web3.0

web3.0

What is Coin Circle Blast? An article explaining the reasons and controversies behind Blast's popularity

What is Coin Circle Blast? An article explaining the reasons and controversies behind Blast's popularity

What is Coin Circle Blast? An article explaining the reasons and controversies behind Blast's popularity

Abstract

php editor Apple currency circle Blast is a topic that has attracted much attention recently. What is it? Why does it attract so much attention? This article will explain the origins, reasons and controversies of Blast. Blast is an emerging cryptocurrency that is highly regarded for its unique mechanism and innovative application scenarios. However, at the same time, Blast also caused a series of controversies and questions. Through a comprehensive analysis of Blast, we will reveal the secrets behind it and help readers better understand this phenomenon.

The main reasons for Blast’s popularity include: Pacman’s success on Blur created a community effect, institutional support, Blast’s fission gameplay and airdrop expectations.

The risks of Blast are mainly reflected in the technical level and potential financial design level.

What is Blast

Blast is a Layer 2 platform that provides the function of passively earning interest for funds in Layer 2 accounts, which is useful to many Funds sitting idle on Layer 2 are very attractive. In the crypto market, cryptocurrencies can be divided into two major categories based on token models. One type is deflationary cryptocurrencies represented by Bitcoin. Their number of tokens has a fixed upper limit and will not be issued additionally. The other type is inflationary cryptocurrencies based on Ethereum, which will be issued at a fixed ratio every year, giving ETH a stable staking yield of 3%-4%. The interest-earning income of Blast comes from this feature.

Specifically, when a user deposits funds into Blast, Blast will then use the corresponding ETH locked on the Layer 1 network for native pledge of the network (currently mainly on Lido), and use the obtained The ETH staking income is automatically returned to users on Blast. In addition to ETH that can participate in native staking, Blast also supports passive interest generation of stablecoins. The specific operating mechanism is that when users bridge stablecoins (such as USDC, USDT and DAI) to Blast, Blast will then deposit the corresponding stablecoins locked on the Layer 1 network into U.S. debt-based DeFi protocols such as MakerDAO, and use Earnings will be automatically returned to users on Blast in the form of USDB (Blast's native stable currency). According to Pacman, Blast’s vision is not just to serve Blur, but to support all types of Dapps, such as DEX, lending, derivatives trading, NFTFi, and even SocialFi.

Currently, Blast has completed US$20 million in financing co-invested by Paradigm and Standard Crypto.

How to participate in the Blast airdrop?

According to the points chart released by Blast, they plan to conduct an airdrop in May 2024 and have set up a corresponding point ranking (Blast Points). The number of points will directly affect the participant's contribution in the airdrop. The airdrop will be divided into two parts, where early members will account for 50% of the total airdrop volume, while developers will account for the other 50%. The specific proportional distribution is shown in the figure below.

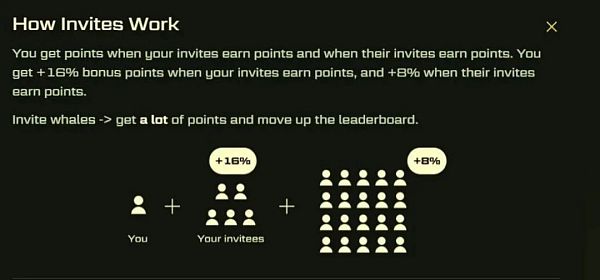

For ordinary users, there are two main ways to obtain Blast points. One is as long as the assets are deposited in the Blast L2 network, and the other is to invite more users to participate in the Blast L2 network. In addition, Blast will also reward based on the number of friends recommended by successful users. According to the information on the Blast official website, users will receive an additional 16% points after a successful recommendation. If the recommended person invites others again, the recommender will receive an additional 8% points. % points.

The expectation for this kind of airdrop is probably one of the main reasons why Blast fans are currently pursuing it, because more points means more airdrop rewards in the future. For example, many well-known figures are now actively using their social platforms to increase their points by inviting more users.

However, another problem can also be seen through the current points ranking, that is, the explosive gameplay seems likely to gradually evolve into the world of big V/whales. For ordinary small retail investors, how many social relationships can they have (in addition, how many points can they get in the face of competition from these big Vs and whales?

Of course, unless you are a Developers can choose to copy the code of some projects and deploy it to the Blast network. After all, 50% of the airdrop quota is allocated to developers, and the competition in this area may be relatively small.

The core gameplay of Blast What is it?

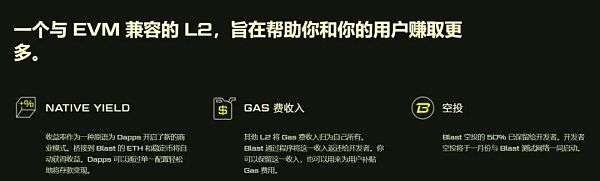

In addition to airdrop self-rewards, another focus of Blast that attracts attention is its positioning as a Layer 2 network that can generate revenue for users. As shown in the figure below.

However, currently most of the ETH in Blast has actually been deposited into Lido for staking. In other words, the core functions of Blast mainly include Ethereum staking and Ether.

To put it simply, the current core gameplay of Blast is: users deposit funds into Blast, and then Blast mainly uses the Lido platform to use these funds for pledge on the Ethereum main network (Layer1). In this way, users can not only get staking benefits, but also Blast rewards. However, in essence, there is no unique difference between this kind of staking and users staking directly on the Lido platform.

Therefore, the fundamental purpose of Blast adopting this strategy seems to be to increase its total locked value (TVL) and attract more users to participate. The reason why users choose to participate seems more to get additional Blast rewards.

Judging from the nature of financial markets, liquidity tends to flow to those places that can provide the highest returns. Blast has captured this key point, and currently Blast L2 seems to be leading this liquidity trend. This is a dual consequence for users, even if crypto assets are transitioned to the Blast chain, stablecoins and other tokens such as ETH will retain their original coal while also receiving additional Blast rewards.

In general, users actually indirectly participate in the pledge of ETH by depositing assets into Blast, and Blast will directly return the pledge proceeds to these users and dapps (developers). At the same time, the asset balance deposited in Blast will be automatically restored, and additional muscles can be obtained from Blast rewards.

In addition, in addition to earning income by depositing ETH, depositing stablecoins is also a way to earn income. Specifically, when you bridge stablecoins such as USDC, USDT, and DAI to Blast, Blast will increase the deposit of these assets into protocols such as MakerDAO, and return the generated revenue to Blast users through Blast's automatic base stablecoin USDB.

It is worth noting that users who participate in depositing assets into Blast will be locked for 3 months until the official launch of the Blast mainnet in February 2024.

No matter how you look at it, the Blast strategy does look quite attractive in the short term at the moment, as is evident from its rapidly growing TVL numbers. As more and more well-known figures begin to promote Blast, and early participating users can receive airdrop rewards, it will inevitably continue to trigger a wave of FOMO for Blast among more users. As for the sustainability of Blast’s strategy and gameplay, and whether the platform will face a large number of junk projects in the future, it is still difficult to predict. We will continue to pay attention to the development!

The reasons behind the explosion of Blast

On November 21, Blur founder Pacman announced that he would launch a new project Blast; as of November 28, Blast The pledged funds on the platform have exceeded 580 million US dollars. The main reasons for Blast’s popularity are as follows:

1. The success of Blur has accumulated a broad community base for Blast. According to the official introduction: Blur is currently one of the largest NFT market protocols on Ethereum, with more than 330,000 users and NFT transactions worth US$7 billion.

2. Institutional support helps Blast win widespread trust. Along with the launch of Blast, Pacman also announced that the project has received US$20 million in financing, with participation from several angel investors such as Paradigm, Standard Crypto, eGirl Capital, and Mechanism Capital co-founder Andrew Kang, Lido strategic advisor Hasu, and The Block CEO Larry Cermak. .

3. Blast’s own fission gameplay and airdrop expectations also prompted it to quickly attract money. Participants can earn points through invitations. When the invitee earns points, the inviter can also earn points. Under the first-level invitation relationship, the inviter will receive 16% bonus points, and under the second-level invitation relationship, the inviter will receive 8% bonus points. Regarding the description of points, officials stated that Blast plans to launch the mainnet and develop withdrawals on February 24 next year, and open the “redemption” of Blast Points on May 24.

Potential risks and controversies of Blast

The risks of Blast are currently mainly reflected in the technical aspects of multi-signature issues and potential financial design risks. The team is currently actively working on technical issues such as multi-signing, which needs to be further observed after the mainnet is launched; the financial design risk is that Blast’s interest-earning design is based on Ethereum’s native applications Lido and MakerDao, which reflects the building block effect of Ethereum applications. But once the underlying application is at risk, systemic risks will inevitably occur.

At the technical level, the current market controversy over Blast is technical issues such as multi-signing. L2Beat pointed out that although the Blast contract (0x5f...a47d) is called LaunchBridge, it is not actually a Rollup Bridge, but a simple custody contract protected by a 3/5 multi-signature address; Blast does not yet have the L2 state root necessary Proof of validity attached, or a fraud prevention mechanism must be in place. Polygon developer relations engineer Jarrod Watts also further pointed out that the five signers of the Blast multi-signature contract are all new addresses and their identities are unknown; Blast is not L2 and has no testnet, transactions, bridges, rollbacks, and transaction data sent to Ethereum. ; and the contract authorizes any "mainnetBridge" contract to spend the maximum possible amount of its Lido and DAI.

Regarding the doubts from the technical faction, Blast began to speak out in defense. On the 27th, Blast issued an article on the X platform stating that security is multi-faceted and involves smart contracts, browsers and physical security dimensions. Immutable smart contracts are generally considered more secure, but may carry greater risks, especially in complex protocols. When it comes to upgradable smart contracts, the specific upgrade mechanism is very important. Upgradable smart contracts with timelocks may have vulnerabilities. In many cases, the only way to avoid a vulnerability being exploited is to perform on-chain operations before malicious actors do. In these cases, timelocks make smart contracts less secure. That's why every L2 has a direct upgrade path. Additionally, Blast highlighted the effectiveness of multi-signature security, which is also used by other L2 projects such as Arbitrum, Optimism and Polygon.

From the perspective of financial design, Blast actually builds the security of L2 on two projects (Blast pledges the Ethereum on L1 to earn interest on Lido; Blast’s native stable currency hopes to use MakerDAO channels Earn income from U.S. Treasury bills). On November 22, Lido DAO contributors posted: They are aware of an early platform vulnerability that affects InfStones, an active node operator using Lido on Ethereum in the past few months. The vulnerability was disclosed to InfStones in July 2023 by dWallet Labs. The node operator has now announced that the vulnerability has been resolved. In addition to technical issues, MakerDao also faces regulatory issues, which if it occurs will bring Blast down with it.

Summary

From the perspective of innovation, Blast does have certain financial innovations, and the risk-free interest rate it proposes can indeed find a "good place" for idle funds. However, Blast seems too anxious, and it is really difficult to call it Layer 2 at present. As Paradigm criticized: "(Blast) sets a very bad precedent for other projects, and excessive marketing also damages the team's serious image." From a financial design perspective, Blast is deeply tied to Lido and MakerDao. Although this brings obvious benefits, it also increases potential and uncontrollable financial risks.

The above is the detailed content of What is Coin Circle Blast? An article explaining the reasons and controversies behind Blast's popularity. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.