Gemini to repay more than $1.8 billion to win customers in regulatory settlement

Cryptocurrency exchange Gemini announces it will return more than $1 billion to Earn program customers under a regulatory settlement with the New York State Department of Financial Services (NYDFS)

Repay all customers’ assets at the price of the day

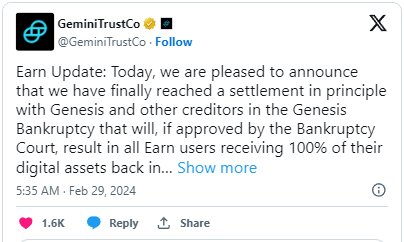

On February 28, Gemini, founded by the Winklevoss brothers in 2014 Trust Company announced that it has reached an in-principle settlement with Genesis and other creditors in the company's bankruptcy proceedings.

The settlement will allow Earn Project clients to “recover 100% of their digital assets in physical form.”

The announcement further explains that if approved by the bankruptcy court, users can expect to recover their assets on a 1:1 basis:

After lending Bitcoins in the Earn program, you will get the same amount of Bitcoins back when you choose to redeem. Therefore, any appreciation in value since the asset was borrowed into the Earn plan will also be returned to you.

According to the cryptocurrency exchange’s claims, they will return more than $1.8 billion in assets at that day’s price, which is $700 million more than what Genesis’ assets were worth when it stopped withdrawals two years ago.

Upon approval of the settlement, users can expect to receive approximately 97% of their assets within 2 months. The remaining 3% of assets are expected to be returned within 12 months of approval.

Gemini clarified that the required bankruptcy court proceedings could take up to two months to complete. Furthermore, it said that, in principle, the settlement was subject to final documentation.

Genesis Agreement with SEC

Gemini and Genesis Global Capital (GGC) co-launched the Earn program. Launched in February 2021, the program allows users to earn passive income through interest payments.

These interests are accrued after users lend their digital assets to GGC through the Earn program, and the company then lends these assets to its peers.

Customers raised the alarm in November 2022 when Genesis requested that withdrawals from the program be suspended. Two months later, in January 2023, the service was permanently terminated.

Soon after, the U.S. Securities and Exchange Commission (SEC) filed charges against the two companies, saying they then offered unregistered securities through the Earn program.

Earlier this month, GGC reached a settlement with the SEC, ending civil litigation against the company. Under the settlement, it agreed to pay a $21 million civil penalty, with the amount contingent on the company's repayment to customers and creditors.

Gemini fined for failure to exercise due diligence

On Wednesday, Adrienne Harries, head of the New York State Department of Financial Services (NYDFS), announced that the cryptocurrency exchange will contribute $40 million to the Genesis Global Capital bankruptcy case.

In addition, Gemini will pay a $37 million fine to NYDFS for "significant failures" in protecting customers that "threatened the company's security."

NYDFS concluded that the company failed to conduct adequate due diligence on GGC and failed to "maintain adequate reserves throughout the life of Earn."

Chief Harries said the settlement was a win for Earn users. Customers will regain rights to assets they entrusted to the exchange and failed to protect.

Harries said:

"Gemini's failure to conduct due diligence on unregulated third parties, resulting in subsequent accusations of massive fraud, harmed Earn customers who were suddenly unable to access their assets following Genesis Global Capital's financial crisis."

Finally, NYDFS announced that as part of the settlement, it reserves the right to take further legal action if the company fails to meet its obligation to return at least $1.1 billion to Earn program customers.

The above is the detailed content of Gemini to repay more than $1.8 billion to win customers in regulatory settlement. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them