Software Tutorial

Software Tutorial

Computer Software

Computer Software

How to make a summary declaration for the personal income tax withholding and payment system - How to make a summary declaration for the personal income tax withholding and payment system

How to make a summary declaration for the personal income tax withholding and payment system - How to make a summary declaration for the personal income tax withholding and payment system

How to make a summary declaration for the personal income tax withholding and payment system - How to make a summary declaration for the personal income tax withholding and payment system

php Editor Apple has brought detailed methods on how to summarize and declare the personal income tax withholding and payment system. The system's summary declaration refers to the process of integrating and submitting relevant information about personal income tax withholding and payment. Through this article, readers will learn how to conduct system summary declaration, including operating steps, precautions, etc., to help everyone better manage and declare the personal income tax withholding and payment system.

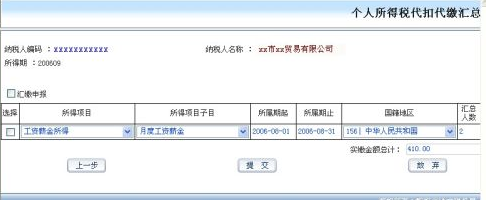

Enter the declaration: In the personal income tax module, click "Personal income tax withholding and payment summary declaration", as shown in the figure below:

When filling in the report, the system will display the "Personal Income Tax Withholding and Payment Summary Return Form", which should be filled in according to the rules (the rules are the same as those for paper reports).

[Instructions for filling in the form]:

1. Remittance declaration: When reporting for remittance, select directly;

2. Income item: drop-down selection. When reporting remittance, the default is "wage and salary income"

3. Obtained project sub-item: drop-down selection;

4. Starting from the period it belongs to: the system automatically displays it and can be modified;

5. The period to which it belongs: the system automatically displays it and can be modified;

6. Nationality region: drop-down selection; the default is "People's Republic of China"

7. Total number of people: filled in by the taxpayer;

8. Taxable income (summary): filled in by the taxpayer.

9. Tax rate: displayed after tax calculation, automatically calculated by the system, and cannot be modified.

10. Quick calculation of deductions (summary): displayed after tax calculation and cannot be modified;

11. Tax payable (summary): displayed after tax calculation and cannot be modified.

12. Declared tax payable (summary): displayed after tax calculation and cannot be modified;

13. Approved tax reduction or exemption amount (summary): displayed after tax calculation and cannot be modified;

14. The amount of tax that can be deducted (summary): displayed after tax calculation and cannot be modified;

15. The amount of tax that should be withheld (refunded): displayed after tax calculation;

16. Total amount paid: displayed after tax.

[Note]: Withholding agents who have opened online declarations must obtain the consent of the tax authorities before they can make a summary declaration of personal income tax to complete the tax declaration, and then use the "Personal Income Tax Withholding and Payment Supplementary Record Details" in the online filing system. Submit detailed personal income tax return information.

Tax Calculation: After filling in the data and confirming it is correct, click "Calculate Tax" button, the system will automatically calculate the tax, and the page after tax calculation is as follows. If you find that there is an error in filling in the data, you can click the "Clear" button to refill the report or click the "Abandon" button to exit the declaration.

[Note]: If you select "Remittance Declaration", the income column system defaults to "Wages and Salaries" and cannot be selected.

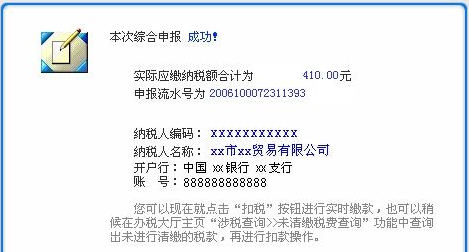

Submit declaration: After verifying that the data is correct, click the "Submit" button to submit the declaration data. The system prompts as shown in the figure below. If errors in calculated data are found, You can click the "Previous" button to modify the declaration data or click the "Give Up" button to exit the declaration.

Withhold taxes

Print report

Supplementary entry details: After the declaration is successful, detailed information must be supplemented through the "Personal Income Tax Withholding and Payment Supplementary Entry Details" within the time specified by the tax bureau.

The above is the detailed content of How to make a summary declaration for the personal income tax withholding and payment system - How to make a summary declaration for the personal income tax withholding and payment system. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

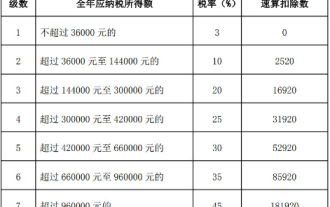

'Personal Income Tax' Tax Rate Table Latest in 2024

Mar 05, 2024 pm 07:20 PM

'Personal Income Tax' Tax Rate Table Latest in 2024

Mar 05, 2024 pm 07:20 PM

With the continuous development of the times, personal income tax rates are also constantly adjusted. The latest personal income tax rate table for 2024 has been released, which is an important reference for every taxpayer. Let us take a look at the latest personal income tax rate table for 2024! The latest personal income tax rate table for 2024 I, tax rate table 1, comprehensive income tax rate table 2, salary and salary tax rate table 3, transitional salary and salary tax rate table 4, withholding and prepayment tax rate for residents’ personal labor remuneration income table 2, annual personal income tax Calculation formula 1. Personal income tax payable = taxable income × applicable tax rate - quick calculation deduction 2. Taxable income = annual income - allowed deduction 3. Allowed deduction = basic deduction fee of 60,000 yuan + special items

Personal income tax rate calculator

Mar 05, 2024 pm 11:40 PM

Personal income tax rate calculator

Mar 05, 2024 pm 11:40 PM

The calculation of personal income tax is very complicated. Most players do not know how to calculate personal income tax. Click on the link https://www.gerensuodeshui.cn/ to enter the tax rate calculator. Next, the editor will bring it to users. Personal income tax rate calculator online calculation portal, interested users come and take a look! Personal Income Tax App Tutorial Personal Income Tax Rate Calculator Tax Rate Calculator Entrance: https://www.gerensuodeshui.cn/ 1. Personal tax calculation formula 1. Payable income = pre-tax salary income amount - five insurances and one fund (individual Payment part) - expense deduction amount 2. Tax payable = payable income × tax rate - quick calculation deduction number two

How to declare personal income tax app How to declare personal income tax app

Mar 12, 2024 pm 07:40 PM

How to declare personal income tax app How to declare personal income tax app

Mar 12, 2024 pm 07:40 PM

How to declare personal income tax on the app? Personal Income Tax is a very practical mobile software. Users can declare some businesses on this software, and can also make tax refunds on this software. As long as the user downloads this software, he or she does not have to wait in line offline, which is very convenient. Many users still don’t know how to use personal income tax software to file returns. The following editor has compiled the reporting methods of personal income tax software for your reference. Personal income tax app declaration method 1. First, open the software, find and click the "I want to file taxes" button on the homepage; 2. Then, find and click "Annual Comprehensive Income Summary" in the tax declaration here.

How to fill in the special additional deduction declaration for personal income tax in 2024

Apr 01, 2024 pm 04:01 PM

How to fill in the special additional deduction declaration for personal income tax in 2024

Apr 01, 2024 pm 04:01 PM

In the process of filing personal income tax, special additional deductions are an important policy measure, which provide taxpayers with more opportunities for tax reduction and exemption. Therefore, in this article, the editor has prepared the step-by-step process for filing special additional deductions for personal income tax. Let’s learn together. Steps and procedures for claiming special additional deductions for personal income tax 1. Open the personal tax APP, select [Common Business] on the homepage, and then select [Fill in special additional deductions] 2. Scope of special deduction items: children’s education, continuing education, serious illness medical treatment, housing loan interest , housing rent and support for the elderly, infant and child care. According to the relevant policies and regulations of the national tax department, the Personal Income Tax Law determines the scope of the following special deduction items: Children’s Education 3. At the bottom of the page, you can select [One-click import], so that you can fill in last year’s declaration with one click.

How to cancel the tax refund declaration on the personal income tax app? The process of canceling the tax refund declaration on the personal income tax app

Mar 12, 2024 am 11:50 AM

How to cancel the tax refund declaration on the personal income tax app? The process of canceling the tax refund declaration on the personal income tax app

Mar 12, 2024 am 11:50 AM

How to cancel the personal income tax refund application? Personal income tax is a very popular mobile phone software. The functions on this software are very powerful. Users can perform many operations in this software. For example, they can declare on this software, and then they can also do it on this software. For tax refunds or a series of other operations, many users want to know how to cancel a declaration on this software. The editor below has compiled the methods for canceling a declaration for your reference. Personal Income Tax App Tax Refund Declaration Cancellation Process 1. Enter the Personal Income Tax Mobile App and click to declare annual income calculation. 2. A declaration prompt pops up on the page, click on the declaration details. 3. Then click Done. 4. Click on the submitted withdrawal

How to get a personal income tax refund in 2024_A complete introduction to the personal income tax refund operation process

Mar 20, 2024 pm 07:26 PM

How to get a personal income tax refund in 2024_A complete introduction to the personal income tax refund operation process

Mar 20, 2024 pm 07:26 PM

Have you filed personal income tax returns? You can make an appointment on March 1st. Make an appointment in advance and declare in advance. If you see that you have to pay taxes, your worries will finally die. So how to refund the personal income tax refund? Friends in need, please come and take a look below. How to get a personal income tax refund in 2024. After installing and registering the personal income tax APP, you can click "Income Tax Detail Inquiry" on the homepage to view the income and declared tax amount of the previous year. Select "Annual Comprehensive Income Summary", the system will automatically fill in the relevant data, and the user needs to check whether the information is accurate. If you need to modify it, you can click "Standard Declaration" to make adjustments. 3. Check the basic personal information, remittance place, amount of tax paid and other information, and submit the declaration after confirming that it is correct. 4. Then you need to select the corresponding card to ensure that it can

How to correct declaration records in personal income tax app

Mar 14, 2024 pm 03:04 PM

How to correct declaration records in personal income tax app

Mar 14, 2024 pm 03:04 PM

The Personal Income Tax App is an official app that facilitates users to conduct tax enquiries, payments, registrations and even business transactions. In our lives, this app can help us understand our tax situation in real time. So if we use the Personal Income Tax App If an error is found in the declaration record, how to correct it? This tutorial guide will provide you with a detailed step-by-step guide. First of all, we first enter the personal income tax app, click on the handle & check option, and then in the handle & check option, you can see the query of the declaration record and find it in the record. Click on the record we want to correct and pull the page to You can see the correction button at the bottom, click Correction to make corrections

What should I do if I can't log in to the Personal Income Tax app?

Oct 30, 2023 pm 04:30 PM

What should I do if I can't log in to the Personal Income Tax app?

Oct 30, 2023 pm 04:30 PM

Failure to log in to the Personal Income Tax app is caused by network problems, APP problems, account problems, system or environmental problems and other reasons. The solutions are as follows: 1. Network problem, make sure the network environment is good, refresh the web page, or try another network environment; 2. APP problem, try to uninstall the old version and reinstall the latest version; 3. Account problem, register an account, and Make sure the account is activated, check the account password, and make sure it is entered correctly; 4. System or environment problems, try to repair system files, or reinstall the operating system, etc.