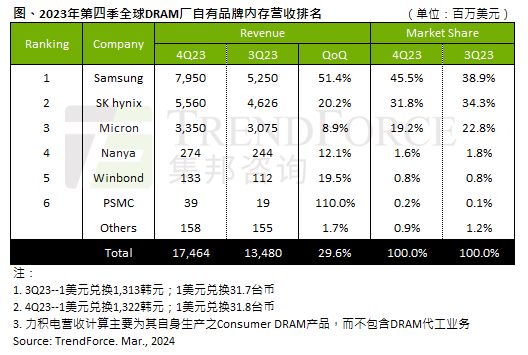

News from this site on March 5. According to the latest report released by TrendForce, the enthusiasm of various manufacturers for stocking has gradually been mobilized, and the production control benefits of the three major original manufacturers have been affected by many factors. In the fourth quarter of 2023, global DRAM Industrial revenue reached $17.46 billion, a month-on-month increase of 29.6%.

Through observation, the agency believes that the DRAM market will continue to rise in the first quarter of 2024. The original factory’s goal is still to improve profits and has a strong intention to increase prices. This will prompt the DRAM contract price to increase by another 20% month-on-month.

Samsung benefited from the increase in 1alpha nm DDR5 shipments, server DRAM shipments increased by more than 60% month-on-month, and quarterly revenue reached 79.5 billion, and overall revenue increased by more than 50% month-on-month.

SK hynix (SK hynix), although the quarterly increase in bit shipments is only 1~3%, it continues to benefit from the price advantages of HBM and DDR5, as well as from In terms of profits from high-capacity Server DRAM modules, the average sales unit price increased by 17~19% quarterly, and revenue in the fourth quarter reached US$5.56 billion, a quarterly increase of 20.2%.

Micron performed strongly in terms of volume and price, with quarterly growth rates of shipments and average selling price reaching 4~6%. Although sales of DDR5 and HBM are relatively low, revenue growth has been relatively solid. Revenue in the fourth quarter reached US$3.35 billion, a year-on-year increase of 8.9%.

In the fourth quarter of last year, Samsung significantly reduced production to cope with inventory pressure. Starting from the first quarter of this year, as the inventory situation improved, the production volume gradually recovered, and the utilization rate was approximately 80%. The second half of the year will usher in the peak season, demand is expected to increase significantly, and production capacity will continue to increase into the fourth quarter.

SK Hynix is actively expanding its HBM production capacity, and its wafer production volume is slowly increasing. With the mass production of HBM3e, related advanced process wafer production has also continued to increase.

Micron's wafer production volume is recovering, and in the future it plans to increase the proportion of advanced process 1beta nm to produce HBM, DDR5 and LPDDR5 (X) products. With the increase in advanced process equipment, production capacity will gradually converge.

The original address of the report is attached to this website. Interested users can read it in depth.

The above is the detailed content of The benefits of controlling output are evident, with DRAM output value in 2023Q4 reaching US$17.46 billion: an increase of 29.6% from the previous quarter. For more information, please follow other related articles on the PHP Chinese website!