web3.0

web3.0

Bitcoin continues to fluctuate at $43,000! Take stock of 2 signs of a bull market outbreak

Bitcoin continues to fluctuate at $43,000! Take stock of 2 signs of a bull market outbreak

Bitcoin continues to fluctuate at $43,000! Take stock of 2 signs of a bull market outbreak

Bitcoin (BTC) once fell below the US$42,000 mark on the 1st, hitting a low of US$41,884, but then rebounded to US$42,000 on the 2nd, and has continued to trade at US$42,000 for the past three days. It fluctuated between US$42,600 and US$43,500, with no obvious fluctuations. As of press time, Bitcoin was quoted at $43,033, down 0.3%.

Ethereum (ETH) reached a high of $2,391 on January 31, but then slid to a low of $2,240 on the 1st. After that, the price recovered slightly and continued to fluctuate between $2,280 and $2,330 over the past 3 days. As of now, the price of Ethereum is at $2,285, down 0.8% from the past 24 hours.

Trend Observation 1: GBTC capital outflows slow down

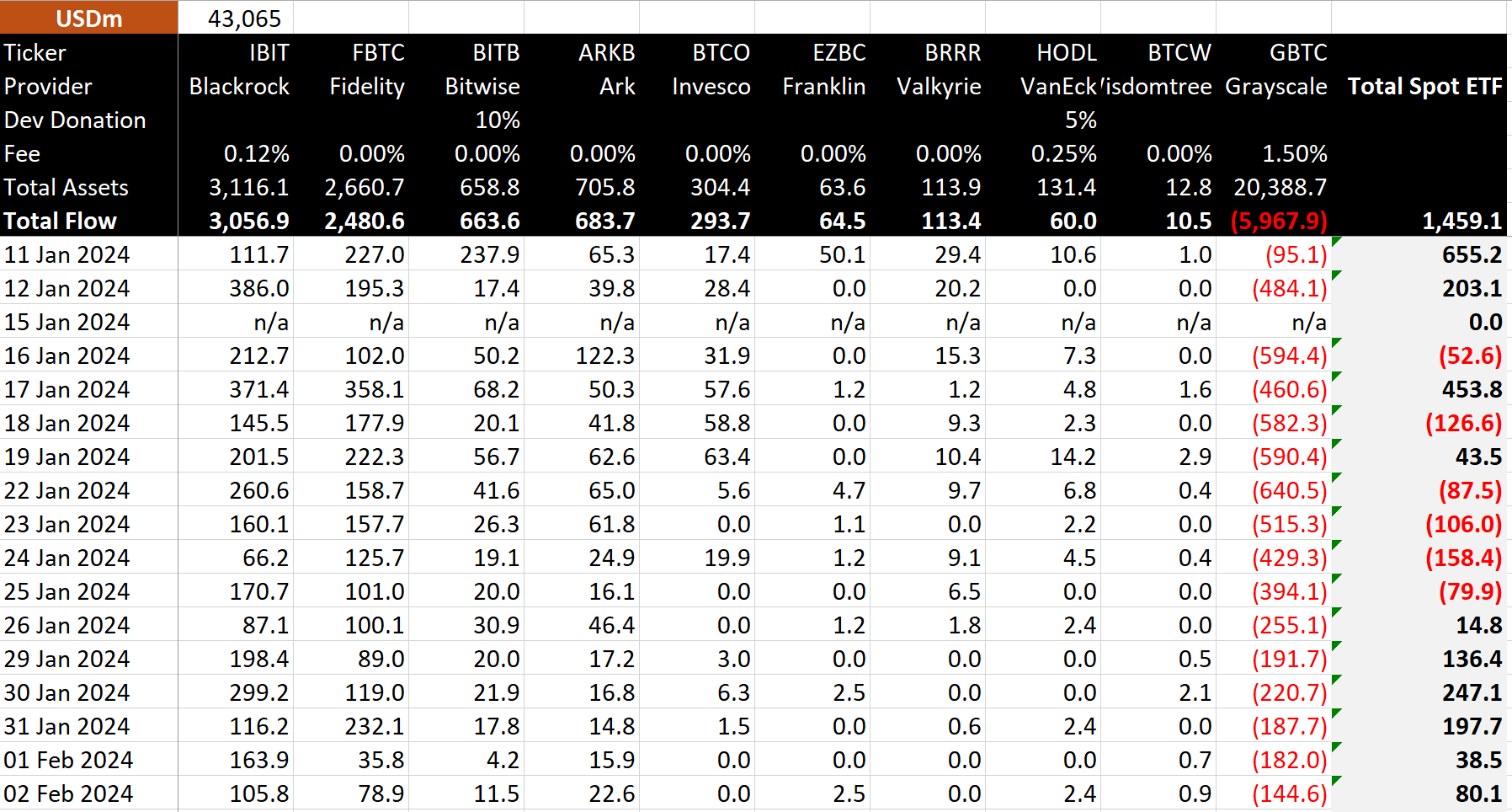

It is worth noting that the latest data shows that the scale of grayscale GBTC capital outflows is continuing to decrease. According to data from BitMEX Research, the Bitcoin spot ETF experienced a single-day outflow of US$145 million on February 2, the 16th trading day of its launch. Nine trading days have passed since the single-day outflow reached its peak of US$640 million on January 22, and the scale of outflows has begun to slow down (except for a slight increase on the 30th). This shows that investor outflow pressure on Bitcoin has weakened, which may mean that market sentiment is gradually improving.

Bitcoin spot ETF capital inflows and changes

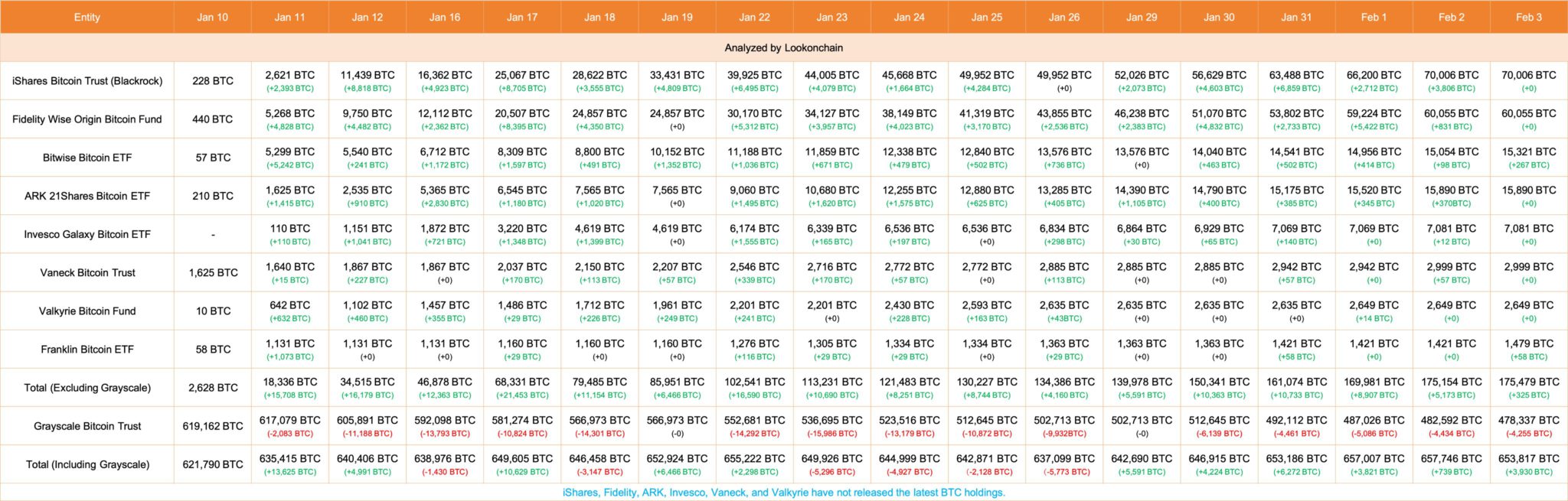

According to Lookonchain data, the latest data shows that GBTC has decreased by 4,255 BTC in the past 3 days, which is equivalent to at approximately US$183 million. Since the GBTC Conversion Bitcoin Spot ETF application was approved, GBTC has lost a total of 140,825 BTC, equivalent to approximately $6.07 billion. At the same time, eight other spot ETFs such as BlackRock added 175,479 BTC, equivalent to approximately US$7.56 billion. This means that net inflows into spot ETFs reached 34,654 BTC.

Changes in BTC holdings of Bitcoin Spot ETF

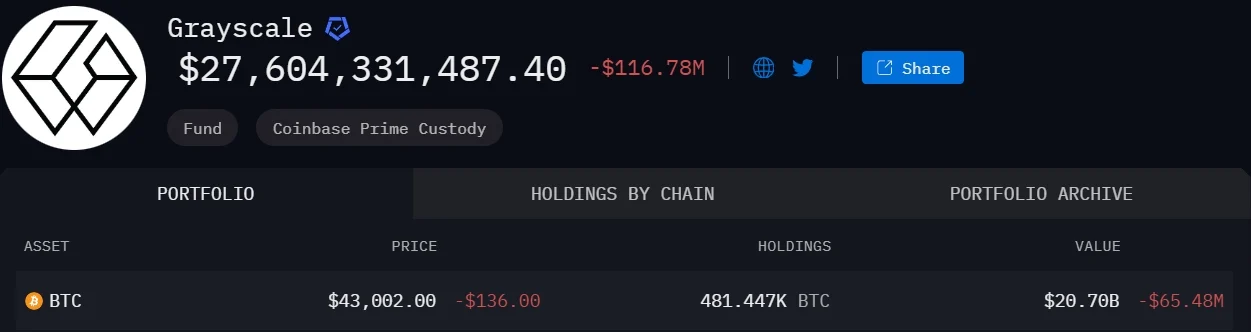

According to Arkham Intelligence data, Grayscale GBTC still holds approximately 481,000 Bitcoins. , worth approximately US$20.7 billion.

GBTC’s BTC holdings

Bloomberg analyst Eric Balchunas had previously expected GBTC’s outflow rate to be higher than 20%, but did not It will exceed 35%, and at least 1/3 of these outflows from GBTC will reinvest in Bitcoin. After including GBTC outflows, the net inflow of Bitcoin spot ETF funds this year will still reach 10 billion US dollars.

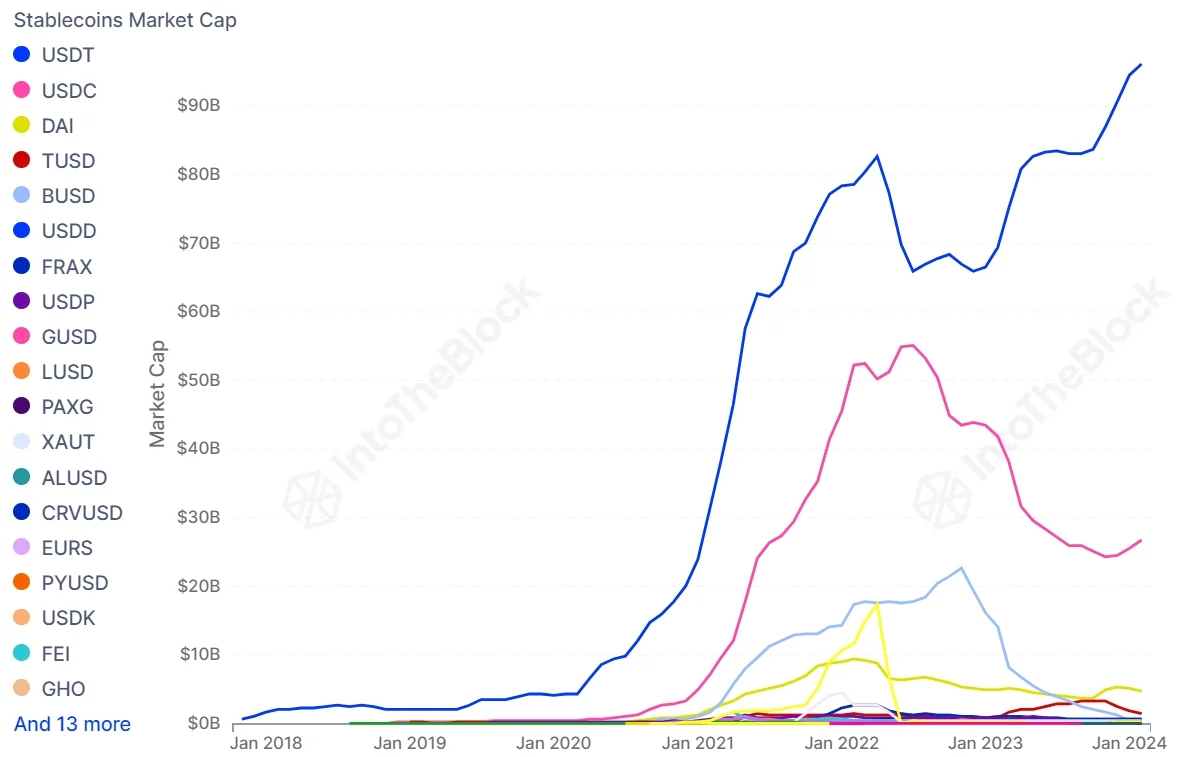

Trend Observation 2: USDT market value hits new high

In addition, IntoTheBlock data shows that USDT has written a major new milestone. The market value has now climbed to 96 billion US dollars, setting a record high. IntoTheBlock also It is pointed out that the market value of stablecoins is rising strongly, with an increase of more than 9 billion US dollars since October 2023. The continued upward trend further enhances the possibility of a bull market cycle.

Market value of stablecoin

The above is the detailed content of Bitcoin continues to fluctuate at $43,000! Take stock of 2 signs of a bull market outbreak. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.

gate official website login address gateio web version login portal address

Mar 31, 2025 pm 01:15 PM

gate official website login address gateio web version login portal address

Mar 31, 2025 pm 01:15 PM

Gate.io not only provides basic buying, selling and trading functions, but also launches a variety of innovative trading models and services to meet the needs of different users. The platform also provides a wealth of trading tools and analysis functions to help users make smarter investment decisions. Users can pledge their holdings to the platform, participate in mining activities, and obtain additional benefits.

The top ten authoritative releases of the currency circle contract introduction trading apps

Mar 31, 2025 pm 02:51 PM

The top ten authoritative releases of the currency circle contract introduction trading apps

Mar 31, 2025 pm 02:51 PM

The world's first unified trading account, supports delivery/perpetual/optional contracts, provides a 100,000 TPS memory matching engine, and responds to extreme market conditions in milliseconds. The world's largest spot contract ecosystem, supports 1,200 trading pairs, and the 24-hour trading volume exceeds 100 billion US dollars. Used by more than 20 million users, it can replicate the global win rate of 85%.