Coinbase: Is the strong momentum in the crypto market sustainable?

Written by: David Han, David Duong

Compiled by: DAOSquare

Key Points

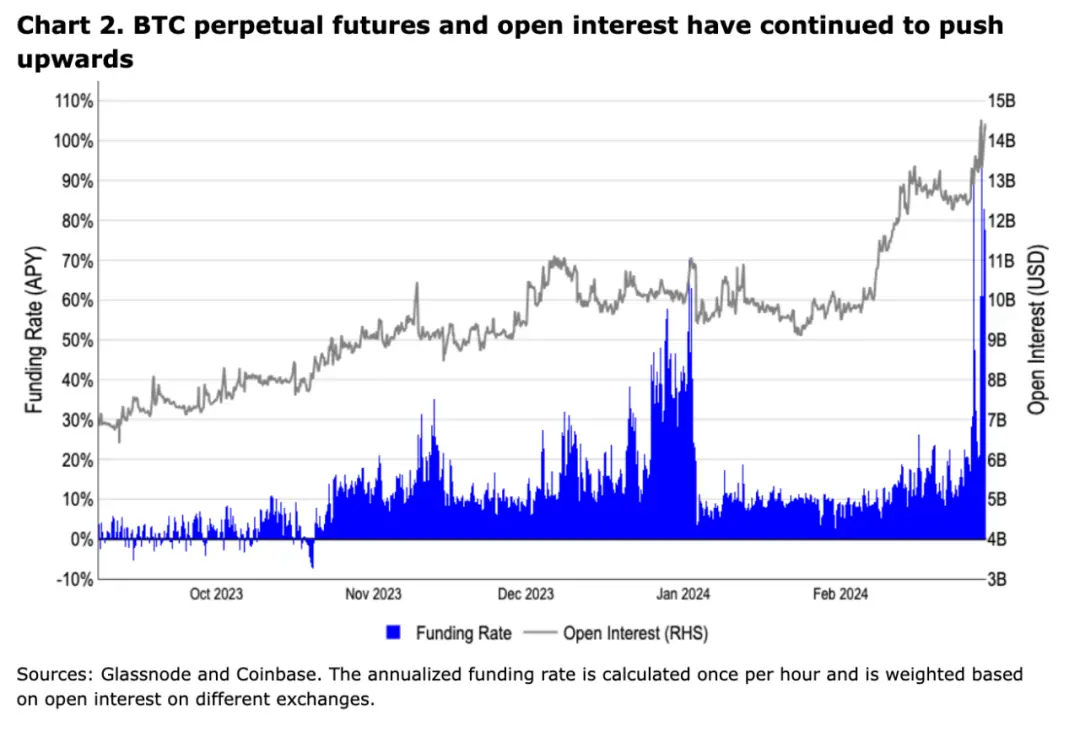

- #The Crypto market’s rebound this week was supported by large inflows into U.S. spot Bitcoin ETFs and a short squeeze in leveraged derivatives positions. Open interest reached its highest level since January 2022, and funding rates surged to their highest level since April 2021 (109% annualized).

- The proposal put forward by the Uniswap Foundation on February 23 lays the technical foundation for the implementation of a fee mechanism for paying UNI stakers and delegators (participating in governance) in wETH.

- We believe that the discussion about blockchain adoption will shift from scalability to how to create silky user experiences, which means not only the abstraction of the underlying blockchain, but also Regarding pain points such as mnemonic phrases and wallet management.

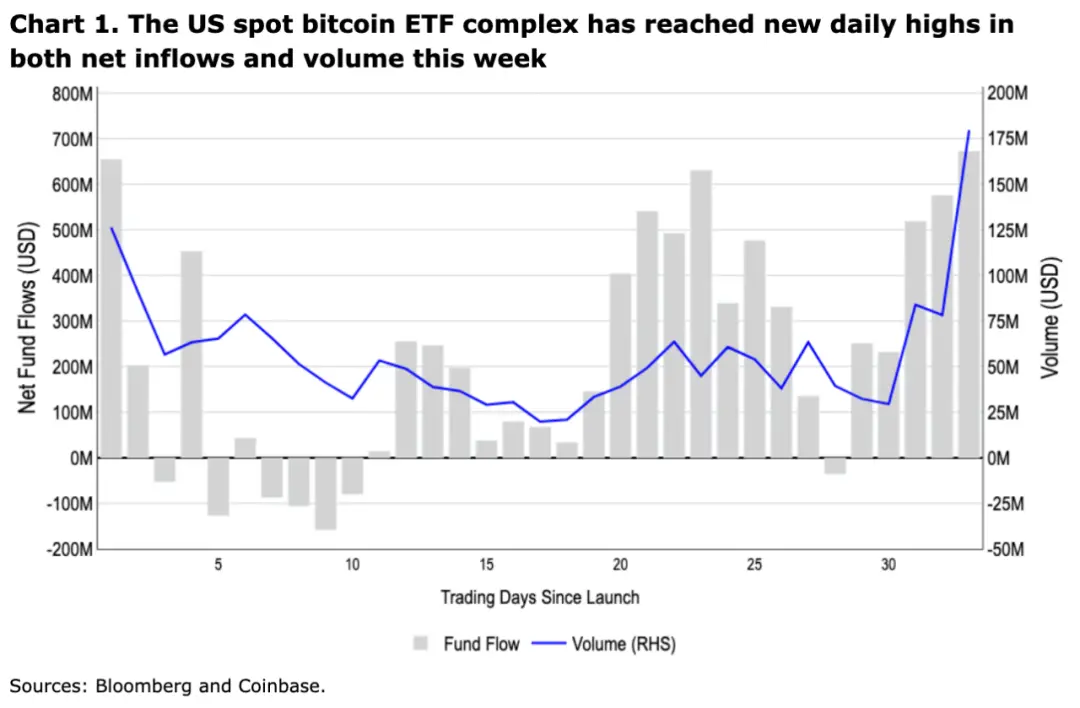

Market Watch

This week, the cryptocurrency market has shown an impressive rebound, Mainly benefiting from the influx of large amounts of funds into U.S. spot Bitcoin ETFs and leveraged derivatives, which caused short positions to be squeezed and provided overall support for the market. Spot Bitcoin ETFs attracted nearly $1.8 billion in net inflows earlier this week, with BlackRock’s iShares Bitcoin ETF (IBIT) accounting for 70% of that (see chart 1 for details). While large brokers like Morgan Stanley are still conducting a cautious review of these products, which is a prerequisite for offering them to clients, this week's performance is certainly encouraging.

Bitcoin price momentum has fueled a short squeeze in recent days, with BTC perpetual futures open interest at the highest level since January 2022 highest level ($14.2 billion). The weighted average funding rate for open interest reached an annualized rate of 109% on February 28, the highest level since April 2021, according to Glassnode data. Subsequently, the rate dropped to approximately 70% (see Figure 2). Nearly $750 million of shorts were liquidated between February 25 and 28, setting new highs for the number of shorts liquidated year-to-date. At the same time, we believe that short covering based on the futures long-short ratio may be coming to an end but is not yet fully complete.

The recent performance is consistent with the constructive outlook we issued in early February, but we are cautious about some negative seasonality that may still emerge in March. For example, traditional assets tend to be affected by drivers such as tax payments, which can cause some temporary downward pressure. Large and sustained positive moves in funding rates and open interest could also have an impact on the market if the liquidation of funding rates and open interest results in a cascade of long liquidations. Nonetheless, we remain generally constructive on the outlook for the coming months, as a large number of wealth managers will also continue to include spot ETFs, with such net inflows clearly absorbing the circulating supply of liquidity faster than Bitcoin miners can produce it. Faster.

On-chain: Uniswap fee switching

On February 23, the Uniswap Foundation (UF) announced a proposal to upgrade the Uniswap V3 protocol governance to achieve Part of the transaction fees are awarded to UNI token delegators and stakers. However, it should be noted that the proposal itself does not enable fee conversion, but rather sets out a technical mechanism for how to implement fee conversion. If the proposal passes, the initial fee parameter will be set to 0, but a range of 10% to 20% of transaction fees can be used for reward programs in future proposals.

In our opinion, the biggest concern about enabling protocol fees is the impact on liquidity providers, as any such fees will be deducted from their revenue. This may result in a reduction in Total Value Locked (TVL) and MEV-based traffic. A detailed analysis by Gauntlet (involved with UF) addresses this question and suggests that the impact on core non-MEV volumes is likely to be minimal, with annual revenue estimates ranging from a conservative $10 million to an optimistic $72 million based on historical activity. If this initial proposal passes, the Gauntlet team will also be responsible for coming up with a fee rollout plan.

We believe this proposal is likely to be implemented given that it has been proposed by UF’s governance leaders and has received broad support in the forum. In fact, in the previous fee proposal that was rejected in June 2023, most participants expressed approval, but the voting differences between different fee levels ultimately made "no fee" the majority. Given that the proposal has not yet changed any revenue structures and does not present the same vote distribution issues, we do not see any significant obstacles. Interestingly, the proposal also links revenue to governance (through staking and delegation), which we believe could incentivize more active community participation by UNI holders. The voting period for the proposal is expected to take place between March 1 and 7.

The widespread attention to the proposal has also led several other projects to consider following suit, such as Frax. If this trend develops in other mature DeFi protocols, we think it may start to bring previously speculative token valuations into a clear and actually supported valuation model, especially for those that can generate sustainable Fee tokens and protocols. At the same time, this shift also represents a change in the protocol's value accrual mechanism, as it rewards agents and stakers directly with wETH (the current proposed payment token), unlike other protocols such as MakerDAO that use native token buyback and destruction. The mechanics contrast.

On-Chain: The Proliferation of Application Chains

Additionally, we would like to discuss the growing field of rollups on Ethereum, which has given rise to A new kind of rollup as a service (RaaS) product that allows you to create and deploy rollups with just a few clicks. The development of modular blockchains has accelerated with the emergence of various technologies and is used to deploy Layer2 (L2) and other application-specific chains. The aforementioned Frax protocol plans to launch its own L2 Fraxtal, which will make it part of the Optimism superchain. Other major protocols, such as decentralized perpetual contract exchange GMX, currently the top TVL protocol on Arbitrum, are also considering deploying their own chains (it is currently known that the GMX protocol will remain on Arbitrum and Avalanche C-Chain superior).

As more and more L2s are born, we believe that there will be more scrutiny in the field of cross-chain bridges and interoperability, and the complexity of the entire ecosystem will also increase, Different solutions have their own considerations in terms of security assumptions, validation time, development timelines and costs, which can also cause certain obstacles for non-technical end users. In addition, the fixed cost of Rollup (the cost of gas for the Layer1 infrastructure layer) is also a factor to consider. In a world where L2 proliferates, monetization may become increasingly difficult and will likely push applications further into Layer 3, which in turn will lead to a reshuffling of profitable L2 chains. This fragmentation of the execution environment has led some critics to argue that the shared state provided by a single or integrated blockchain enables more use cases and better cross-application security.

The discussion of both approaches to scalability, with both the arguments for and against, has far-reaching implications, although we believe these technical trade-offs are actually essential to building a smooth user experience. is secondary. In our view, widespread adoption of any application will ultimately require the abstraction of technical complexity from the consumer, just as the underlying technology stack (and design trade-offs) of a large web2 platform are largely user-agnostic. With this in mind, we believe technology that enables users to protect their wallets with passkeys, such as Coinbase’s wallet solution, is even more important to growing the Crypto market. While these tools are often overlooked in the scalability debate, we believe these innovations could ultimately have a huge impact on user adoption and new acquisitions, especially if scalability solutions converge to similar performance over the long term.

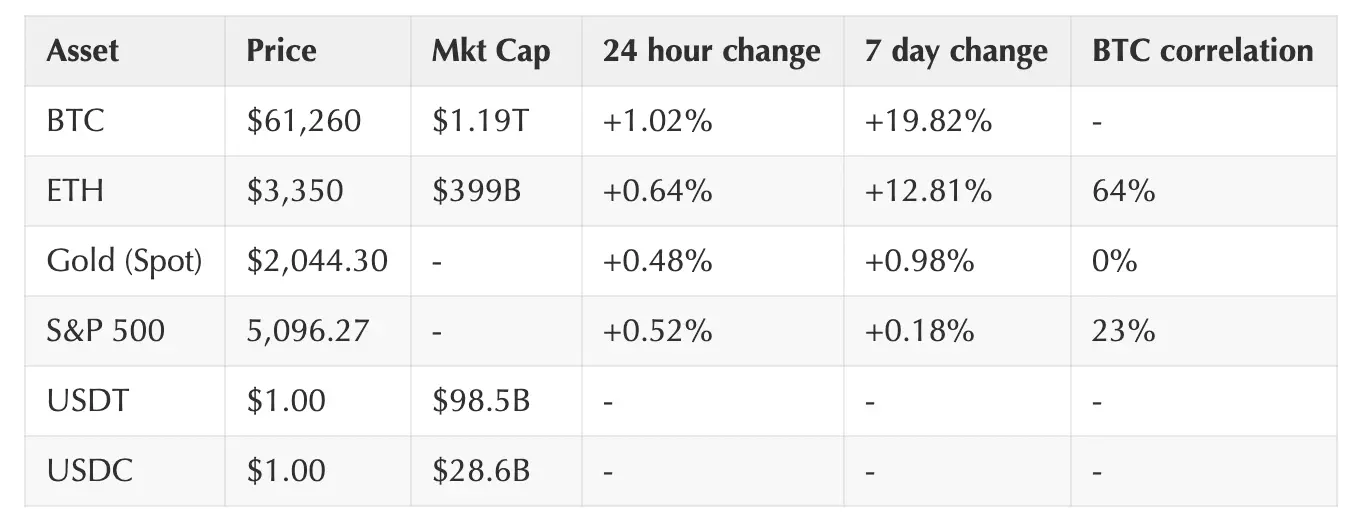

Crypto and Traditional Domain Performance

(As of February 29, ET 4 p.m.)

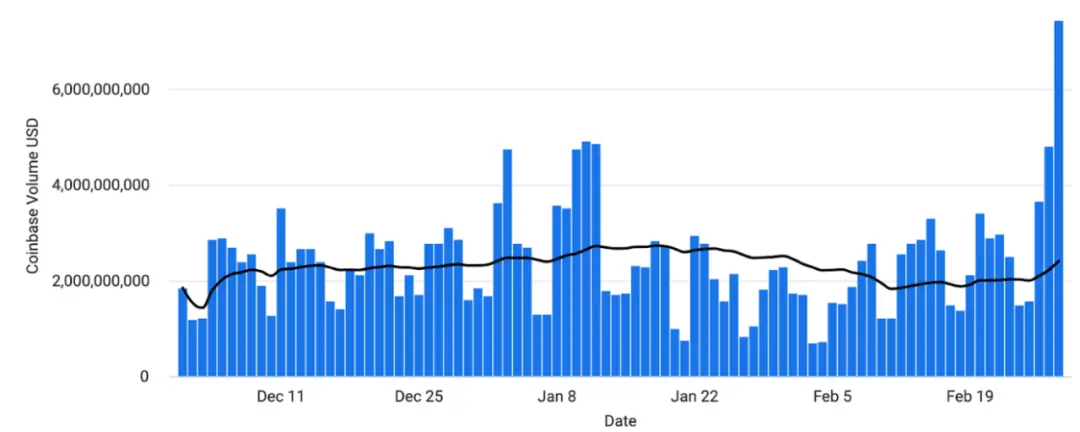

Coinbase Exchange and CES Insights

BTC’s rally continues to have many markets participating with its strength were surprised. Long holders are benefiting from this momentum, as more than $2 billion in new money entered ETF products over the past week. Still, high funding rates and rising open interest in perpetual futures products could pose risks to the rally. Over the past seven days, funding rates have averaged over 30%, making it costly to hold long exposure. Altcoin flows have shown a closer correlation with investor trading behavior around sectors and narratives.

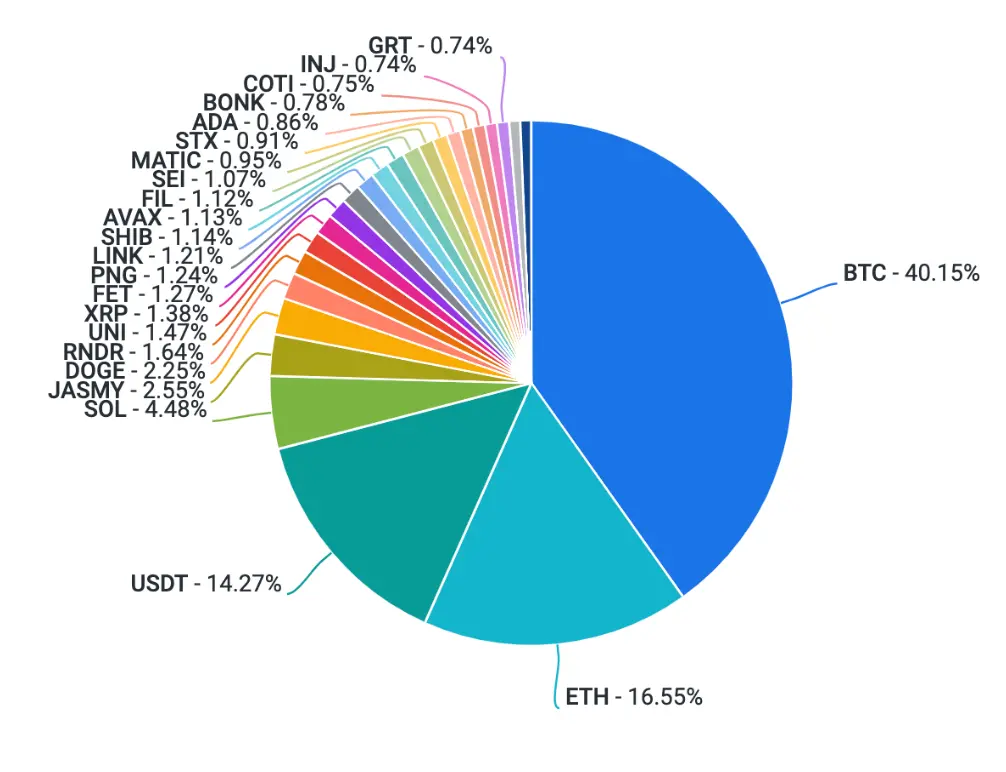

Coinbase platform trading volume (USD)

Coinbase platform trading volume (asset ratio)

Funding Rate

Notable Crypto News

Institution

- VanEck launches NFT platform to offer token-run watch and wine ownership splits by March (The Block)

- Ledn launches a loan business backed by Ethereum and accepts supervision from former Celsius users (The Block)

- Elizabeth Warren is willing to "cooperate" with the crypto industry (but reiterates that traditional financial rules must be followed) (The Block)

- Hong Kong End of Cryptocurrency Exchange License Application Campaign (Cointelegraph)

General

- Ethereum NFT Card Game "Gods" Unchained" on iOS and Android (Decrypt)

Coinbase

- Coinbase Announces Support for Asset Recovery on BNB Smart Chain and Polygon (Coinbase Blog)

- Coinbase Cloud adds support for Nethermind and Erigon to Increasing the diversity of Ethereum execution clients (Coinbase Blog)

- The growing wallet industry will help bring a billion users on-chain (Coinbase Blog)

Global perspective

Europe

- European Central Bank official says: Bitcoin is fair The value remains zero (ECB blog) (Decrypt)

- Paris Saint-Germain becomes the first football team to verify blockchain (CoinDesk)

- England Law Commission seeks comment on draft legislation to label cryptocurrencies as property (CoinDesk)

亚洲

- Japanese major companies Mitsubishi UFJ, Rakuten, and Mizuho will launch security tokens (Cryptonews)

- The Hong Kong Monetary Authority issued a circular on the sale and distribution of tokenized products (HKMA)

- The Financial Secretary of Hong Kong said that Hong Kong will launch a regulatory sandbox (The Block) for stablecoin issuers

The above is the detailed content of Coinbase: Is the strong momentum in the crypto market sustainable?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance is about to remove 14 cryptocurrencies, causing market turmoil! Binance, the world's leading cryptocurrency exchange, announced that it will remove 14 cryptocurrencies on April 16. The move is the result of the Binance community vote and reflects the exchange's new project screening criteria, aiming to improve the overall quality of the platform. This major change marks a transformation in Binance's strategy, focusing more on the actual performance and long-term value of the project. The 14 tokens to be removed include: Badger (BADGER), Balancer (BAL), BetaFinance (BETA), CreamFinance (

Despite the speed of market rewards, every coin will eventually encounter pressure and cannot be ignored.

Apr 21, 2025 pm 01:18 PM

Despite the speed of market rewards, every coin will eventually encounter pressure and cannot be ignored.

Apr 21, 2025 pm 01:18 PM

The crypto market is changing with opportunities and risks coexisting, and every cryptocurrency is facing tremendous pressure. This article will analyze the current situation of three cryptocurrencies: Sui, Ethereum and BlockDag, and explore the reasons and future trends behind their price fluctuations. Sui: Price is under pressure, and the future trend is unknown. Sui's price trend shows a classic head and shoulder reversal pattern. The current price hovers around US$2.22, down 8.73% from the neckline of US$2.52. In the past 24 hours, nearly US$1.92 million long positions have been closed, and shorts have dominated. Although the MACD indicator bent slightly upward, the volume was insufficient, with support at $2.16 and $1.42 respectively. Unless the bulls break through the $2.52 resistance level, S

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

The exchange rate of Bitcoin to currencies of various countries is as follows: 1. USD: at 7:20 on April 9, the exchange rate is 10,152.53. 2. Domestic: at 2:2 on April 9, 1 Bitcoin = 149,688.2954 yuan. 3. Swedish Krona: At 12:30 on April 9, the exchange rate was 758,541.05.

BlockDag (BDAG) demand booms: Simplify crypto mines for everyone!

Apr 21, 2025 am 11:45 AM

BlockDag (BDAG) demand booms: Simplify crypto mines for everyone!

Apr 21, 2025 am 11:45 AM

The cryptocurrency market rebounded strongly, and the trends of major digital assets were differentiated. The surge in Binance Coin (BNB) prices have attracted market attention, while Ethereum (ETH) price analysis shows it faces resistance. Against this backdrop, BlockDag (BDAG) stands out among the top cryptocurrencies in 2025, with BDAG adoption soaring after the release of Keynote3. Its easy-to-use X1 mining machine application has attracted more than 1 million users, sold 19.1 billion tokens, raising $212.5 million, marking a major leap in the process of inclusive cryptocurrency. BNB price rose, trading at about $627.99, with a market value of $89.47 billion, up 1.81% in recent times, consistent with the market trend. Since its launch in 2017

alert! Binance adjusts the mortgage rate of multiple assets, and the crypto market may cause turmoil

Apr 21, 2025 am 11:48 AM

alert! Binance adjusts the mortgage rate of multiple assets, and the crypto market may cause turmoil

Apr 21, 2025 am 11:48 AM

Binance has adjusted the collateral ratios of several assets to manage risks and ensure market stability. 1. The mortgage ratio of FLOW and COMP has dropped from 80% to 70%, and 2. 1INCH has dropped from 70% to 65%, which may lead to a decline in market liquidity and investors' adjustment of holding strategies, but will help market stability in the long run.

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

Popular science in the currency circle: How much can a Bitcoin be exchanged for? Where to redeem?

Apr 21, 2025 pm 12:00 PM

Popular science in the currency circle: How much can a Bitcoin be exchanged for? Where to redeem?

Apr 21, 2025 pm 12:00 PM

In China, transactions of Bitcoin exchange for domestic money are not allowed. In other countries and regions where transactions are allowed, exchanges can be carried out through the following platforms: 1. Binance, 2. Ouyi (OKX), 3. Huobi (Huobi).

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

The top ten leading virtual currency trading apps in the world in 2025 are: 1. Binance, 2. Gate.io, 3. OKX, 4. Huobi Global, 5. Bybit, 6. Kraken, 7. FTX, 8. KuCoin, 9. Coinbase, 10. Crypto.com.