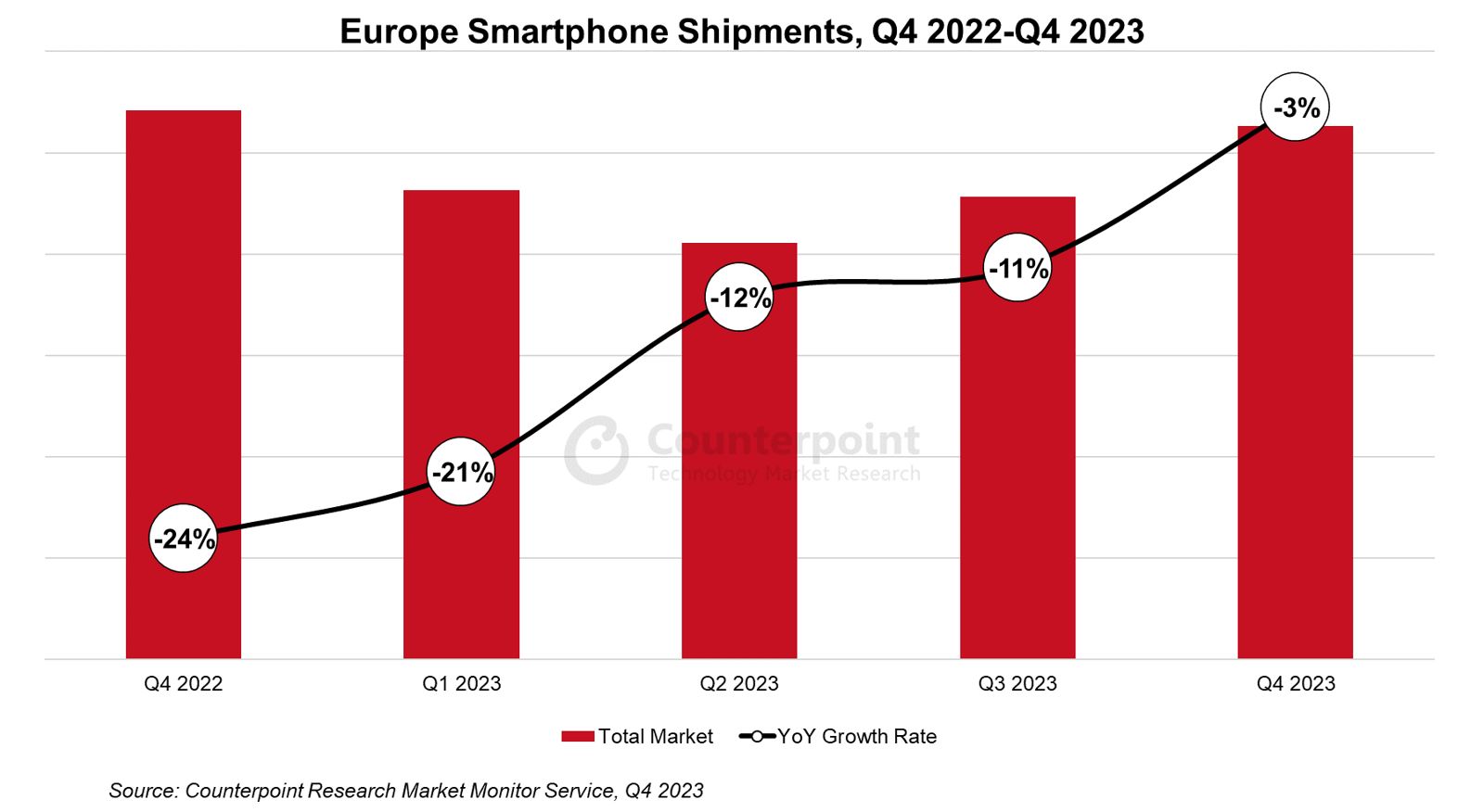

News from this site on February 27, Counterpoint Research recently released a report stating that European smartphone shipments fell by 3% year-on-year in the fourth quarter of 2023, compared with a year-on-year decrease of 24% in the fourth quarter of 2022, The decline The significant narrowing indicates that the market has begun to recover.

Commenting on the market dynamics, Research Analyst Harshit Rastogi said: With the first single-digit decline since the fourth quarter, the worst appears to be over.

While shipments in Western Europe were down 5% year over year, shipments in Central and Eastern Europe increased 2% in the quarter. Some countries are recovering from historically low quarterly shipments, including major markets such as the United Kingdom and Russia, which saw shipments increase 6% year over year.

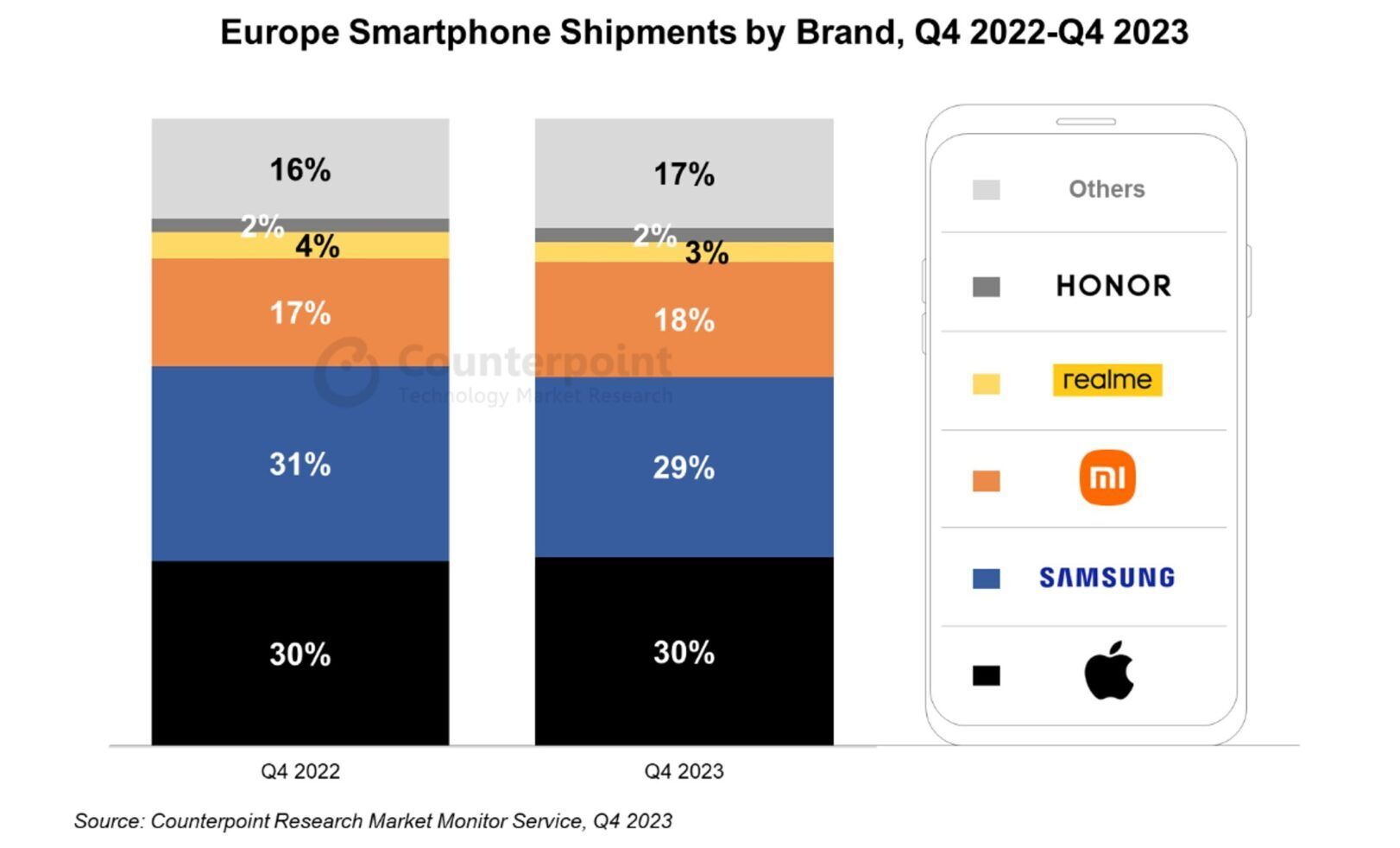

is broken down into brands. This site summarizes the content of this report as follows:

Samsung:

Samsung Shipments in the fourth quarter fell 10% year-over-year, reaching a new fourth-quarter record low since 2015. Promotional activities for the S23 series successfully mitigated the downward trend in the high-end market, while the A series further consolidated its market share in the mid- to low-end market.

Apple

Apple’s shipments in the region reached their lowest level since 2015 in the fourth quarter, but its market share hit a record high.

The overwhelming popularity of the iPhone 15 series and continued demand for the iPhone 14 limited year-over-year decline to 1% in the fourth quarter of 2023.

Xiaomi

Xiaomi was one of the few major OEMs to post growth in the fourth quarter of 2023, with shipments of its Redmi series phones driving Xiaomi's growth in the mid-price segment , and took away some share from Samsung. Xiaomi further expanded its market share in Central and Eastern Europe due to strong shipments in the fourth quarter.

Glory

Glory's overall sales in Europe increased 2% year-on-year, with a 31% increase in Western Europe offsetting a 21% decline in Central and Eastern Europe. The brand has significantly expanded its product portfolio compared to the fourth quarter of 2022, reflecting its growing ambitions in the region.

OPPO

OPPO’s problems in the region continued, leading to a 59% year-over-year decline in Q4 2023. The brand signed a 5G patent with Nokia in early 2024, which should spark a recovery in the coming quarters.

The above is the detailed content of 2023Q4 European mobile phone shipments battle report: Apple 30% first, Samsung 29% second, Xiaomi 18% third, Realme 3% fourth, Honor 2% fifth. For more information, please follow other related articles on the PHP Chinese website!