What is the Bitcoin Fear and Greed Index?

The Bitcoin market fluctuated violently. After reaching a low of 17,618 usdt on June 18, it broke a six-week high on July 31. However, it fell from $24,670 to $23,555 within a few hours.

The crypto market fluctuates violently, and we often see"extreme panic in the market"or"market Expressions like "The greed index is very high" all come from the fear-greed index.

So, what exactly is the fear-greed index? Let’s take a look.

01. About the Fear and Greed Index

What is the Fear and Greed Index?

The Fear and Greed Index is a tool to measure the psychology of the Bitcoin market crowd. This overall feeling of investors towards market conditions is also called market sentiment.

Why fear and greed?

Fear and greed are the two main emotions in human psychology that can affect the behavior of investors. The Bitcoin market is no exception. Therefore, market sentiment awareness is important in helping us decide when to enter or exit the market.

On the surface, investors generally follow the index’s theory that excessive fear tends to drive down the price of Bitcoin, while excessive greed drives up the price.

The hypothesis is that extreme fear will increase selling pressure on Bitcoin, driving the price down and providing investors with buying opportunities. On the other hand, extreme greed drives up demand for Bitcoin, raising the price and providing good selling opportunities.

Accumulate analysis and summarization from multiple data sources to generate a number. This number is measured on a scale from 0 to 100, where 0 represents maximum fear and 100 represents extreme greed.

On a scale of 0 to 100, the index is divided into four basic categories: 0 to 24 = extreme fear, 25 to 49 = fear, 50 to 74 = greed, and 75 to 100 = extreme greed.

Meanwhile, the index pulls data from the following sources to calculate the score:

Volatility: Converts Bitcoin’s current value to its average over the past 30 days and the past 90 days Compare.

Market Trends and Exchange Volume: Market trends and exchange volume for Bitcoin over the past 30 and 90 days.

Social Media Sentiment: What people think about Bitcoin on social media.

Market Share: Bitcoin’s share of the crypto market relative to all other cryptocurrencies (also known as dominance).

Search Trends: Trends in related Bitcoin search terms to determine whether people are expecting a rise or fall.

02. Anti-human investors

However, one type of investor believes that going against the trend (going against this market sentiment) can outperform The market is also called anti-human investors.

Anti-human devotees take action against conformity. When the market sells out of fear, they start to get greedy. When greed prevails and everyone else is buying, contrarian investors will find opportunities to exit the market when prices rise.

03. Is this Greed and Fear Index reliable?

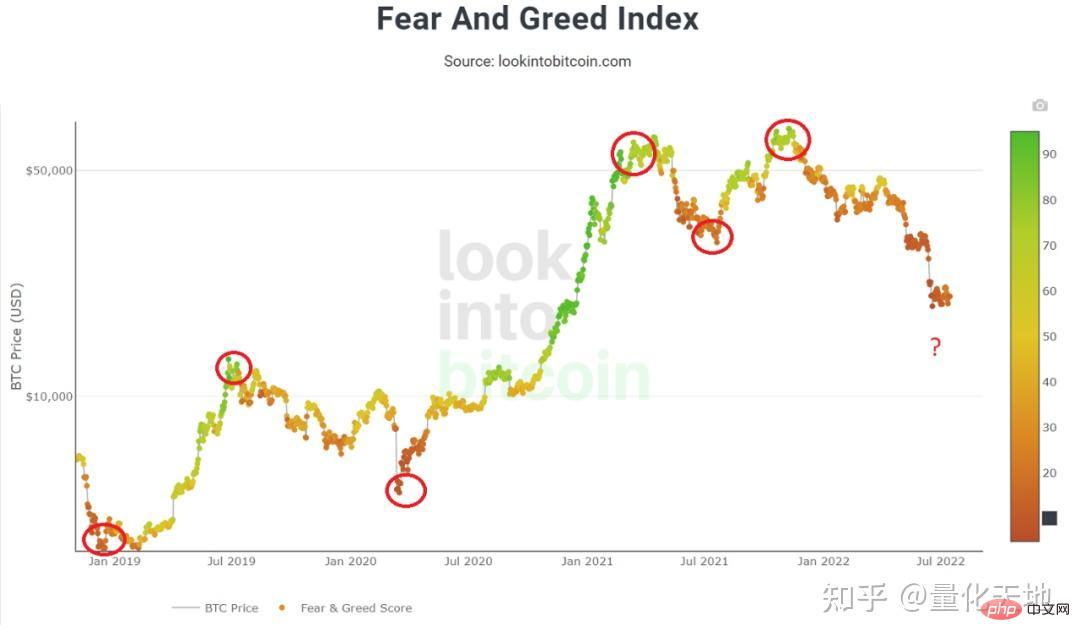

The answer to this question lies in the data. http://Lookintobitcoin.com Gives investors insight into how the index has historically interacted with Bitcoin price.

Historically, the more extreme the feelings about the market, the more likely Bitcoin is to experience a trend reversal.

As shown in the chart above, the index is the best indicator for predicting local tops and bottoms as well as temporal changes in Bitcoin market direction. However, it did not specify at which price point this shift would occur.

One claim made by opponents of this indicator is that it is not a forward-looking tool and could be particularly dangerous if used repeatedly over a short period of time: When market conditions Investors who decide to pull the trigger when signals of extreme fear may enter the market at the beginning of a lengthy bearish period.

If managing your finances were as easy as following popular sentiment, we would probably all be winners. So this index is more effective at predicting broader trends.

However, please be careful not to use just this single metric to make any investment decisions. We should use it in conjunction with other technical, fundamental and on-chain indicators, especially currently in the uncertain macroeconomic environment we are experiencing.

The above is the detailed content of What is the Bitcoin Fear and Greed Index?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.