54 PM

The difference between Ether and Bitcoin What is the difference between Ether and Bitcoin

Mar 19, 2025 pm 04:54 PM

The difference between Ethereum and Bitcoin is significant. Technically, Bitcoin uses PoW, and Ether has shifted from PoW to PoS. Trading speed is slow for Bitcoin and Ethereum is fast. In application scenarios, Bitcoin focuses on payment storage, while Ether supports smart contracts and DApps. In terms of issuance, the total amount of Bitcoin is 21 million, and there is no fixed total amount of Ether coins. Each security challenge is available. In terms of market value, Bitcoin ranks first, and the price fluctuations of both are large, but due to different characteristics, the price trend of Ethereum is unique.

How to check the contract address on gate.io exchange

Mar 25, 2025 pm 03:54 PM

How to check the contract address on gate.io exchange

Mar 25, 2025 pm 03:54 PM

There are two ways to view contract addresses on the Gate.io exchange: 1. Through the currency details page: log in to the account, search for the target currency, and enter the details page to find the contract address. 2. Through the recharge page: log in to the account, enter the recharge page, and select the currency to view the contract address in the recharge information.

gate exchange web version entrance gate exchange latest official website entrance

Mar 25, 2025 pm 04:15 PM

gate exchange web version entrance gate exchange latest official website entrance

Mar 25, 2025 pm 04:15 PM

The web version of the Gate.io exchange can be obtained in three ways: 1. Obtain official links through authoritative platforms such as CoinMarketCap or CoinGecko; 2. Follow Gate.io's official social media to obtain the latest entry; 3. Use the cryptocurrency navigation website to find official links. To ensure security of access, you need to carefully check the domain name, view the SSL certificate, not trust unknown links, verify official announcements, beware of abnormal prompts, and enable two-factor authentication, set complex passwords, keep keys and mnemonics, and regularly check account activities.