web3.0

web3.0

Earn over 40% from Bitcoin investment in El Salvador! President: Those who think bad things should shut up

Earn over 40% from Bitcoin investment in El Salvador! President: Those who think bad things should shut up

Earn over 40% from Bitcoin investment in El Salvador! President: Those who think bad things should shut up

Under the initiative of President Nayib Bukele, El Salvador, which regards Bitcoin as legal tender, has launched a number of Bitcoin policies. These policies include the development of digital wallets, the issuance of US$1 billion in Bitcoin bonds, and the launch of an investment citizenship program.

President of El Salvador: Bitcoin holdings have a floating profit of 40% and will not sell!

With Bitcoin soaring by more than 10% and once exceeding 64,000 today (29th), Bugele took advantage of the situation and posted an article satirizing the media for reporting many article estimates when the price of Bitcoin was low. El Salvador's losses, but when the price of Bitcoin increased, they were completely silent: now the market price of BTC has increased significantly, and if we sell, we will make a profit of more than 40%. Our main source of BTC is our citizenship program. Of course, we will not sell. 1BTC=1BTC. This is true when the market price is low, and it is also true now.

The American exchange Kraken is an institution that believes in Bitcoin. They said: "Firmly follow your vision and persevere. Thank you for being a pioneer of Bitcoin and promoting the widespread application of Bitcoin!"

This is not the first time that Bugele has publicly discussed the profits earned by holding Bitcoin in El Salvador. In December last year, when the price of Bitcoin soared above $42,400, he announced that El Salvador had earned more than $3.6 million from investing in Bitcoin and emphasized that he would continue to adhere to a long-term investment strategy.

At the same time, he also choked the media at the time: "If you are a real reporter, you should report the fact that we have made a profit with the same intensity that we reported our losses before." Nayib Tracker data shows that the country currently has 2,849 Bitcoins, with an average purchase cost of US$42,504.71, unrealized profits of US$54.129 million, and a floating profit of 44.7%.

Same position as the founder of MicroStrategy

Michael Saylor, the founder of MicroStrategy, who has the same position as Bugelei and just announced on the 26th that he will increase his position in 3,000 Bitcoins, in In a recent interview with Bloomberg, when asked whether he would sell Bitcoin to cash out, he also insisted on his belief and said: MicroStrategy has no plans to sell Bitcoin in the near future or even ever, and continues to be optimistic about Bitcoin. Holding Bitcoin is MicroStrategy’s market exit strategy.

At the same time yesterday, Michael Saylor once again issued an appeal: "Don't sell your Bitcoin."

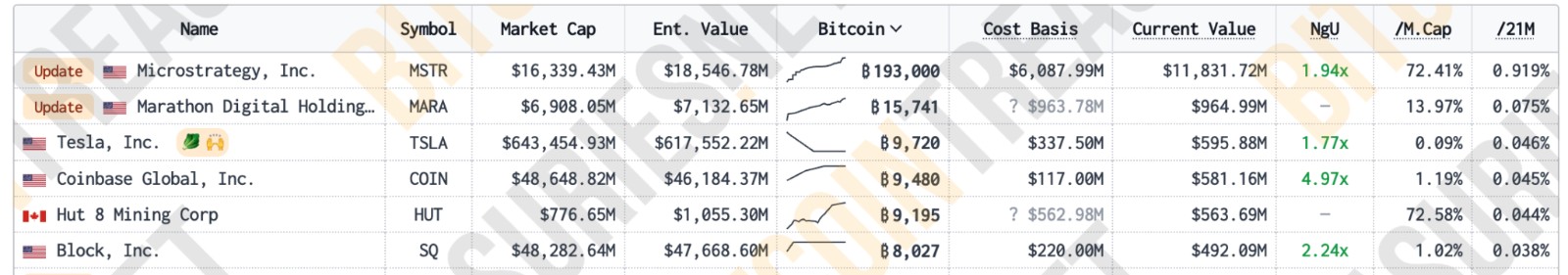

Currently, MicroStrategy continues to dominate the Bitcoin holdings of listed companies, with its total BTC holdings reaching 193,000 and unrealized profits of US$5.77 billion.

MicroStrategy’s total Bitcoin holdings reached 1.93 million, more than 12 times more than the second-ranked mining company Marathon

The above is the detailed content of Earn over 40% from Bitcoin investment in El Salvador! President: Those who think bad things should shut up. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

The exchange rate of Bitcoin to currencies of various countries is as follows: 1. USD: at 7:20 on April 9, the exchange rate is 10,152.53. 2. Domestic: at 2:2 on April 9, 1 Bitcoin = 149,688.2954 yuan. 3. Swedish Krona: At 12:30 on April 9, the exchange rate was 758,541.05.

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance is about to remove 14 cryptocurrencies, causing market turmoil! Binance, the world's leading cryptocurrency exchange, announced that it will remove 14 cryptocurrencies on April 16. The move is the result of the Binance community vote and reflects the exchange's new project screening criteria, aiming to improve the overall quality of the platform. This major change marks a transformation in Binance's strategy, focusing more on the actual performance and long-term value of the project. The 14 tokens to be removed include: Badger (BADGER), Balancer (BAL), BetaFinance (BETA), CreamFinance (

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

What to do if the USDT transfer address is incorrect? Guide for beginners

Apr 21, 2025 pm 12:12 PM

What to do if the USDT transfer address is incorrect? Guide for beginners

Apr 21, 2025 pm 12:12 PM

After the USDT transfer address is incorrect, first confirm that the transfer has occurred, and then take measures according to the error type. 1. Confirm the transfer: view the transaction history, obtain and query the transaction hash value on the blockchain browser. 2. Take measures: If the address does not exist, wait for the funds to be returned or contact customer service; if it is an invalid address, contact customer service and seek professional help; if it is transferred to someone else, try to contact the payee or seek legal help.

Why is the rise or fall of virtual currency prices? Why is the rise or fall of virtual currency prices?

Apr 21, 2025 am 08:57 AM

Why is the rise or fall of virtual currency prices? Why is the rise or fall of virtual currency prices?

Apr 21, 2025 am 08:57 AM

Factors of rising virtual currency prices include: 1. Increased market demand, 2. Decreased supply, 3. Stimulated positive news, 4. Optimistic market sentiment, 5. Macroeconomic environment; Decline factors include: 1. Decreased market demand, 2. Increased supply, 3. Strike of negative news, 4. Pessimistic market sentiment, 5. Macroeconomic environment.

Top 10 cryptocurrency exchanges ranked in the top 10 digital currency exchanges latest list

Apr 21, 2025 am 10:30 AM

Top 10 cryptocurrency exchanges ranked in the top 10 digital currency exchanges latest list

Apr 21, 2025 am 10:30 AM

The top ten cryptocurrency exchanges in 2025 are: 1. Binance, 2.Bybit, 3.OKX, 4.Coinbase, 5.Kraken, 6.HTX, 7.Gate.io, 8.KuCoin, 9.Crypto.com, 10.BitMEX. These exchanges have their own characteristics to meet the needs of different users.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.