php Editor Banana will provide you with a detailed analysis of the detailed declaration operation process of the personal income tax withholding and payment system. The detailed declaration of the personal income tax withholding and payment system includes steps such as filling in personal information, reporting withholding and payment details, and generating a declaration form. During the operation, you should pay attention to filling in the form accurately to ensure the smooth completion of the declaration. The following will step by step guide you to understand the detailed declaration process of the personal income tax withholding and payment system, allowing you to easily master the key points of operation and improve work efficiency.

Enter the declaration: On the personal income tax page, click "Declaration of personal income tax withholding and payment details", as shown in the figure below.

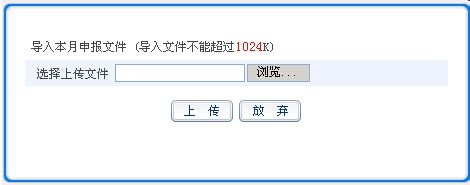

When uploading declaration documents, the system will pop up a dialog box. You need to click "Browse" to select the file to be uploaded, and then click the "Upload" button to complete the operation.

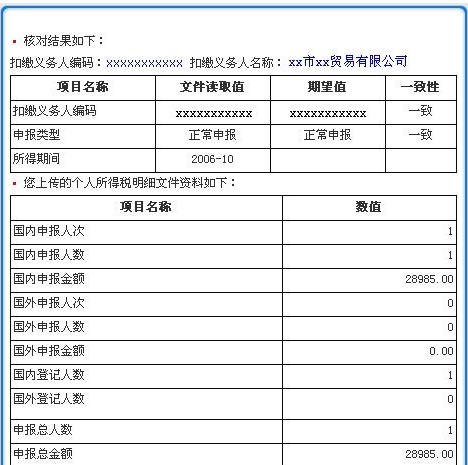

Confirm upload: The system pops up the file upload verification result page. The expected value income period on the page is the time when the last declaration was successful. There are two test results for consistency verification: consistent; inconsistent. The consistency here does not affect the file upload declaration. You only need to check whether the file read value is your actual declaration data. If there are data errors, please check the uploaded file, modify it, and then upload it again. Confirm that it is correct and click the "Confirm Upload" button to upload the file.

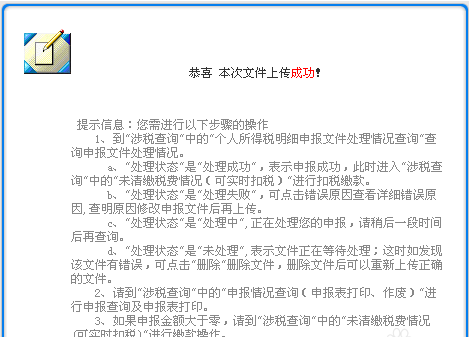

Upload successful: The system prompts that the file has been uploaded successfully and prompts for the next step. After confirmation, click the "OK" button to close this window.

Query processing results: The above operations have completed the first step of "detailed declaration of personal income tax withholding and payment": upload the declaration documents, and then enter the second step: query the processing results of the detailed declaration. For details, see "Personal Income Tax Withholding and Payment Detailed Declaration" in the document in the personal income tax module. Inquiry on the processing status of detailed income tax declaration documents."

Withhold taxes: Query the processing results through "Personal Income Tax Detailed Declaration Document Processing Status Inquiry". The result is: the processing is successful, you can proceed to the third step: clear the taxes and perform the deduction operation, click "Deduction" below column to enter the deduction.

Print the report.

The above is the detailed content of How to file detailed declarations in the personal income tax withholding and payment system - Operational procedures for detailed declarations in the personal income tax withholding and payment system. For more information, please follow other related articles on the PHP Chinese website!

Tutorial on making inscribed coins

Tutorial on making inscribed coins

The phone cannot connect to the Bluetooth headset

The phone cannot connect to the Bluetooth headset

Compound usage

Compound usage

vue common instructions

vue common instructions

What should I do if msconfig cannot be opened?

What should I do if msconfig cannot be opened?

What is the difference between Douyin and Douyin Express Edition?

What is the difference between Douyin and Douyin Express Edition?

Property management system software

Property management system software

Why can swoole be resident in memory?

Why can swoole be resident in memory?

Domestic free ChatGPT encyclopedia

Domestic free ChatGPT encyclopedia