IDC: China's AR/VR shipments in 2023 will be 725,000 units

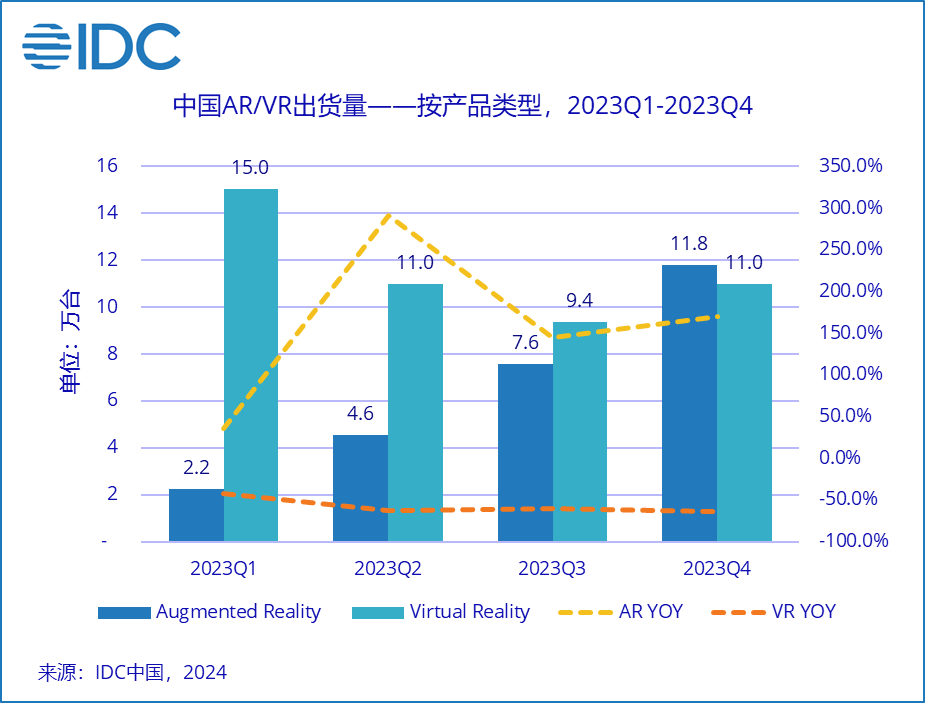

According to the latest report released by IDC, in 2023, China’s AR/VR headset shipments will be 725,000 units (sales-in caliber), a year-on-year decrease of 39.8% in 2022. Among them, 262,000 AR units were shipped, a year-on-year increase of 154.4%, and VR shipments were 463,000 units, a year-on-year decrease of 57.9%.

For the whole year of 2023, AR shipments accounted for 36.1% of the overall AR/VR shipments in the Chinese market, reaching a record high, of which 118,000 AR units were shipped in the fourth quarter. , VR shipments reached 110,000 units. Although some AR manufacturers are trying to suppress shipments through channels, this is also the first time that AR shipments in the Chinese market have exceeded VR in a single quarter.

Overall AR market in 2023

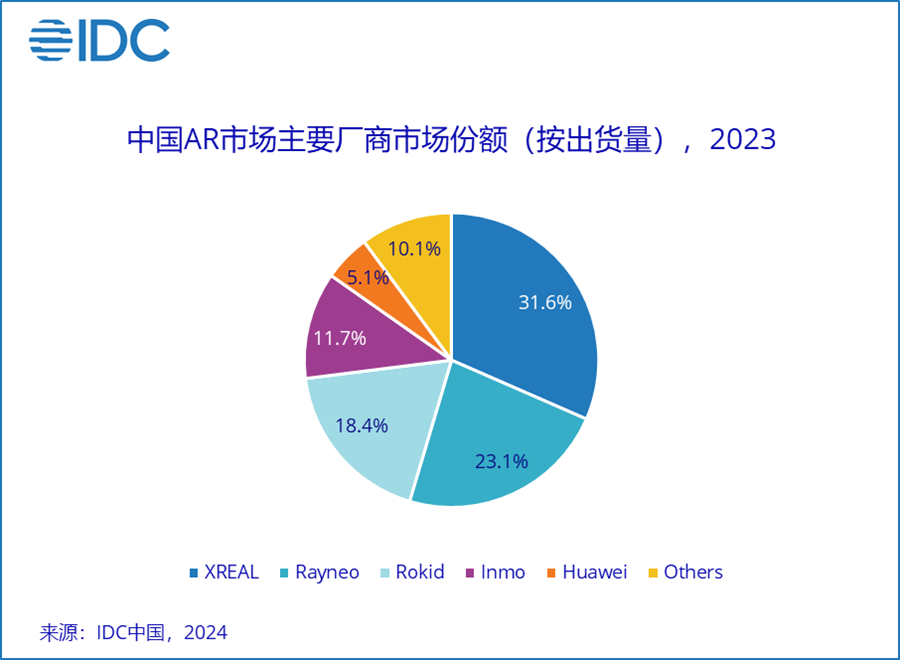

In 2023, the Chinese AR market will ship 261,000 units, of which 230,000 split AR units will be shipped and 31,000 integrated AR units will be shipped. At that time, the leading domestic AR manufacturers were mainly startups, and the top four manufacturers were all startups with a short history of establishment. They had all completed multiple rounds of large-amount financing in the past two years.

Compared with the strategy of manufacturers gathering together to release lightweight split AR glasses in 2022, in 2023, domestic mainstream brands also began to launch all-in-one AR glasses equipped with Qualcomm processors. AR glasses.

Among the split AR glasses, each product line focuses on smart projection scenarios, such as XREAL Air 2/2 pro, Rayneo Air 1S/Air/Air plus, Rokid Air/Max. The competition is fierce, and the unit price of shipments Basically they are all under $400.

The focus is slightly different. XREAL's sound quality and electrochromic characteristics have made it a good reputation among users who need to travel. Rayneo's first switch direct connection is favored by console gamers, and Rokid's first Station box There are massive resources to promote AR away from mobile phones.

From the perspective of shipping channels, in addition to selling products to consumers on e-commerce platforms, each company has begun to build an offline retail system and cooperate with domestic new energy vehicle brands for joint shipments.

Among all-in-one AR glasses, Inmo is deeply involved in listening to books and information prompts. The X2 launched by Rayneo is mainly aimed at high-end machine geek players and developers to test the waters of true wireless AR glasses. However, its price is higher than split glasses. Currently, such products are concentrated around $600.

Overall VR market in 2023

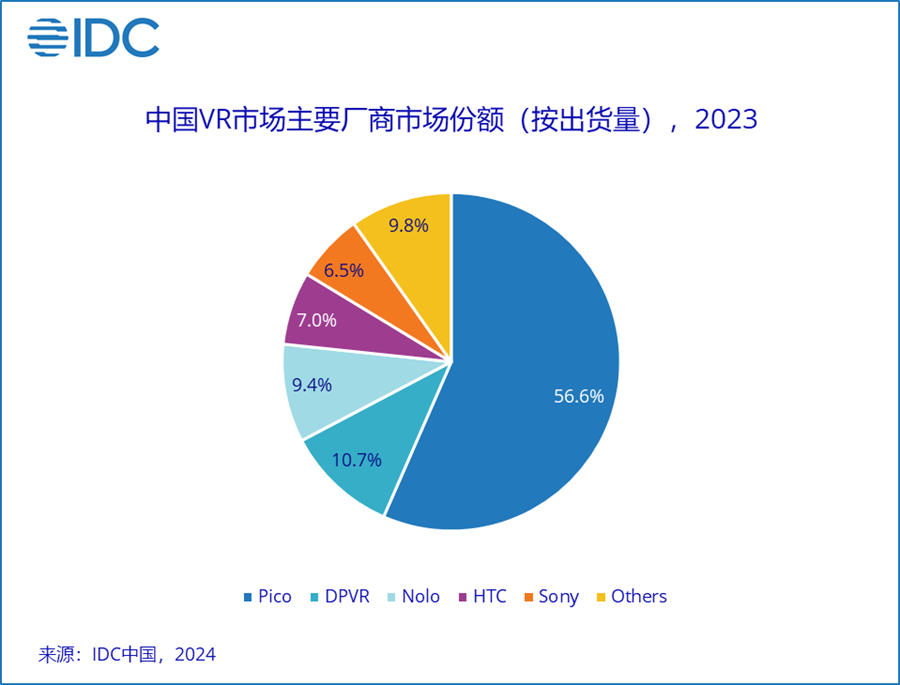

In 2023, China’s VR market will ship 463,000 units, including 357,000 integrated VR units and 106,000 split VR units, led by Pico Chinese VR manufacturers have begun to significantly reduce costs and increase efficiency, cutting advertising and marketing investment expenses, reducing platform subsidies, weakening promotional activities such as punch-in cash rebates, and reducing employee size.

iQiyi Dream Bloom encountered a capital chain break in 2023 and failed to launch its new XR headset as scheduled. Sony Playstation VR2 will make a strong comeback in 2023, but shipments will only be in the first quarter, and will continue to digest first-quarter inventory in the later period.

None of the top 4 manufacturers has launched any eye-catching new products in 2023. The main series are still old products such as Pico 4, Nolo CM1, DPVR E4, HTC Vive Cosmos, etc. However, due to the current all-in-one VR replacement cycle is still relatively It is relatively long, the game content on each platform is highly consistent, and consumers lack motivation to upgrade.

In the commercial market, the vast majority of shipments in 2023 will still be concentrated in online and downstream entertainment experience stores, and commercial purchases such as education, government, and medical care will be smaller. At the same time, traditional cultural blogs, cultural tourism and other projects have also been impacted by AR manufacturers. AR glasses manufacturers, such as Rokid, have advantages in channels and content adaptation.

2024 AR/VR Market Outlook

AI R&D capabilities: Starting from the end of 2023, AI AR will help users achieve better NLP interaction and display screen presentation, in content generation, translation, and navigation. In multiple AR usage scenarios, where current hardware levels are relatively close, differences in AI capabilities will become the key to product differentiation among manufacturers.

Hardware innovation: After the release of Apple Vision Pro, the cost of Micro-oled screens has dropped rapidly and will gradually replace the current mainstream fast-lcd screens. In the future, pancake micro-oled will become the mainstream match in VR headsets. .

At the same time, with the development of Apple's next-generation products, the supply chain system will continue to grow, and hardware costs will accelerate in the next three years.

Manufacturer competition: At present, mobile phone manufacturers have a relatively complete layout of the AR track, and they also have strong supply chain management capabilities and offline store operation levels. Mobile phone manufacturers are expected to accelerate their entry into the AR market in 2024, which will be The current domestic AR manufacturer landscape has had a certain impact.

Apple Vision Pro is expected to enter the Chinese mainland market in 2024, which will lead domestic VR manufacturers to accelerate the layout of high-end lines. Apple has customized more than 600 native applications for it, and the first batch of 100,000 units has been sold. Less flow will go to XR developers. As it is gradually launched in countries other than the United States, developers in various places will adapt and innovate more content applications according to the characteristics of their own countries, completing the transformation of VR products from gaming equipment to productivity tools.

Zhao Siquan, senior analyst at IDC China, believes that there are still many uncertainties in China’s AR/VR market in 2024, and manufacturers’ new product release rhythm will be more affected by supply chain costs, the speed of building offline channel systems, and consumption. It is affected by multiple factors such as the degree of market recovery and the research and development progress of AR/VR content developers.

Compared with the strategy of heavily subsidizing new products to drive shipments in the past two years, manufacturers have now begun to focus on a certain degree of active user conversion, continuous content application repurchase, product innovation and other aspects. Against the backdrop of declining supply chain costs and rich content, China's AR/VR market will develop in a more healthy and sustainable direction.

The above is the detailed content of IDC: China's AR/VR shipments in 2023 will be 725,000 units. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Xiaomi POCO Pad 5G: Xiaomi releases new POCO tablet with affordable starting price

Aug 24, 2024 am 06:43 AM

Xiaomi POCO Pad 5G: Xiaomi releases new POCO tablet with affordable starting price

Aug 24, 2024 am 06:43 AM

Xiaomi has now released the POCO Pad 5G following the tablet's appearance on Geekbench earlier this week. Incidentally, the tablet is the second entry in the POCO Pad range after the non-cellular model (curr. $326.50 on Amazon) that arrived earlier t

Geely's new pure electric car 'Xingyuan' official image released: equipped with Flyme Auto vehicle system

Sep 02, 2024 pm 01:10 PM

Geely's new pure electric car 'Xingyuan' official image released: equipped with Flyme Auto vehicle system

Sep 02, 2024 pm 01:10 PM

DoNews reported on September 2 that Geely Automobile today released the official image of its new pure electric car "Xingyuan". The car will be equipped with the FlymeAuto vehicle system and is expected to compete with BYD Dolphin and other models after its launch. The car adopts a round and lovely styling style, with smooth lines and a full and smooth overall outline. It adopts a dual-color body. Its length, width and height are 4135/1805/1570mm respectively, and the wheelbase is 2650mm. The official released the cockpit design of the new car this time. The interior of the new car also uses a large number of curves, echoing the agile appearance of the exterior. It is equipped with a suspended central control screen, a two-spoke steering wheel, and decorative panels on the doors and in front of the passenger seat. It is embellished with an outline drawing that resembles a group of urban high-rise buildings. The car will be built based on a new pure electric platform.

Realme launches 320W super-light speed second charge

Aug 14, 2024 pm 06:46 PM

Realme launches 320W super-light speed second charge

Aug 14, 2024 pm 06:46 PM

On August 14, the Realme mobile phone made the world's first flash charging black technology - 320W super-light speed charging, marking another revolutionary leap in mobile phone flash charging speed, and China's technology once again leads the world! Realme's 320W super-light speed charging has achieved unprecedented breakthroughs in terms of power, safety and efficiency. It not only pushes the industry's flash charging technology to a new height, but also brings a new flash charging experience to users. 320W super-light speed second charging, a miraculous experience of 4 minutes and 30 seconds. 320W super-light speed second charging technology breaks the limit of charging speed again. It only takes 4 and a half minutes to charge a 4420mAh mobile phone battery to 100%, which is faster than the previous 240W. Flash charging technology once again improves charging efficiency. Behind this achievement is actually the combination of "high power, high safety and miniaturization"

No.9 electric vehicle mechanic MMAX2 released: starting from 7999 yuan

Aug 23, 2024 am 06:59 AM

No.9 electric vehicle mechanic MMAX2 released: starting from 7999 yuan

Aug 23, 2024 am 06:59 AM

On August 22, Nine Company, my country's leading smart two-wheeled electric vehicle company, released three series of multiple new two-wheeled electric vehicle products at once, including both new product series and upgraded products of existing series. The many new products released by No.9 Company this time have been almost fully upgraded to "top-of-the-line" products from configuration, design to intelligence. In addition to iterative upgrades on the product side, Nine Company has also made a lot of layout and optimization in the whole sales process services. In addition to increasing offline pure after-sales outlets, Nine Company will also build a national rapid energy replenishment network. In recent years, my country's two-wheeled electric vehicle market has reached a stage of high-quality development, and consumer demand for two-wheeled electric vehicles has become diversified and "high-end." Correspondingly, on the supply side, the competition between brands has also transitioned from the previous pure "volume price" to

Global terminal sales of SAIC Passenger Vehicles exceeded 477,000 units from January to July, a year-on-year increase of over 12%

Aug 12, 2024 pm 06:42 PM

Global terminal sales of SAIC Passenger Vehicles exceeded 477,000 units from January to July, a year-on-year increase of over 12%

Aug 12, 2024 pm 06:42 PM

In July 2024, global terminal sales of SAIC's dual-brand passenger cars exceeded 59,000 units; from January to July, global cumulative terminal sales exceeded 477,000 units, a year-on-year increase of more than 12%. The industry's highest "Super Safety Commitment" pays one for every burn, and the lifetime warranty of three electric vehicles follows the car but not others. With a deep insight into the pulse of the market and an accurate grasp of consumer needs, on July 4, SAIC Passenger Cars officially launched the industry's highest The standard "Super Safe Core Commitment" sets a new industry benchmark for battery zero-combustion guarantee with a service standard of paying new cars within 20 working days. At the same time, it is announced that the lifetime warranty of three electric vehicles is not limited to the first car owner and annual driving mileage, providing users with Provides comprehensive security and worry-free experience. This move goes beyond the current warranty standards of mainstream car companies and bids farewell to the 30,000-kilometer warranty commonly used in the industry.

Wenjie's new M7 Pro is officially launched with prices starting at NT$249,800, equipped with the basic version of HUAWEI ADS

Sep 02, 2024 pm 12:34 PM

Wenjie's new M7 Pro is officially launched with prices starting at NT$249,800, equipped with the basic version of HUAWEI ADS

Sep 02, 2024 pm 12:34 PM

On August 26, Hongmeng Smart held a new product launch conference. Its three major brands, AITO, LUXEED and STELATO, were unveiled with a number of blockbuster new cars. At the press conference, Wenjie's new M7 Pro was officially launched, priced at 249,800-289,800 yuan. It is equipped with the HUAWEIADS basic version of the intelligent driving assistance system, ushering in a new era of intelligent driving for all. Yu Chengdong, Huawei’s Managing Director, Chairman of Terminal BG, and Chairman of Smart Car Solutions BU, said: “Wenjie’s new M7 Pro has the largest space, the best driving control, the strongest intelligent driving and the strongest safety in its class. It is the best in the 250,000 class. SUV! will bring users a more extreme travel experience and help the sales of Hongmeng Zhixing family continue to increase. "Extraordinary space, ever-changing magic comfortable seats."

Hongmeng Zhixing Wenjie's new M7 Pro was officially released, and its first coupe SUV, Zhijie R7, was unveiled on the same stage

Sep 02, 2024 pm 01:40 PM

Hongmeng Zhixing Wenjie's new M7 Pro was officially released, and its first coupe SUV, Zhijie R7, was unveiled on the same stage

Sep 02, 2024 pm 01:40 PM

On August 26, Hongmeng held its first new product launch conference. Wenjie’s new M7 Pro was officially launched, with an official price of 249,800-289,800 yuan. At the same time, Hongmeng Zhixing’s first coupe SUV, the Zhijie R7, was officially unveiled. Yu Chengdong, Huawei’s Managing Director, Chairman of Terminal BG, and Chairman of Smart Car Solutions BU, said: “Wenjie’s new M7 Pro has the largest space, the best driving control, the strongest intelligent driving and the strongest safety in its class. It is the best in the 250,000 class. "SUV!" will bring users a more extreme travel experience and help Hongmeng Zhixing continue to increase sales." At the press conference, Hongmeng Zhixing handed over the latest answer: AITO Wenjie delivered 400,000 vehicles in 2 years and 5 months, creating a smart luxury brand. New record. Gaoyan’s urban performance SUV Wenjie’s new M5 has been delivered with over 20,000 deliveries

SAIC-Volkswagen's new SUV unveiled, Tuyue Xinrui sets new benchmark for A-class SUVs

Aug 21, 2024 pm 08:46 PM

SAIC-Volkswagen's new SUV unveiled, Tuyue Xinrui sets new benchmark for A-class SUVs

Aug 21, 2024 pm 08:46 PM

Recently, SAIC Volkswagen’s new SUV TharuXR was unveiled. The new car is positioned as an A-class SUV, and its Chinese name is Tuyue Xinrui. As a new warrior of the Tuyue family, it will join forces with the new Tuyue to accelerate its lead in the A-class SUV market with new development momentum. Since the announcement of the Ministry of Industry and Information Technology’s declaration in June, Tuyue Xinrui has attracted widespread attention with its new-generation Volkswagen SUV design language and its class-leading, powerful and fuel-efficient 1.5TEVOII net-efficiency engine. This debut, along with the release of more model information, creates a new realm of fuel economy and durability, surprising the first batch of KOLs who experienced it. A KOL said: "The Tuyue Xinrui may be the most worth buying A-class SUV, and I am very much looking forward to its launch." You won’t get tired of the appearance for a long time. Tuyue’s cutting-edge appearance adopts Volkswagen’s new generation SU