web3.0

web3.0

Bitcoin ETF benefits are undervalued! Andrew Kang: Bitcoin reached 50K in February and a new high in March

Bitcoin ETF benefits are undervalued! Andrew Kang: Bitcoin reached 50K in February and a new high in March

Bitcoin ETF benefits are undervalued! Andrew Kang: Bitcoin reached 50K in February and a new high in March

Andrew Kang, co-founder of Mechanism, wrote an article highlighting the profound impact of Bitcoin spot ETFs on prices. He believes Bitcoin will reach a new all-time high next month and cited several data points to support his view.

Bitcoin’s annual net buying flow is astonishing

Andrew Kang believes that his multi-country trek experience allows him to perceive global U.S. dollar liquidity and the scale of funds that may flow into Bitcoin and cryptocurrencies. .

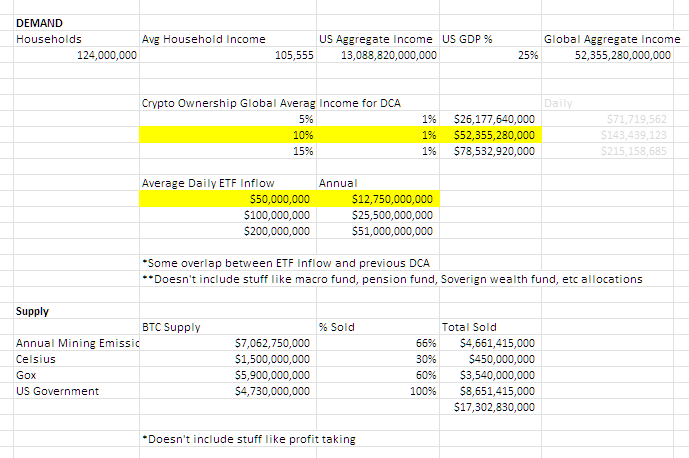

He pointed out that the total annual income of individuals in the United States is about 13 trillion U.S. dollars, and the United States accounts for 25% of global GDP. The total annual income of individuals in the world is about 52 trillion U.S. dollars.

Global cryptocurrency holders account for about 10%. Assuming 1% of annual income is invested in Bitcoin, the annual net purchase of Bitcoin is approximately US$52 billion, which is equivalent to a net purchase of US$150 million per day. Buy.

Bitcoin ETFs further drive buying momentum

Andrew Kang emphasized that the above data did not cover the impact of Bitcoin spot ETFs: Everyone seems to have forgotten that before these ETFs were approved, Bitcoin’s The demand has always been there, otherwise how do you think Bitcoin has continued to move higher over the past 10 years?

Therefore, he believes that the calculation of net buying is already very conservative, and the following factors have not been taken into account:

Crypto investors may invest 1% per year, but True believers may invest more than 50%, so the overall average may be 3-5%.

The estimation does not include investment from enterprises, macro funds, pension funds, sovereign wealth funds and other funds.

The negative selling pressure is simply not as good as the net buying

Andrew Kang also pointed out MtGox’s creditor claims, the US government’s seizure of Bitcoin, and even mining companies’ mining withdrawals Selling, has been the bearish thesis for many, but the reality is that these selling pressures simply pale in comparison when measured against net buying.

He calculated the potential selling pressure on MtGox and others in the chart below, which is about $17 billion.

And if he calculated that the annual net buying is US$52 billion, plus the buying momentum of Bitcoin ETF, it would be far higher than these negative selling pressures.

Note: Andrew Kang’s calculation does not take into account investors’ profit-taking, and the data is also different from Bitcoin Treasuries.

Bitcoin broke all-time high in March

Andrew Kang emphasized that the benefits of Bitcoin spot ETFs are related to the launch of Bitcoin futures by CME Group and Coinbase IPO The events are incomparable, and net inflows have begun to occur for several consecutive days.

He predicted that Bitcoin would no longer be below $40,000 in the future, but would rise to $50,000-60,000 in February and hit a record high in March.

Andrew Kang concluded by quoting his tweet from October last year, when he called on everyone not to miss the epic rally, and the price of Bitcoin had just exceeded $30,000.

The above is the detailed content of Bitcoin ETF benefits are undervalued! Andrew Kang: Bitcoin reached 50K in February and a new high in March. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1371

1371

52

52

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.