Can Uniswap's new crypto wallet take MetaMask's throne?

Uniswap’s new crypto wallet has attracted much attention recently and has been praised for its functionality and security. As the DeFi field continues to develop, many people have begun to speculate whether this can replace MetaMask as the industry’s dominant player. In this article, php editor Xigua will explore the advantages and possible challenges of Uniswap’s new crypto wallet, and whether it is possible to seize MetaMask’s throne.

•Uniswap announced the launch of a new wallet that will be located in the browser sidebar and provide a more granular transaction process.

•The wallet will provide a limit order function to automatically execute transactions to meet the user's preset price.

•This launch follows the launch of the Ethereum ETF, which has renewed excitement for holdings. Since September 2023, Uniswap’s price increase has reached 111%.

Uniswap recently launched a browser sidebar crypto wallet to enhance user experience. The development comes against the backdrop of growing interest in restaking and the potential for Ethereum exchange-traded funds (ETFs), making Uniswap a potential competitor to the established MetaMask.

Following the release of Uniswap V4, the platform has launched this new non-custodial wallet. The move is part of Uniswap’s broader strategy to innovate in the cryptocurrency wallet space.

Uniswap vs. MetaMask: Preface to a new chapter

In response to governance proposals, Uniswap has launched its new browser-based self-hosted crypto wallet waiting list. The wallet aims to modernize the trading process and user interface, offering features such as setting limit orders for up to one year on any coin. This feature is designed to facilitate automated trade execution at user-specified prices without the need for constant market monitoring.

Registration for the waitlist is now open and holders of the uni.eth username will receive early access. As of the time of publication, Uniswap Labs has not responded to a request for comment on this release.

The wallet announced the news shortly after Uniswap proposed changes to its governance structure. The proposal involves staking tokens to delegated parties who have a say in the direction of the protocol.

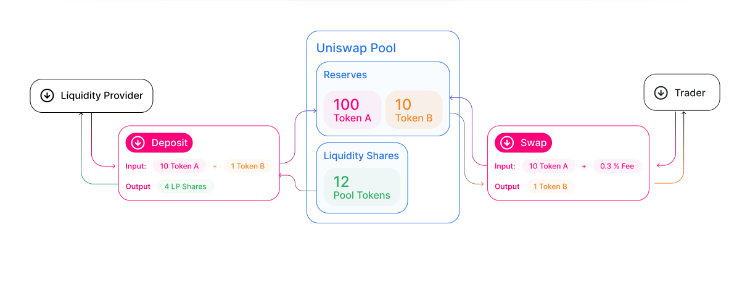

Uniswap Liquidity Supply | Source: Uniswap

Following this governance proposal, the price of Uniswap token (UNI) increased by 50% in 24 hours. As of last update, the coin’s price has increased by 2.3% over the past day and is currently trading at $11.14.

The highly competitive cryptocurrency wallet industry

The launch of the Uniswap wallet comes at a time of significant growth for MetaMask’s user base, with a 55% increase in new users from September 2023 to January 2024. Cryptocurrency markets have also been affected by excitement over the approval of Bitcoin and Ethereum spot ETFs, which has led to significant price swings in these assets.

Since the U.S. Securities and Exchange Commission approved 11 Bitcoin ETFs on January 11, 2024, the price of Bitcoin has exceeded $60,000. Meanwhile, the price of Ethereum has doubled since September 2023 and is now trading at $3,477.60. The increase represents a 111.3% increase in prices since September last year.

Despite market optimism, Bloomberg analyst James Seyffart is cautious about the imminent approval of an Ethereum ETF in 2024.

Seyffart said,

"I am cautiously optimistic about the approval of an Ethereum ETF this year, but I would not be surprised if it was rejected in May. Compared to the Bitcoin ETF, my level of confidence is far less than before."

As the cryptocurrency market evolves, the Ethereum network is approaching the important milestone of 1 million validators. This growth has been driven in part by the popularity of “re-staking” services such as EigenLayer, which allows ETH-derived tokens to be reinvested from crypto staking services such as Lido Finance to earn additional rewards.

The above is the detailed content of Can Uniswap's new crypto wallet take MetaMask's throne?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them