Getting started with Ethereum layer2 leader Arbitrum

In the second half of last year, the entire crypto market was in deep bear trouble, but Arbitrum ecological representative projects GMX and Treasure DAO still grew against the trend. Since entering 2023, with the overall recovery of the market, the Arbitrum ecosystem has become more comprehensive flowering.

Especially after Arbitrum announced the issuance of the governance token ARB, until now, Arbitrum is still a hot topic of discussion in major communities.

But how much do you know about Arbitrum? Why does Arbitrum issue Token ARB? What's the use? Today I will explain to you the vernacular blockchain.

01

What is Arbitrum?

Arbitrum is an Ethereum Layer2 extension solution based on Optimistic Rollup technology. Offchain Labs, a team composed of well-known blockchain researchers and software engineers, launched in 2021 Created, aims to solve the congestion and high gas fee problems on Ethereum.

It can also be understood that Arbitrum is the auxiliary chain of Ethereum. The operating principle is simply that Arbitrum packages many transactions together, settles them on the Arbitrum chain first, and then submits the transaction data to the Ethereum main chain.

Among all Layer 2, Arbitrum is the first to launch the mainnet in Layer 2, occupying a certain first-mover advantage. At the same time, Arbitrum is nearly 100% compatible with Ethereum EVM, allowing applications on the Ethereum network to be seamlessly migrated to Layer 2. When the mainnet was launched, 74 projects led by Uniswap V3 were deployed on it.

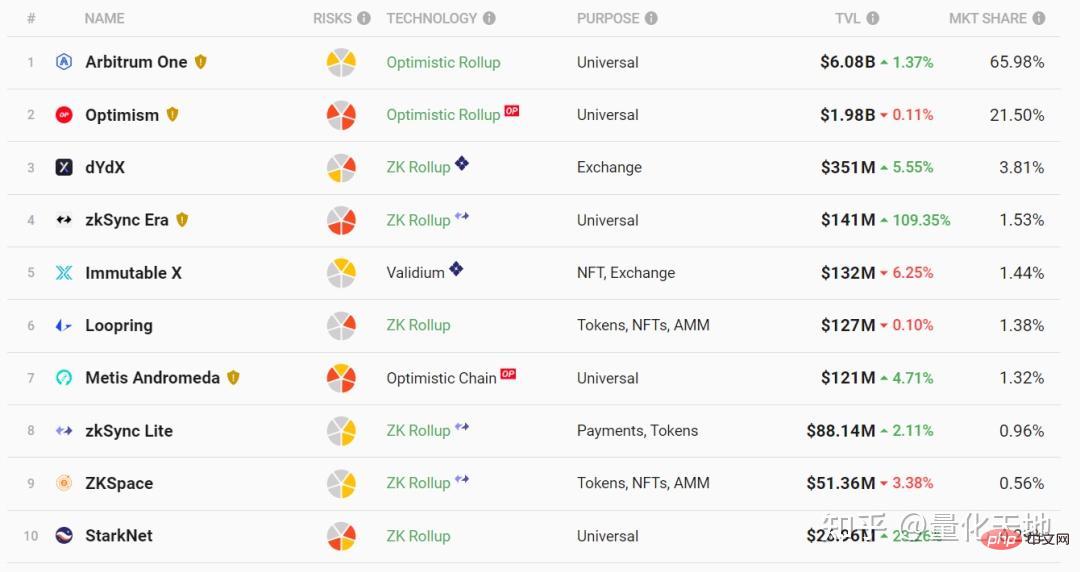

As shown in the figure, Arbitrum’s TVL accounts for nearly 66% of the total volume of Layer 2 so far, and it can be said to be the well-deserved leader in Layer 2.

In the Layer2 track, competition There are many players, but compared with competing products, in addition to the first-mover advantage, Arbitrum has significant advantages:

From the data point of view, because it has EVM equivalence and development threshold The rapid maturation of low-volume and large-scale applications has formed an effective ecological barrier. Arbitrum's number of transactions and active addresses far exceeds its opponents, and has formed a trend, with TVL rising all the way.

In addition, in terms of user experience, because Arbitrum is EVM compatible, it can be used directly on the Ethereum Little Fox wallet MetaMask, which is more attractive to users than many other incompatible competitors.

With its sudden rise in less than two years, Arbitrum has become one of the most popular layer 2 blockchains on Ethereum. It must be said that its strength cannot be underestimated.

02

What is ARB

ARB is the native Token of the Arbitrum network. The standard used is Ethereum ERC-20. The governance and incentive tokens of the Arbitrum network are mainly used to reward verification nodes, participate in network governance, etc. Specifically:

· Reward verification nodes: Participate in the Arbitrum network The verification nodes will receive ARB rewards in return for their contributions. That is, validators need to pledge a certain amount of ARB on the Arbitrum network as an incentive to maintain network security and reliability. If a validator violates network rules or malfunctions, they will lose a portion of their stake to encourage them to comply with network rules and keep nodes running stably.

· Participate in network governance: ARB holders can participate in the governance of the Arbitrum network ecosystem, because Arbitrum was also established when the airdrop was conducted on March 23 DAO (Decentralized Autonomous Organization), DAO members holding ARB will be able to participate in the governance of the Arbitrum chain, such as voting on some important protocol changes and proposals, or providing certain rewards to users to encourage users to participate in the construction of the ecosystem And development.

However, it should be noted that ARB cannot be used as transaction gas, that is, ARB is just a governance token and is not used to pay any fees on the Arbitrum chain. Currently, the gas fee paid by users interactively on the Arbitrum chain is still ETH.

Generally speaking, apart from its function of not being responsible for gas fees, ARB is of great significance to the operation and development of the Arbitrum network and can effectively promote the security, stability and development of the Arbitrum ecosystem.

03

Summary

To sum up, Arbitrum’s advantages have attracted many DeFi native projects, brought a stable user base to the Arbitrum ecosystem, and created a highly inclusive environment for nurturing innovative DeFi applications.

The future development of Arbitrum at the DeFi level is worth looking forward to.

The above is the detailed content of Getting started with Ethereum layer2 leader Arbitrum. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.