When is the best time to sell airdrop tokens?

When is the best time to sell airdrops?

1. 24 hours: The best time to sell

php Editor Youzi One of the topics that attracts a lot of attention in the blockchain field is the best time to sell airdrop tokens. When it comes to airdrop tokens, many people wonder when to sell to maximize profits. In fact, choosing the best time to sell requires considering many factors, such as market conditions, token value, trading volume, etc. Through in-depth research and timely market analysis, you can better grasp the timing of selling and achieve better investment returns.

2. First 14 days: Be patient

OP: Offering you the opportunity to buy at $0.51. CANTO: Offers you the opportunity to buy at $0.19 and subsequently sell off. APTOS: Offers You the Option to Buy for $7, Crypto Markets Continue to Crash Next. BLUR: Offering you the chance to buy at $0.6, USDC decoupled a few weeks later, causing a sell-off in the crypto market. ARB: Offering you the chance to buy at $1.11. Patience, the first of all good qualities, you might as well wait.

3. The first 30 days: Timing to get onboard

It makes no sense to rush to buy these tokens immediately after the airdrop. During the first 30 days, each token works to determine its market value. However, market data shows that within these first 30 days, prices have hit the bottom or are very close to it. This means that buying the token at this stage may result in excessive risk, as the price may have already reached a temporary high. It would be wiser to wait for the market to stabilize and watch price movements in order to make more informed investment decisions. At this early stage, be cool

- OP: $0.40 (bottom $0.40);

- CANTO: $0.11 (bottom $0.07);

- APTOS: $3.61 (bottom $3.10) ;

- BLUR: $0.45 (bottom $0.45);

- ARB: $1.11 (bottom $1.11).

These tokens all have a feature that other tokens do not have at the current stage: the new currency rule. The market has developed the habit of buying new rather than old. Taking their prices on the 30th day as an example, we can feel how ingrained this habit is.

- OP: $0.40 ➡️ $3.22, an increase of 705%;

- CANTO: $0.11 ➡️ $0.76, an increase of 590%;

- APTOS: $3.61 ➡️ $19.92, an increase of 451% ;

- BLUR: $0.45 ➡️ $0.82, an increase of 82%;

- ARB: $1.11 ➡️ $1.79, an increase of 61%.

Summary

Selling your tokens within 24 hours of issuance is a good strategy; be patient over the next 14 days to avoid fear of losing money And blindly follow the trend; experience shows that buying tokens again within 30 days after the token airdrop is an excellent time.

After the airdrop tokens arrive, when should they be sold to maximize profits?

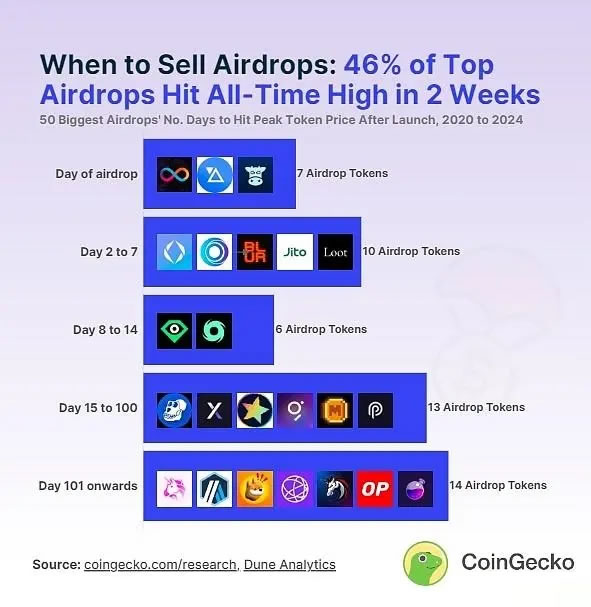

Of the 50 largest airdrops, 23 (46%) reached their highest point in token price within two weeks of the airdrop date. This suggests that within 14 days of receiving your airdrop tokens, it may be the best time to sell your tokens for maximum profit.

The airdrop tokens that achieved the highest price returns in the short term include Ethereum Name Service (73% on day 2 of trading), X2Y2 (121% on day 2), Blur (90% on day 6), LooksRare (192 )% (Day 10) and ArbDoge AI (Day 14 425%).

Among the recent airdrops, Jito (43% increase on day 2), Wen (37% increase on day 3), Dymension (75% increase on day 10), Manta (72% increase on day 12 ) and Heroes of Mavia (217% increase on day 13), it is also most profitable for investors who received the airdrop if sold shortly after the airdrop. Still, these airdrops have only been trading for a few weeks, and it remains to be seen whether their token prices will rise to new highs.

Of the 23 airdropped tokens, 16 airdrops reached peak yields between the 2nd and 14th day after the airdrop date. In other words, once a token is airdropped and trade begins, interest tends to spike dramatically. This confirms that token airdrops are an effective marketing or growth strategy, but also shows that as more people talk about airdrops, interest in a specific token tends to grow, peaking shortly thereafter and reflected in the token price. coin price.

The price of the remaining 7 airdrops peaked on the day of the airdrop, and the token price was unable to recover thereafter. For example, Solana aggregator Jupiter’s airdrop token began trading at around $0.66, but has since fallen 28% and remains below its initial price. This happens when airdrop recipients are eager to cash in on their “free funds,” causing the airdrop to be immediately sold off. As recipients decide to exit airdrops over time, token prices from these airdrops continue to face selling pressure and reach new lows.

On the other hand, 27 of the top 50 largest airdrops reached peak returns more than two weeks after the airdrop date, with time ranges ranging from 15 to 581 days. Price spikes on such longer time frames often coincide with favorable market conditions and growth of individual projects, which pushes airdrop token valuations beyond initial levels.

Market conditions drive airdrop price returns

38% of airdropped tokens peak in 2021 bull run

Among the 50 largest airdrops in the crypto bull run 19 hit all-time highs (ATH) in 2021. All of these were launched before or in 2021, suggesting market conditions are driving higher valuations in the price of these airdrop tokens.

4 of these 19 tokens reached ATH more than 100 days after the airdrop. These airdrop tokens are Uniswap (1.145%), 1inch (216%), Gitcoin (242%), and Bank (94%).

These tokens have seen significantly higher returns on their ATH prices compared to their short-term peaks. For example, Uniswap’s ATH price return is 1.145%, which is 10 times the highest price return of 106% in the 14 days prior to trading.

This suggests that for some airdrops, recipients may consider retaining their airdrop allocation to increase in value over a longer period of time in order to achieve higher profits under favorable market conditions.

2022: A good year for NFT airdrops, but not others

In 2022, market conditions were relatively pessimistic, with 11 out of 50 airdropped tokens reaching ATH.

However, early 2022 saw a bull run in non-fungible tokens (NFTs), which helped push the valuations of 3 of these 11 airdrop tokens (ApeCoin, LooksRare, and X2Y2) to New ATH. On the other hand, other airdrop tokens that reached ATH in 2022 were launched in the same year and reached ATH shortly after the airdrop date. The exception is Osmosis, which launched in June 2021 but reached ATH in 2022.

This shows that during a bear market, after an airdrop is the best time to sell airdrop tokens to maximize profits.

2023 and 2024: Bullish sentiment returns?

The remaining 21 of the 50 airdropped tokens reached ATH in 2023 and 2024, with bullish sentiment returning due to the approval of a US spot Bitcoin ETF.

8 of these 21 airdropped tokens reached ATH more than 100 days after the airdrop. These airdrop tokens are Arbitrum (68%), Bonk (28,091%), Celestia (777%), Optimism (186%), Aptos (34%), WorldCoin (249%), Arkham (67%), and Maverick (38 ) %).

Another 5 airdrops took 15 to 100 days to reach the token price peak, while the remaining 8 airdrop tokens reached ATH within 14 days of the airdrop date. (Note that of the 8 coins that peaked within 14 days, 5 were recently airdropped: Manta, Jupiter, Dymension, Heroes of Mavia, and Wen).

This suggests that market sentiment will shift in 2024, so it may be more profitable to hold airdrop tokens when they reach new valuations in an expected bull run.

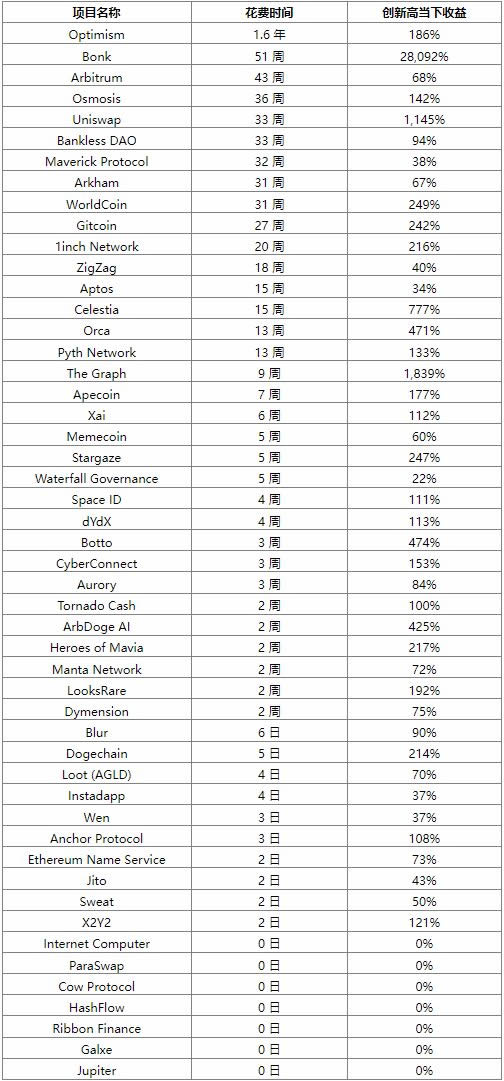

Number of days, weeks, or years required for the 50 largest airdrops to reach all-time high token prices as of February 20, 2024, and corresponding peak price return percentages:

Bull Market Push Airdrop currency prices hit new highs

CoinGecko also pointed out that with the bullish market sentiment in 2023 and 2024, 8 airdrop projects reached ATH after more than 100 days, including:

-

Arbitrum(ARB): 68%

Bonk(BONK): 28,091%

- ##Celestia(TIA): 777%

- Optimism(OP): 186%

- Aptos(APT): 34%

- WorldCoin( WLD): 249%

- Arkham(ARKM): 67%

- Maverick(MAV): 38%

The above is the detailed content of When is the best time to sell airdrop tokens?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

This article recommends ten mainstream cryptocurrency exchanges, including Binance, OKX, Sesame Door (gate.io), Coinbase, Kraken, Bitstamp, Gemini, Bittrex, KuCoin and Bitfinex. These exchanges have their own advantages, such as Binance is known for its largest trading volume and rich currency selection in the world; OKX provides innovative tools such as grid trading and a variety of derivatives; Coinbase focuses on US compliance; Kraken attracts users for its high security and pledge returns; other exchanges have their own characteristics in different aspects such as fiat currency trading, altcoin trading, high-frequency trading tools, etc. Choose an exchange that suits you, and you need to use your own investment experience