How Merkle Trees Make Exchange Funding More Transparent?

With the fall of FTX, investors’ confidence in centralized exchanges has been shaken. Exchanges have announced Merkle-Treeproof-of-reserves to make asset reserves transparent.

MerkleTree Introduction

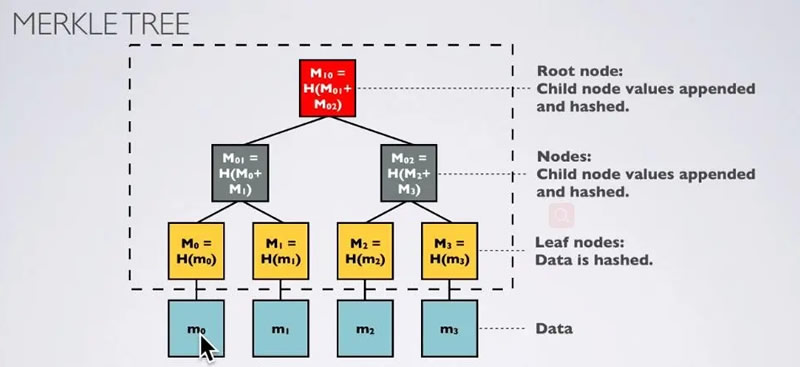

MerkleTree was originally proposed by Ralph Merkel, a famous computer scientist in the field of public key cryptography. It is a tree-structured data processing system designed to verify the integrity and accuracy of data and is considered an important part of blockchain technology. A MerkleTree is a hash tree in which each leaf node contains the cryptographic hash of a data block, and each non-leaf node contains the label of the cryptographic hash of its child node. This structure makes verifying data integrity efficient and reliable.

The Development and Principle of MerkleTree

In 2014, the Crypto community launched a discussion on how exchanges can prove their reserves to auditors.

In 2019, the market began to study more detailed solutions, and the MerkleTree-based proof model is a solution generally recognized by the market.

PoR (Proof of Reserves) is a method of verifying assets through independent third-party audits. A third-party auditor takes an anonymous snapshot of all account balances, then aggregates this data into MerkleTree, and finally generates MerkleRoot. This approach ensures account transparency and asset authenticity, while also providing users with greater security. Through PoR, users can have more trust in the digital asset reserves declared by institutions on their platforms, thereby reducing potential risks. This kind of transparency and verifiability is crucial for financial institutions and digital asset trading platforms,

Auditors collect digital signatures generated by exchanges that prove ownership of the chain via publicly verifiable balances Address. Finally, auditors compare and verify whether these balances match or exceed the customer account balances shown in MerkleTree to determine whether the exchange has sufficient reserves.

The basis of MerkleTree is to generate a Hash value for the asset data held by each account, and then generate a new Hash from the two Hash values, layer by layer. The final hash contains the total amount of all assets on the exchange.

The verification scheme can ensure the data integrity of the Merkel tree root, thereby proving the integrity of the data in the entire Merkel tree.

Summary

Through the Merkle tree and its upgrades, the assets of centralized exchanges will gradually become transparent, which will be beneficial to the development of the industry.

The above is the detailed content of How Merkle Trees Make Exchange Funding More Transparent?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1377

1377

52

52

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages