The Vanishing Mango: Understanding the MangoFarmSOL Exit Scam

php Editor Baicao will take you through the entire process of MangoFarmSOL exiting the scam. Recently, the MangoFarmSOL project suddenly announced its closure, and many investors faced losses. This incident has aroused widespread attention and heated discussion. What is the truth hidden behind it? Let us uncover this mystery together and explore the story behind the disappearing mango.

Event Overview

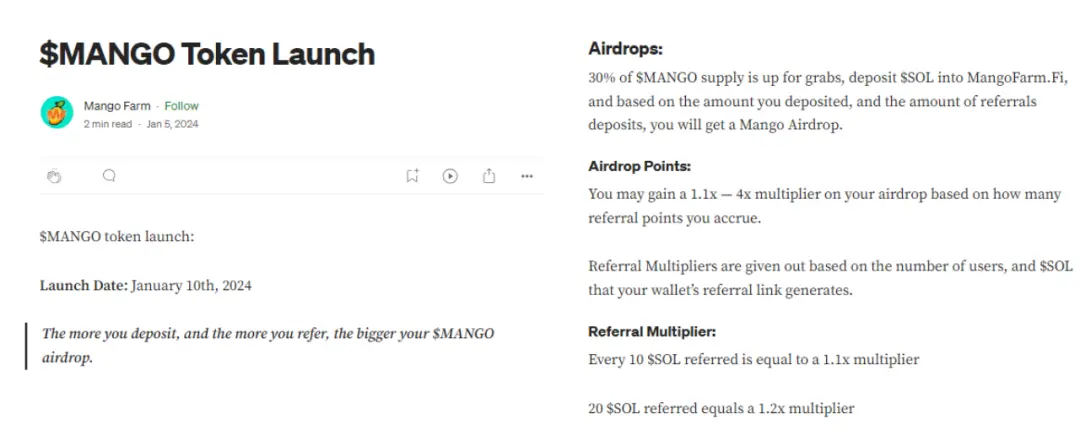

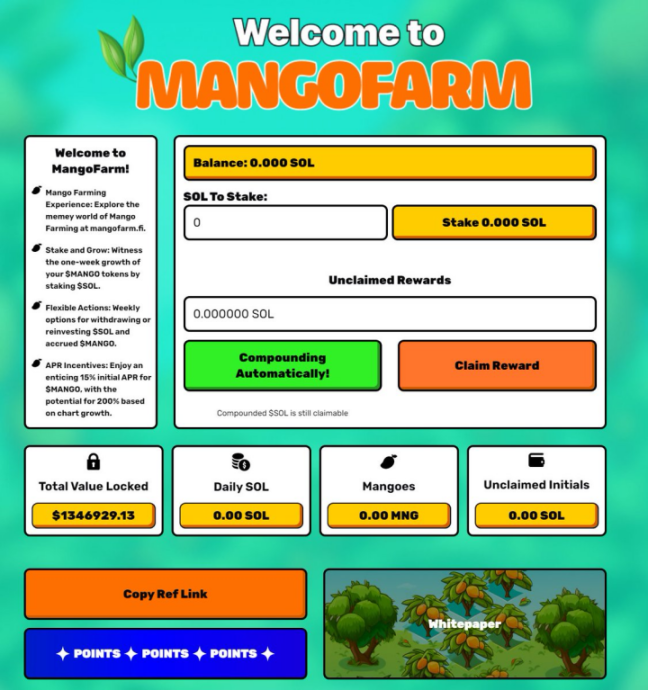

MangoFarmSOL positions itself as a staking protocol on the Solana network, encouraging users to earn rewards for depositing SOL. The project gained attention from the Solana community by promising an airdrop on January 10th.

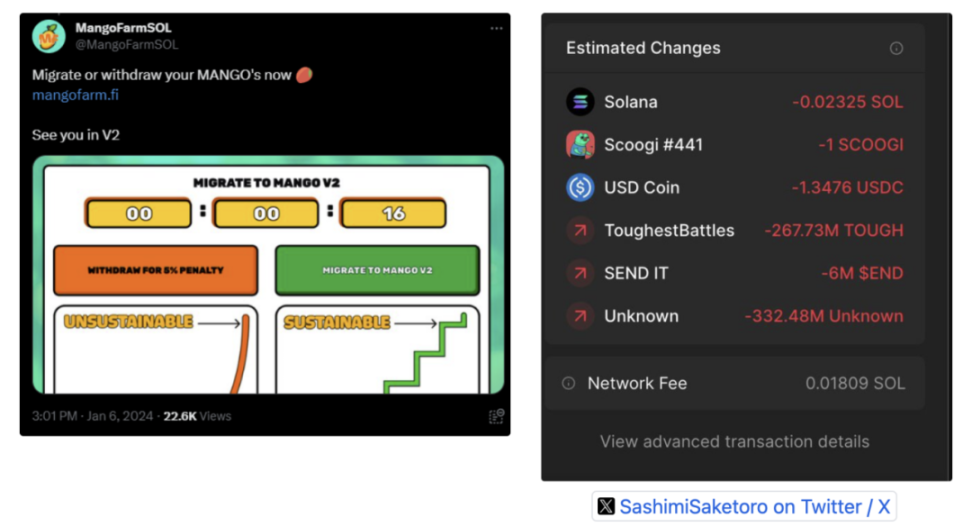

However, the promise of January 10 was never fulfilled. On January 6, 2024, MangoFarmSOL implemented an exit scam, transferring 13,512 SOLs deposited by users from the project contract (approximately US$1.26 million at the time), and deployed a malicious front end to mislead users to authorize "emergency migration" and here Approximately $60,000 was stolen. This is the largest exit scam we’ve uncovered so far in 2024.

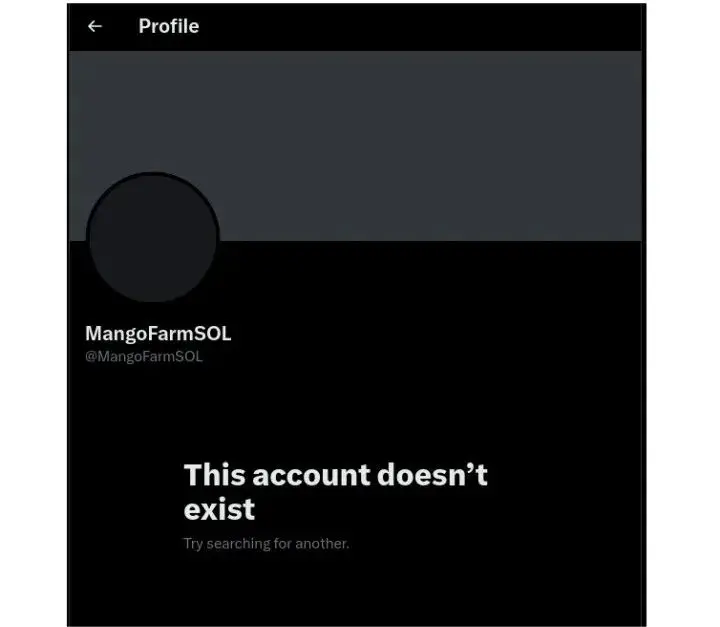

Subsequently, MangoFarmSOL closed its social accounts and website.

Similar to the previously reported xKingdom incident, this incident once again highlights the risk of exit scams in the DeFi field, emphasizing the importance of users’ KYC on the team and the need to remain vigilant.

Scam Timeline

Step One: Lay the Trap

① On January 3, the project used social media KOL promotion to increase its credibility and attract more users.

On January 5, the team announced plans to conduct a MANGO token airdrop on January 10, and encouraged users to participate by staking SOL and recommending other users to receive additional rewards.

Users will start depositing SOL into the MangoFarmSOL contract from January 3 to January 7. Thanks to the MANGO token airdrop commitment and the impact of online marketing, the protocol’s TVL exceeded $1.3 million.

Step 2: Implement the scam

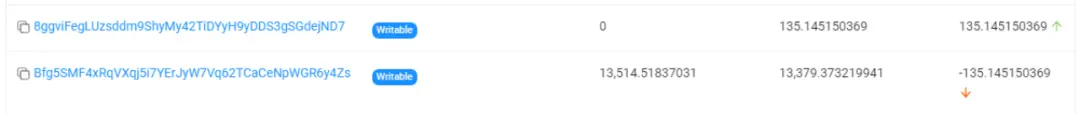

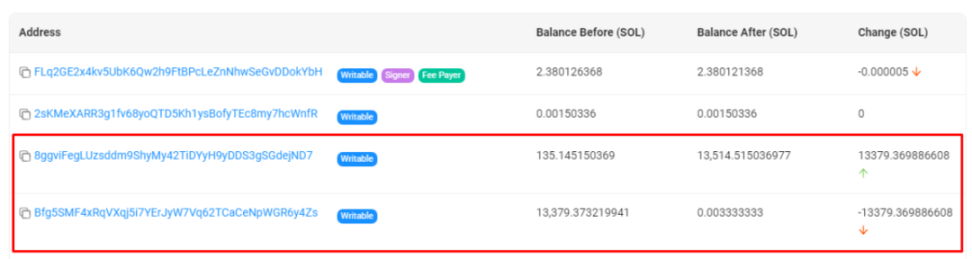

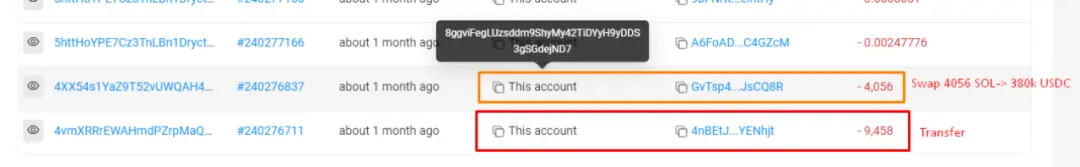

① Stealing contract funds: The MangoFarmSOL team launched a scam and deposited users into the Mango contract 13,514 SOL (approximately $1.26 million) was withdrawn to wallet 8ggvi.

First transaction: 135 SOL transferred from Mango contract (Bfg5SM) to wallet 8ggvi.

Second transaction: 13,379 SOL transferred from Mango contract (Bfg5SM) to wallet 8ggvi.

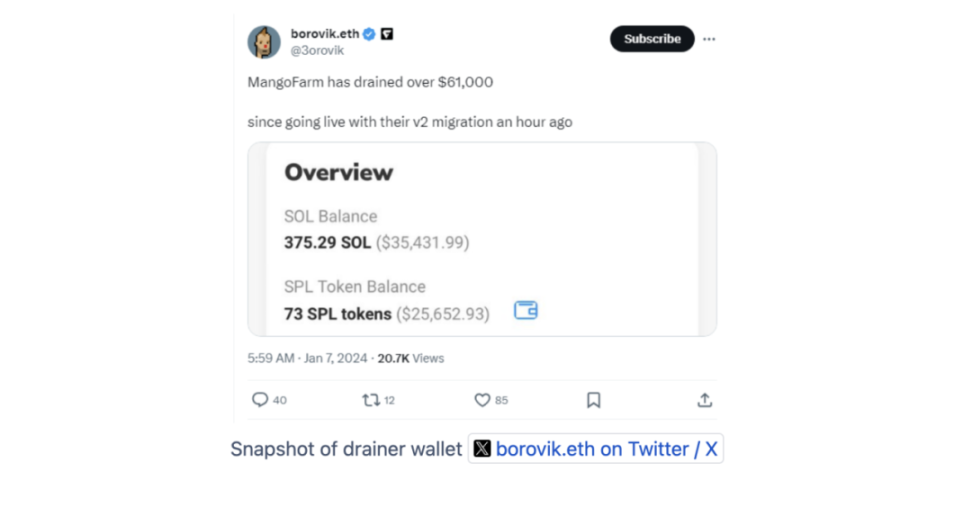

② Deploying a malicious front-end to commit fraud again: Subsequently, the team also used the previous theft incident to deploy a front-end containing malicious code under the guise of "emergency migration". The project's official social media account also posted the malicious frontend, tricking users into conducting transactions that resulted in the theft of approximately $60,000 in additional assets.

③ Complete disappearance: MangoFarmSOL subsequently deactivated its social media accounts and closed its official website, and began transferring funds.

③ Complete disappearance: MangoFarmSOL subsequently deactivated its social media accounts and closed its official website, and began transferring funds.

Step Three: Fund Transfer

Mango Contract Stolen Fund Flow

① Initial Transfer: Mango There are a total of 13.5K SOL in the contract, worth approximately US$1.26 million. After being stolen, they were sent to the address 8ggvi....ejND7.

② Mixing & Conversion: Next, 9,458 SOL were sent to 4nBETJ to obfuscate the funding link; all SOL in 8ggvi and 4nBE were subsequently converted to USDC.

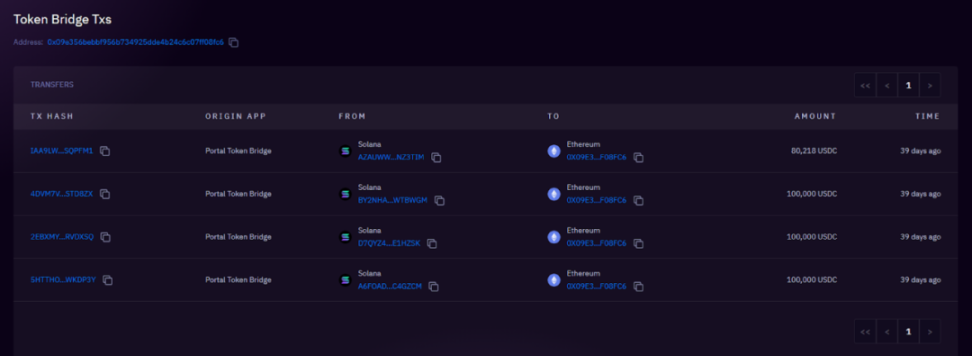

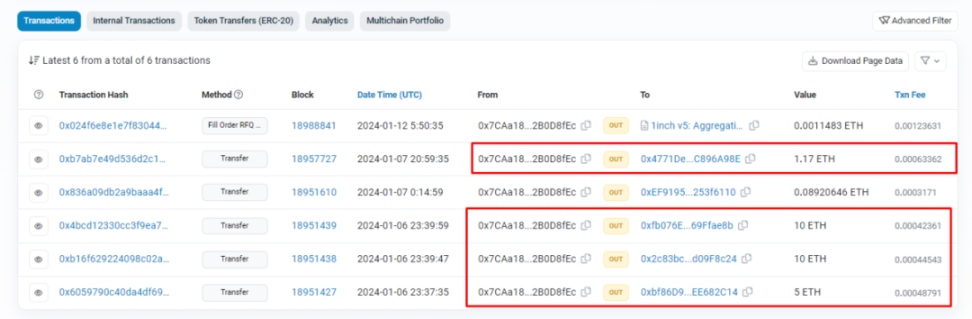

③ Cross-chain to Ethereum: These USDC are cross-chained from the Solana network to Ethereum through Wormhole, and these USDC are sent to 4 different ETH through multiple transactions address.

380k USDC cross-chain to 0x09e3 after 4 transactions

380k USDC cross-chain to 0x09e3 after 4 transactions

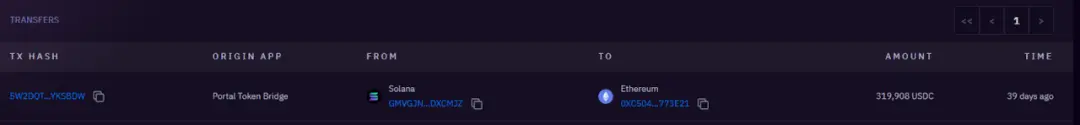

319k USDC cross-chain to 0xc504

319k USDC cross-chain to 0xc504

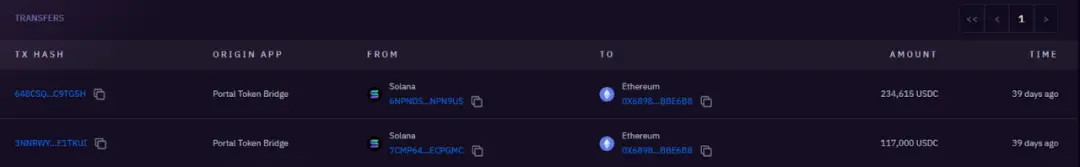

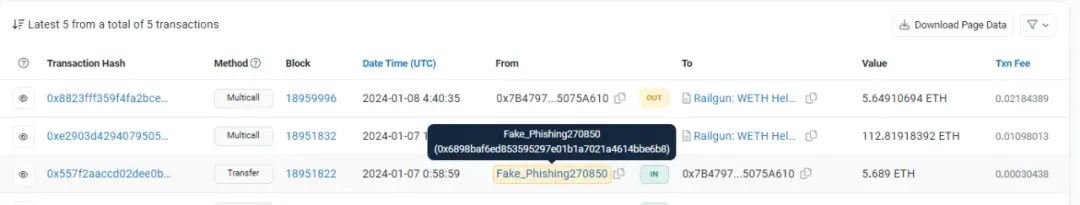

##351k USDC cross-chain to 0x6898

##351k USDC cross-chain to 0x6898

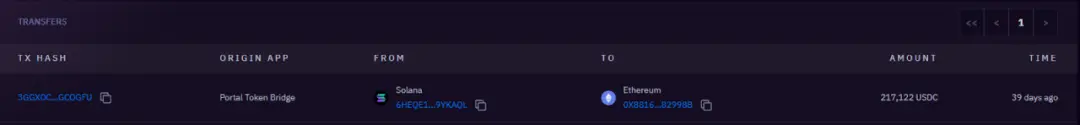

217k USDC cross-chain to 0x8816

217k USDC cross-chain to 0x8816

Transaction example transferred to Railgun

Transaction example transferred to Railgun

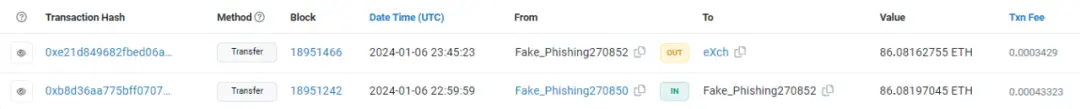

Transferred to eXch’s transaction example

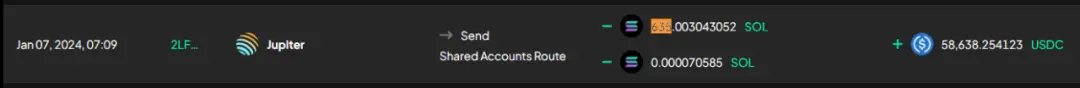

Flow of funds stolen by malicious front-end① Integration and conversion: User assets stolen through the malicious front-end are integrated into SOL and then converted into approximately 5.86 million USDC.

- eXch: About 292ETH

- Railgun: About 263ETH

- FixedFloat: About 26ETH

The above is the detailed content of The Vanishing Mango: Understanding the MangoFarmSOL Exit Scam. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1389

1389

52

52

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

The world's leading ten digital currency apps include: 1. OKX, 2. Binance, 3. Huobi, 4. Matcha (MXC), 5. Bitget, 6. BitMEX, 7. Pionex, 8. Deribit, 9. Bybit, 10. Kraken. These platforms have their own characteristics in security, transaction services, technical architecture, risk control team, user experience and ecosystem.

Which 2025 currency exchanges are more secure?

Apr 20, 2025 pm 06:09 PM

Which 2025 currency exchanges are more secure?

Apr 20, 2025 pm 06:09 PM

The top ten safe and reliable exchanges in the 2025 cryptocurrency circle include: 1. Binance, 2. OKX, 3. Gate.io (Sesame Open), 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Gemini, 8. Crypto.com, 9. Bitfinex, 10. KuCoin. These exchanges are rated as safe and reliable based on compliance, technical strength and user feedback.

How to choose the blockchain asset that suits you

Apr 21, 2025 am 07:45 AM

How to choose the blockchain asset that suits you

Apr 21, 2025 am 07:45 AM

When choosing a blockchain asset that suits you, you need to comprehensively consider the following factors: 1. Clarify investment goals and risk tolerance, short-term speculation or long-term investment determine asset choices; 2. Research project fundamentals, including team background, technological innovation and application scenarios; 3. Analyze market trends and trends, pay attention to price trends, market hotspots and macroeconomic environment; 4. Assess liquidity and transaction costs, and choose assets with good liquidity and low transaction costs.

Despite the speed of market rewards, every coin will eventually encounter pressure and cannot be ignored.

Apr 21, 2025 pm 01:18 PM

Despite the speed of market rewards, every coin will eventually encounter pressure and cannot be ignored.

Apr 21, 2025 pm 01:18 PM

The crypto market is changing with opportunities and risks coexisting, and every cryptocurrency is facing tremendous pressure. This article will analyze the current situation of three cryptocurrencies: Sui, Ethereum and BlockDag, and explore the reasons and future trends behind their price fluctuations. Sui: Price is under pressure, and the future trend is unknown. Sui's price trend shows a classic head and shoulder reversal pattern. The current price hovers around US$2.22, down 8.73% from the neckline of US$2.52. In the past 24 hours, nearly US$1.92 million long positions have been closed, and shorts have dominated. Although the MACD indicator bent slightly upward, the volume was insufficient, with support at $2.16 and $1.42 respectively. Unless the bulls break through the $2.52 resistance level, S

Asset Manager Canary Capital is seeking SEC approval to launch SUI Exchange Trade's fund with points

Apr 21, 2025 pm 02:36 PM

Asset Manager Canary Capital is seeking SEC approval to launch SUI Exchange Trade's fund with points

Apr 21, 2025 pm 02:36 PM

Share this article! CanaryCapital Asset Management plans to launch its first spot cryptocurrency exchange-traded fund (ETF) that tracks the price of SUI (Sui). The company has filed an application with the U.S. Securities and Exchange Commission (SEC) seeking approval to issue its SUIETF. This will be the first ETF to track the performance of a well-known Layer-1 network. The ETF plans to leverage some of its positions through trusted staking providers. “The issuer may utilize or motivate all or part of the SUI of the Trust Fund to participate in Staking through one or more trusted Staking providers. Considering any of the Trusts’ possible participation in any

The global unkillable token market has begun the new moon in April 2025 healthy and strong

Apr 20, 2025 pm 06:21 PM

The global unkillable token market has begun the new moon in April 2025 healthy and strong

Apr 20, 2025 pm 06:21 PM

DefiDungeons, an NFT series in a fantasy placement RPG game powered by the Solana blockchain, showed strong market performance at the beginning of April 2025. The global NFT market started strongly in April after weeks of growth in trading volume. In the past 24 hours, the total NFT transaction volume reached US$14 million, with trading volume soaring 46% from the previous day. Here are the hottest NFT series in the first week of April: DefiDungeonsNFT series: This fantasy placement RPG game NFT on the Solana blockchain became the best-selling NFT series in the first week of April. In the past 24 hours, the transaction volume reached US$1.5 million, with a total market value of more than US$5 million.

As blockchain technology advances, certain names focus on technological depth rather than changing the way people interact with cryptocurrencies.

Apr 20, 2025 pm 08:27 PM

As blockchain technology advances, certain names focus on technological depth rather than changing the way people interact with cryptocurrencies.

Apr 20, 2025 pm 08:27 PM

BlockDag, ThetaNetwork and TheGraph: Innovators in the blockchain field The blockchain technology field is changing with each passing day, with numerous projects emerging, each with its own characteristics and committed to meeting different user needs. This article will focus on three compelling projects: BlockDag, ThetaNetwork and TheGraph, which show unique advantages in handling blockchain data, video content and cryptocurrency mining. TheGraph is a project launched in 2020 to simplify searching for blockchain data. It allows users to quickly access relevant information through an open source indexing system. Although it focuses on the Ethereum blockchain, TheGraph also supports many other

What is the virtual currency withdrawal process? Tutorial on Virtual Currency withdrawal

Apr 21, 2025 am 09:09 AM

What is the virtual currency withdrawal process? Tutorial on Virtual Currency withdrawal

Apr 21, 2025 am 09:09 AM

The virtual currency withdrawal process includes preparation and specific operation steps before withdrawal. 1. Select the right exchange; 2. Complete identity verification (KYC); 3. Bind the withdrawal address; 4. Understand the withdrawal rules. The specific operation steps are: 1. Log in to the exchange account; 2. Enter the "Cash Withdrawal" page; 3. Select the withdrawal currency; 4. Fill in the withdrawal address; 5. Fill in the withdrawal quantity; 6. Select the withdrawal network; 7. Verify identity; 8. Confirm withdrawal; 9. Wait for review; 10. Wait for receipt to ensure safe operation to avoid fund losses.