web3.0

web3.0

Three applications were withdrawn in one month, and the road to applying for a Hong Kong virtual asset exchange license is uncertain.

Three applications were withdrawn in one month, and the road to applying for a Hong Kong virtual asset exchange license is uncertain.

Three applications were withdrawn in one month, and the road to applying for a Hong Kong virtual asset exchange license is uncertain.

On February 23, 2024, another application for a licensed exchange in Hong Kong was withdrawn.

After years of groping on the road of "how to comply", the veteran exchange Huobi finally seized the golden opportunity to enter Web3 in 2023 and chose Hong Kong as the place to implement compliance. Once it successfully obtains compliance recognition in Hong Kong, Huobi will usher in an important turning point. This is not only an opportunity to improve its image, but also a critical moment to revitalize its business.

However, the results are obvious: Hong Kong’s road to compliance is not easy.

On January 29, Greenland Hong Kong failed to enter; on February 7, Kaisa suffered a defeat; a few days later, on February 23, Huobi was not spared either . There were 24 applicants, and in less than a month, the number of withdrawals exceeded the number, which poured cold water on the applicants who were still waiting in line.

What is the difficulty in applying for a licensed virtual asset exchange in Hong Kong? Who can be left to the end in the future?

In this issue’s article, Bailu Parlor has an in-depth discussion on the operation of Hong Kong’s licensed virtual asset exchange.

(1) Three key points for application: capital injection, technical assessment requirements, and suitable candidate requirements

In 2023, the Hong Kong SAR government launched a large-scale publicity and action, and market and financial practitioners generally It is believed that this will be an important measure to save Hong Kong's financial industry. This frenzied atmosphere has also led to the misconception that anyone can easily take this "hard drug".

The 331 pages of the Anti-Money Laundering and Counter-Terrorist Financing Act 2022 and the 99 pages of guidelines applicable to virtual asset trading platform operators provide complex regulations for Hong Kong’s licensed virtual asset trading platforms. frame. Only applicants with strong legal, technical and capital capabilities will be eligible for approval.

In general, all applicants must be prepared in three major areas: capital infusion, external assessment requirements, and staffing that meets fit and proper requirements.

Inject capital

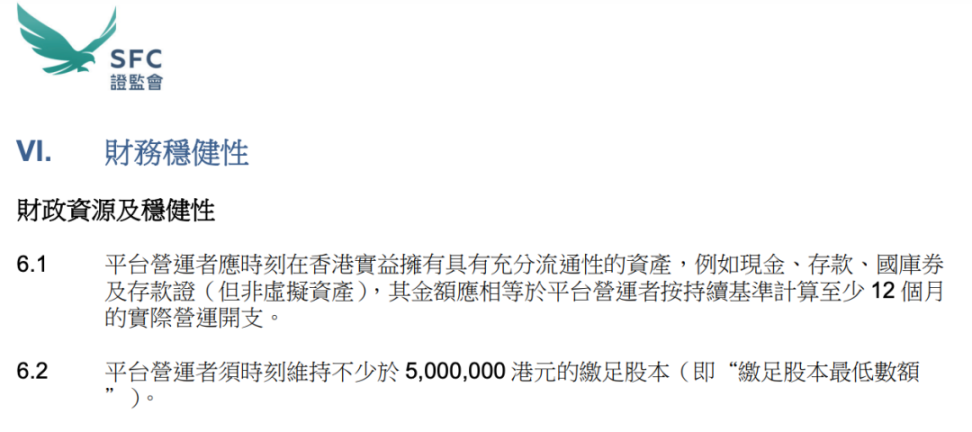

According to the "Guidelines for Virtual Asset Trading Platform Operators" issued by the Hong Kong Securities and Futures Commission, in terms of capital preparation, applicants must meet 2 basic requirements:

- The platform operator should at all times beneficially possess fully liquid assets in Hong Kong, such as cash, deposits, treasury bills and certificates of deposit (but not virtual assets), the amount of which should be equal to at least the platform operator’s calculated on an ongoing basis. Actual operating expenses for 12 months.

- Platform operators must maintain a paid-up share capital of not less than HK$5,000,000 at all times.

# Capital preparation before application is not a difficult step. For those who dare to enter the exchange track, they must have been mentally prepared for the required financial and material resources, otherwise they would not dare to get involved. The real test in terms of capital comes more from the costs incurred by continuing to operate an exchange in Hong Kong, which we will mention later.

External assessment requirements

What the author puts in second place is various external assessment requirements, including but not limited to private key management, investor protection measures, anti-money laundering, and monitoring guarantees , network security and other aspects of work.

In terms of solutions, the path to meet the relevant conditions is actually quite mature; different types of applicants have their own advantages, and they can all pass if they perform well. For applicants with a background in senior leading firms, they already have mature development capabilities and rich operational experience, and they need to make up for the gaps in legal affairs and compliance; while applicants for traditional financial transformation are in exactly the opposite situation. , years of hard work in the Hong Kong financial market has made its capabilities in corporate management and compliance very sound, and it is more necessary to reconfigure a development team with sufficient industry background and strength.

Pure entrepreneurs may encounter some difficulties. But generally speaking, the fit and proper requirements are a hurdle that all applicants must face.

Fit and fit and competent requirements

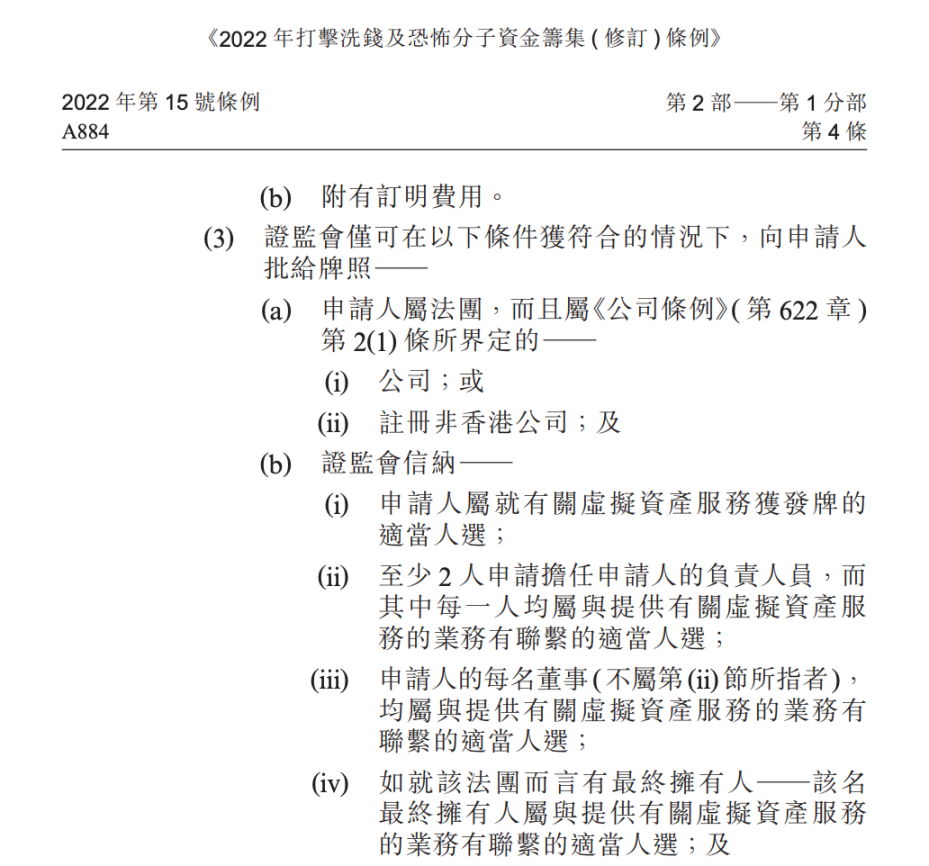

According to the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Regulations 2022, the Securities and Futures Commission can only approve a license if the applicant meets the conditions . Applicant requirements are:

- A company established in Hong Kong with a fixed place of business, or a company established elsewhere but registered in Hong Kong in accordance with the Companies Ordinance;

- has Applicants who pass SFC's Fit and Proper Test.

Passing the fit and proper test is not easy. The conditions include:

- The applicant must have at least two SFC-approved responsible officers (ROs) to supervise the business. , to ensure that the applicant complies with anti-money laundering and combating terrorist asset-raising regulations and other regulatory requirements; only an RO can serve as the executive director of VASP.

- The applicant’s ultimate beneficiary should be the person who can provide virtual asset services;

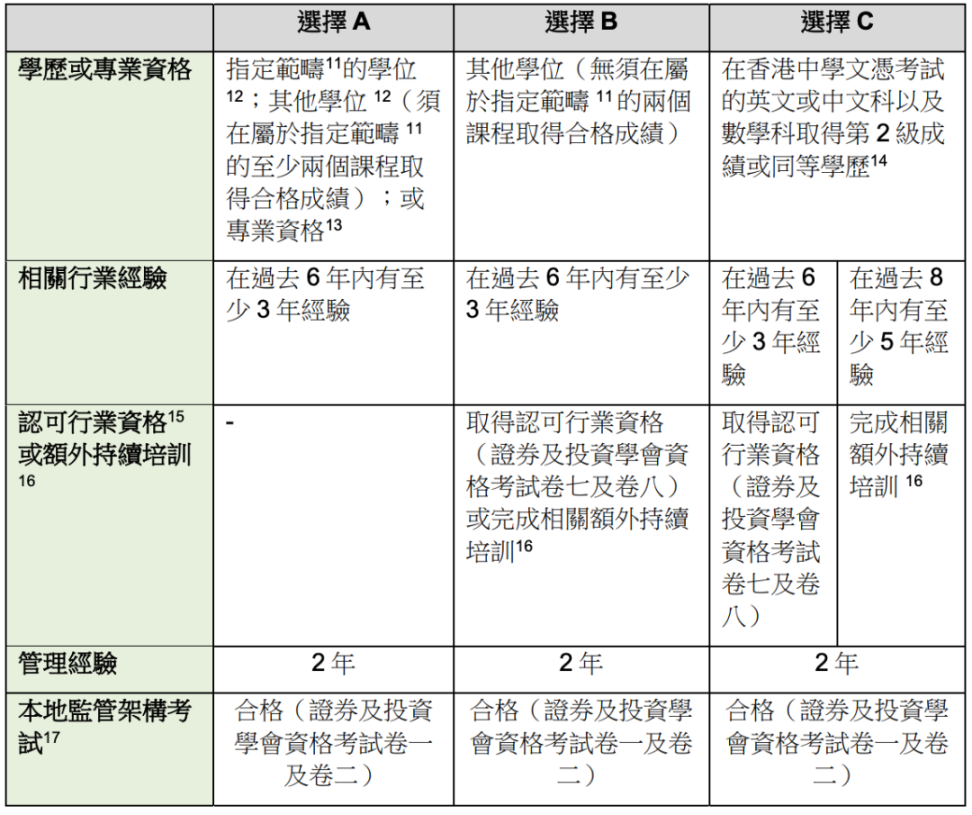

Focus on each RO, who must have a basic academic background and more than 3 years of experience in related industries. There are not many candidates who meet the requirements, so the service fees of qualified ROs have also increased. If there are differences in cooperation, personnel changes may directly disrupt the entire application process.

In addition to senior executives, relevant personnel must also meet competency requirements and ongoing training requirements. From management to grassroots employees, although the Hong Kong government's supervision ensures that each practitioner can maintain adequate professional ethics, it also increases the difficulty of each applicant's team building and the burden of ongoing operations.

(2) Two operational problems: burning money and too much money

Even if you get a license, you won’t be able to sit back and relax. The two major dilemmas of continuing to operate Hong Kong's licensed exchanges are "being killed for holding a license" and "more wolves and less meat".

The Dilemma of Being Killed for Holding a License

The "killed for holding a license" proposed by Wang Yang, Vice President of the Hong Kong University of Science and Technology, is the best summary of the operational dilemma of licensed exchanges in Hong Kong. The apparent HKD 5 million is just the baseline for registration, and the accumulation of various operating costs is the operator’s challenge.

Some costs can be reasonably estimated. Legal compliance team, investment in security and technical resources, implementation of fund segregation and risk management mechanisms, establishment of audit and reporting systems, employee compliance training and education, and the cost of setting up a local branch in Hong Kong to store mnemonic phrases and private keys.

The above is the detailed content of Three applications were withdrawn in one month, and the road to applying for a Hong Kong virtual asset exchange license is uncertain.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1359

1359

52

52

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages