Ether.fi will support Omni Network! $600 million in ETH available

Ether.fi announced its cooperation with Omni Network and will provide ETH worth $600 million as a node to maintain network security after EigenLayer opens external projects to join. It is expected that more new teams will seek support from the LRD project in the future, which will help promote the development of the liquidity re-hypothecation protocol.

Ether.fi will support Omni Network

Ether.fi as an active verification service provider for Omni Network

Liquidity Re-staking protocol Ether.fi just received $27 million in investment last month. Yesterday, the protocol announced that it will commit to using pledged ETH to maintain Omni Network's network consensus security after the third phase of EigenLayer's products is launched.

In the future, nodes running through Ether.fi will become Omni Network’s Active Verification Service Providers (AVS). These nodes will use pledged ETH as security to run Omni Network nodes and obtain network rewards.

Provide US$600 million in ETH

In this cooperation, Ether.fi stated that it will use US$600 million worth of ETH for Operating Omni Network nodes represents approximately one-third of the current assets of the protocol.

What is Omni Network

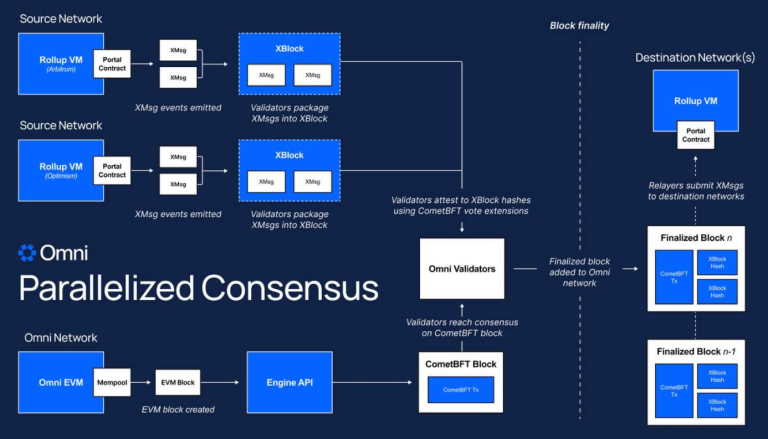

Omni Network is a decentralized network that provides high performance with a parallel consensus design, and also provides fast communication functions across Rollups. The project has received $18 million in financing.

Omni Network Parallel Consensus Mechanism

Ether.fi may launch tokens in the near future

On the other hand, today the Ether.fi team also The further token distribution plan was revealed. If the amount of eETH accumulated in the agreement increases before March 15th, the community distribution ratio of tokens can be increased, hoping to maximize the marketing value of the tokens.

For every 50,000 eETH accumulated in pledge, the protocol can increase the token community allocation by 0.25%, up to a maximum of 2% of the total allocation, which will then be divided equally between new pledgers and existing pledgers.

There will be more LRD cooperation cases in the future

As EigenLayer continues to develop, it will advance to the third phase in the future, allowing new external projects to be built on EigenLayer, by seeking AVS's Support to reduce project cold start barriers.

The largest AVS at present undoubtedly includes liquidity re-pledge projects (LRD) such as Ether.fi, Puffer Finance, Kelp DAO, etc. Therefore, we can expect to see more emerging teams taking the initiative to LRD projects in the future. Extend an olive branch.

It may even happen that multiple projects compete with each other for support. For example, the scale of rewards issued to Ether.fi is used as a measure of cooperation, and then there will be another wave of bonuses for stakers. If you think about it from this perspective, in the long run, the biggest winner of this cooperation is Omni Network, which has occupied a large piece of the pie.

On the other hand, since Ether.fi’s governance module has not yet been launched, the cooperation is only decided by the team. Such actions will have an impact on the rights and interests of eETH holders and should be improved in the future. governance process.

The above is the detailed content of Ether.fi will support Omni Network! $600 million in ETH available. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

Top Crypto ICO Rivals DeFi Giants: IntelMarkets Takes the Crypto Trading World by Storm

Nov 10, 2024 am 09:24 AM

Top Crypto ICO Rivals DeFi Giants: IntelMarkets Takes the Crypto Trading World by Storm

Nov 10, 2024 am 09:24 AM

IntelMarkets is making waves in the crypto space, setting its sights on top rivals with a unique offering aimed at transforming crypto trading.

Can Fil tokens exceed US$50 per coin in 2025?

Mar 04, 2025 am 08:33 AM

Can Fil tokens exceed US$50 per coin in 2025?

Mar 04, 2025 am 08:33 AM

Can Filecoin (FIL) break through $50 in 2025? Let's dive into Filecoin's potential and its future price trends. Decentralized storage is becoming a new trend in data management, and Filecoin, as a pioneer, has attracted much attention with its unique economic model and strong community support. This article will analyze the core functions of Filecoin, the investment records of major institutional investors, and Grayscale funds, and predict the future price of FIL, as well as the positive factors affecting its price. 1. Filecoin Overview Filecoin is a blockchain-based decentralized storage network that provides secure, efficient and economical distributed cloud storage services. It is based on IPFS (Interstellar File System), utilizing content

Top 10 recommended rankings of formal exchanges in the currency circle (2025 formal exchanges ranking)

Mar 03, 2025 pm 05:09 PM

Top 10 recommended rankings of formal exchanges in the currency circle (2025 formal exchanges ranking)

Mar 03, 2025 pm 05:09 PM

This article introduces the top ten cryptocurrency trading platforms in the world, including Binance, Huobi Global Station, Ouyi, Coinbase, Kraken, Gemini, Bybit, Crypto.com, KuCoin and FTX. The average daily trading volume of these platforms is more than hundreds of millions of dollars, and it provides a variety of trading products and services such as spot, contracts, and options. Some platforms also have special functions such as fiat currency channels and leveraged lending. The platform has different registration locations and business priorities. For example, Binance is known for its huge trading volume and multi-currency support, Coinbase is known for its compliance and user-friendliness, while OKX and Bybit focus on derivatives trading. Investors can choose the right platform according to their own needs.

Which direction in the cryptocurrency circle will soar in 2025? Which track is the hottest?

Mar 03, 2025 pm 06:24 PM

Which direction in the cryptocurrency circle will soar in 2025? Which track is the hottest?

Mar 03, 2025 pm 06:24 PM

In 2024, fields such as Web3, meme coins and AI stood out in the wave of blockchain technology, showing great potential, and also inspiring investors' enthusiasm for innovative projects. However, the market competition is fierce, and all tracks are struggling to compete for market share. Investors need to keep up with market trends in order to remain invincible in volatility. So, what directions are worth paying attention to in the cryptocurrency circle in 2025? This article will analyze potential popular fields such as Web3, MEME concept, RWA track, AI concept, Solana ecosystem, and L2 track. Potential surge in the cryptocurrency circle in 2025: Web3 Direction: As the next stage of the Internet, its decentralization, security, privacy protection and other features will continue to attract attention. represent

What is the Chinese name of Yiwen Science CertiK in Chinese? How much does CertiK audit cost?

Mar 05, 2025 pm 07:09 PM

What is the Chinese name of Yiwen Science CertiK in Chinese? How much does CertiK audit cost?

Mar 05, 2025 pm 07:09 PM

The openness and transparency of blockchain-based contracts are vulnerable to attacks, and Web3 security is also crucial and is one of the most important infrastructures of Web3. As a leading company in the global Web3 security track, CertiK has always attracted much attention. CertiK is a blockchain security company that provides end-to-end blockchain security audit services in cooperation with formal verification and AI technology. After a brief understanding of the company concept, some people are curious about what is the Chinese name of CertiK in Chinese? According to the information, CertiK is called Unicorn in Chinese. Next, the editor will introduce CertiK in detail. What is CertiK's Chinese name? CertiK is called Unicorn in Chinese, CertiK is a form

The All-Sports Meme Token You Can't Afford to Bench!

Nov 03, 2024 pm 06:36 PM

The All-Sports Meme Token You Can't Afford to Bench!

Nov 03, 2024 pm 06:36 PM

XYZ is your exclusive VIP pass to a sports-driven, meme-fueled revolution. Think of it as the MVP of the XYZVerse ecosystem

Ethereum White Paper Anniversary: Reflecting on 11 Years of Transforming Technology, Finance, and Decentralization

Nov 05, 2024 pm 03:02 PM

Ethereum White Paper Anniversary: Reflecting on 11 Years of Transforming Technology, Finance, and Decentralization

Nov 05, 2024 pm 03:02 PM

On the 11th anniversary of the release of Ethereum’s white paper, it’s worth reflecting on how this pivotal document has transformed technology, finance, and our very concept of decentralization.

The Hidden Forces Shaping Ethereum's Future: Unseen Opportunities and Perils

Oct 27, 2024 pm 06:20 PM

The Hidden Forces Shaping Ethereum's Future: Unseen Opportunities and Perils

Oct 27, 2024 pm 06:20 PM

Emerging Trends Beyond Resistance Levels While Ethereum's resistance level is captivating the attention of traders and analysts alike, there are more