The Block cited an S&P analysis report. Analysts Andrew O'Neill and Alexandre Birry pointed out that the Ethereum spot ETF that contains a "staking function" may continue to expand its asset size. Will significantly change the concentration of Ethereum validators.

Ethereum ETF introduces staking, or will it lead to the centralization of staking?

As an example of the Bitcoin ETF, Coinbase serves as the custodian for 8 issuers out of 11 tranches. In addition, Coinbase has been selected as the staking institution for 4 Ethereum staking ETFs outside the United States.

Analysts pointed out that to reduce the risk of centralization (possibly referring to Coinbase’s dominance of the staking market), ETF issuers need to consider decentralizing Ethereum staking to multiple emerging large custodians. Doing so helps increase market diversity, reduce systemic risk, and provide more institutions with the opportunity to participate in the staking market. With the emergence of new custodians, Ethereum's staking ecosystem will become more robust and healthy, including issuers such as Ark Invest and Franklin Templeton, which have already negotiated with regulators on the staking function in their application documents.

S&P: Issuers will not choose Lido for staking

Liquidity staking protocol Lido is currently the largest Ethereum validator, followed by Coinbase.

S&P analysts believe that ETF issuers are unlikely to choose decentralized protocols such as Lido. Instead, they may choose custodians.

JP Morgan Chase analysts also recently warned of the concentration risk of Ethereum staking, pointing out that Lido is the largest validator and may have a single point of failure, become a target of attacks, or deliberately monopolize to strengthen the Lido protocol itself.

Does S&P think too much?

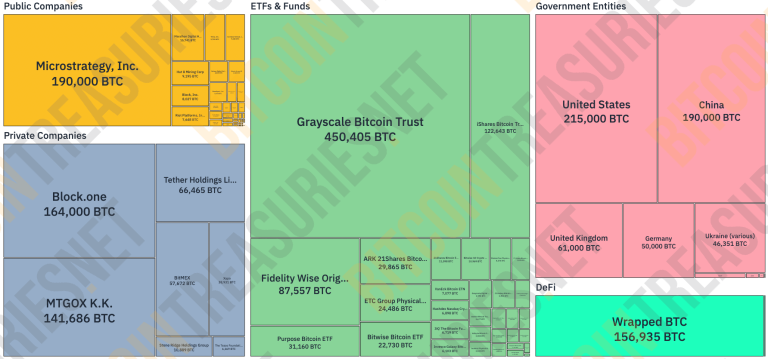

However, according to Bitcoin Treasures data, all Bitcoin ETF products hold a total of 876,000 BTC, accounting for only about 4.17% of Bitcoin circulation.

So if you switch to an Ethereum ETF with lower attractiveness and lower trading volume, how much ETH will be locked in the circulation? Can it change the staking ecology of Ethereum on a large scale, leading to centralization?

Perhaps instead of worrying about the rising staking market share of institutions such as Coinbase, it is better to try to solve Lido’s dominance. This is also the case for Ethereum developers and even Ethereum founder Vitalik Buterin The issue that has been raised before is to limit the proportion of a single verification entity through handling rates and other methods.

Perhaps instead of worrying about the rising staking market share of institutions such as Coinbase, it is better to try to solve Lido’s dominance. This is also the case for Ethereum developers and even Ethereum founder Vitalik Buterin The issue that has been raised before is to limit the proportion of a single verification entity through handling rates and other methods.

The above is the detailed content of S&P Ratings: Ethereum spot ETF integration of pledges may lead to the risk of pledge concentration. For more information, please follow other related articles on the PHP Chinese website!