web3.0

web3.0

Bitcoin spot ETF trading is booming! BlackRock's IBIT turnover exceeded US$1.3 billion for 2 consecutive days

Bitcoin spot ETF trading is booming! BlackRock's IBIT turnover exceeded US$1.3 billion for 2 consecutive days

Bitcoin spot ETF trading is booming! BlackRock's IBIT turnover exceeded US$1.3 billion for 2 consecutive days

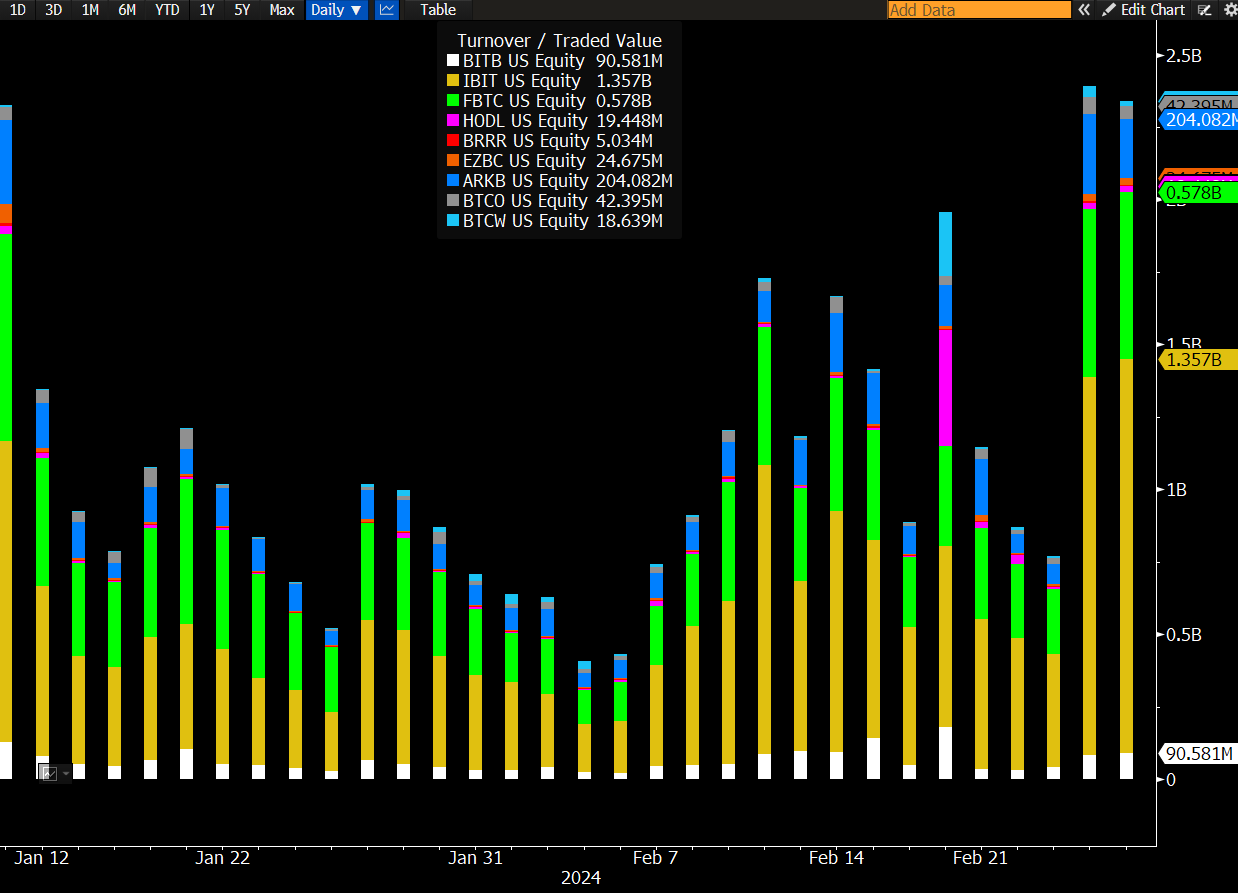

The Bitcoin spot ETF trading frenzy continues to surge, with the total trading volume exceeding US$2 billion for two consecutive days, and the trading volume of BlackRock's IBIT also exceeding US$1.3 billion for the second consecutive day.

Bloomberg ETF analyst Eric Balchunas wrote at the close of trading on Tuesday that IBIT’s trading volume reached US$1.357 billion that day, higher than Monday’s US$1.3 billion, setting a new record for single-day trading volume. A total of 42 million shares of IBIT changed hands on Tuesday, more than double the average daily volume since it went public in January, according to Nasdaq data.

Bitcoin investor HODL15Capital pointed out that IBIT ranks fifth among all U.S. ETFs in terms of morning trading volume. He also mentioned that the trading volume of Fidelity’s Bitcoin spot ETF FBTC has also shown strong growth.

According to data provided by Eric Balchunas, the total turnover of U.S.-listed Bitcoin spot ETFs exceeded $2 billion on Tuesday, slightly lower than the historical record of $2.4 billion set on Monday.

According to data from CoinShares, as of last Friday, the cumulative trading volume of all Bitcoin spot ETFs in the United States was close to US$52 billion, of which net inflows reached US$5.8 billion.

The Bitcoin spot ETF has attracted considerable trading volume, showing the increasing popularity of this type of investment tool, but it has also had an impact on market dynamics. Kaiko analysts found that Bitcoin’s weekend trading volume this year The proportion has dropped to 13%, reaching a historical low, which is closer to the traditional financial market and the working hours of large traders. It is in sharp contrast to the original situation of uninterrupted trading 24 hours a day, 7 days a week.

The above is the detailed content of Bitcoin spot ETF trading is booming! BlackRock's IBIT turnover exceeded US$1.3 billion for 2 consecutive days. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

Quantum Chain (Qtum) is an open source decentralized smart contract platform and value transmission protocol. 1. Technical features: BIP-compatible POS smart contract platform, combining the advantages of Bitcoin and Ethereum, introduces off-chain factors and enhances the flexibility of consensus mechanisms. 2. Design principle: realize on-chain and off-chain data interaction through main control contracts, be compatible with different blockchain technologies, flexible consensus mechanisms, and consider industry compliance. 3. Team and Development: An international team led by Shuai Chu, 80% of the quantum coins are used in the community, and 20% rewards the team and investors. Quantum chains are traded on Binance, Gate.io, OKX, Bithumb and Matcha exchanges.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

Institutional investors should choose compliant platforms such as Coinbase Pro and Genesis Trading, focusing on cold storage ratios and audit transparency; retail investors should choose large platforms such as Binance and Huobi, focusing on user experience and security; users in compliance-sensitive areas can conduct fiat currency trading through Circle Trade and Huobi Global, and mainland Chinese users need to go through compliant over-the-counter channels.