web3.0

web3.0

BlackRock Bitcoin Spot ETF trading volume surpasses Grayscale twice! GBTC selling pressure has dropped by 50%

BlackRock Bitcoin Spot ETF trading volume surpasses Grayscale twice! GBTC selling pressure has dropped by 50%

BlackRock Bitcoin Spot ETF trading volume surpasses Grayscale twice! GBTC selling pressure has dropped by 50%

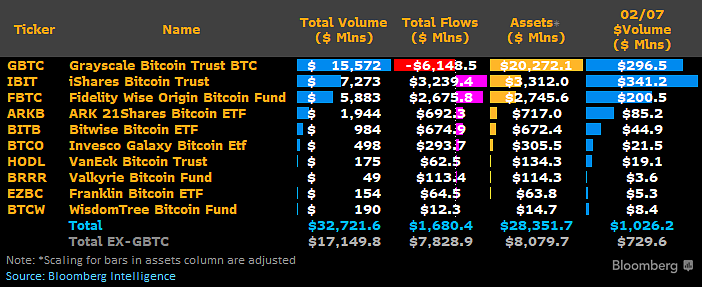

According to data released by Bloomberg analyst James Seyffart, the trading volume of Grayscale Bitcoin Trust (GBTC) has been attracting market attention in the past month, especially in U.S. securities This comes after the Exchange Commission (SEC) approved 11 Bitcoin spot exchange-traded funds (ETFs). According to reports, the single-day trading volume of the Bitcoin spot ETF reached $1 billion yesterday. This data once again highlights the market's interest in Bitcoin and investor demand for the digital asset.

BlackRock’s IBITETF became the biggest winner with a trading volume of US$340 million, leaving behind GBTC’s US$296 million trading volume. This is the second time in the 19 trading days since its launch that IBIT has surpassed GBTC.

The trading volume of various Bitcoin spot ETFs yesterday

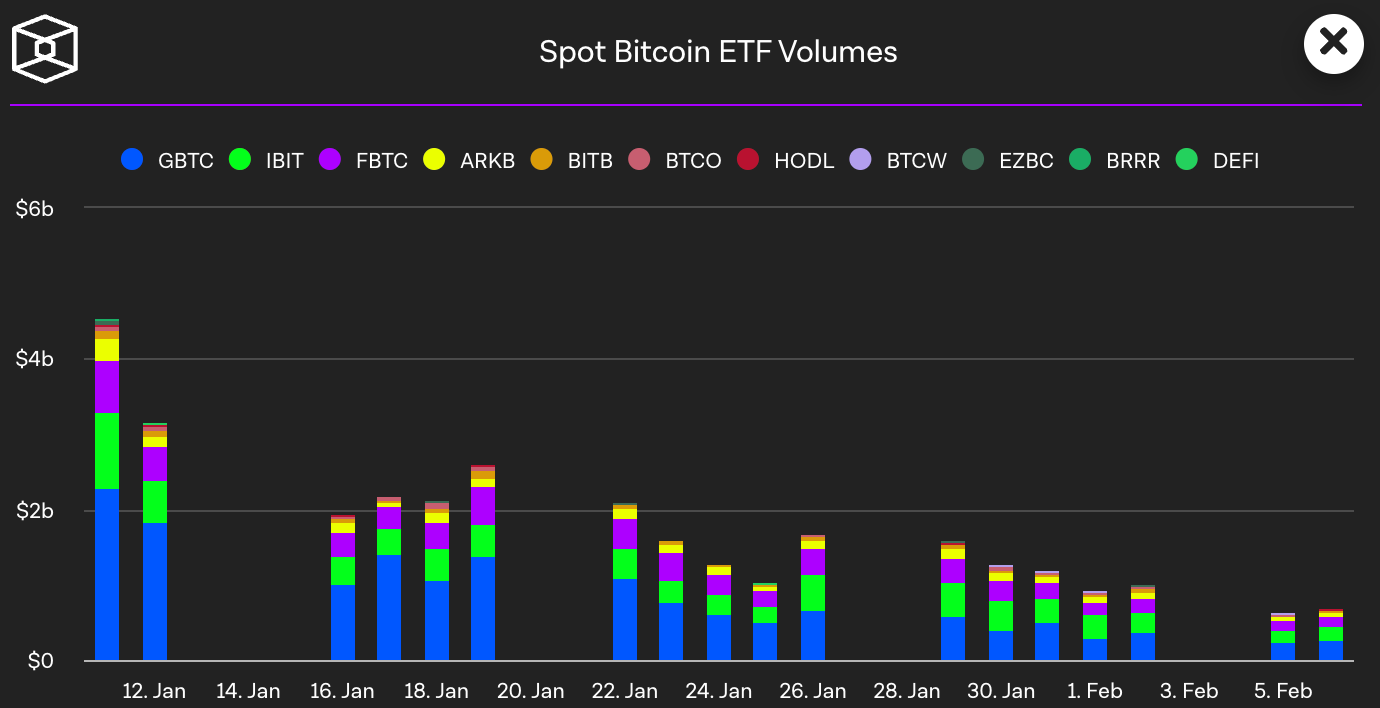

On the other hand, as of the close of U.S. stocks on February 7, all spot Bitcoin ETFs have been listed since The total trading volume since then has reached an astonishing US$32.7216 billion. Although the recent trading volume has dropped significantly compared with when it first went public, analyst James Seyffart said that exceeding $1 billion per day is no longer a big deal.

Bitcoin spot ETF trading volume continues to decline

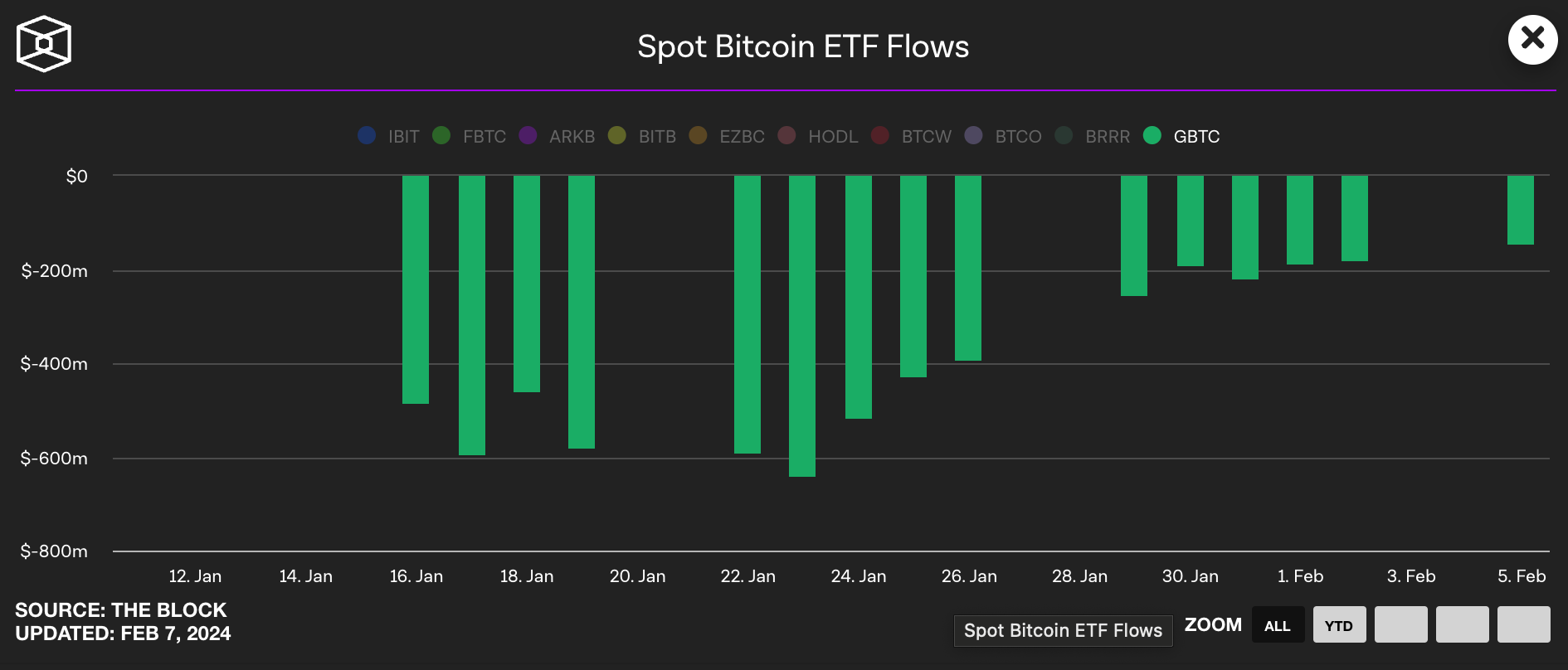

Grayscale selling pressure continues to decrease

Since the Bitcoin spot ETF was launched, Bitcoin The price of the currency has continued to fall for many days, even falling below US$39,000 at one point. The continued outflow of GBTC funds is considered to be the main reason for the decline. GBTC will not only put pressure on the price of Bitcoin, but also drive investors’ sentiment toward Bitcoin. The short-term outlook is not optimistic.

The latest official data shows that as of February 7, its GBTC Bitcoin holdings have declined. Specifically, the total number of Bitcoins currently held by GBTC is 470,637.4128, a decrease of approximately 1707.64 from the previous trading day. Although the asset management scale of GBTC is still as high as 20.2 billion U.S. dollars, if we observe the daily outflow, the selling pressure of GBTC Declining significantly.

Data shows that the daily outflow of GBTC could reach US$400-600 million when it was first launched. This week it only dropped to US$200-300 million, which also means that if this trend continues, GBTC’s final Bitcoin equilibrium holdings may be higher than market expectations.

GBTC daily outflow

The above is the detailed content of BlackRock Bitcoin Spot ETF trading volume surpasses Grayscale twice! GBTC selling pressure has dropped by 50%. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1662

1662

14

14

1419

1419

52

52

1311

1311

25

25

1262

1262

29

29

1234

1234

24

24

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

With the popularization and development of digital currency, more and more people are beginning to pay attention to and use digital currency apps. These applications provide users with a convenient way to manage and trade digital assets. So, what kind of software is a digital currency app? Let us have an in-depth understanding and take stock of the top ten digital currency apps in the world.

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

The built-in quantization tools on the exchange include: 1. Binance: Provides Binance Futures quantitative module, low handling fees, and supports AI-assisted transactions. 2. OKX (Ouyi): Supports multi-account management and intelligent order routing, and provides institutional-level risk control. The independent quantitative strategy platforms include: 3. 3Commas: drag-and-drop strategy generator, suitable for multi-platform hedging arbitrage. 4. Quadency: Professional-level algorithm strategy library, supporting customized risk thresholds. 5. Pionex: Built-in 16 preset strategy, low transaction fee. Vertical domain tools include: 6. Cryptohopper: cloud-based quantitative platform, supporting 150 technical indicators. 7. Bitsgap:

2025 Digital Currency Trading App Recommendation Top Ten Digital Currency Exchange App Ranking

Apr 30, 2025 am 11:00 AM

2025 Digital Currency Trading App Recommendation Top Ten Digital Currency Exchange App Ranking

Apr 30, 2025 am 11:00 AM

The top ten digital currency trading apps recommended in 2025 include: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bybit, 10. Bitstamp, these platforms stand out in the market for their capabilities, user experience and security.

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Recommended cryptocurrency trading platforms include: 1. Binance: the world's largest trading volume, supports 1,400 currencies, FCA and MAS certification. 2. OKX: Strong technical strength, supports 400 currencies, approved by the Hong Kong Securities Regulatory Commission. 3. Coinbase: The largest compliance platform in the United States, suitable for beginners, SEC and FinCEN supervision. 4. Kraken: a veteran European brand, ISO 27001 certified, holds a US MSB and UK FCA license. 5. Gate.io: The most complete currency (800), low transaction fees, and obtained a license from multiple countries. 6. Huobi Global: an old platform that provides a variety of services, and holds Japanese FSA and Hong Kong TCSP licenses. 7. KuCoin

How to download, install and register the Hong Kong Digital Currency Exchange app 2025

Apr 30, 2025 pm 07:18 PM

How to download, install and register the Hong Kong Digital Currency Exchange app 2025

Apr 30, 2025 pm 07:18 PM

The download, installation and registration process of the Hong Kong Digital Currency Exchange app is very simple. Users can quickly obtain and use this app through the official app download link provided in this article. This article will introduce in detail how to download, install and register the Hong Kong Digital Currency Exchange app to ensure that every user can complete the operation smoothly.

uniswap on-chain withdrawal

Apr 30, 2025 pm 07:03 PM

uniswap on-chain withdrawal

Apr 30, 2025 pm 07:03 PM

Uniswap users can withdraw tokens from liquidity pools to their wallets to ensure asset security and liquidity. The process requires gas fees and is affected by network congestion.

Ranking of the top ten exchanges in the currency circle 2025 virtual currency app authoritative rankings

Apr 30, 2025 am 10:57 AM

Ranking of the top ten exchanges in the currency circle 2025 virtual currency app authoritative rankings

Apr 30, 2025 am 10:57 AM

The rankings of the top ten exchanges in the cryptocurrency circle in 2025 are: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi, 6. Bitfinex, 7. Bittrex, 8. Poloniex, 9. KuCoin, 10. Gemini. Each exchange is highly respected for its trading volume, currency richness, security, and user-friendliness.

Ranking of the top ten formal virtual currency exchange apps in 2025 (digital currency trading platform app list)

Apr 30, 2025 pm 05:39 PM

Ranking of the top ten formal virtual currency exchange apps in 2025 (digital currency trading platform app list)

Apr 30, 2025 pm 05:39 PM

Ranking of the top ten formal virtual currency exchange apps in 2025: 1. OKX, 2. Binance, 3. Huobi, 4. Coinbase, 5. Kraken, 6. Bitfinex, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Poloniex, each performs outstandingly in terms of security, user experience, transaction fees, liquidity, currency richness, professional tools, compliance, privacy protection, leveraged trading, degree of internationalization, customer service, etc.