Computer Tutorials

Computer Tutorials

Computer Knowledge

Computer Knowledge

How to refund personal income tax? What is the process of personal income tax refund?

How to refund personal income tax? What is the process of personal income tax refund?

How to refund personal income tax? What is the process of personal income tax refund?

php Editor Zimo will introduce you to the personal income tax refund process. Personal income tax refund refers to the process in which taxpayers apply for a refund of the overpaid personal income tax in accordance with relevant regulations. It generally includes steps such as filling out the application form, preparing relevant materials, and submitting the application. Next, we will explain the specific process of personal income tax refund in detail, allowing you to easily clarify the steps of tax refund.

Click Start Declaration in the Personal Income Tax App and apply for a tax refund on the tax calculation page.

Tutorial applies

Model: iPhone 13

System: iOS 15.3.1

Version: IIT 1.6.2

Analysis

1Open the personal income tax app, select the return form pre-filling service on the personal tax declaration interface, and then click to start filing.

2 Then check whether the information is correct on the declaration interface. If there is no problem, click Next.

3On the tax calculation page, if the tax payable is less than the tax paid, a tax refund will be generated, click Next.

4Finally, just choose to apply for a tax refund.

Supplement: What does personal income tax mean

1Personal income tax is a tax that everyone needs to pay after receiving income. It is a type of income tax levied by the state on the income of its own citizens, individuals residing in my country, and the income of overseas individuals derived from my country.

Summary/Notes

Taxpayers are legally responsible for the authenticity and legality of the materials they fill in.

The above is the detailed content of How to refund personal income tax? What is the process of personal income tax refund?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

iPhone 16 Pro and iPhone 16 Pro Max official with new cameras, A18 Pro SoC and larger screens

Sep 10, 2024 am 06:50 AM

iPhone 16 Pro and iPhone 16 Pro Max official with new cameras, A18 Pro SoC and larger screens

Sep 10, 2024 am 06:50 AM

Apple has finally lifted the covers off its new high-end iPhone models. The iPhone 16 Pro and iPhone 16 Pro Max now come with larger screens compared to their last-gen counterparts (6.3-in on the Pro, 6.9-in on Pro Max). They get an enhanced Apple A1

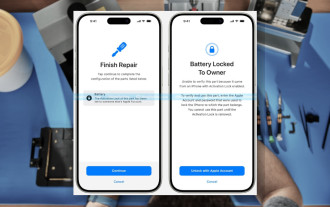

iPhone parts Activation Lock spotted in iOS 18 RC — may be Apple\'s latest blow to right to repair sold under the guise of user protection

Sep 14, 2024 am 06:29 AM

iPhone parts Activation Lock spotted in iOS 18 RC — may be Apple\'s latest blow to right to repair sold under the guise of user protection

Sep 14, 2024 am 06:29 AM

Earlier this year, Apple announced that it would be expanding its Activation Lock feature to iPhone components. This effectively links individual iPhone components, like the battery, display, FaceID assembly, and camera hardware to an iCloud account,

iPhone parts Activation Lock may be Apple\'s latest blow to right to repair sold under the guise of user protection

Sep 13, 2024 pm 06:17 PM

iPhone parts Activation Lock may be Apple\'s latest blow to right to repair sold under the guise of user protection

Sep 13, 2024 pm 06:17 PM

Earlier this year, Apple announced that it would be expanding its Activation Lock feature to iPhone components. This effectively links individual iPhone components, like the battery, display, FaceID assembly, and camera hardware to an iCloud account,

Gate.io trading platform official app download and installation address

Feb 13, 2025 pm 07:33 PM

Gate.io trading platform official app download and installation address

Feb 13, 2025 pm 07:33 PM

This article details the steps to register and download the latest app on the official website of Gate.io. First, the registration process is introduced, including filling in the registration information, verifying the email/mobile phone number, and completing the registration. Secondly, it explains how to download the Gate.io App on iOS devices and Android devices. Finally, security tips are emphasized, such as verifying the authenticity of the official website, enabling two-step verification, and being alert to phishing risks to ensure the safety of user accounts and assets.

Multiple iPhone 16 Pro users report touchscreen freezing issues, possibly linked to palm rejection sensitivity

Sep 23, 2024 pm 06:18 PM

Multiple iPhone 16 Pro users report touchscreen freezing issues, possibly linked to palm rejection sensitivity

Sep 23, 2024 pm 06:18 PM

If you've already gotten your hands on a device from the Apple's iPhone 16 lineup — more specifically, the 16 Pro/Pro Max — chances are you've recently faced some kind of issue with the touchscreen. The silver lining is that you're not alone—reports

Anbi app official download v2.96.2 latest version installation Anbi official Android version

Mar 04, 2025 pm 01:06 PM

Anbi app official download v2.96.2 latest version installation Anbi official Android version

Mar 04, 2025 pm 01:06 PM

Binance App official installation steps: Android needs to visit the official website to find the download link, choose the Android version to download and install; iOS search for "Binance" on the App Store. All should pay attention to the agreement through official channels.

How to solve the problem of 'Undefined array key 'sign'' error when calling Alipay EasySDK using PHP?

Mar 31, 2025 pm 11:51 PM

How to solve the problem of 'Undefined array key 'sign'' error when calling Alipay EasySDK using PHP?

Mar 31, 2025 pm 11:51 PM

Problem Description When calling Alipay EasySDK using PHP, after filling in the parameters according to the official code, an error message was reported during operation: "Undefined...

Beats adds phone cases to its lineup: unveils a MagSafe case for the iPhone 16 series

Sep 11, 2024 pm 03:33 PM

Beats adds phone cases to its lineup: unveils a MagSafe case for the iPhone 16 series

Sep 11, 2024 pm 03:33 PM

Beats is known for launching audio products such as Bluetooth speakers and headphones, but in what can best be described as a surprise, the Apple-owned company has branched into making phone cases, starting with the iPhone 16 series. The Beats iPhone