Hardware Tutorial

Hardware Tutorial

Hardware Review

Hardware Review

The stock price remains stagnant, product demand is weak, and U.S. institutions' confidence in Apple declines

The stock price remains stagnant, product demand is weak, and U.S. institutions' confidence in Apple declines

The stock price remains stagnant, product demand is weak, and U.S. institutions' confidence in Apple declines

CNMO Technology News reported that Goldman Sachs recently made an important adjustment in its latest investment strategy and removed the technology giant Apple from its best buy list. The main reasons for this decision were poor performance of Apple's stock and concerns about declining demand for its main products. Goldman Sachs may believe that the current challenges and uncertainties faced by Apple have caused them to have doubts about its future growth and profitability. This move also reflects the changing attitude of investors towards the technology industry, where they are more cautious in evaluating investment targets in response to market fluctuations and risks. Goldman Sachs' decision may trigger market sentiment towards Apple. From a data point of view, Apple's stock price has remained almost unchanged since June 2023, while the stock price of Apple has remained unchanged over the same period. The S&P 500 index rose nearly 22%. This contrasting performance has caused Goldman Sachs to have doubts about Apple's investment prospects. Especially on March 1, after Apple was removed from the best buy list, its stock price fell by 0.6%, further validating the market's concerns.

In addition to Tesla, Apple also appears to be inadequate in comparison with the other seven technology giants. These technology giants, including Google, Microsoft, Amazon, etc., have performed well in the past period of time. In comparison, Apple's stock price performance appears somewhat weak.

The above is the detailed content of The stock price remains stagnant, product demand is weak, and U.S. institutions' confidence in Apple declines. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Huawei's Qiankun ADS3.0 intelligent driving system will be launched in August and will be launched on Xiangjie S9 for the first time

Jul 30, 2024 pm 02:17 PM

Huawei's Qiankun ADS3.0 intelligent driving system will be launched in August and will be launched on Xiangjie S9 for the first time

Jul 30, 2024 pm 02:17 PM

On July 29, at the roll-off ceremony of AITO Wenjie's 400,000th new car, Yu Chengdong, Huawei's Managing Director, Chairman of Terminal BG, and Chairman of Smart Car Solutions BU, attended and delivered a speech and announced that Wenjie series models will be launched this year In August, Huawei Qiankun ADS 3.0 version was launched, and it is planned to successively push upgrades from August to September. The Xiangjie S9, which will be released on August 6, will debut Huawei’s ADS3.0 intelligent driving system. With the assistance of lidar, Huawei Qiankun ADS3.0 version will greatly improve its intelligent driving capabilities, have end-to-end integrated capabilities, and adopt a new end-to-end architecture of GOD (general obstacle identification)/PDP (predictive decision-making and control) , providing the NCA function of smart driving from parking space to parking space, and upgrading CAS3.0

Another Snapdragon 8Gen3 tablet ~ OPPOPad3 exposed

Jul 29, 2024 pm 04:26 PM

Another Snapdragon 8Gen3 tablet ~ OPPOPad3 exposed

Jul 29, 2024 pm 04:26 PM

Last month, OnePlus released the first tablet equipped with Snapdragon 8 Gen3: OnePlus Tablet Pro. According to the latest news, the "baby-replacement" version of this tablet, OPPOPad3, will also be released soon. The picture above shows OPPOPad2. According to the Digital Chat Station, the appearance and configuration of OPPOPad3 are exactly the same as those of OnePlus Tablet Pro. Color: gold, blue (different from OnePlus’ green and dark gray). Storage version: 8/12/16GB+512GB. Release date: New products for the same period in the fourth quarter of this year (October-December): Find

Upgrade to full screen! iPhone SE4 advanced to September

Jul 24, 2024 pm 12:56 PM

Upgrade to full screen! iPhone SE4 advanced to September

Jul 24, 2024 pm 12:56 PM

Recently, new news about iPhone SE4 was revealed on Weibo. It is said that the back cover process of iPhone SE4 is exactly the same as that of the iPhone 16 standard version. In other words, iPhone SE4 will use a glass back panel and a straight screen and straight edge design. It is reported that iPhone SE4 will be released in advance to September this year, which means it is likely to be unveiled at the same time as iPhone 16. 1. According to the exposed renderings, the front design of iPhone SE4 is similar to that of iPhone 13, with a front camera and FaceID sensor on the notch screen. The back uses a layout similar to the iPhoneXr, but it only has one camera and does not have an overall camera module.

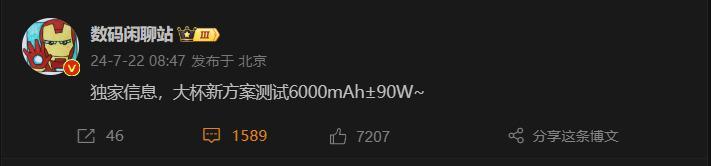

6000 mAh silicon negative battery! Xiaomi 15Pro upgrade leaked again

Jul 24, 2024 pm 12:45 PM

6000 mAh silicon negative battery! Xiaomi 15Pro upgrade leaked again

Jul 24, 2024 pm 12:45 PM

According to news on July 23, blogger Digital Chat Station broke the news that the battery capacity of Xiaomi 15 Pro has been increased to 6000mAh and supports 90W wired flash charging. This will be the Pro model with the largest battery in Xiaomi’s digital series. Digital Chat Station previously revealed that the battery of Xiaomi 15Pro has ultra-high energy density and the silicon content is much higher than that of competing products. After silicon-based batteries are tested on a large scale in 2023, second-generation silicon anode batteries have been identified as the future development direction of the industry. This year will usher in the peak of direct competition. 1. The theoretical gram capacity of silicon can reach 4200mAh/g, which is more than 10 times the gram capacity of graphite (the theoretical gram capacity of graphite is 372mAh/g). For the negative electrode, the capacity when the lithium ion insertion amount reaches the maximum is the theoretical gram capacity, which means that under the same weight

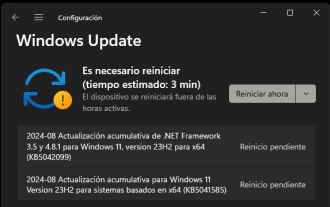

Microsoft releases Win11 August cumulative update: improving security, optimizing lock screen, etc.

Aug 14, 2024 am 10:39 AM

Microsoft releases Win11 August cumulative update: improving security, optimizing lock screen, etc.

Aug 14, 2024 am 10:39 AM

According to news from this site on August 14, during today’s August Patch Tuesday event day, Microsoft released cumulative updates for Windows 11 systems, including the KB5041585 update for 22H2 and 23H2, and the KB5041592 update for 21H2. After the above-mentioned equipment is installed with the August cumulative update, the version number changes attached to this site are as follows: After the installation of the 21H2 equipment, the version number increased to Build22000.314722H2. After the installation of the equipment, the version number increased to Build22621.403723H2. After the installation of the equipment, the version number increased to Build22631.4037. The main contents of the KB5041585 update for Windows 1121H2 are as follows: Improvement: Improved

Honor X60i launched with smart island punch-hole screen + bathroom heater dual camera. How would you rate its appearance?

Jul 24, 2024 pm 12:37 PM

Honor X60i launched with smart island punch-hole screen + bathroom heater dual camera. How would you rate its appearance?

Jul 24, 2024 pm 12:37 PM

Yesterday, Honor announced that the Honor X60i is on the shelves. Pre-orders have been opened and pre-sales will be officially launched at 10:08 am on July 26. Let’s first take a look at the appearance and configuration. As you can see in the picture above, the Honor X60i uses a straight screen with a hole in the center similar to the shape of a smart island, and a right-angled middle frame. On the back is a bathroom heater with dual cameras, and the right side should be a flash, which is very iPhone-like. ~Honour +2MPfenye

Bai Jian breaks the news about the new NIO Phone and responds to why NIO insists on making mobile phones

Jul 25, 2024 pm 01:14 PM

Bai Jian breaks the news about the new NIO Phone and responds to why NIO insists on making mobile phones

Jul 25, 2024 pm 01:14 PM

The new NIO NIO Phone (NIOPhone 2) will be released on July 27. As the release date approaches, on July 24, Bai Jian, Vice President of NIO Technology (Anhui) Co., Ltd., answered two of the most common questions about NIO Phone among netizens. NIOPhone "Why does NIO insist on making mobile phones?" Similar questions appear in almost all comment areas related to the new NIOPhone. Bai Jian responded that Weilai had started thinking and planning about making mobile phones very early, and it was not a whim, let alone as some people said, because some mobile phone brands have started to make cars. Bai Jian broke the news about the new NIOPhone "smart car and mobile phone"

Haqu K2 projector brings Olympic passion and dreams within reach

Jul 24, 2024 pm 01:34 PM

Haqu K2 projector brings Olympic passion and dreams within reach

Jul 24, 2024 pm 01:34 PM

In the just-concluded European Cup final, did you cheer crazily for the team you supported? In the upcoming Paris Olympics, are you also looking forward to perfectly capturing the highlight moments of each event? Among them, having a high-quality viewing equipment is crucial. The Haqu K2 projector is well-deserved to be a good choice for watching games due to its high cost performance and excellent performance. It not only has high brightness and clear picture quality, but also provides an immersive viewing experience, making every exciting moment of the game feel as if it is close at hand. Are you already attracted by such a device? It will definitely allow you to enjoy the passion and dreams of the Olympic Games at home. The most intimate highlight of Haqu K2 is its 210° super angle adjustment, which makes it convenient to watch movies whether on the ceiling or on the wall.